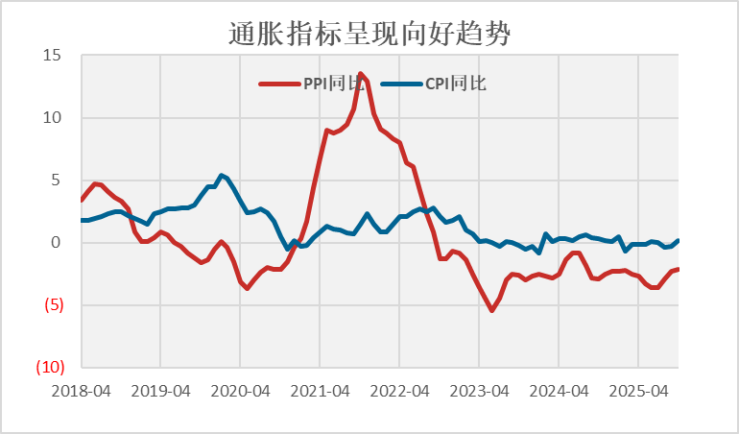

CPI Warms Up, Polyolefins Welcome Macroeconomic Support Window

The price data for October 2025 released by the National Bureau of Statistics on November 9 carries significant implications: the year-on-year CPI turned positive to 0.2% from a negative month-on-month rate, and the PPI achieved its first increase of the year at 0.1% month-on-month. This data directly dispels previous market concerns about deflation. Coincidentally, the central bank's third-quarter monetary policy implementation report released on November 11 clarifies the core guidance of "implementing moderately loose monetary policy" and "promoting a reasonable rise in prices". These two signals corroborate each other, suggesting that polyolefin futures may be entering a critical stage of "macroeconomic policy support + improved cost expectations."

In October, the core CPI increased by 1.2% year-on-year, marking a steady expansion for six consecutive months. This change was mainly driven by three factors: first, the low base effect, as the CPI in October 2024 was at a temporarily low level, providing the foundational condition for this year's positive year-on-year change; second, seasonal influences, with the National Day and Mid-Autumn Festival boosting service consumption recovery, and prices of seasonal items like fresh vegetables rising by 4.3% month-on-month, directly driving the CPI month-on-month increase; third, the anti-involution policies showing effectiveness, with the central bank launching 500 billion yuan in service consumption and pension refinancing, combined with local measures to promote consumption, leading to a 0.8% year-on-year increase in service prices. However, looking deeper, the foundation for the CPI's positive turn is not solid: food prices are still down by 2.9% year-on-year, pork prices have dropped by 16.0%, consumer goods prices are flat to slightly down year-on-year, and the average CPI from January to October is still 0.1% lower than the same period last year, reflecting the weak recovery of terminal demand, and expectations for cuts in reserve requirement ratios and interest rates are rising. The central bank's monetary policy report precisely responds to these expectations, clearly stating "making reasonable price recovery an important consideration in grasping monetary policy," providing a policy basis for subsequent liquidity easing.

However, the constraints of the fundamentals still need to be closely monitored, as the core contradiction of oversupply in polyolefins has not fundamentally eased. In October, the inventories of polyolefins from the two major oil producers remain at high levels, and it is estimated that new PE and PP capacities will exceed 5 million tons by 2025, indicating objective supply pressure. The central bank has also pointed out in its monetary policy report that "external uncertainties remain numerous," which means that it is difficult for polyolefin futures to experience a one-sided trend of upward price movement; instead, a "policy-driven + inventory digestion" oscillation pattern is more likely. On the trading front, two key signals need to be closely monitored: first, the landing rhythm of the "structural monetary policy tools" mentioned in the monetary policy report; second, whether the inventories of polyolefins can achieve continuous reduction. Only when both resonate can the price rebound space be truly opened up.

Looking ahead, the October price data and the central bank's monetary policy report jointly provide macro-level support for polyolefin futures. In terms of operations, one can seize the short-term driven market during the period of intensive policy expectations and capture structural opportunities through polyolefin inter-product spread arbitrage.

Author: Zhou Yongle, Senior Market Analysis Expert

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

[Today's Plastics Market] General Materials Weakly Fluctuate, Engineering Materials Steadily Rise

-

New Breakthrough in Domestic Adiponitrile! Observing the Rise of China's Nylon Industry Chain from Tianchen Qixiang's Production

-

Daily Review: Polyethylene Prices Under Weak Consolidation, Sellers Face Significant Pressure to Move Inventory