Differential Electricity Pricing Implementation Accelerates, Reshaping PVC Industry Landscape

Recently, many regions have intensively introduced differentiated electricity pricing optimization policies, making it increasingly clear that price leverage is being used to compel the transformation of high-energy-consuming industries. As a typical high-energy-consuming industry, polyvinyl chloride (PVC) has its core production processes deeply tied to electricity costs. The implementation of these policies is continuously increasing the cost pressure on PVC through the transmission along the industrial chain, leading to a profound adjustment in the industry's profitability structure and production capacity.

The differentiated electricity price policy has entered a deepening stage of regional differentiation, focusing on precise measures for high energy-consuming industries. From local practices, the policy exhibits characteristics of "classified price increases and regional autonomy": some regions implement an additional charge standard of 0.4-0.5 yuan per kilowatt-hour for eliminated capacities such as steel and calcium carbide, while restricted capacities incur an additional charge of 0.1 yuan per kilowatt-hour. Calcium carbide, as a core raw material for PVC production, has been explicitly included in the key control range. At the regional level, provinces such as Shandong, Sichuan, and Jiangsu have developed differentiated implementation plans: Shandong has introduced a "five-segment" time-of-use electricity pricing system, with peak electricity prices rising 100% compared to flat periods, forcing high energy-consuming enterprises to stagger production; Sichuan connects with the electricity spot market, allowing enterprises to negotiate prices based on market signals, enhancing price flexibility; Jiangsu has expanded the scope of time-of-use pricing to all industrial and commercial users, guiding the consumption of renewable energy through time optimization. This regional differentiation not only responds to the national "dual carbon" goals but also takes into account the differences in industrial structures across regions.

The impact of policies on PVC costs is mainly transmitted through the calcium carbide segment, and the degree of impact is highly rigid. PVC production in China primarily uses the calcium carbide method, and the calcium carbide industry is a typical high electricity consumption sector, requiring 3,000-3,400 kilowatt-hours of electricity per ton of calcium carbide produced. Electricity costs account for over 40% of the production costs of calcium carbide. Since calcium carbide costs account for 65%-70% of the total PVC cost, fluctuations in electricity prices have a significant impact on PVC costs. It is estimated that for every 0.1 yuan/kilowatt-hour increase in electricity prices, the cost per ton of PVC will increase by approximately 512 yuan. The current differentiated electricity pricing policy, which imposes additional charges on restricted calcium carbide production capacity, directly raises the production costs for calcium carbide enterprises. Taking Shaanxi as an example, as a significant calcium carbide production hub in the country, accounting for 14% of the capacity, the implementation of differentiated electricity pricing has narrowed the profit margins for local calcium carbide enterprises, indirectly driving up the raw material procurement costs for downstream PVC companies.

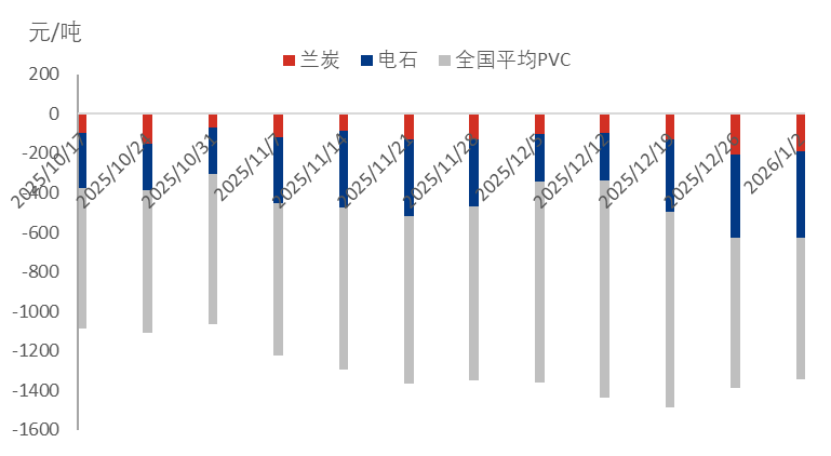

Figure 1 Profit Chart of Semi-coke Derivatives in the Upstream PVC Industry Chain

Under the pressure of policies and the overlapping supply-demand contradictions within the industry, the PVC industry is facing a dual test of costs and production capacity. Currently, the gross profit from PVC produced via the calcium carbide method has fallen to a loss range of -500 yuan/ton, and the increase in electricity costs due to differential pricing has further exacerbated the loss situation. On the supply side, the production characteristics of the chlor-alkali co-production result in a certain passivity in PVC output; even with deteriorating profits, the exit of production capacity tends to lag. However, sustained losses have triggered a reassessment of the capacity structure within the industry, and the elimination of inefficient and high-energy-consuming capacities is expected to accelerate. On the demand side, 80% of PVC downstream relies on real estate-related fields; weak demand has already suppressed industry profitability, and rising costs have further compressed the pricing space for enterprises. Some small and medium-sized enterprises have shown signs of production cuts as a risk-avoidance measure.

The deep implementation of differentiated electricity pricing policy is essentially a "catalyst" for promoting the green and low-carbon transformation of the PVC industry. In the short term, it will intensify industry differentiation and benefit leading enterprises with energy and technological advantages. In the long term, the policy will force enterprises to advance energy-saving technological modifications and process upgrades or to shift production capacity to regions with electricity price advantages. Enterprises need to proactively adapt to policy directions to hedge against cost pressures.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories