Europe's Plastic Recycling Industry Sees Largest Recorded Production Capacity Contraction

Recently, Plastics Recyclers Europe (PRE) released its latest annual report, indicating that the plastic recycling industry in Europe is facing its most severe downturn, with revenues declining by 5.5%.

The extent of the capacity contraction this time is the largest on record. Preliminary data for 2025 indicate that the number of closed recycling facilities has increased by 50%; in just three years, Europe's recycling capacity has decreased by nearly 1 million tons.

This trend not only threatens the stability of Europe's circular economy and industrial development but may also lead to the loss of thousands of local jobs.

Ton Emans, President of the PRE Association, stated: "Now is the time for everyone to unite and collectively support this industry—not only to protect the jobs and businesses at risk but also to maintain Europe's achievements in environmental protection and technological development, thereby creating a sustainable future for all. We call on EU institutions and national policymakers to take decisive action and introduce supportive policies to protect this industry and the circular economy system in Europe."

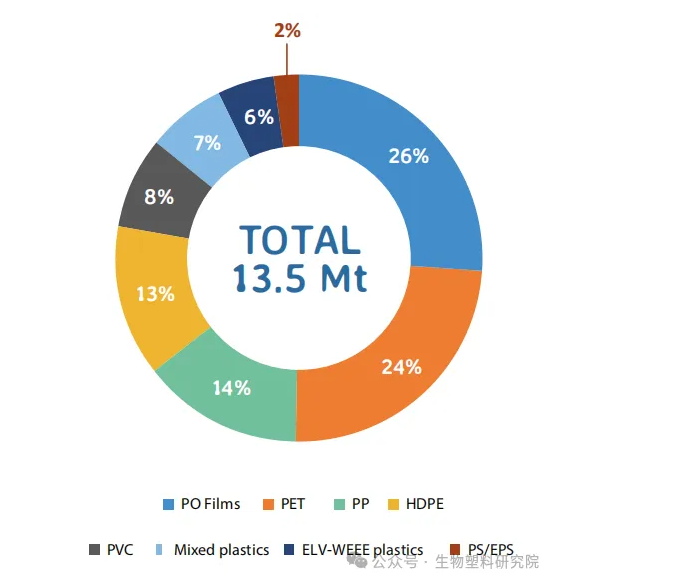

In 2024, Europe's plastic recycling capacity is only 13.5 million tons, far below the 6% annual growth rate required to achieve the targets of the Plastic Packaging and Waste Management Directive. The industry is facing increasing pressure: production costs and energy costs continue to rise, market demand continues to decline, and there is a growing influx of low-cost, unregulated plastic imports from outside Europe. Polyolefin films and PET plastics are the most severely affected; between 2023 and 2024, the proportion of factory closures caused by these materials reached 25%.

These data reveal a series of issues threatening the long-term sustainability of the plastic recycling industry in Europe. The PRE Association urges EU institutions and member states to take coordinated action immediately. Urgent measures include: developing fair and binding market regulations, enhancing supervision of imported products, reducing energy costs, and standardizing reporting requirements across the region through third-party certification.

To strengthen the regulation of imported products, the PRE Association recommends establishing separate customs codes for fossil-based raw materials and various non-fossil-based raw materials and products (bio-based, recycled materials, and carbon capture-based). It also suggests establishing a unified EU verification framework and simplifying third-party certification processes, which are crucial for detecting illegal imports.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

[Today's Plastics Market] General Materials Weakly Fluctuate, Engineering Materials Steadily Rise

-

New Breakthrough in Domestic Adiponitrile! Observing the Rise of China's Nylon Industry Chain from Tianchen Qixiang's Production

-

Daily Review: Polyethylene Prices Under Weak Consolidation, Sellers Face Significant Pressure to Move Inventory