[EVA Daily Review] Market Maintains Stability, Transactions Center on Rigid Demand

1 Today's Summary

This week, EVA petrochemical ex-factory prices will remain stable overall.

②. This week's EVA petrochemical plants: Sinochem Quanzhou is shut down for overhaul; other plants are operating stably.

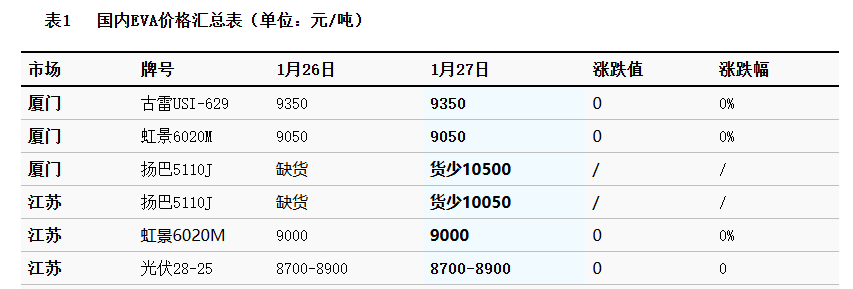

Today, the domestic EVA market is running stably. EVA manufacturers' ex-factory prices are firm, and traders' quotations are stable. The market is still mainly focused on the delivery of previous orders. Downstream factories replenish their stocks of spot goods based on rigid demand, and the trading atmosphere in the market is general. 。 Mainstream prices: Soft material reference 9000-10100 yuan/ton, hard material reference 8600-10200 yuan/ton.

|

Figure 1: Domestic EVA Price Trend Chart (RMB/ton) |

Figure 2: Domestic EVA Price Trend by Type (RMB/ton) |

![[EVA日评]:周初EVA生产商维稳撑市 市场弱稳整理运行(20260126)](https://oss.plastmatch.com/zx/image/057bf7c9e6874f4dac0520b6724f57f2.png) |

![[EVA日评]:周初EVA生产商维稳撑市 市场弱稳整理运行(20260126)](https://oss.plastmatch.com/zx/image/0fd7fd1599064699b5609b8ce948ab8d.png) |

|

Data source: Longzhong Information |

Data source: Longzhong Information |

3 Production Dynamics

Domestic EVA petrochemical plants: Sinochem Quanzhou will be shut down for maintenance on November 28th, and plans to restart production of high-pressure EVA this week; Jiangsu Serbon's tubular reactor produces photovoltaic grade EVA, and its autoclave produces UE3315; Jiangsu Hongjing's PV1 line will be shut down for maintenance from January 26th to January 29th, its PV2 line produces 6020M, and the status of its PV3 line is currently unknown; Ningxia Baofeng produces hard materials 1703; Yan'an Yulin produces photovoltaic grade V2825Y; Tianli Gaoxin produces photovoltaic grade EVA; Zhejiang Petrochemical produces photovoltaic grade EVA; Gulei Petrochemical produces USI-629; all three EVA units at Yanshan are shut down.

In South China, the main flexible material prices range from 9000-10100 RMB/ton, while the gross profit margin of the domestic EVA industry is around 1000 RMB/ton.

|

Figure 3: Trend Chart of Domestic EVA Capacity Utilization Rate |

Figure 4: Comparison of Domestic EVA Profit and Price (RMB/ton) |

![[EVA日评]:周初EVA生产商维稳撑市 市场弱稳整理运行(20260126)](https://oss.plastmatch.com/zx/image/037ac6ddfc8a45488e46e6cc1e232877.png) |

![[EVA日评]:周初EVA生产商维稳撑市 市场弱稳整理运行(20260126)](https://oss.plastmatch.com/zx/image/87bfc334e63e49439ed519569946db0d.png) |

|

Data source: Longzhong Information |

Data source: Longzhong Information |

4 Price Prediction

Looking ahead, the EVA supply and demand fundamentals will continue to be a tug-of-war. On the supply side, most EVA producers are supporting prices without pressure, mainly maintaining stable ex-factory prices. On the demand side, downstream terminal factories are gradually starting their Chinese New Year holidays, and replenishment of raw materials is coming to an end. The market trading atmosphere is gradually weakening. Therefore, it is expected that the market will enter a situation of weak supply and weak demand. The domestic EVA market is expected to consolidate sideways, with narrow fluctuations. 。

5 Related product information

1 Ethylene: January 26th, CFR Northeast Asia $700/ton stable, CFR Southeast Asia $685/ton stable. Sinopec Marketing & Sales East China ethylene price remained stable at 5750 yuan/ton, and Jinshan United Trade ethylene price was also at 5750 yuan/ton.

2 Vinyl acetate In the East China market, the mainstream negotiation price for ethylene vinyl acetate (EVA) produced via the non-calcium carbide method is 5950 yuan/ton, while for the calcium carbide method... Price is 5900 yuan/ton, petrochemical prices are stable, demand remains at previous levels, and spot trading is sluggish.

6 Data Calendar

Table 2 EVA Data Overview in China (Unit: 10,000 tons)

|

Data |

Release date |

Data |

Projected trend for this period |

|

EVA Capacity utilization rate |

Thursday 4:00 PM |

90.69% |

↑ |

|

EVA Weekly Production |

Thursday 4:00 PM |

7.24 |

↑ |

|

Data source: Longzhong Information Note: 1. Consider "↓↑" as significant fluctuations, highlighting data dimensions with price changes exceeding 3%. 2. ↗↘ are considered narrow fluctuations, highlighting data with a price change of 0-3%. |

|||

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories