[EVA Daily Review] Supply and Demand Weakness Continues, EVA Market Remains Stalemated

1 Today’s Summary

This week, the ex-factory price of EVA petrochemical has been lowered, and the auction source price continues to decline significantly.

This week, the EVA petrochemical units: Tianli Gaoxin stopped on the morning of the 21st, Yanshan Petrochemical's units are in prolonged shutdown, while the others are operating steadily. South Korea's Hanwha-GS Energy has an annual capacity of 300,000 tons.September 25Device put into production.

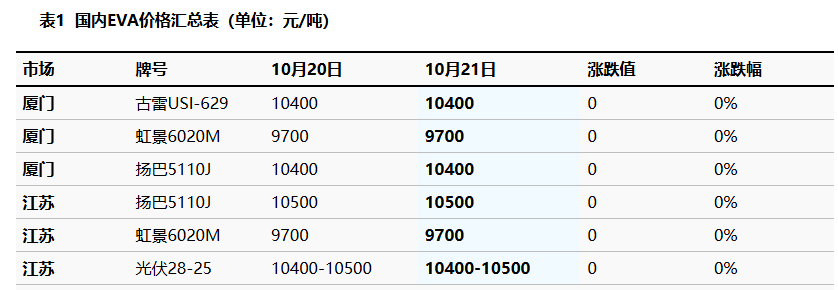

2. Spot Overview

Today, the domestic EVA market is weakly consolidating, with ample supply of market commodities. The atmosphere among downstream factories is characterized by low-frequency purchasing, maintaining a just-in-time buying strategy. Holders face increased pressure for export sales, and some negotiations involve price concessions. 。 Mainstream prices: Soft materials are referenced at 9600-10200 RMB/ton, hard materials are referenced at 10300-10500 RMB/ton. 。

|

Figure 1 Domestic EVA Price Trend Chart (yuan/ton) |

Figure 2 Domestic EVA Price Trend by Category (Yuan/Ton) |

![[EVA日评]:需求跟进缓慢 市场承压混乱下跌 (20251013)](https://oss.plastmatch.com/zx/image/401159e37d15419dbc19588dc0e137bb.png) |

![[EVA日评]:需求跟进缓慢 市场承压混乱下跌 (20251013)](https://oss.plastmatch.com/zx/image/69a6403b966747ca8aec06fb0497ba78.png) |

|

Data Source: Longzhong Information |

Data Source: Longzhong Information |

3 Production dynamics

Domestic EVA petrochemical facilities: Sinochem Quanzhou produces V1815; Jiangsu Sierbang produces photovoltaic from tubular reactors and UE3315 from batch reactors; Jiangsu Hongjing PV1 line produces photovoltaic, PV2 line.Produce photovoltaic V2825PV3 line produces 6020M; Ningxia Baofeng produces photovoltaic 2825; Yanchang Yulin produces V2825Y; Tianli Gaoxin is undergoing maintenance today, intending to switch to hard material; Zhejiang Petrochemical produces photovoltaic; Gulei Petrochemical switches production to USI-629.All three EVA units at Yanshan have been shut down.In addition, the soft material prices in the South China market range from 9600 to 10200 yuan per ton, and the gross profit level in the domestic EVA industry is around 1050 yuan per ton.

|

Figure 3 Domestic EVA Capacity Utilization Rate Trend Chart |

Figure 4 Comparison of Domestic EVA Profit and Price (Yuan/Ton) |

![[EVA日评]:需求跟进缓慢 市场承压混乱下跌 (20251013)](https://oss.plastmatch.com/zx/image/584820cf9ddc46ff9aeb75158df5b4d3.png) |

![[EVA日评]:需求跟进缓慢 市场承压混乱下跌 (20251013)](https://oss.plastmatch.com/zx/image/b46afc644d1e4a53b1eadfbd69087ff4.png) |

|

Data Source: Longzhong Information |

Data Source: Longzhong Information |

4 Price prediction

In the short term, the market supply and demand fundamentals lack positive support, making it difficult for holders to sell their goods. Downstream buying is infrequent, and the offered prices are relatively low. The market performance is weak, and it is expected to continue this way in the short term. The weak situation in the domestic EVA market is difficult to change, with some petrochemical companies planning to switch production to hard materials. This may lower the price of hard materials in the future. 。

5 Relevant Product Information

1 Ethylene: On October 21, CFR Northeast Asia is stable at $780 per ton, and CFR Southeast Asia is stable at $770 per ton. Sinopec East China Sales Branch's ethylene price remains stable at 6300 yuan/ton, and Jinshan Union Trade's ethylene price is synchronized to 6300 yuan/ton.

2 Vinyl acetate: The mainstream negotiation price for vinyl acetate in the East China market is 5800-5900 yuan/ton in Jiangsu. The petrochemical price is 5800-5900 yuan/ton, with limited spot supply. Holders are reluctant to sell at low prices, and negotiations are being sorted within the focus range. 。

6 Data Calendar

Table 2 Domestic EVA Data Overview (Unit: Ten Thousand Tons)

|

Data |

Publication Date |

Data |

This issue's trend forecast |

|

EVA Capacity Utilization Rate |

Thursday 16:00PM |

89.84% |

↓ |

|

EVA Weekly Production |

Thursday 4:00 PM |

6.23 |

↓ |

|

Data Source: Longzhong Information Note: 1. Consider ↓↑ as significant fluctuations, highlighting data dimensions where the price change exceeds 3%. 2. ↗↘ are regarded as narrow fluctuations, highlighting data with a rise or fall within 0-3%. |

|||

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

India's Q3 Smartphone Shipments Rise 3%; Japanese Mold Factory Closures Surge; Mercedes-Benz Cuts 4,000 Jobs

-

Ascend's Restructuring Plan Approved! Jwell Launches Global Acceleration Plan; Nexperia Chip Crisis Threatens Global Auto Production

-

Dow To Restart Pe Units 5 And 7 This Week, Recovery Date For Unit 6 Remains Undetermined In The United States (US)

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

The Roller-Coaster Behind Sanhua Intelligent Controls' Stock Price: What Are the Advantages of Automotive Thermal Management Companies Crossing Into Humanoid Robots?