Female Billionaire Xiong Haitao Detained! Controlling Shareholder of Vicall, Dongcai Technology, and Gaomeng New Material, Wife of Kingfa Sci. & Tech. Founder

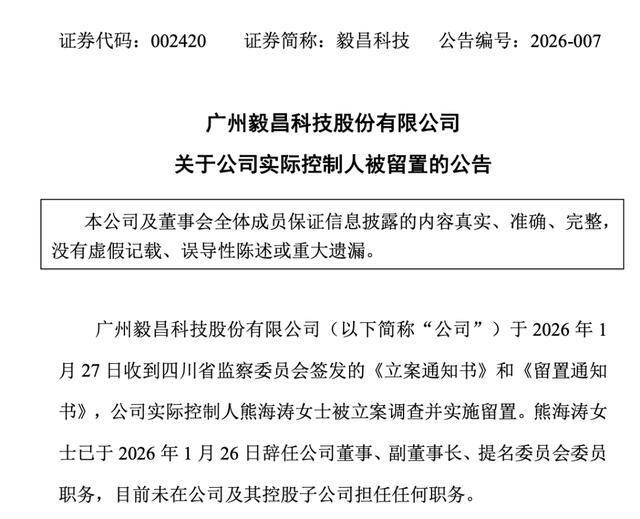

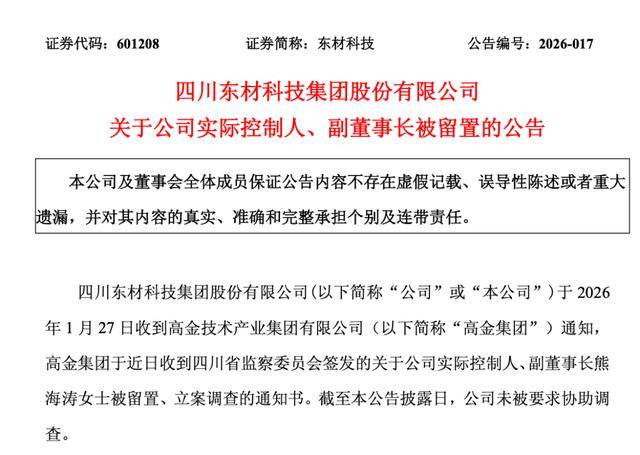

On the evening of January 27, 2026, the capital market was hit with major news. Three listed companies, Yichang Technology (002420), Dongcai Technology (601208), and Gomoly High Polymer Material (300200), announced that their actual controller and vice chairman, Xiong Haitao, had been placed under detention and investigation by the supervisory authority.

According to Tianyancha, Dongcai Technology, Yichang Technology, and Gaomeng New Material, three listed companies, all have Gaojin Technology Industry Group Co., Ltd. as their largest shareholder. The actual controller is Xiong Haitao (Source: Tianyancha).

The detention of this businesswoman, who was awarded the Greater Bay Area Outstanding Female Entrepreneur title and controls three listed companies deeply rooted in the new materials sector, has quickly garnered widespread market attention. This article will delve into the business layout of these three companies and their performance in the first three quarters of 2025.

Figure: Xiong Haitao (Source: Gaojin Fuheng Group WeChat)

Focusing on the new materials sector, Xiong Haitao's capital empire encompasses three listed companies, each specializing in a specific area and holding a position in key fields such as automotive, new energy, and electronic information. Public information reveals that Xiong Haitao controls these three companies through High Goal Technology Industry Group Co., Ltd., directly and indirectly holding 28.35%, 25.25%, and 22.86% of the shares of Gao Meng New Material, ECHOO Technology, and Dong== Technology respectively. As of the market close on January 27th, the total market value of the three companies was nearly 37 billion yuan.

Eechain

Source: ECI Technology Advertisement

Yichang Technology aims toAutomotive, New Energy, Healthcare, Home Appliance PartsThe company focuses on the R&D, production, and sales of related products, with [specific core business area, if known, otherwise omit this part] as its core business. Its main products cover automotive interior and exterior parts and assemblies, functional components and assemblies for new energy thermal management systems, medical and healthcare molds and consumables, and home appliance parts and assemblies. It is a key supplier to many well-known car and home appliance manufacturers. From a business structure perspective, the company has been deeply involved in the traditional home appliance structural components field for many years, while actively laying out new energy vehicles and medical health tracks, attempting to create new growth poles.

In the first three quarters of 2025, ECHUNG's performance showed... Revenue up, profits down. The company's financial report shows that in the first three quarters, it achieved a main business revenue of 2.106 billion yuan, a year-on-year increase of 14.3%; however, the net profit attributable to the parent company was only 38.0785 million yuan, a significant year-on-year decrease of 46.84%; the non-recurring net profit was 27.3048 million yuan, a year-on-year decrease of 47.08%. On a quarterly basis, the main business revenue for the third quarter alone was 715 million yuan, a year-on-year increase of 11.13%; the net profit attributable to the parent company for the single quarter was 3.6538 million yuan, a year-on-year increase of 193.37%. Although the single-quarter profit rebounded significantly year-on-year, it still remained at a low level.

Further analysis of financial indicators shows that YiChang Technology's gross margin for the first three quarters was 12.95%, up 1.16 percentage points year-on-year, indicating an improvement in product competitiveness. However, the net profit margin was only 2.37%, down 1.43 percentage points from the same period last year, suggesting that profitability is under pressure. Furthermore, the company's accounts receivable reached 766 million yuan, a year-on-year increase of 24.10%, while cash and cash equivalents decreased by 18.97% year-on-year to 75.6551 million yuan. Coupled with a 32.53% year-on-year increase in interest-bearing debt to 561 million yuan, cash flow pressure and debt risks have become prominent. This reflects that behind its revenue growth, the company faces challenges such as long collection cycles and tight liquidity.

2Dongcai Technology

Source: Dong====== Announcement

Dongcai Technology, on the other hand,

New insulation materials

Based on this foundation, the company focuses on developing a series of products including optical film materials, environmentally friendly flame retardant materials, and advanced electronic materials. Its business scope covers numerous high-end fields such as power generation equipment, ultra-high voltage power transmission and transformation, smart grids, new energy, rail transit, consumer electronics, flat panel displays, electrical appliances, and military industry. As a leading enterprise in the domestic insulation material industry, the company's products have high technological content and strong market barriers.

Since 2025, Dongcai Technology has fully benefited from the high-quality development of emerging fields such as domestic UHV power grids, new energy vehicles, artificial intelligence, and computing power upgrades, resulting in outstanding performance. In the first three quarters, the company achieved operating revenue of 3.803 billion yuan, a year-on-year increase of 17.18%; net profit attributable to the parent company was 283 million yuan, a year-on-year increase of 19.8%; and basic earnings per share were 0.31 yuan. Among them, single-quarter operating revenue in the third quarter was 1.372 billion yuan, a year-on-year increase of 22.12%; net profit was 92.6211 million yuan, a year-on-year increase of 21.27%, demonstrating strong growth momentum.

It is worth noting that Dong== Technology announced on January 23, 2026, that it intends to transfer 31.4265% of its shares in its holding subsidiary, Henan Huajia New Materials Technology Co., Ltd., to Shengye Electric for a transaction price of 66.93 million yuan. After the transaction is completed, the company's shareholding ratio in Henan Huajia will decrease to 30.1498%, and the latter will no longer be included in the consolidated financial statements. This transaction will not only increase the company's pre-tax profit by approximately 77 million yuan in 2026, improving its financial situation and cash flow, but also jointly build a complete industrial chain of "polypropylene-based film production - metallized coating processing - thin film capacitor preparation" with Henan Huajia and Shengye Electric, realizing controllable costs, traceable quality, and synergistic technological innovation, laying the foundation for the company's long-term development.

Diagram: Major Shareholders of Dong== Technology

3Gaomeng New Material

Gaomeng New Material is Leading domestic high-performance composite polyurethane adhesive enterprise The product range includes adhesives for plastic flexible packaging, polyurethane adhesives for high-speed rail, etc., widely used in emerging industries and important fields such as packaging, transportation, new energy, home appliances, building materials, and photovoltaic new energy.

Founded in 1999 and listed on the ChiNext market in 2011, the company now has six wholly-owned subsidiaries and one holding subsidiary. It has established four major production bases in Beijing, Nantong, Wuhan, and Qingyuan, with a nationwide sales network and product exports to over 50 countries and regions.

In the first three quarters of 2025, Gao Meng New Material achieved operating revenue of 952 million yuan, a year-on-year increase of 5.93%; net profit attributable to the parent company was 114 million yuan, a year-on-year increase of 3.58%, demonstrating steady growth in performance. Looking at the performance by quarter, the company's performance showed a good trend of gradual improvement. In the first quarter, operating revenue decreased by 11.85% year-on-year, and net profit attributable to the parent company excluding non-recurring items decreased by 24.52% year-on-year. In the second quarter, operating revenue increased by 4.30% year-on-year, and net profit attributable to the parent company excluding non-recurring items increased by 24.05% year-on-year. In the third quarter, operating revenue reached 355 million yuan, a year-on-year increase of 28.65%, net profit attributable to the parent company was 37.8452 million yuan, a year-on-year increase of 46.56%, and net profit excluding non-recurring items increased significantly by 68.20% year-on-year, with continued release of growth momentum.

From a future development perspective, Gaomeng New Material's capacity expansion is worth anticipating. The company's Nantong base project with an annual output of 46,000 tons of electronic and new energy adhesives is expected to be officially accepted in the fourth quarter of 2025. The second phase of the technical modification project with an annual output of 124,500 tons of adhesive new materials and a byproduct of 4,800 tons of diethylene glycol is steadily advancing. The release of future production capacity is expected to further increase the company's market share and consolidate its leading position in the industry.

The detention of Xiong Haitao undoubtedly brings uncertainty to the three listed companies. However, all three companies stated that, as of the date of the announcement, other directors and senior management personnel are performing their duties normally, production and operation management is normal, and the relevant matters will not have a significant impact on the normal production and operation of the companies.

From an industry perspective, the new materials track in which the three companies operate is a strategic emerging industry strongly supported by the state, with vast market space. Yichang Technology's layout in automotive lightweighting and healthcare, Dongcai Technology's technological advantages in UHV and new energy vehicle materials, and Gaomeng New Material's leading position in the adhesive industry all provide solid support for their long-term development. However, in the short term, the news of the actual controller being detained may trigger capital market sentiment fluctuations, and the stock price may face pressure.

Edited by: Lily

Source materials: Announcements from three companies, Securities Star, Cai Zhongshe, China Economic Net, China Restaurant Packaging Association, etc.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories