From 3.5% to 10% Growth Rate, How TPU Film Becomes the "Invisible Engine" of Outdoor Clothing?

Background Briefing

On August 28, 2025, Anta Group, in collaboration with Donghua University, officially launched China's self-developed high-performance fluorine-free waterproof and breathable material—Aerovent Zero. As China's first independently developed and mass-produced high-performance fluorine-free waterproof and breathable material, the birth of Aerovent Zero marks a key breakthrough in the field of high-performance waterproof and breathable fabrics in China. Moreover, being fluorine-free makes it more environmentally friendly, earning it the title of a new generation of textile "chips" with the potential to reshape the global competitive landscape of technological fabrics.

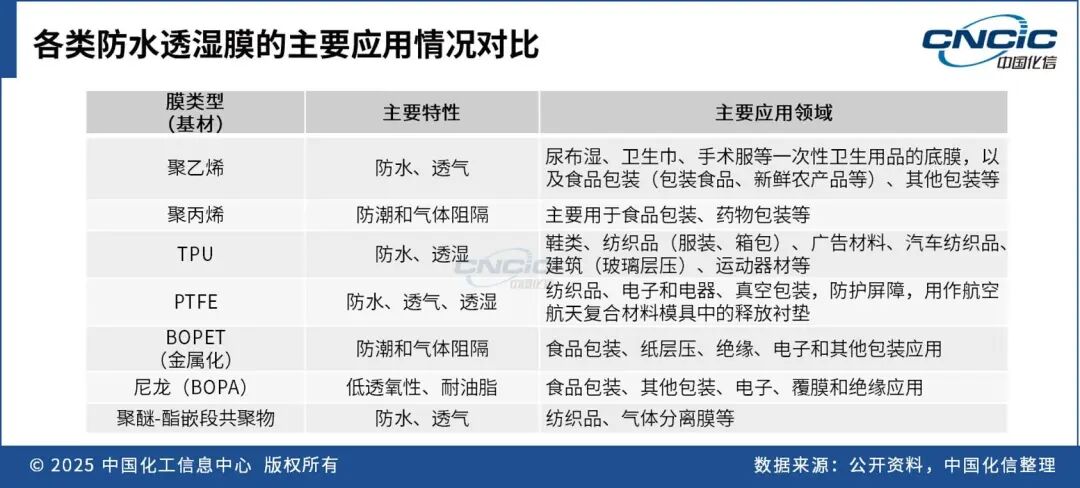

Waterproof and breathable membranes can be categorized into three types based on their waterproof and breathable principles or the mechanisms that prevent the penetration of liquid water and transmission of water vapor: microporous membranes, non-porous membranes, and bicomponent membranes. Microporous breathable membranes allow only water vapor molecules to pass through, while any mist, raindrops, or water droplets cannot pass through, thereby achieving waterproof and breathable effects. The overall effectiveness of these membranes is determined by factors such as the average pore size and distribution, quantity, thickness, and hydrophilic/hydrophobic properties. These mainly include polytetrafluoroethylene (PTFE), polyurethane (PU), expanded polyethylene (e-PE), and electrospun nanofiber membranes. In non-porous breathable membranes, the soft segments can rapidly transmit water vapor from the inside to the outside through "adsorption-diffusion-desorption," while the hard segments can block water droplets, providing waterproof properties. The waterproof and breathable performance of non-porous breathable membranes is directly determined by the ratio of soft/hard segments, processing techniques, and membrane thickness, mainly involving thermoplastic elastomer (TPE) and thermoplastic polyurethane (TPU) membranes.

01

Development Status and Forecast of Waterproof Breathable Membranes

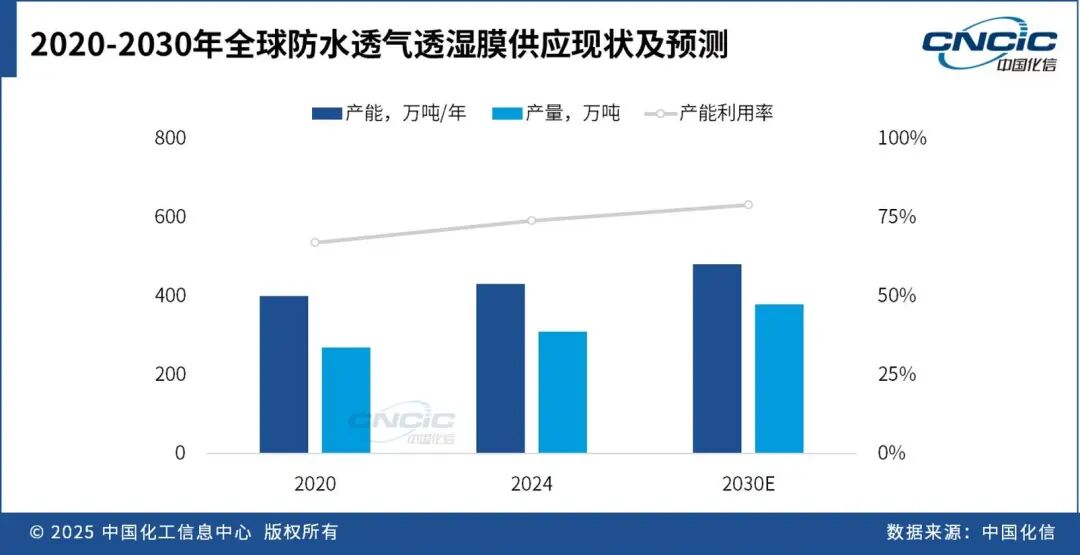

In 2024, the global production capacity for waterproof and breathable membranes is approximately 4.3 million tons per year, with a production output of around 3.1 million tons. The industry primarily operates on a production-to-sales basis, with production volume essentially equating to consumption volume. In 2024, the global market size for waterproof and breathable membranes is estimated to be about $7.5 billion. From 2020 to 2024, the total production of global waterproof and breathable membranes has maintained steady growth, with an average annual growth rate of 3.5%. It is expected that from 2025 to 2030, the average annual growth rate will remain around 3.5%, consistent with the past five years. By 2030, the global demand for waterproof and breathable membranes is projected to reach 3.8 million tons.

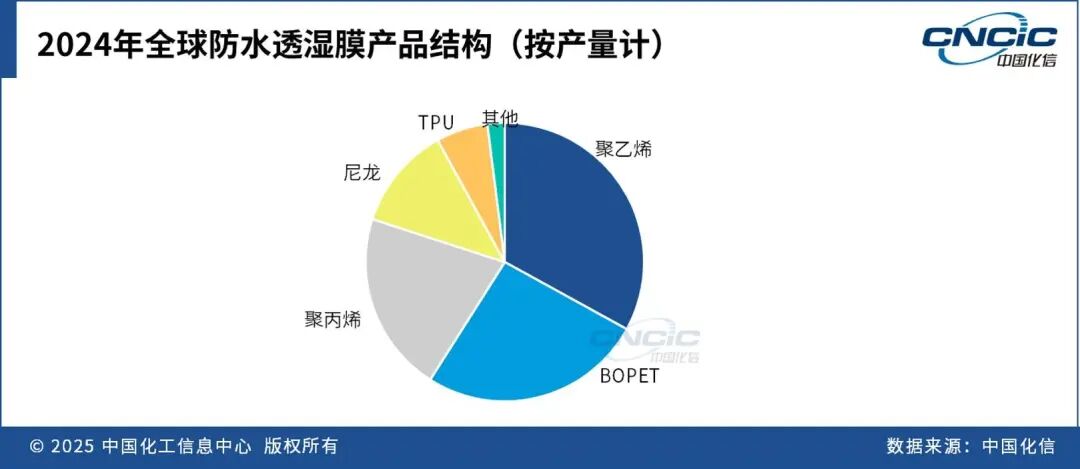

Among the product types, polyethylene film has the largest production share, accounting for about one-third of the total production; followed by polyester film (BOPET), polypropylene film, nylon film, and TPU film.

The main downstream application areas for waterproof breathable membranes are packaging, medical hygiene, textiles, etc. Among them, the membrane types with the largest usage in outdoor fabrics/clothing applications are PTFE membranes and TPU membranes. Due to the difficulty of production and processing and high cost, PTFE membranes are generally used only in specialized jackets, ski suits, mountaineering suits, military uniforms, firefighting suits, and other applications that require high standards or are used under harsh conditions. While TPU membranes have slightly poorer breathability, they are cheaper and offer higher cost performance, primarily used for ordinary protective clothing and everyday jackets.

In 2024, the global consumption of waterproof breathable membranes in the outdoor fabric/apparel application field is approximately 110,000 tons, with a market size of about 670 million USD. In terms of consumption volume, TPU membranes are the largest, followed by PTFE membranes; in terms of consumption value, PTFE membranes are the largest, followed by TPU membranes.

The global demand for waterproof and breathable membranes in the outdoor fabrics/clothing sector is expected to grow steadily in the future, with an average annual growth rate of 5% to 6% between 2025 and 2030. However, the demand for TPU waterproof and breathable membranes is projected to grow at a faster pace, with an average annual growth rate potentially reaching 7% from 2025 to 2030.

02

Current Status and Forecast of TPU Waterproof Breathable Membranes Development

TPU waterproof and breathable membrane is made from TPU resin through blow molding or casting, featuring excellent moisture permeability, wind resistance, waterproofing, easy cleaning, good oil resistance, high flexibility, solvent resistance, and chemical resistance. It is widely used in various fields such as textiles, medical, military, automotive, and electronics. Currently, major overseas TPU film suppliers include Germany's Covestro, Italy's Novotex, and the UK's Permali. In China, there are more than 40 manufacturers of TPU waterproof and breathable membranes, mainly concentrated in coastal areas of South China and East China, such as Guangdong, Jiangsu, and Zhejiang. However, only 5 companies have more than 10 production lines for TPU waterproof and breathable membrane products, while most companies have a small production scale, with only about 3 to 4 production lines.

In 2024, there are approximately 130 production lines for TPU waterproof and breathable membranes in China. Calculated based on a single production line with a capacity of 700 tons per year, the industry has a production capacity of about 91,000 tons per year. Mainly benefiting from the rapid growth of the downstream outdoor industry, TPU waterproof and breathable membrane manufacturers have expanded their production capacity in 2024, adding about 30 new production lines throughout the year. However, since the majority of these new production lines were launched in the second half of the year, the annual industry operating rate decreased by ten percentage points compared to the previous year.

In 2024, the total consumption of TPU waterproof and breathable membranes in China is approximately 50,800 tons, with the textile and apparel sector being the largest consumer area, primarily used for outdoor clothing. This is followed by other textile products, mainly including tents, shoe materials, home textiles, and other textiles. Additionally, it is used in medical and firefighting fields.

The TPU waterproof and breathable membrane market is primarily dominated by domestic products in China. The production equipment and technology of Chinese local enterprises are already quite mature. For applications requiring special performance, companies tend to use imported TPU particles to meet high standards. In terms of exports, currently only a few enterprises of considerable scale can achieve about 10% export. The average export volume of the entire industry accounts for approximately 6% to 7% of the total production.

In the future, thanks to the continuous rapid growth in demand from downstream sectors such as outdoor clothing and medical fields, and the profitability potential of TPU waterproof and breathable membrane products, the production capacity of TPU waterproof and breathable membranes in China is expected to continue to grow. Existing TPU film manufacturers may gradually upgrade their production lines, progressively moving towards the high-end TPU waterproof and breathable membrane sector. On a global scale, as the textile industry continues to shift towards Southeast Asian countries, Chinese TPU waterproof and breathable membrane manufacturers will actively expand their export markets, with export volumes expected to further increase. Meanwhile, the textile and apparel industry in China will remain the most important downstream application field for TPU waterproof and breathable membranes, with demand growth potentially exceeding 10%, continuously driving the consumption growth of China's waterproof and breathable membrane products.

Hua Xin's perspective.

With the improvement of people's living standards and changes in consumption concepts, the demand for outdoor sports, functional clothing, and other products continues to increase, leading to a growing demand for TPU waterproof and breathable membranes in these fields. Coupled with the rapid development of industries such as automotive and medical, the demand for high-performance waterproof and breathable materials is becoming increasingly strong, providing a broad development space for the TPU waterproof and breathable membrane market. However, as the market continues to expand, more and more enterprises will gradually enter the TPU waterproof and breathable membrane industry, resulting in increasingly fierce market competition.

Overall, China's TPU waterproof and breathable membrane industry is still in the "growth-maturity" phase. Given the technical capabilities and downstream customer resources, entering the TPU waterproof and breathable membrane production field is still a promising investment: firstly, the investment in TPU waterproof and breathable membrane production lines is relatively low, with a quick return on investment, and the project's dynamic payback period is 12 to 15 months; secondly, the versatility of technology and equipment ensures that production enterprises can profit in multiple downstream application fields.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories