Hainan Closure Has Limited Short-Term Impact on Plastic

On December 18, the full-scale closure of Hainan Free Trade Port officially commenced, implementing the regulatory framework of "opening up the first line, controlling the second line, and free movement within the island." It is expected to reshape the plastic industry landscape through three core pathways: expanding "zero tariffs," implementing processing value-added policies, and enhancing trade facilitation. In the short term, the policy benefits are concentrated on optimizing the cost structure of Hainan's local industry chain, with limited impact on the national plastic industry, as key factors still focus on the traditional supply-demand imbalance. In the long term, Hainan will gradually form a plastic "raw material-processing-export" industrial cluster, enhancing competitiveness in Southeast Asian trade, while also promoting high-end transformation, potentially altering the domestic plastic regional price difference structure. Overall, the full-scale closure of Hainan presents a "short-term local optimization, long-term pattern reshaping" characteristic for the plastic industry, with limited short-term impact on the industry's overall operating rhythm, while in the long term, cost advantages and trade facilitation will create new market opportunities.

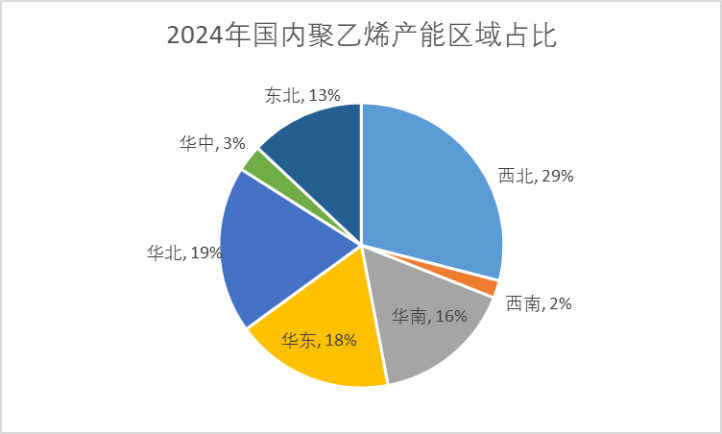

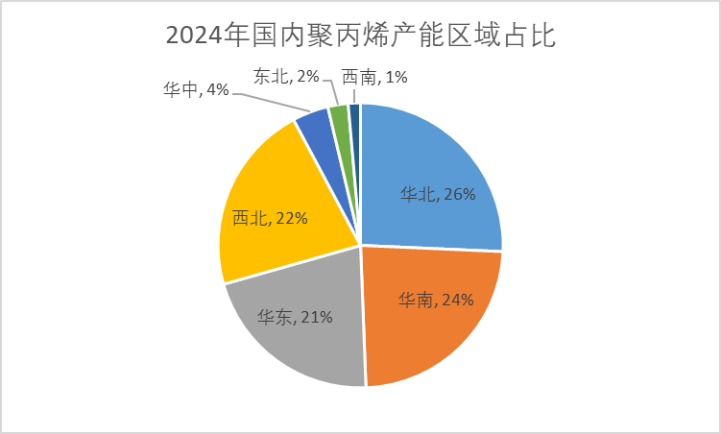

Limited short-term impact, regional benefits stand out. From the perspective of domestic polypropylene capacity distribution, North China, South China, and East China are the core concentration areas. As of 2025 data, the capacity share in South China is 24%, East China is 22%, and North China is 19%, with the three regions accounting for a total of 65%. Within the South China region where Hainan is located, Hainan's capacity share is only about 4.2%. In terms of polyethylene, the current plastic capacity in Hainan centers around the Hainan Refining & Chemical 1 million tons ethylene project, accounting for less than 2% of the national capacity. Even if cost optimization post-closure improves the operating rate, it cannot change the national supply pattern. According to statistics, Hainan Refining & Chemical is expected to reduce raw material costs by 9 million yuan by 2025 with the help of closure-related policies, and downstream Weida Chemical can save 400 yuan per ton on polypropylene raw material purchases, but such benefits only cover local enterprises. Moreover, there is still pressure on national plastic inventory, with polypropylene comprehensive inventory at 537,000 tons and polyethylene social inventory at 581,000 tons, and the overall downstream operating rate is about 43%. Therefore, the demand in Hainan is relatively small and is unlikely to drive an overall increase in industry demand. In the short term, plastics are still dominated by the actual operation of the industry.

The medium- to long-term impact will deepen, reshaping regional and trade patterns. After the closure, the logistical advantages of Yangpu Port's 65 shipping routes will be further unleashed. In the future, increasing the frequency of shipping routes can reduce the logistics costs for plastic exports to Southeast Asia, combined with a cost advantage of around 400 RMB per ton, significantly enhancing the export competitiveness of Hainan enterprises. In terms of industry, Hainan plans to add 1.8 million tons per year of propylene capacity by 2027, gradually forming a "raw material-processing-export" industrial cluster, increasing its share in the national production capacity. This will lead to a regular price difference between Hainan and the East and South China markets; meanwhile, the expansion of high-end plastic production capacity may also change the product structure.

In summary, the closure of Hainan is unlikely to boost the overall demand in the plastics and chemicals industry in the short term. However, in the medium to long term, the closure will bring not only tariff reductions but also promote institutional innovation, driving the industrial chain towards higher levels of synergy and higher added value development.

Author: Senior Market Analysis Expert Wang Shiqi

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories