Half-Month Deadline: Bohai Chemical Terminates Acquisition of TEDA New Material, Transformation Stumbles into Dilemma

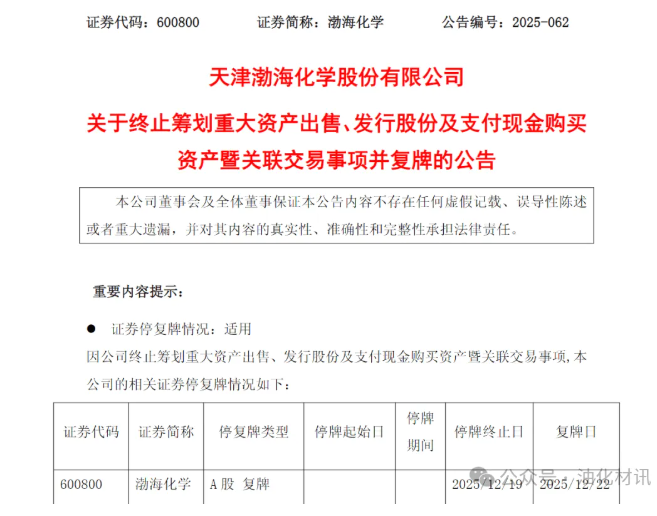

On December 19, Bohai Chemical announced the termination of its major asset restructuring plan, a transaction that was just disclosed on December 5, involving the "sale of core loss-making assets and the acquisition of a high-profit new materials leader," which concluded hastily in just half a month. The statement in the announcement that "the parties failed to reach an agreement on the core terms of the transaction" reflects both the urgency and helplessness of traditional chemical companies attempting to transform into the new materials sector, casting a heavy shadow over Bohai Chemical's path to self-rescue.

1. "Selling Old to Buy New": A Mutual Endeavor of Self-Rescue and Breakthrough

The core logic of this transaction is the "mutual demand matching" between Bohai Chemical and Teda New Materials. For Bohai Chemical, this is a desperate battle to break free from continuous losses and avoid the risk of delisting. Bohai Petrochemical, as the company's core asset, has an annual production capacity of 600,000 tons of PDH (propane dehydrogenation to propylene) and was once the pillar of its business. However, in recent years, it has been mired in an industry downturn. Due to structural overcapacity in the PDH industry, continuous negative profit margins, and the impact of Sino-US tariff policies increasing propane import costs, Bohai Petrochemical has become a heavy burden on its performance—reporting a net loss of 326 million yuan in the first half of 2025, accounting for over 90% of the net loss of the listed company. From 2022 to the third quarter of 2025, Bohai Chemical's net profit attributable to the parent company has shown continuous losses of -38 million yuan, -521 million yuan, -632 million yuan, and -579 million yuan, with the chemical business's gross margin being negative for two consecutive years, making transformation urgent.

In order to break out of the predicament, Bohai Chemical initially planned a "dual-line operation": having the controlling shareholder take over 100% equity of Bohai Petrochemical to divest loss-making assets, while simultaneously acquiring control of TEDA New Material through issuing shares and paying cash to quickly enter the high-growth fine chemical sector. It is noteworthy that Bohai Chemical itself is also advancing the transformation of its PDH facilities towards new material projects such as acrylate. However, the project, which has already seen an investment of 215 million yuan, is not yet completed and is difficult to quickly reverse performance. Acquiring TEDA New Material has become a crucial choice for its "shortcut-style transformation."

For Taida New Material, this acquisition is an important opportunity to solve its capital dilemma. As a leading enterprise in China's trimellitic anhydride (TMA) sector, Taida New Material, along with Zhengdan Co. and Baichuan Chemical, jointly occupies the core domestic production capacity. Globally, only a few companies like INEOS from the United States and Polynt from Italy have competitive strength. In 2024, due to INEOS's permanent closure of its TMA facilities, the global supply-demand balance was disrupted, causing TMA prices to soar from 19,000 yuan/ton to 50,000 yuan/ton, driving Taida New Material's performance to explode — with a year-on-year increase of 1112.41% in net profit attributable to the parent company in 2024, a year-on-year revenue growth of 53.38% in the first half of 2025, and a year-on-year net profit increase of 179.28%. The gross profit margin of the TMA business reached as high as 73.87%.

Despite impressive profits, Taida New Material's path to capital has been exceptionally bumpy. Its attempts to enter the Growth Enterprise Market in 2016 and the Beijing Stock Exchange in 2021 were both rejected, with the core issue being its significantly higher and more volatile gross profit margin compared to peers. The third attempt at listing on the Beijing Stock Exchange, initiated in 2024, was also terminated in March 2025. If acquired by Bohai Chemical, Taida New Material could leverage the main board listing platform to indirectly enter the capital market, while gaining the funds needed to support its project to produce 80,000 tons of polyphenylene sulfide (PPS) resin annually. This project, with a total investment of 1.6 billion yuan, targets high-end demands such as 5G communications and humanoid robots, with the first phase expected to start production by the end of June 2026, urgently requiring capital support.

Section 2: Divergence in Core Terms: The Key Battle Between High Valuation and Control

The quick termination of the transaction is superficially attributed to "core terms not being agreed upon," but in reality, it stems from the difficulty in reconciling both parties' core demands. Based on the fundamentals of both sides and the industry background, the differences may focus on three major dimensions:

Firstly, there is a significant disparity in valuation pricing. Tianda New Materials, with its high profitability since 2024, will undoubtedly seek a high valuation in the transaction; however, Bohai Chemical, which has been continually losing money and has a market value of only 5.606 billion yuan, will find it difficult to meet Tianda New Materials' valuation expectations, whether through issuing shares or cash payments. In particular, the ongoing regulatory scrutiny of Tianda New Materials' high gross profit margin may lead to difficulties in reaching a consensus on valuation adjustment mechanisms and performance commitment clauses between the two parties.

Secondly, the game of control and development leadership. The actual controllers of Taida New Materials are the Ke brothers, Ke Bocheng and Ke Boliu, and the company's board and executive team are primarily composed of individuals born in the 1960s, giving them strong control over the enterprise. If Taida New Materials is acquired by Bohai Chemical, whether the Ke brothers can retain control and how to ensure the independence of Taida New Materials’ operational decision-making are key points of contention. This is especially important as Taida New Materials is advancing a high-investment PPS project and has a clear plan for its future development, which may lead them to be unwilling to sacrifice project leadership due to the acquisition.

Thirdly, there are disputes regarding the conditions of the transaction. In this transaction, the "sale of Bohai Petrochemical" and the "acquisition of Taida New Materials" are interdependent. The loss status of Bohai Petrochemical may affect its sale price, which in turn could impact the balance of the acquisition consideration. Furthermore, the ongoing losses of Bohai Chemical may lead the shareholders of Taida New Materials to doubt the sustainability of the listed company's operational capabilities after the transaction, resulting in disagreements over terms such as performance compensation and the timing of capital payments.

Three, Bidirectional Pressure: The Transformation Paths of Both Parties Change After Termination of the Transaction.

The termination of the transaction signifies an urgent "brake" on the strategic layout for both parties, and their future development faces greater uncertainty.

For Bohai Chemical, the transformation plan encountered a major setback. After losing the highly profitable asset of TEDA New Material, it still has to bear the burden of losses from Bohai Petrochemical. Meanwhile, its own new material renovation projects are not yet completed, making it difficult to reverse the downturn in performance in the short term. Although the announcement claims that terminating the transaction will not adversely affect production and operations, the ongoing loss situation remains unchanged. If it cannot quickly find a new transformation path, it may face delisting risks. Additionally, the company has committed not to plan any major asset restructuring within a month, closing off the acquisition channel for transformation in the short term, further intensifying the pressure to transform.

For TEDA New Material, the hope of going public through a curve has fallen through, and the capital dilemma has once again become prominent. Although current profits are impressive, the price of TMA is greatly affected by the global supply-demand pattern, with uncertainty in its long-term trend. Additionally, the PPS project's large investment scale and long cycle, lacking capital support, may slow down the project's advancement pace. With three IPO failures compounded by the termination of an acquisition, TEDA New Material's path to capital is increasingly bumpy. How to solve the funding issue to support its high-end transformation has become the core challenge for its future development.

IV. Industry Snapshot: The Game and Dilemma of Traditional Chemicals Transforming into New Materials

This "short-lived acquisition" is not an isolated case, but rather a typical reflection of the wave of traditional chemical companies transitioning to new materials. Currently, traditional chemical sectors such as PDH and refining are generally facing challenges of overcapacity and low profitability, while the new materials sector has become a hotspot for transformation due to its alignment with the future industrial demands of high-end manufacturing and new energy. However, during the transformation process, companies often face multiple dilemmas.

1. The contradiction between "rapid transformation" and "financial strength." Traditional chemical companies are often deep in losses with limited financial reserves, while new materials projects or acquisition targets have high valuations, making it difficult to bear the high costs; 2. The balance between "short-term profits" and "long-term investments." New materials companies like Taida New Materials may have high profits, but there may be cyclical issues or regulatory disputes behind them. Differences in the assessment of profit stability between both parties can affect transaction negotiations; 3. The disconnection between "scale expansion" and "core technology." Traditional chemical companies lack core technology in new materials and are eager to enter the field through acquisitions, but the target companies often hold core technologies, leading to fierce control battles.

From the perspective of industry development, mergers and acquisitions remain an important pathway for chemical enterprises to transform. However, this incident also reminds companies that transformation should not be pursued hastily; they need to fully assess their financial strength, the rationality of the transaction price, and the feasibility of business integration to avoid falling into greater difficulties due to a "quick decision."

The acquisition saga between Bohai Chemical and Tianjin TEDA New Materials has come to a hasty end, leaving both parties with confusion and challenges on their transformation paths. For Bohai Chemical, the immediate priority is to quickly sort out the progress of its new materials projects while exploring alternative ways to divest its loss-making assets. Tianjin TEDA New Materials, on the other hand, needs to replan its capital layout to ensure the smooth advancement of the PPS project. The termination of this transaction also serves as a wake-up call for more traditional chemical companies: while the new materials sector holds promise, it is essential to address core issues such as funding, technology, and valuation in a pragmatic manner to truly achieve a breakthrough in transformation.

Bohai Chemical's stock will resume trading from the market opening on December 22. Its subsequent transformation measures and performance, as well as the capital path adjustments of Taida New Materials, are worthy of ongoing attention from the industry.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories