How Much Time Does India Leave for PVC?

1. Current Status of PVC Production and Import in India

In 2024, India's PVC production capacity is expected to be around 1.59 million tons, while the national demand for PVC is approximately 4 million tons. This means that domestic production can only meet less than half of the consumption demand, with more than 60% relying on imports. The largest producer is Reliance Industries Ltd. (RIL), with a capacity of about 750,000 tons per year, accounting for nearly half of the national total capacity. Other major domestic producers include Finolex Industries (300,000 tons), Chemplast Sanmar (300,000 tons), DCW Ltd. (90,000 tons), and DCM Shriram (70,000 tons). Due to insufficient domestic supply, India's PVC import volume has significantly increased in recent years. In 2020, imports were about 1.6 million tons, and by 2024, they have climbed to approximately 3.3 million tons, with expectations that import volume will rise to 3.9 million tons in 2025.

PVC demand is primarily driven by agricultural irrigation pipes, urban water supply and drainage networks, building profiles, packaging, and electrical cables, all of which are experiencing strong demand. India's PVC demand is expected to grow at a rate of 8-10% in the future, thus expanding domestic PVC production capacity to reduce import dependency has become an important task for the Indian petrochemical industry.

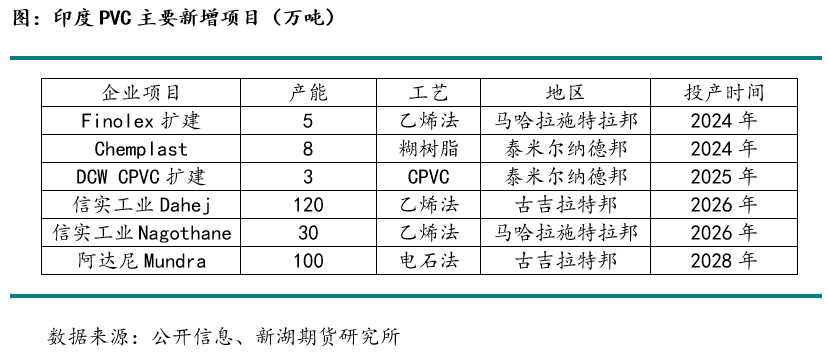

II. Details of New Production Capacity and Major Expansion Projects

High import dependence makes India highly sensitive to global PVC market price fluctuations, leading to a trade deficit. Therefore, the Indian government and companies are promoting the expansion of PVC production capacity. With the commissioning of a series of new projects, India's PVC import dependence is expected to drop to below 30% around 2027.

Reliance Industries (RIL)

Reliance Industries, the largest PVC producer in India, announced at its annual shareholder meeting in August 2024 that it will build new PVC facilities at its existing sites in Dahej, Gujarat, and Nagothane, Maharashtra, with a combined additional capacity of 1.5 million tons per year. These new facilities are scheduled to be commissioned in 2026-2027. After commissioning, RIL's PVC capacity will increase from the current approximately 750,000 tons to over 2.25 million tons per year. The largest project is the new PVC Phase II facility in Dahej (1.2 million tons). Additionally, capacity expansions of approximately 50,000 tons and 40,000 tons will be achieved through technological upgrades at the old plants in Hazira and Vadodara, respectively.

Adani Group

Adani, an infrastructure giant, has ventured into the petrochemical sector for the first time in recent years by establishing an integrated PVC project in Mundra, Gujarat. The project plans a production capacity of 1 million tons per year, utilizing the calcium carbide process route, which includes supporting upstream facilities such as chlor-alkali, calcium carbide furnaces, and acetylene generation. The project has received environmental clearance and construction approval and was launched at the end of 2023. According to the plan, Adani PVC will be completed and put into operation in 2027–2028, making it India’s first PVC production facility using the calcium carbide process. Additionally, land has been reserved for future expansion to 2 million tons.

Chemplast Sanmar

Chemplast Sanmar focuses on specialty PVC resins and has been working to expand its PVC paste resin capacity in recent years to meet the downstream demand from synthetic leather, coatings, and other applications. In March 2024, Chemplast completed the construction and commissioning of a 41,000 tons/year paste resin facility, increasing its total paste resin capacity to approximately 107,000 tons/year. Additionally, Chemplast is advancing the expansion plan for its Mettur plant in Tamil Nadu, aiming to increase paste resin capacity from 66,000 tons to 145,000 tons/year. Chemplast's parent company, Sanmar Group, is also monitoring the changes in PVC supply and demand in India and does not rule out the possibility of further expanding general PVC capacity in the future.

Finolex Industries

Finolex, a major PVC pipe manufacturer in India, has certain PVC production capacity (located in Ratnagiri, Maharashtra). In recent years, it has primarily focused on small-scale technical upgrades to enhance capacity, completing an expansion of approximately 50,000 tons in 2024, bringing its capacity to about 330,000 tons per year, partially meeting its own resin demand for pipe production. Finolex has also planned to build a new 100,000-ton PVC plant in eastern India, but this project is currently on hold; the decision to restart the new project will depend on market conditions in the future.

DCW Ltd

DCW is a well-established chlor-alkali and PVC manufacturing company in India, currently with a PVC production capacity of 90,000 tons. However, in recent years, it has shifted its focus towards high value-added products such as CPVC (chlorinated polyvinyl chloride). In October 2024, DCW announced plans to expand its CPVC capacity, aiming to increase its annual production from 20,000 tons to 50,000 tons. This will make DCW a major CPVC supplier in India, catering to the demand for hot water pipelines and fire protection systems. In the general PVC sector, DCW has no significant expansion plans, and its existing PVC facilities will continue to operate steadily.

If the construction progress of the aforementioned projects proceeds as scheduled, most of them will gradually commence production between 2025 and 2027, with a peak in production launches expected in 2026–2027. The implementation of projects by RIL and Adani, among others, will significantly alter the PVC supply landscape in India.

3. Outlook on India's Production Capacity and Import Dependence Trends

In the future, with the successive commissioning of the aforementioned new capacities, India's total PVC capacity will increase from the current approximately 1.59 million tons per year to over 4 million tons per year by the end of 2025 to 2028, sufficient to cover most of the domestic incremental demand. Based on an annual PVC demand growth rate of 8%, by 2028, India's annual PVC demand may reach around 6 million tons, with the import dependency expected to decrease from the current 60% to about 30%.

The year 2027 will be a turning point, as RIL's additional 1.5 million tons and Adani's 1 million tons projects come online, India's production capacity will exceed 3 million tons for the first time. If all planned projects are successfully completed in 2028, India's total capacity will reach 4 million tons. The Indian PVC market will gradually transition from a state of supply shortage to a balance between supply and demand, significantly reducing the industry's dependence on external supplies.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

[Today's Plastics Market] General Materials Weakly Fluctuate, Engineering Materials Steadily Rise

-

New Breakthrough in Domestic Adiponitrile! Observing the Rise of China's Nylon Industry Chain from Tianchen Qixiang's Production

-

Daily Review: Polyethylene Prices Under Weak Consolidation, Sellers Face Significant Pressure to Move Inventory