India Reduces December Russian Oil Orders! Oil Prices See Biggest Single-Day Increase in Three Weeks, Plastics Futures Mixed

I. Overnight Crude Oil Market Dynamics

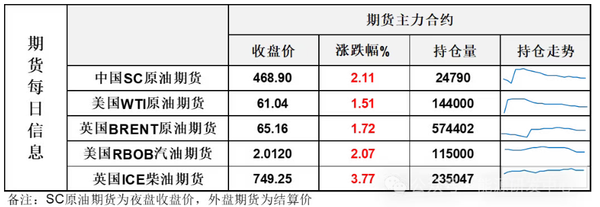

The market expects that the U.S. government shutdown is about to end, boosting demand expectations, coupled with ongoing geopolitical instability, leading to an increase in international oil prices. NYMEX crude oil futures for the December contract rose by $0.91 to $61.04 per barrel, a month-on-month increase of 1.51%; ICE Brent crude futures for the January contract rose by $1.10 to $65.16 per barrel, a month-on-month increase of 1.72%. China's INE crude oil futures for the 2601 contract fell by 0.8 to 461.8 yuan per barrel, rising by 9.3 to 471.1 yuan per barrel in the night session.

Market Forecast

On Tuesday, oil prices rose more than 1.5%, marking the largest single-day increase in nearly three weeks, as the previously stagnant tug-of-war between bulls and bears finally showed signs of change. Ukrainian forces continue to intensify strikes on multiple key energy facilities in Russia to weaken its military and economic potential. Meanwhile, the West is increasing pressure on Russia through sanctions, with recent information indicating that India has slowed down its oil purchases from Russia and is seeking alternative solutions, highlighting the ongoing impact of the sanctions. The U.S. sanctions on Russia are affecting Europe's winter energy supply, raising concerns about supply shortages, which has led to a surge in European diesel prices, becoming the main driver behind the rise in oil prices on Tuesday.

Although refined oil has shown strong performance, the monthly spread remains relatively weak, especially with the WTI crude oil monthly spread showing further weakness. This performance reflects the ongoing loose supply situation due to OPEC+ continuing to increase production, leading to a sustained weak performance in the Middle East physical market. Additionally, the high level of floating storage at sea has kept investors cautious about the potential oversupply pressure in the future. This means that despite the consecutive rebounds in crude oil over the past few trading days, the willingness of funds to chase prices remains limited. For oil prices to break through the consolidation range of the past two weeks, more driving factors will be needed.The short-term trend of oil prices has strengthened, with a chance to challenge the upper resistance zone. OPEC and the International Energy Agency will soon release key reports, which may provide some guidance for the future market of crude oil.Looking ahead, unless there are factors that can significantly reverse the supply surplus, it is highly likely that the oil price will remain under downward pressure for the rest of the year. It is still recommended to take advantage of rebounds to seize short selling opportunities, while paying attention to the timing.

II. Macroeconomic Dynamics

According to the American Automatic Data Processing Company (ADP), in the four weeks ending October 25,The average private sector in the United States lost 11,250 jobs per week.;Goldman Sachs estimates that the U.S. nonfarm payrolls decreased by about 50,000 in October.It will be the largest decline since 2020.

2、The U.S. Senate voted to pass a temporary funding bill, and the House of Representatives is reportedly set to begin voting on the bill at 5 a.m. Beijing time on Thursday.。

3. Informed sources:India reduces December Russian oil orders, instead increasing purchases of U.S. oil.。

Sources: The 15% tariff agreement between Switzerland and the United States could be reached as early as Thursday or Friday.

AI valuation surge drives SoftBank's Q2 net profit to soar to $16.6 billion, with its fund selling off Nvidia and reinvesting $22.5 billion in OpenAI.

6、The National Development and Reform Commission held a seminar with private enterprises to gather opinions and suggestions on the development of the service industry during the 14th Five-Year Plan period.。

The National Development and Reform Commission: 83 infrastructure REITs projects have been issued and listed, expected to drive total investment in new projects exceeding 1 trillion yuan.

8. The Ministry of Commerce answered reporters' questions regarding the U.S. decision to suspend the implementation of the export control penetration rules. After a one-year pause, both parties will resume discussions.。

9、The People's Bank of China released the Monetary Policy Implementation Report for the third quarter of 2025.。

The Ministry of Industry and Information Technology is publicly soliciting opinions on two mandatory national standards (draft for comments), including the "Safety Technical Specifications for Mobile Power Supply".

According to the China Association of Automobile Manufacturers, in October, the sales of new energy vehicles in China exceeded 50% of total sales for the first time.

Multiple informants who were notified to pay additional individual income tax on overseas investment income stated that...Their taxable income for additional tax payments is mainly from the years 2022 and 2023.Previously, the scope of tax retroactive collection was mainly for the past three years.

III. Early Morning Dynamics of the Plastic Market

Oil prices posted their biggest single-day gain in nearly three weeks! Overnight, the main domestic plastic futures contracts showed mixed movements.

The plastic 2601 contract was quoted at 6,802 yuan/ton, up 0.21% compared to the previous trading day.

The PP2601 contract is reported at 6478 yuan/ton, up 0.23% compared to the previous trading day.

The PVC2601 contract is quoted at 4599 yuan/ton, down 0.15% from the previous trading day.

The styrene 2512 contract is quoted at 6298 yuan/ton, down 0.11% from the previous trading day.

4. Market Forecast

PE: On the demand side, downstream factories continue to prioritize rigid demand in their procurement logic, maintaining a replenishment pace based on actual needs to ensure normal production. Although the operating rate has shown a slight increase, it has not translated into a substantial increase in demand, and procurement enthusiasm remains tepid, providing limited support to the market. Overall, the current polyethylene market is in a weak balance between supply and demand. Despite some disruptions from the alternating start-stop of production facilities on the supply side, the core issue of ample spot supply remains unchanged, and pressure persists. The slight increase in operating rates on the demand side lacks sustainable demand release, and the support from rigid demand is limited. It is expected that the polyethylene market will continue to exhibit a weak and stable narrow fluctuation trend in the short term.

PP: The adjustment of ex-factory prices has limited impact, and the spot market quotations fluctuate little. Most merchants continue to adopt a selling strategy that follows the market to maintain a normal circulation rhythm. On the demand side, the performance of downstream industries is average, and the purchasing sentiment of terminal enterprises is tepid, with limited enthusiasm for receiving goods and no concentrated replenishment behavior, which directly leads to a poor transaction atmosphere in the market and overall low trading activity. In this context, market participants generally adopt a cautious mindset, with merchants focusing on digesting existing inventory, while terminals mainly procure on demand, leading to a strong wait-and-see sentiment.

PVC: Downstream demand is primarily driven by rigid needs, with no additional stockpiling or bargain-hunting demand. The supply-demand dynamics offer insufficient guidance, and high inventory levels cannot support price changes, leaving the fundamentals slightly weak. In the international market, crude oil futures prices rose slightly, as news of a possible end to the U.S. government shutdown injected some optimism into the market. However, expectations of oversupply in the oil market limited the extent of price increases. Overall, in the short term, it remains difficult for PVC spot market prices to escape the constraints of low-level adjustments.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

[Today's Plastics Market] General Materials Weakly Fluctuate, Engineering Materials Steadily Rise

-

New Breakthrough in Domestic Adiponitrile! Observing the Rise of China's Nylon Industry Chain from Tianchen Qixiang's Production

-

Daily Review: Polyethylene Prices Under Weak Consolidation, Sellers Face Significant Pressure to Move Inventory