[inventory] 10 domestic peek material listed companies, production capacity and applications (summary chart at the end)

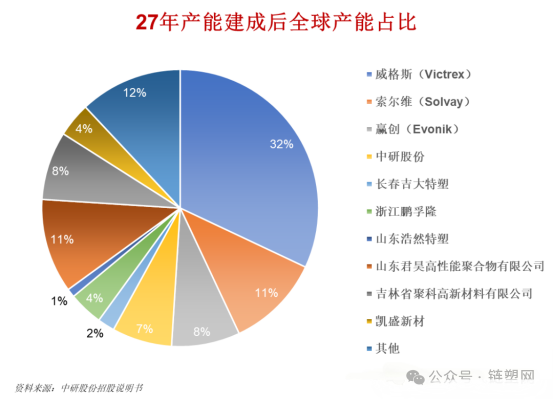

PEEK (polyether ether ketone), as a special engineering plastic, is experiencing continuously growing demand in the global high-end manufacturing wave. Currently, the global market is dominated by the UK-based VICTREX, Belgium-based Solvay (now Solvay Specialty Polymers), and Germany-based Evonik, presenting a "one superpower, many strong players" pattern.

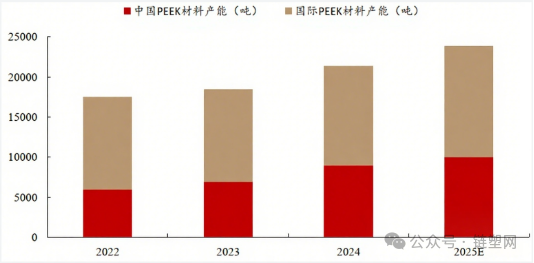

China is becoming the core force driving the growth of global PEEK production capacity, with its global capacity share expected to increase from 17.3% in 2021 to 42% in 2025. The PEEK market size in China will reach 1.9 billion yuan in 2024, with a compound annual growth rate of 15.5% from 2018 to 2024, significantly higher than the global average. Domestic listed companies have become the main force driving the industry's development.

The global share of Chinese PEEK materials from 2022 to 2025.

This article will focus on the midstream applications of PEEK and provide an overview of the current domestic listed companies' positioning. Industry colleagues are also welcome to leave comments and add information at any time so that we can complete this industry map together!

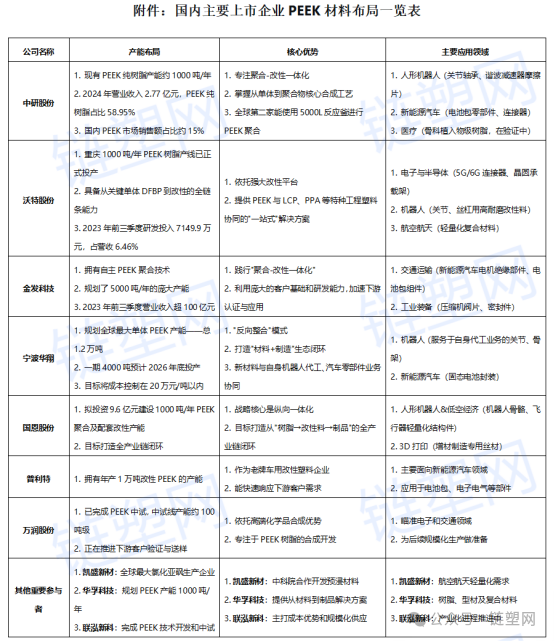

Major domestic listed companies' layout of PEEK materials

(Sorted by existing production capacity scale)

1. Zhongyan Co., Ltd.

Capacity layout

The current production capacity of pure PEEK resin is approximately 1,000 tons per year, making it the largest PEEK producer in China in terms of annual output. Globally, it is the fourth company with a capacity of over a thousand tons, following the UK-based Victrex, Belgium's Solvay, and Germany's Evonik.

In 2024, the company's operating revenue was 277 million RMB, with pure PEEK resin granules accounting for 58.95%, making it the absolute main business. It holds approximately a 15% share of the sales in the domestic PEEK market and about a 5% share of the global production capacity in 2023.

Core Advantages

Focusing on integration of polymerization and modification, and mastering the core synthesis process from monomers to polymers, it is the second company in the world, besides Victrex in the UK, capable of using a 5000L reactor for PEEK polymerization.

Main applications

Humanoid robot (joint bearings, harmonic reducer friction plate base resin)

New energy vehicles (battery pack components, connectors)

Medical (orthopedic implant-grade resin, under validation)

2. Watt Co., Ltd.

Capacity layout

The 1000-ton/year PEEK resin production line in Chongqing has officially been put into operation, with the capability for the full chain from key monomer DFBP to modification.

In the first three quarters of 2023, the R&D investment was 71.499 million yuan, accounting for 6.46% of the revenue, which is relatively high compared to similar companies.

Core Advantages

Relying on a powerful modification platform, we synergize PEEK with special engineering plastics such as LCP and PPA to provide customers with a "one-stop" material solution.

Main Applications

Electronics and Semiconductors (5G/6G Connectors, Wafer Carriers)

Robots (high wear-resistant modified materials for joints and lead screws)

Aerospace (Lightweight Composite Materials)

3. Blonde Technology

Capacity layout

Possesses independent PEEK polymerization technology and has planned a large production capacity of 5,000 tons per year.

As a global leader in modified plastics, the operating revenue exceeded 10 billion yuan in the first three quarters of 2023, but the specific data on the proportion of PEEK-related business has not been disclosed.

Core Advantages

Implement the "integration of polymerization and modification," leveraging a vast customer base and R&D capabilities to accelerate downstream certification and application.

Main applications

Transportation (insulation components for new energy vehicle motors, battery pack components)

Industrial Equipment (Compressor Valve Plates, Seals)

4. Ningbo Huaxiang

Capacity layout

Planned the world's largest known single PEEK production capacity of 12,000 tons in total, with the first phase of 4,000 tons expected to be put into operation by the end of 2026.

As a giant in the automotive parts industry, its cross-sector layout aims to integrate new materials with its own robotics manufacturing and automotive parts business.

Core Advantages

"Reverse integration" to create a "materials + manufacturing" ecological closed loop.

Main Applications

Robots (joints and skeletons serving their own OEM business)

New Energy Vehicles (Solid-State Battery Packaging)

5. Guoen Corporation

Capacity layout

The proposed investment is 960 million RMB to construct a 1,000-ton/year PEEK polymerization and supporting modification capacity.

Core Advantages

The core strategy is vertical integration, aiming to build a complete industry chain closed loop from "resin → modified materials → products".

Main Applications

Humanoid Robots & Low-Altitude Economy (Robot Skeletons, Lightweight Structures for Aircraft)

3D printing (additive manufacturing specialized filament)

6. Puli==

Capacity layout

With an annual production capacity of 10,000 tons of modified PEEK.

Core Advantages

As an established company in automotive modified plastics, we can quickly respond to the needs of downstream customers.

Main Application Directions

Primarily oriented towards the field of new energy vehicles, applied to components such as battery packs and electrical/electronic parts.

7. Wanrun Co., Ltd.

Capacity layout

The PEEK pilot test has been completed, with a pilot line production capacity of approximately 100 tons. We are currently advancing downstream customer validation and sample delivery.

Core Advantages

Relying on the advantages of high-end chemical synthesis, we focus on the synthesis and development of PEEK resin.

Main application

Target the electronics and transportation sectors to prepare for subsequent large-scale production.

Other Important Participants

8. Kaisheng New Materials

As the world's largest producer of thionyl chloride and a leading domestic producer of aramid polymer monomers.

9. Huafu Technology (through its subsidiary Jiangsu Junhua)

The planned PEEK production capacity is 1,000 tons per year, including products such as resin, profiles, and composite materials, aiming to provide solutions from materials to finished products.

10. Lianhong New Materials

The development and pilot testing of PEEK technology have been completed, and the industrialization process is underway. As a chemical new materials platform, it may focus on cost advantages and large-scale supply in the future.

PEEK materials are primarily used in humanoid robots (core components such as joints and gears), low-altitude economy (lightweight structures for drones and flying cars), healthcare (artificial joints, dental implants), and electronic transportation (high-end connectors, insulation components), among other fields.

The domestic PEEK industry has currently developed a multi-path development pattern, with various enterprises advancing the industrialization process in different application scenarios based on their own advantages.

This concludes the review for this issue. Due to space limitations, there are inevitably omissions in the industrial landscape. We welcome readers and industry peers to leave comments for additions or corrections! You can also leave a comment with the topic you would most like to see in the next review, and we will arrange it for future issues.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

India's Q3 Smartphone Shipments Rise 3%; Japanese Mold Factory Closures Surge; Mercedes-Benz Cuts 4,000 Jobs

-

Ascend's Restructuring Plan Approved! Jwell Launches Global Acceleration Plan; Nexperia Chip Crisis Threatens Global Auto Production

-

Dow To Restart Pe Units 5 And 7 This Week, Recovery Date For Unit 6 Remains Undetermined In The United States (US)

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

The Roller-Coaster Behind Sanhua Intelligent Controls' Stock Price: What Are the Advantages of Automotive Thermal Management Companies Crossing Into Humanoid Robots?