Iraq's Resumption of Production Triggers Chain Reaction, Oil Prices Break Downward

As of December 9, 2025, the international crude oil futures market shows a significant adjustment trend, with both WTI and Brent crude oil futures experiencing a single-day decline of over 2%, and the domestic SC crude oil futures main contract simultaneously falling by 1.84%. The current market is influenced by multiple factors such as increased supply, geopolitical easing, and macro policy expectations, with intertwined long and short logic.

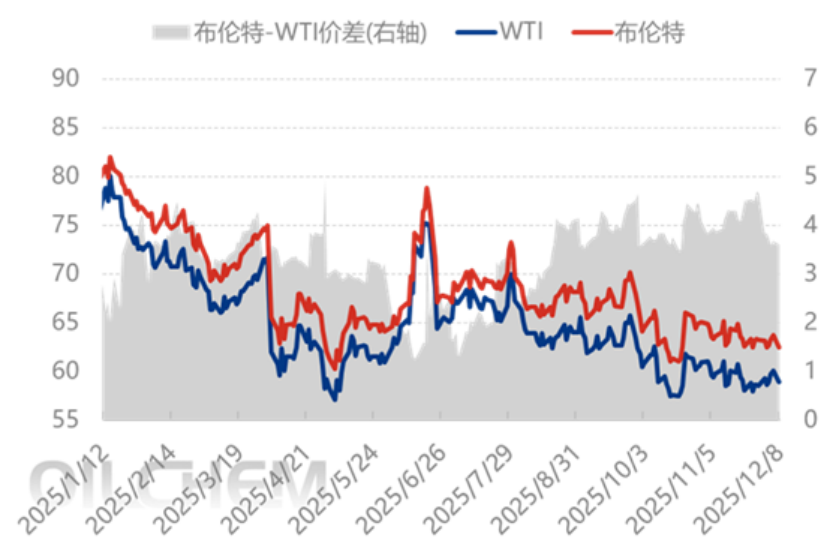

2024-2025 International Crude Oil Price and Spread Chart (USD/barrel, right axis: USD/barrel)

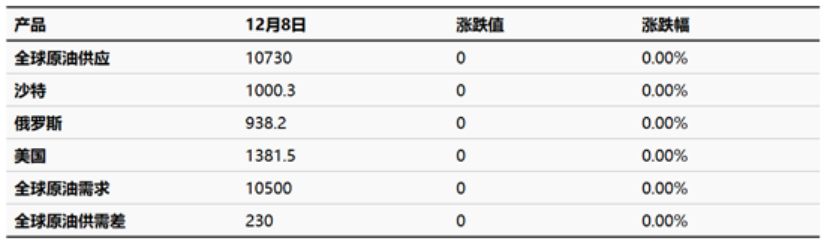

The recovery on the supply side and concerns about oversupply are the core forces suppressing current oil prices. Iraq has resumed production at the West Qurna 2 oil field, operated by Lukoil, which produces 460,000 barrels per day. This large oil field is one of the largest in the world, accounting for 0.5% of global supply, directly exacerbating market oversupply concerns. Meanwhile, although OPEC+ reiterated a pause on production increases for the first quarter of 2026, the December increase of 137,000 barrels per day was in line with expectations, and the market reacted tepidly to its policy support. More notably, U.S. crude oil production remains high at 13.2 million barrels per day, and with new capacity coming online from Brazil, Guyana, and others, the global oil surplus in the fourth quarter could reach 2-3 million barrels per day, with inventories rising above the five-year average. On the demand side, seasonal demand in Europe and the U.S. is declining, with global demand expected to decrease by 500,000 barrels per day quarter-on-quarter, making it difficult to offset supply increases and weakening market confidence in a strong recovery in demand.

Global Crude Oil Supply and Demand Change Statistics Table (Unit: 10,000 barrels)

The weakening of geopolitical risk premiums further suppresses oil prices. The Trump administration is promoting peace negotiations between Russia and Ukraine, and the market anticipates that if a ceasefire agreement is reached, daily oil supply could increase by over 2 million barrels, which presents the main potential downside risk. Although the G7 is considering a ban on maritime services for Russian oil, the short-term geopolitical conflict has limited actual disruptions to supply. ANZ Bank points out that Russian oil is likely to evade sanctions through channel adjustments, and the long-term structural surplus risk remains unchanged.

At the macro level, a two-way game situation is emerging. The market expects an 84% probability of the Federal Reserve cutting interest rates in December. If the rate cut is implemented, a weaker dollar will reduce crude oil procurement costs, providing bottom support for oil prices. However, in the current apparent global crude oil supply-demand weakness, the stimulating effect of monetary policy has significant lag and limitations. In a cycle of inventory accumulation and sluggish demand, it is difficult to quickly reverse the downward trend in commodity prices. Therefore, the expectation of rate cuts is more about providing bottom support and slowing the rate of decline, rather than being the core driver of a trend reversal towards an upward movement.

In summary, the supply side is significantly impacted by the resumption of oil production in Iraq, high output from the United States, and the introduction of new capacity, highlighting excess pressure. Geopolitically, progress in the Russia-Ukraine negotiations reduces risk premiums. On the macro front, the expectation of interest rate cuts by the Federal Reserve only provides bottom support and is unlikely to reverse the downward trend. The short-term outlook for the crude oil market is characterized by a bearish bias with fluctuations.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

New Breakthrough in Domestic Adiponitrile! Observing the Rise of China's Nylon Industry Chain from Tianchen Qixiang's Production

-

Nissan Cuts Production of New Leaf EV in Half Due to Battery Shortage