Large-Scale Limit-Up! This Sector Surges

In the morning session on September 5th, the three major A-share indexes all rose.

On the market, sectors such as batteries, energy metals, photovoltaic equipment, and wind power equipment saw leading gains. Specifically, during the morning session, the solid-state battery sector surged again. As of the time of this report, Paiter "30cm" hit the daily limit up, Jinhaiyin, Yuchen Intelligent, and Huasheng Lithium Battery each reached the "20cm" daily limit up, while Xiamen Tungsten New Energy, Lead Intelligent, and others once rose more than 10%, with the rest of the stocks collectively rallying strongly.

In terms of news, several listed companies related to solid-state batteries have recently disclosed the latest developments in solid-state batteries.

On September 4th, Lead Intelligent stated on the interactive platform that in the field of solid-state batteries, as a service provider with completely independent intellectual property rights for whole-line solutions for all-solid-state batteries, the company has successfully mastered the entire process for mass production of all-solid-state batteries. On September 3rd, EVE Energy's all-solid-state battery "Longquan No. 2" successfully rolled off the production line, with an energy density of up to 300Wh/kg.

Minsheng Securities issued a research report stating that as the energy density of traditional lithium-ion batteries approaches its theoretical limit, solid-state batteries, with their advantages of high energy density (expected to exceed 500 Wh/kg), non-flammability, and higher thermal tolerance, are becoming a key focus for the next generation of battery technology.

It is worth noting that as the market recovers, the lithium battery sector has recently strengthened. In the morning session on September 5th, related concept stocks such as Tianhong Lithium, Fengyuan Co., Jianbang Co., and Boqian New Materials all hit the daily limit. Among them, Tianhong Lithium and Jianbang Co. have both achieved "two consecutive limit-ups in two days."

On September 4, the Ministry of Industry and Information Technology and the State Administration for Market Regulation issued the "Action Plan for Steady Growth of the Electronic Information Manufacturing Industry (2025–2026)" (hereinafter referred to as the "Plan"). The Plan proposes that from 2025 to 2026, the average growth rate of the added value of large-scale enterprises in the computer, communication, and other electronic equipment manufacturing industries will reach 7%. Including related fields such as lithium batteries, photovoltaics, and component manufacturing, the annual average revenue growth rate of the electronic information manufacturing industry will exceed 5%.

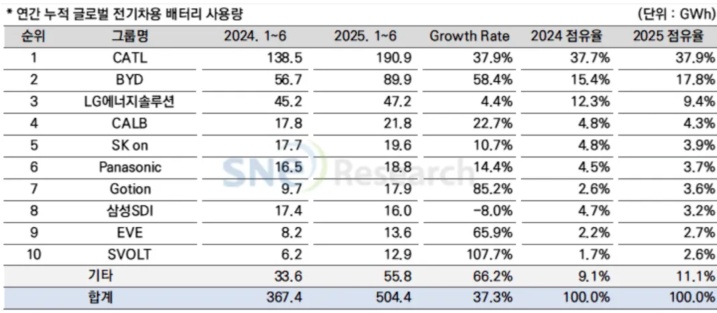

In addition, driven by the dual forces of global energy transition and the wave of electrification, the lithium battery industry saw a recovery in the first half of 2025. On the downstream side, the continuous growth in demand for new energy vehicles and energy storage has helped the lithium battery industry gradually emerge from its downturn.

Under the dual drive of policies and the market, China's new energy vehicle market continued its high growth momentum in the first half of 2025. According to data from the China Association of Automobile Manufacturers, driven by the extension of the old-for-new subsidy policy and popular models, sales of new energy vehicles in China reached 6.937 million units in the first half of 2025, a year-on-year increase of 40.3%. This growth directly boosted the continued high prosperity of the power battery market. GGII data shows that in the first half of 2025, China's power battery shipments reached 477 GWh, a year-on-year increase of 49%.

In the energy storage sector, influenced by the market-oriented reforms in China’s domestic energy storage market and policy uncertainties overseas, there was a “installation rush” in the first half of 2025. The sales growth of energy storage batteries exceeded that of power batteries, making them an important source of market growth. According to GGII data, China’s energy storage battery shipments reached 265 GWh in the first half of 2025, representing a year-on-year increase of 128%.

As the anode segment of the core lithium battery materials sector, it was the first to emerge from the previous adjustment period, showing a positive trend of "stable volume and price, with increasing concentration."

It is reported that the rapid growth of the power battery and energy storage battery industries continuously drives the expansion of demand in the anode material market. According to GGII data, the shipment volume of anode materials in China reached 1.29 million tons in the first half of 2025, a year-on-year increase of 37%. Meanwhile, product technology iteration and the industrialization process of new anode materials are accelerating: anode materials are advancing towards fast charging rates and high compaction density. According to GGII data, the industry penetration rate of fast charging rate (4C) products has exceeded 15%; the shipment volume increment of CVD new silicon anode materials is significant; the shipment volume of hard carbon materials has also increased due to downstream battery manufacturers promoting sodium-ion battery products in specific application scenarios. Technological iteration and product innovation have become new highlights in the industry's development.

Wanlian Securities released a research report stating that in 2025, driven by consumption incentive policies such as trade-in programs, the production and sales of new energy vehicles in China will experience rapid growth. Coupled with the steady increase in global energy storage installations, the demand for the lithium battery industry chain will continue to rise, profitability levels will significantly improve, and the competitive advantages of leading companies will be enhanced. Looking ahead, the overall trend of the lithium battery industry chain is positive and is expected to gradually enter a phase of cyclical recovery.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Four Major Chemical New Material Giants Sell Off and Shut Down Again!

-

Covestro faces force majeure!

-

DuPont to Spin Off Nomex and Kevlar Brands for $14.4 Billion: Is Aramid Fiber Still Attractive?

-

Massive Retreat of Japanese and Korean Battery Manufacturers

-

Napan Unveils Thermoplastic Composite Three-in-One Power System Solution, Battery Cover Weight Reduced by 67%