Lianhong Xinke Sees 30.32% Growth in Net Profit for First Three Quarters

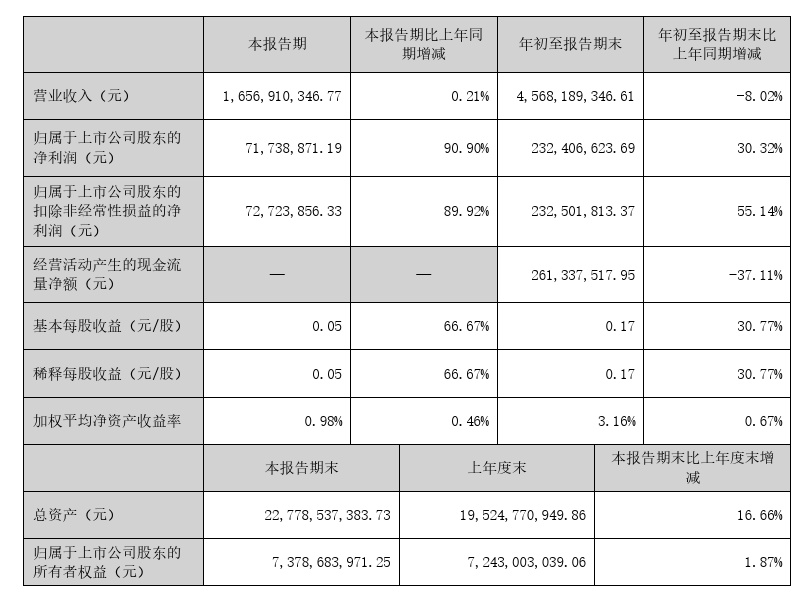

On October 14, Lianhong Xinke (003022) disclosed its third quarter report for 2025. The company achieved an operating income of 1.657 billion yuan in the third quarter, a year-on-year increase of 0.21%; the net profit attributable to shareholders was 71.7389 million yuan, a year-on-year increase of 90.9%. In the first three quarters of 2025, Lianhong Xinke achieved revenue of approximately 4.568 billion yuan, a year-on-year decrease of 8.02%; the net profit was approximately 232 million yuan, a year-on-year increase of 30.32%.

Lianhong Xinke stated that the main reason for the decline in operating income in the first three quarters of 2025 compared to the same period last year is the decrease in prices of certain products. The reason for the year-on-year growth in net profit is the decline in raw material prices and the gradual profit contribution from new products such as EC, UHMWPE, electronic specialty gases, and PLA. The significant increase in net profit in the third quarter benefited from the rise in prices of major products like EVA and UHMWPE, as well as the continued profit contribution from new products.

Lianhong Xinke also revealed that in the third quarter of 2025, the company's construction projects are progressing as planned: the "Integrated Project of New Energy Materials and Biodegradable Materials" and the "Lithium Battery Additive VC Project" have completed the mid-term handover; the "Thermoplastic Polyethylene Elastomer POE Project" has entered the comprehensive equipment installation phase, with plans for completion and mid-term handover by the end of 2025; and the "Special Isocyanate XDI Project" continues to advance engineering design and project preparation work.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

India's Q3 Smartphone Shipments Rise 3%; Japanese Mold Factory Closures Surge; Mercedes-Benz Cuts 4,000 Jobs

-

Ascend's Restructuring Plan Approved! Jwell Launches Global Acceleration Plan; Nexperia Chip Crisis Threatens Global Auto Production

-

Dow To Restart Pe Units 5 And 7 This Week, Recovery Date For Unit 6 Remains Undetermined In The United States (US)

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

The Roller-Coaster Behind Sanhua Intelligent Controls' Stock Price: What Are the Advantages of Automotive Thermal Management Companies Crossing Into Humanoid Robots?