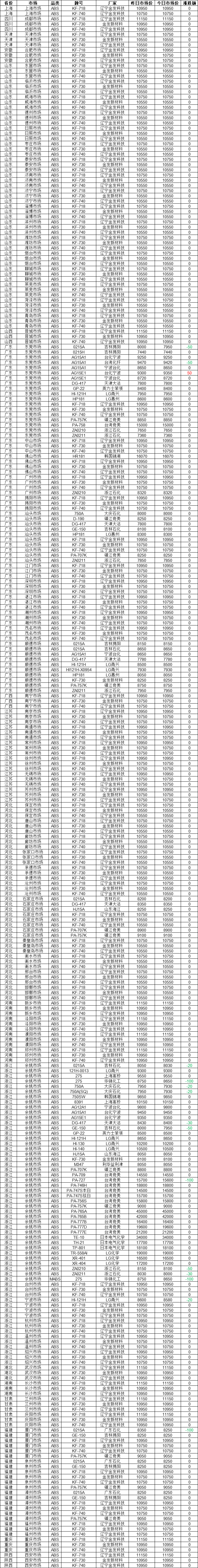

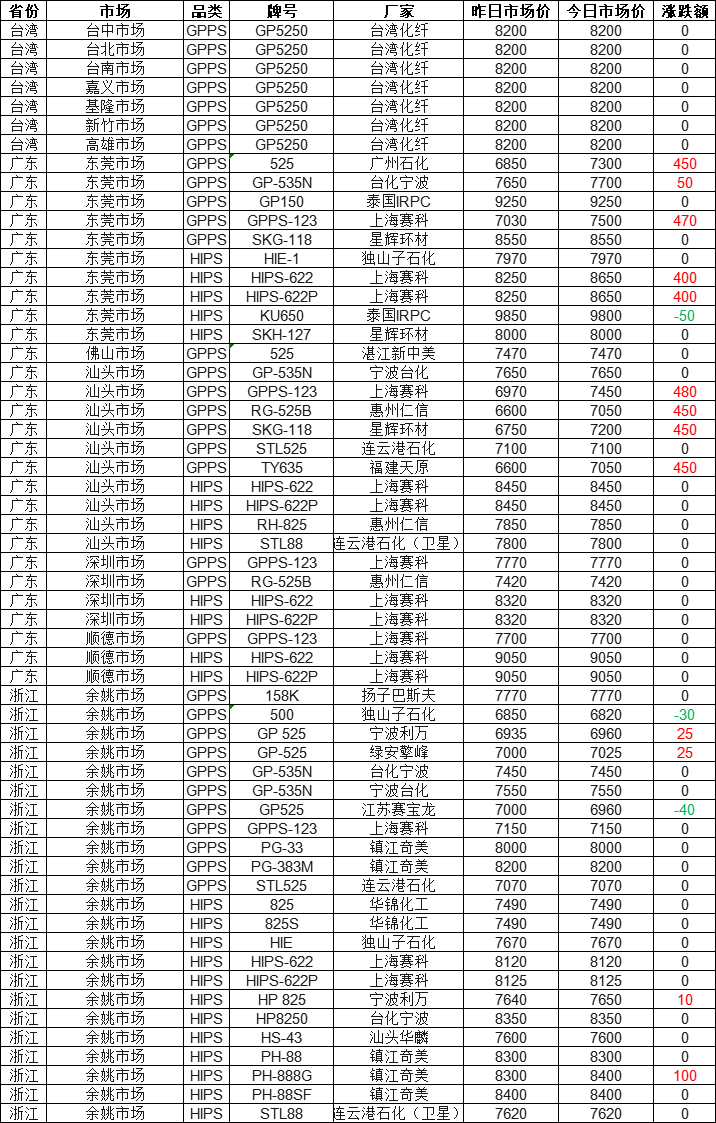

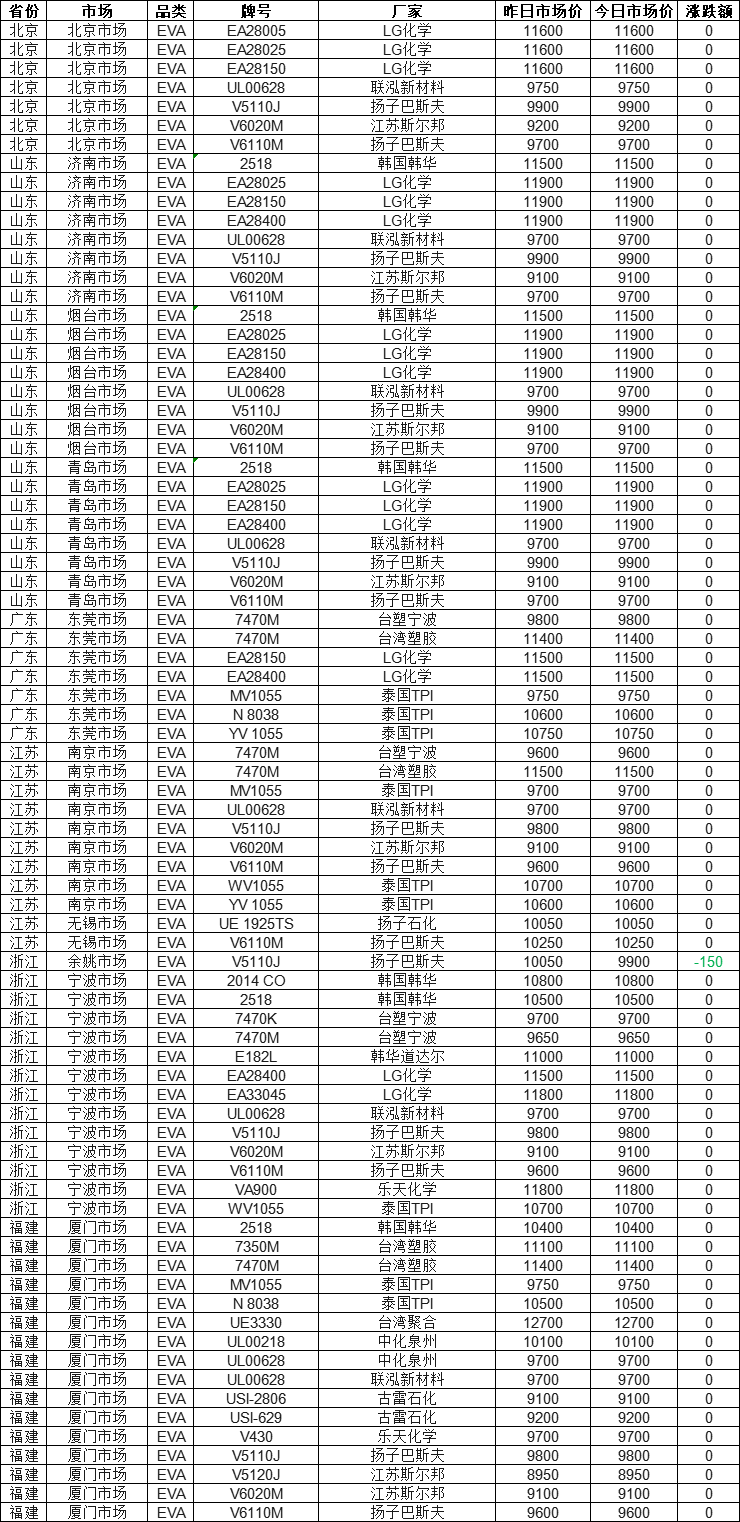

Mexico Imposes Tariffs on 1,463 Products From China! Rates Up to 50%; Today Plastic Sees Partial Increase, PS Up 480

Mexico imposes tariffs on 1,463 Chinese products! The tax rate is as high as 50%.

On December 10, 2025, the Mexican House of Representatives approved the tariff bill proposed by President Claudia Sheinbaum on September 9 with an overwhelming majority of 281 votes in favor, 24 against, and 149 abstentions, taking only 2 hours. The bill aims to amend the "General Import and Export Tax Law" to impose additional tariffs on imported products from countries without free trade agreements (FTAs), such as China, India, Vietnam, Thailand, South Korea, etc., in order to protect domestic industries.

The bill will be submitted to the Senate for a vote and discussion on December 11. Since the ruling party Morena and its ally PVEM hold a majority in the Senate, the review process is expected to be a formality, with quick approval anticipated within a few hours. This is to ensure that the legislative process is completed by December 15, allowing it to take effect on January 1, 2026.

⚠️ Bill Content: The tariff bill adjusts tariffs on 1,463 product categories, raising the rates from the original 0-20% to 10-50%, covering approximately 17 industries.

⚠️ Tariff Distribution: 10%-50% (After committee modifications, most product tariffs are concentrated between 10%-35%); 316 categories previously exempt from tax are now taxed for the first time; 341 at 35%; 302 at 10%; the rest vary.

⚠️ Involved industries: textiles and apparel, steel and products, automotive and parts, plastic products, home appliances, toys, furniture, footwear and leather, paper and cardboard, motorcycles, aluminum products, trailers and glass, cosmetics and soaps, etc.

⚠️ Countries targeted: China, South Korea, India, Vietnam, Thailand, Indonesia, Russia, Turkey, Brazil, Nicaragua, UAE, and South Africa, etc. Countries with free trade agreements (TLC) with Mexico, such as the EU, USA, and Canada, are not affected.

⚠️ Effective Date: The bill is scheduled to complete the legislative process by December 15, 2025, and will officially take effect on January 1, 2026.

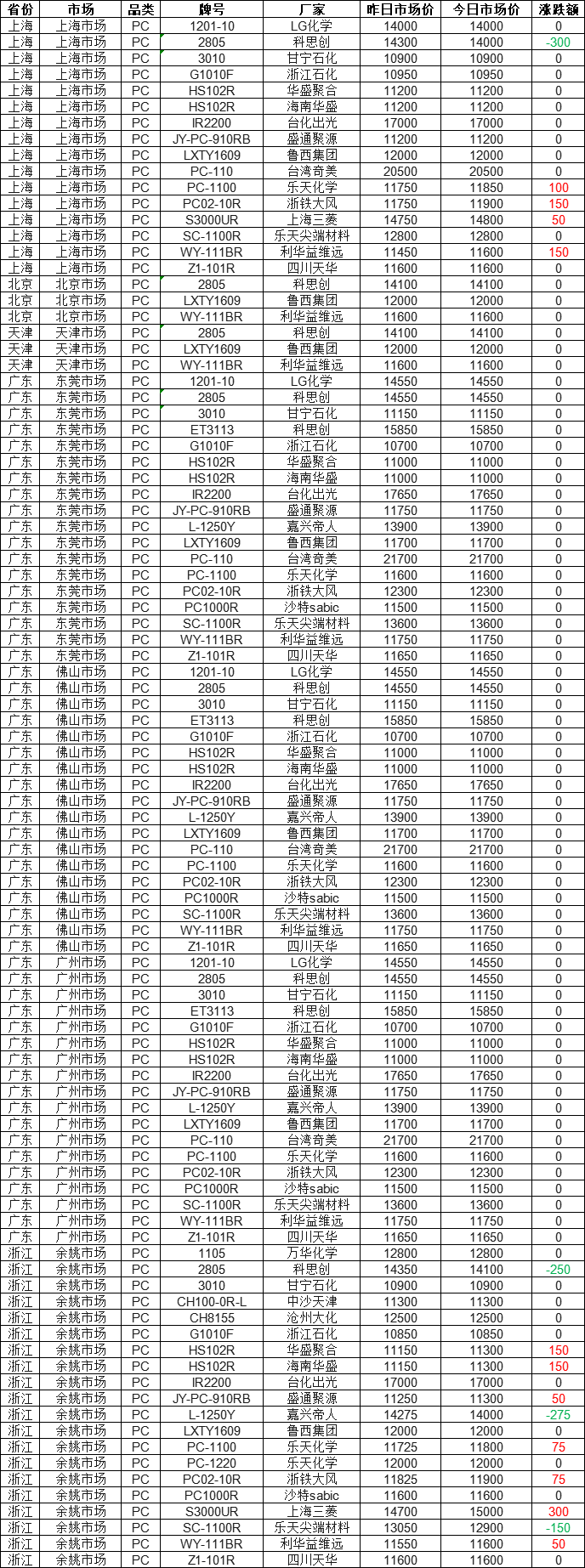

Here are the detailed tariff codes and rates for major products subject to additional tariffs (based on committee modifications, confirmed with no significant changes) (the complete list exceeds 1400 items and can be accessed via the SNICE website):

1. Textiles and Clothing - 1,014 tariff codes, tax rate 10%-35%

2. Steel and Iron Products - 249 tariff numbers, tax rate 15%-50%

3. Automobiles and Parts - 235 tariff codes, tax rate 20%-50%

4. Plastic products - 81 tariff codes, tax rate 10%-35%

5. Home Appliances - 18 tax numbers, tax rate 15%-30%

6. Toys - 37 tariff codes, tax rate 10%-25%

Furniture - 28 tax numbers, tax rate 15%-35%

8. Footwear and Leather - 67 tariff codes, tax rates 10%-30%

9. Paper and paperboard - 47 tariff codes, tax rate 10%-20%

10. Motorcycle - 8 tax codes, tax rate 20%-40%

11. Aluminum products - 21 tariff codes, tax rate 15%-35%

12. Cosmetics and soap - 24 tariff codes, tax rate 10%-25%

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

New Breakthrough in Domestic Adiponitrile! Observing the Rise of China's Nylon Industry Chain from Tianchen Qixiang's Production

-

Nissan Cuts Production of New Leaf EV in Half Due to Battery Shortage