New Han New Materials Reports Double Growth in Revenue and Net Profit for Third Quarter!

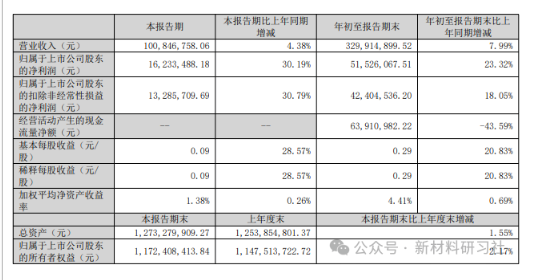

On October 20, Xinhai New Materials (301076) released its third-quarter report for 2025. From an overall performance perspective, by the end of the third quarter of 2025, Xinhai New Materials demonstrated a steady growth trend. During the reporting period, the company's total operating revenue reached 330 million yuan, an increase of 7.99% compared to the same period last year. The net profit attributable to the parent company was 51.5261 million yuan, with an impressive year-on-year increase of 23.32%. The net profit growth rate far exceeded the revenue growth rate, indicating a significant improvement in profitability.

In the current quarter, the total operating revenue was 101 million yuan, an increase of 4.38% year-on-year. The net profit attributable to shareholders for the third quarter was 16.2335 million yuan, with the year-on-year growth rate further expanding to 30.19%. The single-quarter profit growth rate hit a new high, demonstrating the company's continued optimization of operational efficiency in the third quarter.

In the first three quarters of 2025, Xinhan New Materials saw a year-on-year increase of 11.81% in gross profit margin and a year-on-year increase of 14.2% in net profit margin. Both key profitability indicators achieved double-digit growth, reflecting the company's significant achievements in cost control and product structure optimization, further enhancing its core competitiveness.

Product structure is clear: Centered on DFBP, with the coordinated development of multiple categories.

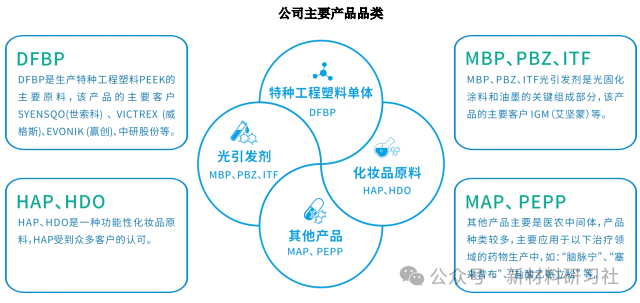

As a company focused on the research and development, production, and sales of aromatic ketone products, New Hanhua New Materials' main business covers core raw materials for specialty engineering plastics, photoinitiators and cosmetic raw materials, as well as pharmaceutical and pesticide intermediates. The product matrix is rich and clearly positioned.

In the first three quarters of 2025, the company's main product sales are clearly defined, and the advantages of core products are prominent.

DFBP (the core raw material for special engineering plastics) accounts for 40%, making it the company's largest revenue source. As a key raw material for the production of PEEK (Polyether Ether Ketone, a high-performance special engineering plastic), the high proportion of DFBP highlights the company's core position in the field of special engineering plastics.

The proportion of cosmetic raw materials accounted for 22%, becoming the second-largest revenue segment, reflecting the company's effective diversification strategy in the fine chemicals field.

Sales of pharmaceutical and agricultural intermediates account for about 20%, providing stable support for the company's performance.

Photoinitiators account for 18% and continue to contribute revenue in the field of UV curing.

Notably, the company's newly added production capacity of 2,500 tons of DFBP per year has achieved stable operation. This not only provides capacity assurance for the continued high proportion of DFBP but also lays a solid foundation for the company to seize the growth dividends in the PEEK industry.

The growth rate of the PEEK market in China leads globally, with the company deeply tied to top clients.

The core product of Xinhai New Material, DFBP, focuses on the PEEK industrial chain, and the current PEEK industry is experiencing significant development opportunities, particularly with the remarkable performance of the Chinese market. From a global perspective, PEEK consumption is primarily concentrated in Europe, the Americas, and the Asia-Pacific region, with Europe being the traditional largest market with mature industrial development. However, as the production capacity of global electronic information, automotive, aerospace, and other high-end manufacturing industries continues to shift towards the Asia-Pacific region, the growth rate of PEEK consumption in the Asia-Pacific has far exceeded that of Europe, with China becoming the core growth driver of the global PEEK market.

From 2019 to 2022, the compound annual growth rate of demand for PEEK products in China reached 18.57%, while the growth rate of global PEEK consumption during the same period was only 9.00%. The growth rate of the Chinese market was approximately twice the global average, demonstrating strong growth momentum.

Currently, Xinhai New Materials has deeply integrated with leading global clients in the PEEK sector through its high-quality DFBP products. These clients include major global manufacturers such as VICTREX, SYENSQO, EVONIK, as well as leading domestic PEEK producers like Zhongyan Co., Ltd. and Pengfulong. They have established stable cooperative relationships. This model of "binding leading customers + deploying core raw materials" enables the company to fully enjoy the growth dividends of the PEEK market in China and globally, providing strong support for long-term development.

In addition to the stable growth of its existing business, Xinhan New Materials' fundraising projects are also progressing in an orderly manner. It has been reported that the equipment for the company's fundraising project "Three Workshops (HDO)" is currently being installed and is expected to be completed by December 2025. HDO (1,6-Hexanediol) is an important fine chemical raw material widely used in polyurethane, polyester, coatings, and other fields, with stable market demand.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

India's Q3 Smartphone Shipments Rise 3%; Japanese Mold Factory Closures Surge; Mercedes-Benz Cuts 4,000 Jobs

-

Ascend's Restructuring Plan Approved! Jwell Launches Global Acceleration Plan; Nexperia Chip Crisis Threatens Global Auto Production

-

Dow To Restart Pe Units 5 And 7 This Week, Recovery Date For Unit 6 Remains Undetermined In The United States (US)

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

The Roller-Coaster Behind Sanhua Intelligent Controls' Stock Price: What Are the Advantages of Automotive Thermal Management Companies Crossing Into Humanoid Robots?