November New Energy Vehicle Sales Ranking: BYD Declines YoY for Three Consecutive Months, Geely, Changan, Chery and Other Nine Automakers Reach New Highs

According to data from the China Passenger Car Association, the wholesale sales of new energy passenger vehicles nationwide reached 1.72 million units in November, marking a year-on-year increase of 20% and a month-on-month growth of 7%. The cumulative wholesale sales for this year have reached 13.78 million units, representing a year-on-year growth of 29%, indicating a steady growth trend in the overall market.

Although BYD has maintained its sales crown with an absolute advantage, the trend of year-on-year decline for three consecutive months highlights the pressure it faces in the domestic market, while the breakthrough growth in its overseas business has become an important counterbalance.

At the same time, automakers such as Geely, Chery, Changan, Leapmotor, Wenjie, Dongfeng, SAIC Passenger Cars, Arcfox, and Zhiji collectively achieved record-high sales, with SAIC Passenger Cars surpassing 40,000 units for the first time, demonstrating strong growth with over 200% year-on-year increase. Tesla China stood out with significant month-on-month growth, while the new forces in the industry showed divergence, with Li Auto and Xpeng underperforming.

▍BYD has experienced a year-on-year decline for three consecutive months.

The overall landscape of the leading camp remains stable, but internal differentiation is intensifying. BYD has again topped the list with an absolute advantage, while facing the pressure of three consecutive months of year-on-year decline. Data shows that BYD's wholesale sales in November reached 474,921 units, a month-on-month increase of 8.7%, but a year-on-year decrease of 5.8%. This marks its third consecutive month of negative year-on-year growth.

Behind this performance is BYD's breakthrough growth in overseas business while facing pressure in the domestic market. In November, its overseas sales exceeded 100,000 units for the first time, a year-on-year increase of 300%, effectively offsetting the impact of intensified competition in the domestic market.

However, the increasingly intense competition in the domestic market is becoming more apparent. Independent brands such as Geely, Chery, and Changan have all set new sales records this month, and their rapid rise is exerting significant pressure on BYD's market share in the mainstream market. Combined with multiple rounds of price wars throughout the year that have eroded profits, BYD is facing the dual challenge of "maintaining market share" and "stabilizing profitability." As a leading automaker experiencing consecutive months of year-on-year declines, its subsequent product iterations and market strategy adjustments will have a significant impact on the overall industry landscape.

▍Geely, Chery, Changan, Dongfeng, and SAIC Motor Passenger Cars reach new highs.

In November, the five major traditional independent brands, Geely, Chery, Changan, Dongfeng, and SAIC Passenger Cars, all achieved record-high wholesale sales of new energy passenger vehicles, becoming the core driving force for industry growth.

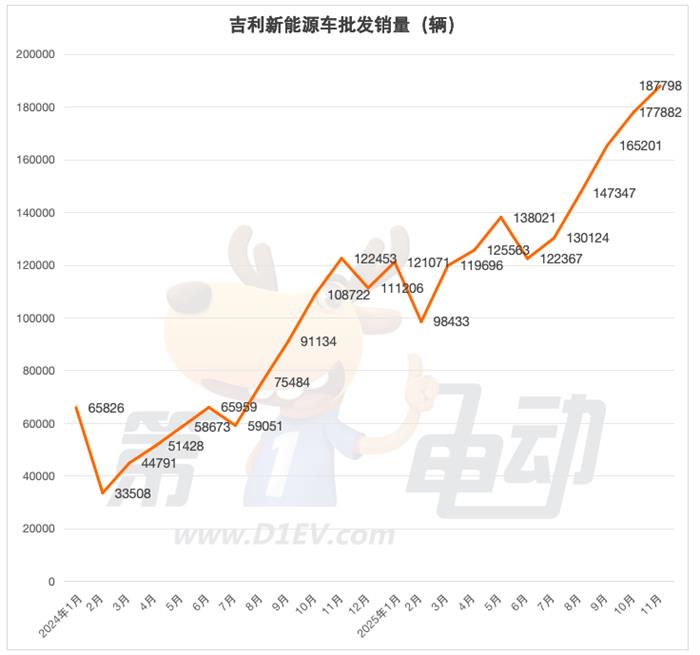

Specifically, Geely secured the runner-up position with sales of 187,798 units, achieving a year-on-year increase of 53.4%, far exceeding the industry average. Several of its hybrid and pure electric models have simultaneously gained momentum, forming a product layout that covers "mainstream + luxury + high-end" segments.

As the core engine of new energy growth, Geely's Galaxy brand achieved sales of 132,700 units in November, a year-on-year increase of 76%. Among them, several models such as Geely Xingyuan, Galaxy E5, Panda Mini, Galaxy M9, Starship 7 EM-i, and A7 consistently sold over 10,000 units per month, forming a "cluster of bestsellers" in the product lineup.

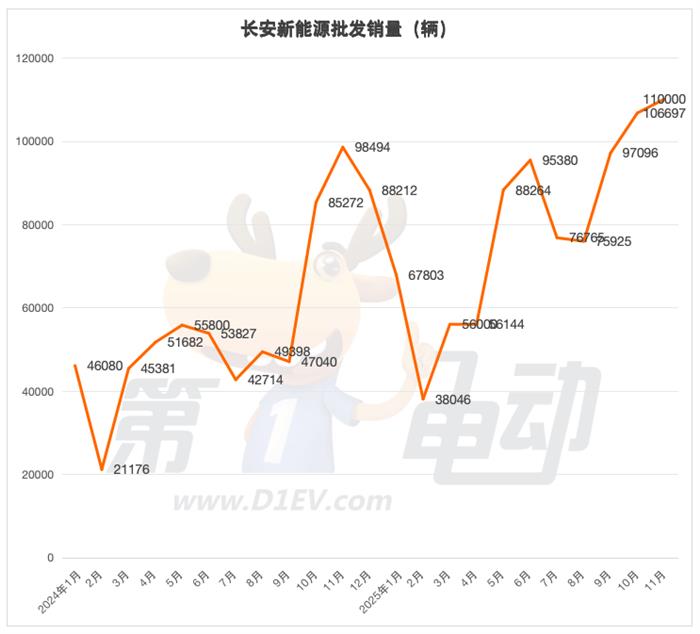

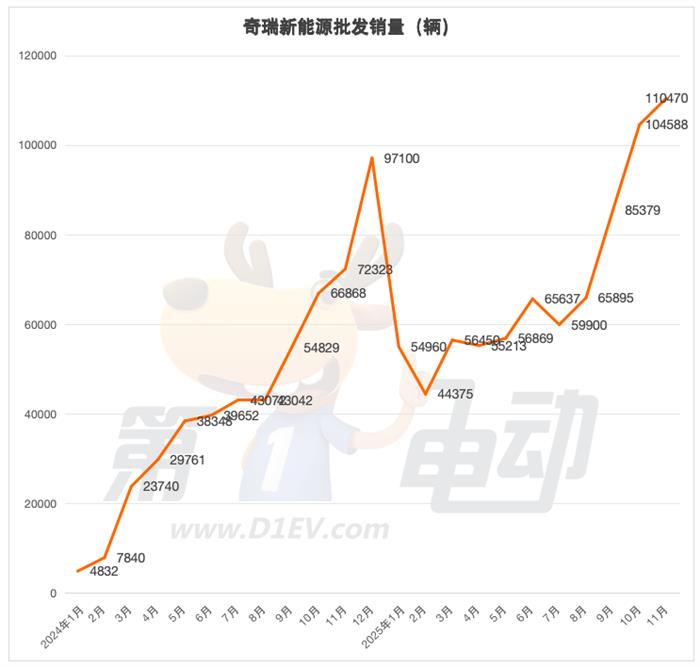

Chery and Chang'an ranked third and fourth with a slight difference, both maintaining a double-digit year-on-year growth. Chery achieved a 52.7% year-on-year growth thanks to its diverse product matrix, including Chery, Exeed, Jetour, iCAR, and Zhijie, and the strong performance of its plug-in hybrid models. Chang'an, on the other hand, achieved both month-on-month and year-on-year growth by leveraging multiple new energy brands such as Avatr, Deep Blue, and Qiyuan. The collective breakthrough of these three brands also demonstrates the comprehensive rise of domestic brands in the new energy sector.

SAIC Passenger Cars became one of the fastest-growing car manufacturers on the list with a year-on-year increase of 221.4%, achieving a month-on-month growth of 12.6%. Their sales exceeded 40,000 units for the first time, rising to 41,976 units, setting a new historical high. This achievement is not only the result of the continued implementation of SAIC Group's "new three driving forces" strategy but also relies on the strong empowerment of its popular models. The flagship Roewe D7 EV has become a hot choice in the 150,000 to 200,000 yuan pure electric segment due to its ultra-long range and intelligent cockpit configuration; the MG4 EV has made simultaneous breakthroughs in both overseas and domestic markets, with nearly 8,000 units sold domestically in a single month, further driving overall brand sales growth. Investments in the technological upgrades of new energy products (especially in the range and intelligent configuration optimization of pure electric platform models) and the expansion into overseas markets are gradually translating into tangible sales advantages.

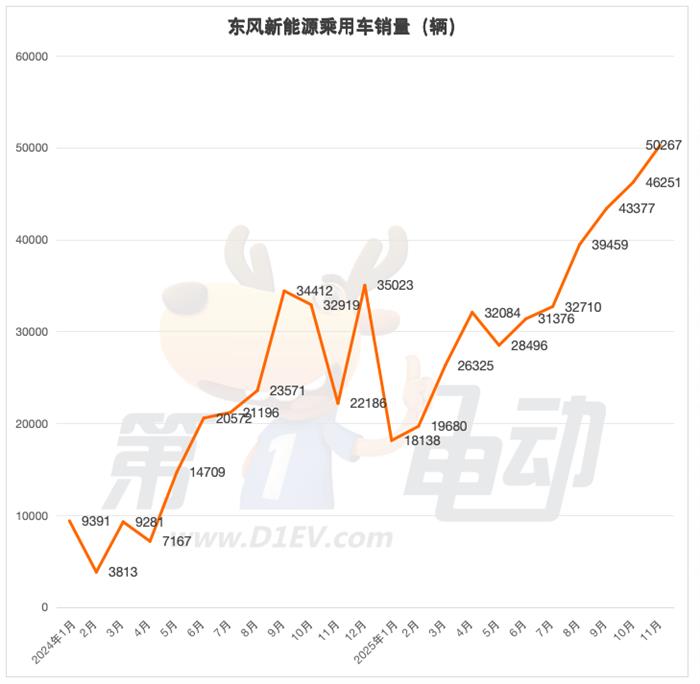

Dongfeng Motor also delivered an impressive report card, with wholesale sales of new energy passenger cars reaching 50,267 units in November, achieving a month-on-month increase of 8.7% and a year-on-year increase of 29.8%, setting a new sales record. The driving effect of popular models is equally significant. Models under Dongfeng Yipai and Fengshen have become the top choice for many young consumers and the ride-hailing market due to their high cost-effectiveness and reliable product quality. The high-end brand Lantu's Lantu FREE has performed outstandingly in the 300,000-level new energy SUV market, with monthly sales exceeding 5,000 units.

▍Tesla wins the month-on-month growth crown.

Tesla China, the only foreign brand on the list, became one of the biggest highlights in November with a month-on-month increase of 41.0%, claiming the top spot for month-on-month growth across the entire list. Its wholesale sales reached 86,700 units, also achieving a year-on-year growth of 9.9%. Considering Tesla's quarterly delivery mechanism, sales typically show a significant rise during the year-end sprint phase. As the delivery window progresses in December, its subsequent sales performance is expected to continue strengthening.

In the domestic new forces camp, Leap Motor continued its growth momentum with a year-on-year increase of 75.1%. AITO achieved a quarter-on-quarter growth of 6.1% thanks to product upgrades, both reaching historical highs. NIO, despite a quarter-on-quarter decline of 10.2%, still showed impressive performance with a year-on-year increase of 76.3%. Xiaomi steadily climbed with sales of 40,000 vehicles, demonstrating the potential of new forces.

In contrast, Li Auto and Xpeng performed poorly this month, becoming the companies with significant declines among the new forces: Li Auto saw a year-on-year decrease of 31.9%, making it the brand with the most significant year-on-year decline among the leading new forces, mainly due to factors such as the transition period of its main models and intensified market competition; Xpeng also experienced a month-on-month decline of 12.6%, reflecting the need to accelerate its pace in product iteration and market strategy adjustments.

▍Niche brands are rising rapidly, while some traditional car manufacturers face obstacles in their transformation.

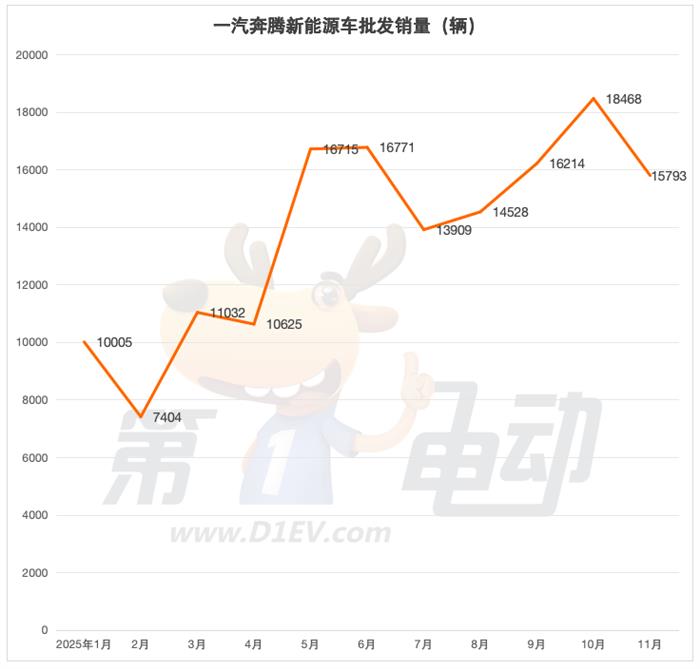

The bottom of the ranking presents a "polarized" scene: some niche brands have emerged rapidly with astonishing year-on-year growth, while some traditional car companies face pressure from declining sales, hindering their transformation process. Among them, FAW Bestune achieved a year-on-year growth of 7529.5%, becoming the fastest-growing car company on the entire list. This rare growth is mainly due to its extremely low base in the same period last year, combined with this year's launch of new energy models that precisely target the low-end segment, achieving a leap in sales. Arcfox also achieved a year-on-year growth of 128.3% thanks to its precise layout in the niche market and continuous enhancement of product strength.

In stark contrast, some traditional car companies performed poorly this month, becoming the group with more severe declines. Great Wall Motors experienced a month-on-month decline of 13.1%, making it the brand with the most noticeable decline among leading independent car companies, reflecting its shortcomings in optimizing its new energy product lineup and adjusting market strategies. SAIC-GM-Wuling saw a month-on-month decrease of 3.8%, mainly due to intensified competition in the low-end market and fluctuations in the sales of its main models. Additionally, although brands like Aion and FAW Hongqi maintained year-on-year growth, they each experienced varying degrees of month-on-month decline, highlighting the intensity of market competition.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

[Today's Plastics Market] General Materials Weakly Fluctuate, Engineering Materials Steadily Rise

-

New Breakthrough in Domestic Adiponitrile! Observing the Rise of China's Nylon Industry Chain from Tianchen Qixiang's Production

-

Daily Review: Polyethylene Prices Under Weak Consolidation, Sellers Face Significant Pressure to Move Inventory