Oil Prices Hit New Low for Second Half of the Year Amid Bearish Factors; Plastic Market Set to Remain Weak and Volatile in the Short Term

Overnight crude oil market dynamics

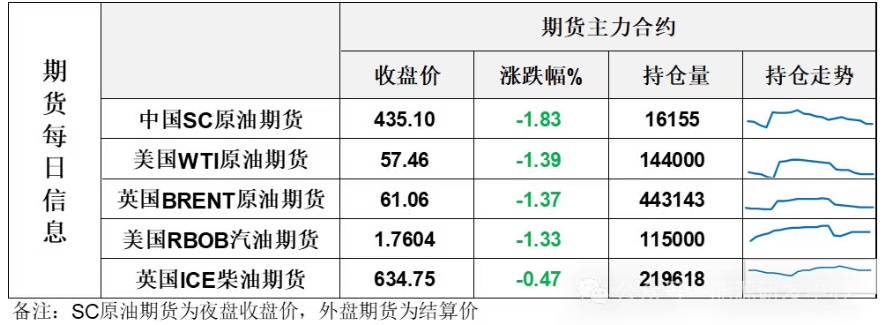

American BusinessCrude oil inventoryContinuous growth for three consecutive weeks, coupled with the prospect of renewed talks between Russia and Ukraine, has led to a decline in international oil prices.Crude oil futuresFor the November contract, it was $57.46 per barrel, down by $0.81, a decrease of 1.39% from the previous period; ICE Brent crude futures for the December contract were $61.06 per barrel, down by $0.85, a decrease of 1.37% from the previous period. China's INE crude oil futures for the 2512 contract rose by 0.7 to 445.6 yuan per barrel, but fell by 8.5 to 437.1 yuan per barrel in the night session.

Market Forecast

The low oil prices faced a difficult oscillation and corrective trend, which suffered another blow late Thursday night. Following a 2.5-hour phone call between the Russian and American presidents, Trump announced he would meet with Putin in Budapest, causing oil prices to continue hitting new lows for the second half of the year.On the other hand, gold broke through the $4,300 mark and continued to accelerate, setting a new record high.Although on Thursday the market had some bullish factors for oil prices, such as Trump's claim that he had a conversation with Modi and received a commitment that India would stop purchasing Russian oil, and Saudi Aramco's statement that the world could face an oil shortage if investments are not increased, it was difficult to boost market sentiment. Since mid-October, several authoritative institutions and major players in the physical market have reached a general consensus that the crude oil market will face significant oversupply pressure in the near future. After a recent sharp decline, the corrective rebound is weak, and there is almost no willingness from investors to chase the gains.

The physical market in the Middle East is weak, and the crack spreads for refined oil products in Europe and the United States have also recently shown weakness. The supply and demand dynamics in the crude oil market lack effective support for oil prices. According to the EIA, although the U.S. has significantly reduced its net imports, crude oil inventories still accumulated by 3.52 million barrels that week, indicating that U.S. crude oil demand continues to decline.

2. Macroeconomic Developments

1. Federal Reserve - ① Waller: AdvocatesProgressive interest rate cutsThe neutral interest rate is approximately 100 to 125 basis points lower than the current rate; the government shutdown has made the future policy path even more uncertain.

② Milan: The Federal Reserve should cut interest rates by 50 basis points, butExpected to decrease by 25 basis points.The Federal Reserve's policy must be forecast-oriented rather than data-oriented.

Kashkari:The job market is slowing down.It is expected that service inflation will tend to decline, but goods inflation may spill over.

Barkin: Consumer spending remains robust but has become more cautious.

5. Barr: Calls for strengthening stablecoin regulation to prevent systemic risk.

Zions Bancorp disclosed that its wholly-owned subsidiary, California Bank and Trust, has set aside provisions for a loan underwriting.$50 million impairment expense.Western Alliance Bancorp also stated that it had extended loans to the same group of borrowers.

Before Zelensky's visit to the U.S. to discuss the "Tomahawk" missile issue,The presidents of Russia and the United States spoke for two and a half hours.Trump stated that Rubio will attend the meeting with the Russian side and will meet with Putin in Budapest.

4、胡塞武装总参谋长在以色列对也门的空袭中身亡。

5. Foreign media:The White House plans to extend the tariff exemption for imported auto parts.。

6、Will China and the United States hold a new round of economic and trade talks?The Ministry of Commerce responded that China has always maintained an open attitude towards equal consultations based on mutual respect.

The Ministry of Commerce: Over 20 days, the U.S. has implemented 20 measures to suppress China, undermining the atmosphere of bilateral trade talks.

8. Is China's purchase of Russian oil part of China-U.S. trade negotiations? Foreign Ministry: We firmly oppose the U.S. side's habit of casually involving China in its issues.

3. Early Morning Update on the Plastic Market

Oil prices were hit and slumped! Overnight, most of the major domestic plastic futures contracts rose.

The plastic 2601 contract is priced at 6907 yuan/ton, unchanged from the previous trading day.

The PP2601 contract reported 6603 yuan/ton, up 0.08% from the previous trading day.

The PVC2601 contract is quoted at 4717 yuan/ton, up 0.82% from the previous trading day.

The styrene 2511 contract is quoted at 6,528 yuan/ton, up 0.06% from the previous trading day.

Market Forecast

PE: The "Silver October" peak season is nearing its end. If downstream factories still cannot secure sufficient new orders, the cautious atmosphere on the demand side may further solidify, making it difficult to break the current situation dominated by rigid procurement. The futures market may maintain a range-bound oscillation due to funds' gaming of marginal variables, but constrained by the core contradiction of weak supply and demand in the spot market, the rebound is limited in height and easily dragged down by the weakness in the spot market. It is expected that in the short term, the polyethylene market will continue to exhibit weak oscillations and lack of trend momentum. A real reversal of weakness in the market requires a substantial recovery in downstream demand or a clear reduction in supply.

PP: The downstream situation of "peak season not thriving" is unlikely to see significant improvement in the short term. The increase in transactions driven by speculative restocking is expected to be unsustainable. Although some facilities are under maintenance, the gradual release of new production capacity will offset the supply reduction caused by the maintenance, and current inventory levels remain relatively high compared to the same period last year, leading to insufficient price support from traders. Overall, bearish factors dominate, and it is expected that the polypropylene market will continue to maintain a pattern of "pressure on spot prices and fluctuations in futures" in the short term, with an overall tendency for weak performance unlikely to change.

PVC: In the PVC spot market, even after the emergence of low prices, there has been no improvement in transactions. After low-level adjustments in futures prices, the basis quotation has strengthened, but downstream purchasing enthusiasm remains low, and the listed prices are relatively low, resulting in limited spot transactions. The variables that supply and demand can provide for pricing are also insufficient. Overall, it is difficult to find favorable factors in the spot market, and in the short term, the PVC spot market may continue to struggle at low levels, with medium-term price performance still expected to be suboptimal.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

India's Q3 Smartphone Shipments Rise 3%; Japanese Mold Factory Closures Surge; Mercedes-Benz Cuts 4,000 Jobs

-

Ascend's Restructuring Plan Approved! Jwell Launches Global Acceleration Plan; Nexperia Chip Crisis Threatens Global Auto Production

-

Dow To Restart Pe Units 5 And 7 This Week, Recovery Date For Unit 6 Remains Undetermined In The United States (US)

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

The Roller-Coaster Behind Sanhua Intelligent Controls' Stock Price: What Are the Advantages of Automotive Thermal Management Companies Crossing Into Humanoid Robots?