OPEC+ Reportedly Keeps Output Unchanged, Focuses on Promoting "New Production Capacity Mechanism"! Plastic Market Sees Partial Adjustments Today

OPEC+ is reported to maintain production levels unchanged and focus on promoting a "new capacity mechanism"!

According to news from Jin Ten Data, informed sources have revealed that...OPEC+ is highly likely to maintain the current oil production levels unchanged at the meeting on Sunday and will focus on a key consensus: establishing a mechanism for assessing the maximum capacity of member countries.Two OPEC+ representatives and a source deeply involved in the negotiations confirmed this development to Reuters.

As for the eight core OPEC+ members gradually increasing production in 2025, they are likely to implement the decision from the previous meeting, namely to "slam the brakes" in the first quarter of 2026.Suspend its production expansion plan.

The OPEC+ alliance controls nearly half of the world's oil supply, and for many years, "capacity" has been a hot-button issue as it serves as the basis for setting production quotas for each country.

Several anonymous sources indicate that the entire OPEC+ group is expected to approve this "capacity" mechanism at a special meeting on Sunday. OPEC hinted as early as May that this assessment would serve as the anchor for the production benchmark in 2027.

OPEC, Saudi, and Russian authorities have not yet responded to Reuters' request for comment.

According to the schedule, four online ministerial meetings will be held on Sunday: first, an OPEC internal meeting; then, a Joint Ministerial Monitoring Committee (JMMC) meeting; followed by a full OPEC+ ministerial meeting; and finally, a wrap-up by the eight countries that are increasing production.

Capacity benchmarks have always been one of the most sensitive topics within OPEC+ because they directly determine the share of production cuts each country must undertake. Last year, Angola left the group in anger because it could not accept the new production targets.

After years of continuous production cuts, OPEC+ began to change its strategy in April this year.Eight core member countries are starting to increase production in an effort to regain the market share that has been eroded.The previous production cuts peaked in March, reaching a total of 5.85 million barrels per day, equivalent to nearly 6% of global production.

These eight countries—Saudi Arabia, Russia, the United Arab Emirates, Kazakhstan, Kuwait, Iraq, Algeria, and Oman—have raised their total production target by about 2.9 million barrels per day from April to December, and unanimously agreed on a "pause" for the first quarter of next year at the last meeting.

Sources added thatFor the overall production target of the group in 2026, ministers also expect not to make any adjustments.This means that the 2 million barrels per day production cut shared by most member countries will continue as planned until the end of next year.

Crude oil prices are heading towards a fourth consecutive monthly decline in November, which would be the longest streak of losses since 2023. Prices have been weighed down by an oversupply outlook, where supply exceeds demand, and by recent diplomatic efforts regarding the Russia-Ukraine situation.

"Geopolitical fluctuations continue, with hopes for a potential ceasefire between Russia and Ukraine offsetting supply concerns raised by new U.S. sanctions on major Russian producers," Barclays analyst Amarpreet Singh wrote in a report. "Even if there is a diplomatic breakthrough, it is unlikely to lead to a substantial increase in Russian production by 2026."

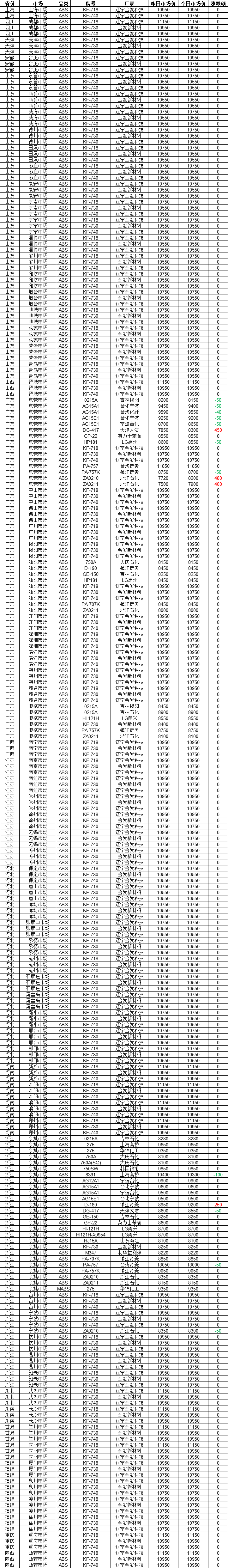

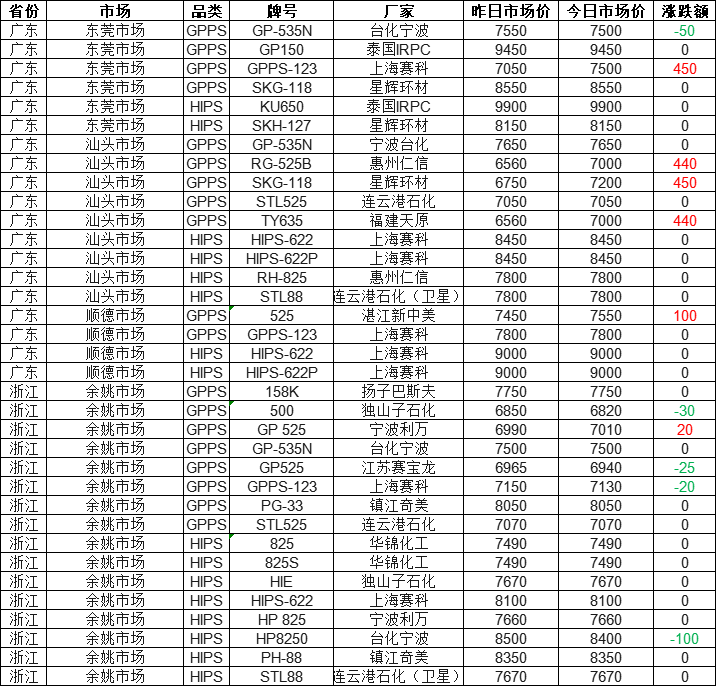

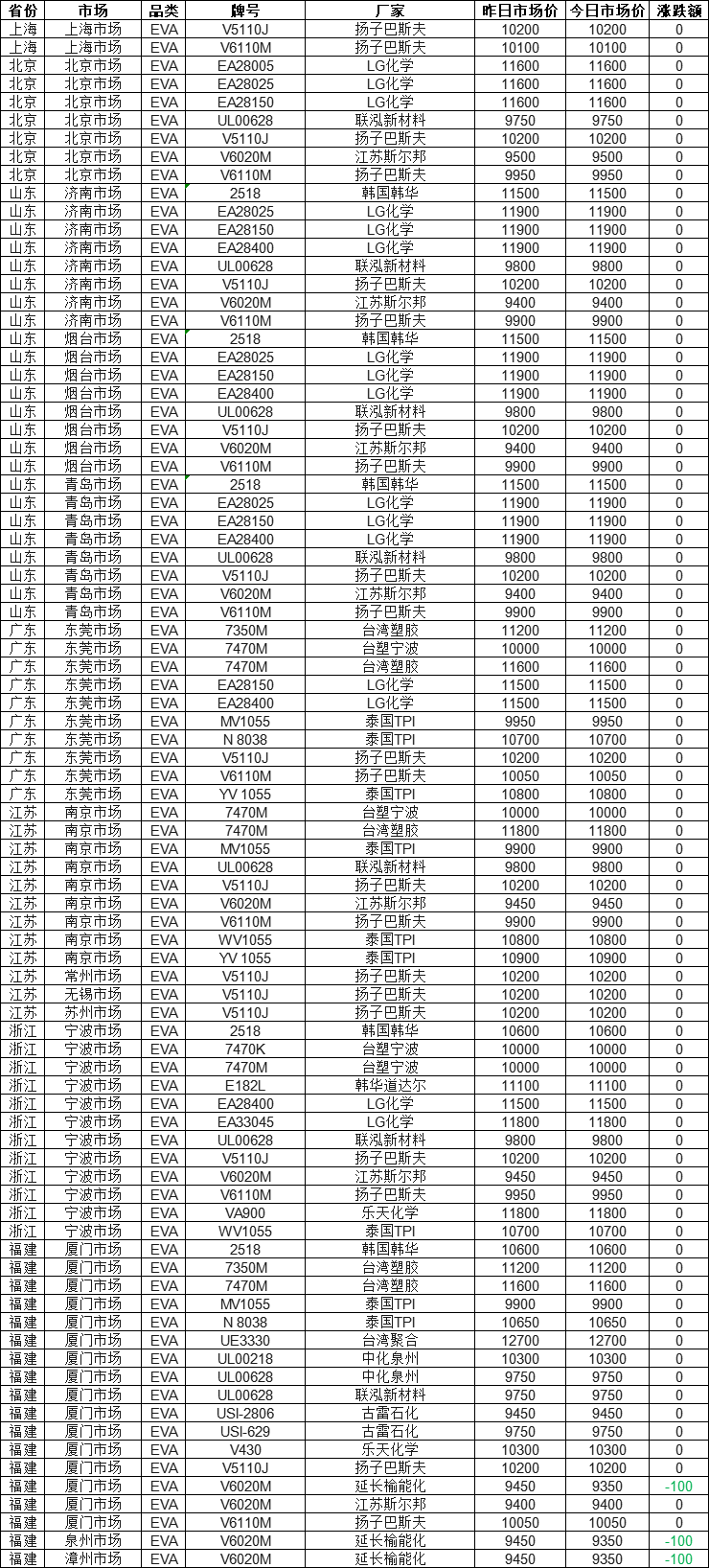

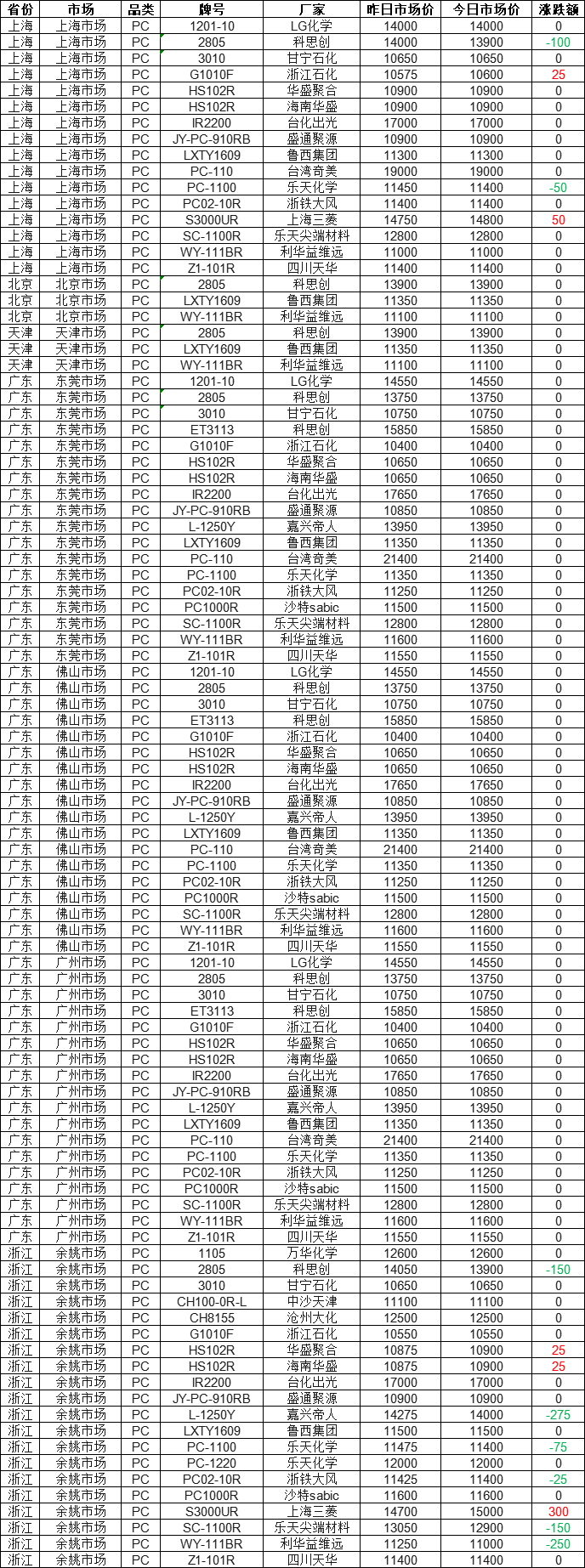

Section 2: Latest Plastic Prices on November 28

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

[Today's Plastics Market] General Materials Weakly Fluctuate, Engineering Materials Steadily Rise

-

New Breakthrough in Domestic Adiponitrile! Observing the Rise of China's Nylon Industry Chain from Tianchen Qixiang's Production

-

Daily Review: Polyethylene Prices Under Weak Consolidation, Sellers Face Significant Pressure to Move Inventory