REACH Regulation Updated! Canada Initiates Anti-Dumping and Countervailing Investigation on China; BASF Launches New Nylon Products

International News Guide:

Raw Material News - Canada Initiates Third Anti-Dumping and Countervailing Sunset Review Investigation on Chinese Oil Country Tubular Goods

Additive News - REACH Regulation Updated! EU Agrees to Classify Flame Retardant DBDPE as a Substance of Very High Concern (SVHC)

Building Materials News - India Initiates Anti-Dumping Investigation on Solar Encapsulation Materials from South Korea and Two Other Countries

Automotive News - Scania's Production Base in China Launches: Planned Annual Capacity of 50,000 Units with Total Investment of €2 Billion

Macroeconomic News - Trump Confirms Authorization of CIA Operations in Venezuela

Price Information - CNY/USD Central Parity Rate Stands at 7.0968, Up 27 Pips

Details of International News:

1.Canada Initiates Third Anti-Dumping and Countervailing Sunset Review Investigation on Chinese Oil Country Tubular Goods

According to the China Trade Remedy Information Network, on October 10 and October 14, 2025, the Canadian International Trade Tribunal (CITT) and the Canada Border Services Agency (CBSA) respectively issued notices to initiate the third anti-dumping and countervailing sunset review investigation on Oil Country Tubular Goods originating from or imported into China.

Stakeholders shall submit questionnaires for this sunset review by November 20, 2025.

2.UK Sanctions 11 Chinese Enterprises, Including 4 Oil Terminals

On October 15, 2025 (local time), the UK imposed its harshest sanctions to date on Russia, with 90 new sanctions directly targeting Russia's oil-related sectors. The UK claimed that the target of these sanctions is Russian companies and their global enablers.

The sanctions cover four Chinese oil terminals, 44 oil tankers in the "shadow fleet" transporting Russian oil, and Nayara Energy Limited, which imported 100 million barrels of Russian crude oil worth over $5 billion in 2024 alone.

Screenshot from the UK Government Website

3.PureCycle Gains EU Market Access to Expand Recycled PP Market

PureCycle announced this week that after obtaining the EU REACH compliance certificate, the company can now sell its PureFive series resins to EU customers.

This certificate confirms that the recycled polypropylene materials processed and produced by PureCycle meet the EU's strict regulatory requirements for human health and environmental protection. Under the EU REACH Regulation, all substances used in product manufacturing with an annual output exceeding 1 ton must be registered. These regulations also apply to Iceland, Liechtenstein, and Norway.

4.REACH Regulation Updated! EU Agrees to Classify Flame Retardant DBDPE as a Substance of Very High Concern (SVHC)

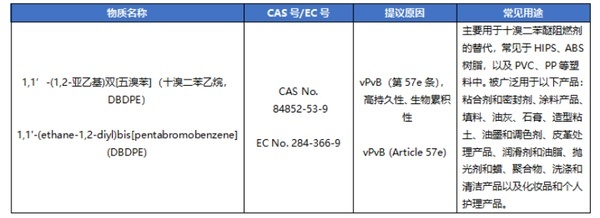

The European Chemicals Agency (ECHA) released information on October 9, 2025, stating that the Member State Committee (MSC) agreed at its October meeting to classify 1,1'-(ethane-1,2-diyl)bis(pentabromobenzene) (decabromodiphenylethane, DBDPE) as a Substance of Very High Concern (SVHC) due to its characteristics of high persistence and high bioaccumulation (vPvB).

ECHA plans to add this substance to the Candidate List in November. In addition to the regular obligations after being included in the Candidate List, classifying decabromodiphenylethane (DBDPE) as an SVHC will support potential restriction work on brominated flame retardants. It also aligns with the deadline for this substance to be transferred to the unified entry list of the CLP Regulation.

Information on the substance classified as SVHC is as follows:

5.Oriental Yuhong Completes 100% Equity Delivery of Chile's Construmart

Oriental Yuhong (002271) recently issued an announcement stating that the company has completed all delivery procedures for the acquisition of 100% equity of Construmart S.A. in Chile, marking the official implementation of its international building materials retail channel layout.

According to the announcement, two of the company's subsidiaries have obtained overseas investment-related documents issued by the Shanghai Municipal Development and Reform Commission and the Shanghai Municipal Commission of Commerce through compliance approval, and completed foreign exchange registration procedures. In terms of fund payment, $113 million has been paid to the seller's designated account in accordance with the agreement, and $10 million has been paid to the Chilean escrow account (to be paid after the expiration of the claim period, after deducting non-permitted leakage from the lock-up date to the delivery date).

6.Meta Builds New GW-Level Data Center in Texas, USA, with Expenditure Exceeding $1.5 Billion

Meta is building a GW-level data center in Texas, USA, to advance its artificial intelligence (AI) development. This is one of a series of major investments made by the company to maintain its leading position in the highly competitive AI industry.

In a blog post on Wednesday, Meta stated that it will invest more than $1.5 billion to build the facility in El Paso, Texas. The final installed capacity of the data center will reach 1 gigawatt (GW), which will be used to provide computing power support for high-end computing chips in AI-related projects.

A company spokesperson said the project is expected to be put into use in 2028.

7.Alexium Launches New Phase Change Material BioCool® PL Compatible with Polyurethane Foam, Providing Long-Lasting Cooling Performance

Recently, Alexium launched BioCool PL (Plus), a new phase change material (PCM) technology designed to provide continuous cooling performance throughout the sleep cycle.

This new R&D achievement is based on the company's existing BioCool platform and incorporates an improved shell structure to enhance thermal stability and durability. The technology is compatible with polyurethane foam.

BioCool PL is specifically designed for bedding and textile applications, including mattress fabrics, foam, mattress covers, and high-performance bedding. The formula uses 100% bio-based PCM cores, meeting the needs of consumers and the industry for environmentally friendly solutions without compromising functionality.

8.BASF Launches Ultramid LowPCF and Ultramid BMB to Expand Sustainable Nylon 6 Product Portfolio in North America

BASF has expanded its sustainable nylon 6 product portfolio in the North American market by launching two innovative products: Ultramid LowPCF (reduced Product Carbon Footprint) and Ultramid BMB (Biomass Balance).

These two new solutions can help customers reduce product carbon footprint and achieve sustainability goals without sacrificing performance or changing existing production processes or supply chains.

Both Ultramid LowPCF and Ultramid BMB use renewable natural gas (RNG) derived from organic waste as raw materials, with traceability through the mass balance method. While maintaining the excellent performance of Ultramid nylon 6, these two products can achieve a lower carbon footprint compared to traditional specifications.

9.India Initiates Anti-Dumping Investigation on Solar Encapsulation Materials from South Korea and Two Other Countries

Recently, India's Ministry of Commerce and Industry issued a notice stating that in response to an application submitted by Indian domestic enterprise RenewSys India Pvt. Ltd., it has initiated an anti-dumping investigation on solar encapsulation materials originating from or imported into South Korea, Thailand, and Vietnam.

This case involves products under Indian Customs Codes 39019000, 39201019, 39201099, 39202090, 39206190, 39206290, 39209919, 39209932, 39209939, 39209992, and 39209999.

The dumping investigation period for this case is from April 1, 2024, to March 31, 2025 (12 months), and the injury investigation period covers 2021-2022, 2022-2023, 2023-2024, and April 1, 2024, to March 31, 2025.

10.1Scania's Production Base in China Launches: Planned Annual Capacity of 50,000 Units with Total Investment of €2 Billion

The industrial production base established in China by Scania, a world-renowned heavy-duty vehicle manufacturer, was officially launched in Rugao, Jiangsu Province on the 15th.

This is one of Scania's largest global investments to date, with a total project investment of €2 billion (approximately RMB 16.6 billion), covering an area of 800,000 square meters and a planned annual capacity of 50,000 units. It will serve both the Chinese and overseas markets and create more than 3,000 jobs.

According to the plan, vehicles produced at this base will be delivered to customers by the end of 2025, and the new product series NEXT ERA will be officially released in the first half of 2026.

Overseas Macroeconomic Market:

【Trump Confirms Authorization of CIA Operations in Venezuela】

U.S. President Trump stated on the 15th (local time) that the U.S. will consider conducting ground operations to strike drug cartels and confirmed that he has authorized the CIA to carry out operations in Venezuela.

Earlier, media reports stated that the U.S. government had secretly authorized the CIA to conduct covert operations in Venezuela. This new authorization allows the CIA to conduct lethal covert operations alone or jointly with the U.S. military, and the U.S. military is also preparing for potential attacks in Venezuela.

【Industry Weekly Report: U.S. API Crude Oil Inventories Increased by Over 7 Million Barrels Last Week】

Data from the American Petroleum Institute (API) showed that U.S. API crude oil inventories increased by 7.4 million barrels last week, compared with an increase of 2.78 million barrels in the previous week.

【Fed Beige Book: Domestic Consumer Demand Remains Basically Unchanged; Many Expect Rising Uncertainty to Weigh on Economic Activity】

Fed Economic Report (Beige Book): Since the last report, overall U.S. economic activity has changed little. Three districts reported a slight to moderate increase in economic activity, five districts reported no change in economic activity, and four districts reported a slight slowdown in economic activity.

Overall consumer spending, especially retail goods spending, declined slightly in recent weeks. However, strong demand for electric vehicles boosted auto sales in some regions before the expiration of federal tax credits at the end of September.

During the period covered by this report, demand for leisure and hotel services from international tourists further declined, while demand from domestic consumers remained basically unchanged. Nevertheless, it was reported that high-income groups continued to spend strongly on luxury travel and accommodation.

【Fed Governor Bowman: No Need to Cut Interest Rates by More Than 50 Basis Points】

Fed Governor Bowman: There is no need to cut interest rates by more than 50 basis points. Policy has become more restrictive than many people think. The U.S. is about to see a significant disinflationary phenomenon in the housing market.

Price Information:

【CNY/USD Central Parity Rate Stands at 7.0968, the Strongest in a Year】

The central parity rate of CNY against USD was reported at 7.0968, an increase of 27 pips; the central parity rate of the previous trading day was 7.0995, the official closing price of the previous trading day was 7.1238, and the night session closing price of the previous day was 7.1278.

【Upstream Raw Material USD Market Prices】

Ethylene Asia: CFR Northeast Asia USD 785/ton; CFR Southeast Asia USD 780/ton.

Propylene Northeast Asia: FOB South Korea average USD 750/ton; CFR China average USD 775/ton.

North Asia refrigerated cargo CIF price: Propane USD 446-450/ton; Butane USD 482-487/ton.

South China (China) refrigerated cargo CIF price for early November: Propane USD 529-539/ton; Butane USD 529-539/ton.

Taiwan region refrigerated cargo CIF price: Propane USD 446-450/ton; Butane USD 482-487/ton.

【LLDPE USD Market Prices】

Film: USD 850-890/ton (CFR Huangpu);

Injection Molding: USD 935/ton (CFR Huangpu).

【HDPE USD Market Prices】

Film: USD 900-940/ton (CFR Huangpu);

Blow Molding (Hollow): USD 855/ton (CFR Huangpu);

Injection Molding: USD 850/ton (CFR Huangpu);

Pipes: USD 1010/ton (CFR Huangpu).

【LDPE USD Market Prices】

Film: USD 1050-1105/ton (CFR Huangpu);

Coating: USD 1100-1280/ton (CFR Huangpu).

【PP USD Market Prices】

Injection Molding: USD 860-915/ton (CFR Huangpu);

Copolymer: USD 850-880/ton (CFR Nansha);

Film Grade: USD 1020/ton (CFR Huangpu);

Transparent Grade: USD 1005-1125/ton (CFR Huangpu);

Pipes: USD 1100/ton (CFR Shanghai).

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

India's Q3 Smartphone Shipments Rise 3%; Japanese Mold Factory Closures Surge; Mercedes-Benz Cuts 4,000 Jobs

-

Ascend's Restructuring Plan Approved! Jwell Launches Global Acceleration Plan; Nexperia Chip Crisis Threatens Global Auto Production

-

Dow To Restart Pe Units 5 And 7 This Week, Recovery Date For Unit 6 Remains Undetermined In The United States (US)

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

The Roller-Coaster Behind Sanhua Intelligent Controls' Stock Price: What Are the Advantages of Automotive Thermal Management Companies Crossing Into Humanoid Robots?