[PE Daily Review] Ample Supply, Price Decline

1. Today's Summary

The Federal Reserve is expected to cut interest rates next week, boosting economic and demand expectations. Coupled with unstable geopolitical situations, international oil prices are rising. NYMEX crude oil futures for the January contract are up $0.41 per barrel at $60.08, an increase of 0.69%; ICE Brent crude futures for the February contract are up $0.49 per barrel at $63.75, an increase of 0.77%.

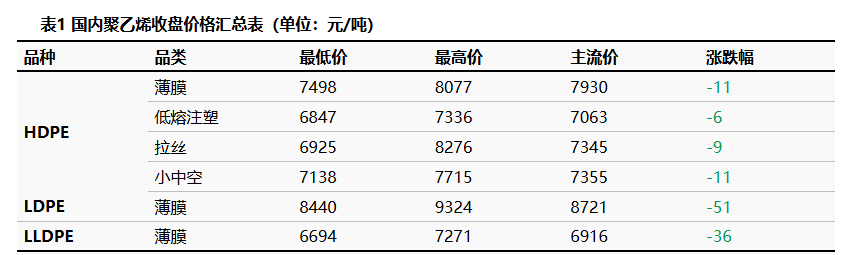

②、 The price fluctuation range for the HDPE market is -11 to 6 yuan/ton, the price for the LDPE market is -51 yuan/ton, and the price for the LLDPE market is -36 yuan/ton.

2. Spot Overview

The current polyethylene market is characterized by ample supply, while downstream factories primarily purchase based on demand. Traders tend to offer discounts to alleviate inventory pressure, leading to a decline in actual transaction prices. Against the backdrop of continuous release of new production capacity, the overall supply pressure remains significant, and the pace of social inventory reduction is slower than expected. The market price fluctuation range for HDPE is -11 to 6 yuan/ton, for LDPE the market price is -51 yuan/ton, and for LLDPE the market price is -36 yuan/ton.

|

Image 1 Domestic Polyethylene Market Price Trends by Type (Yuan) /ton) |

|

|

|

Data source: Longzhong Information |

3 Spot-futures basis

The LL main contract fluctuated downward, opening at 6689 yuan/ton and closing at 6643 yuan/ton by 15:00, a decrease of 68 yuan/ton compared to the previous settlement price. The trading volume was 234,900 lots, and the open interest was 374,200 lots. Today's spot-futures basis was 7 yuan/ton, an increase of 1 yuan/ton compared to the previous working day.

|

Figure 2 Polyethylene price difference trend (yuan) /ton) |

|

|

|

Data Source: Longzhong Information |

4 Production Dynamics

The capacity utilization rate has been 82.94% changed to 84.12%.

|

Graphic 3 Domestic polyethylene capacity utilization rate trend |

|

|

|

Data source: Longzhong Information |

The cost of oil production is 7224 RMB/ton; oil-based profit is -524 RMB/ton; coal-based profit is -164 RMB/ton.

|

Figure 4 Domestic Polyethylene Profit and Price Comparison (Yuan/Ton) |

|

|

|

Data Source: Longzhong Information |

5 Market sentiment

Table 2 Domestic polyethylene upstream and downstream practitioners' sentiment expectations

|

Date |

Bearish |

Bullish |

Steady look |

|

This week |

46.5% |

2.0% |

51.5% |

|

Last week |

49.0% |

1.0% |

50.0% |

|

Rise and Fall |

-2.5% |

1.0% |

1.5% |

|

Data source: Longzhong Information |

|||

|

Note: The above data is updated every Thursday. |

|||

6. Price Prediction

In the short term, the current supply pressure in the polyethylene market is significant. New capacity is scheduled to be released, and imported resources are relatively abundant. On the demand side, downstream factories are generally cautious in their purchasing behavior, primarily replenishing stocks as needed, which provides limited support to the market. It is anticipated that polyethylene market prices will mainly fluctuate and decline tomorrow. .

7. Relevant Product Information

Crude oil market: In the short term, the main trading logic of the international oil market has not changed. The bullish factors come from the continued U.S. sanctions policy against oil-producing countries and the uncertainty in geopolitical situations, while the bearish factors are... OPEC+ maintains its stance on production increases and global economic and demand conditions are suboptimal. Unstable geopolitical situations in Russia-Ukraine, US-Venezuela, and other regions continue to raise concerns about potential short-term supply risks. Coupled with the possibility of the Federal Reserve cutting interest rates this week, international oil prices are expected to have room for an increase tomorrow.

8. Data Calendar

Table 3 Domestic Polyethylene Data Overview Table (Unit: 10,000 tons)

|

Data |

Release Date |

Previous Data |

The trend for this period is expected |

|

PE production enterprises' total inventory (ten thousand tons) |

Wednesday 17:00PM |

45.26 |

↗ |

|

PE Social Sample Repository Inventory |

Tuesday 17:00PM |

-3.25% |

↘ |

|

PE Weekly Production (10,000 tons) |

Thursday 17:00PM |

68.11 |

↘ |

|

PE maintenance impact (10,000 tons) |

Thursday 17:00PM |

9.08 |

↘ |

|

PE Weekly Capacity Utilization Rate |

Thursday 17:00PM |

84.05% |

↘ |

|

PE downstream industry capacity utilization rate |

Thursday 17:00PM |

-0.54% |

↘ |

|

PE Mindset Survey |

Thursday 12:00AM |

-2.48% |

↘ |

|

Data source: Longzhong Information Note: 1. ↓↑ is considered a significant fluctuation, highlighting data dimensions with a rise or fall exceeding 3%. 2. Consider narrow fluctuations as those with price changes within 0-3%. The above data is updated every Thursday. |

|||

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

[Today's Plastics Market] General Materials Weakly Fluctuate, Engineering Materials Steadily Rise

-

New Breakthrough in Domestic Adiponitrile! Observing the Rise of China's Nylon Industry Chain from Tianchen Qixiang's Production

-

Daily Review: Polyethylene Prices Under Weak Consolidation, Sellers Face Significant Pressure to Move Inventory

![[PE日评]:供应充裕,价格下跌(20251208)](https://oss.plastmatch.com/zx/image/a3f5104eab3042f29fac3045f6121ee9.png)

![[PE日评]:供应充裕,价格下跌(20251208)](https://oss.plastmatch.com/zx/image/c78dffe20cb945bd9de8288677f63301.png)

![[PE日评]:供应充裕,价格下跌(20251208)](https://oss.plastmatch.com/zx/image/58fc9003f6a941b8926b38847f6b4700.png)

![[PE日评]:供应充裕,价格下跌(20251208)](https://oss.plastmatch.com/zx/image/bb55409138a349ecbfd82576d55a20e1.png)