[pom daily review] tight supply conditions support sporadic purchases from downstream

1. Today's Summary

The Yanzhou Coal Yulin Chemical Phase I POM plant was shut down for maintenance from November 25 to December 7, and it is currently resuming operations.

②、 The Hebi Longyu POM unit will be shut down for maintenance on October 20th, with the restart date yet to be determined. 。

2 Spot Overview

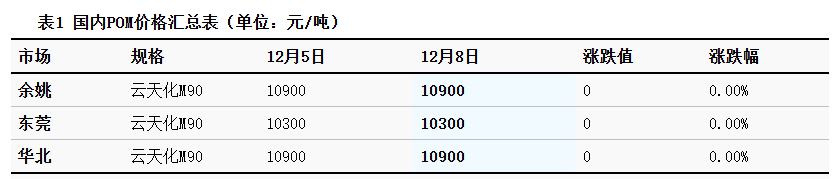

Based on the Yuyao region, today the Yun Tian Hua M90 is priced at 10,900 yuan/ton, with the price remaining stable compared to the previous period. Today, the POM market is consolidating at a high level. Petrochemical plants continue to experience tight supply, with a strong short-term intention to maintain prices. The fundamentals are relatively stable, and the market trend remains high. Traders primarily aim to maintain prices when selling, with mainstream quotations showing no significant fluctuations. End-users are mainly adopting a wait-and-see attitude, and transactions are negotiated as needed. As of the close, the tax-inclusive price of domestic materials in the Yuyao market is 8,200-11,100 yuan/ton, and the cash price in the Dongguan market is 7,700-10,400 yuan/ton.

|

Figure 1: Domestic POM Price Trend Chart for 2025 (Yuan/Ton) |

Figure 2: 2025 Domestic POM Regional Price Trend Chart (Yuan/Ton) |

|

|

|

|

Data Source: Longzhong Information |

Data source: Longzhong Information |

3 Production Dynamics

This week's domestic POM capacity utilization rate is at 73.84%, up 3.46% compared to last week. Yankuang Luhua Phase I POM plant will be shut down for maintenance from November 25 to December 7. Hebi Longyu The startup time for Tianjin Bohua's POM unit is yet to be determined. This week's maintenance loss has increased. This week, the prices of methanol and POM both increased, with POM experiencing a larger increase. The product's gross profit margin continues to rise, increasing the profit margin by 72 yuan per ton.

|

Figure 3: Trend of Domestic POM Capacity Utilization Rate from 2024 to 2025 |

Figure 4 Comparison of Domestic POM Profits and Prices in 2025 (Yuan/ton) |

![[POM日评]:货紧形势支撑 下游零星采购(20251208)](https://oss.plastmatch.com/zx/image/e81815ff6a544139b3e4968e30a7b30b.png) |

![[POM日评]:货紧形势支撑 下游零星采购(20251208)](https://oss.plastmatch.com/zx/image/d5992863f15549fb8a4e7351f55835b6.png)

|

|

Data Source: Longzhong Information |

Data Source: Longzhong Information |

4. Price Prediction

At the beginning of the week, the fundamentals of POM remain supportive. Petrochemical plants have no inventory pressure, showing a strong short-term intention to maintain prices. Ex-factory prices are still supported, and mainstream market quotations remain firm. Traders continue to exhibit reluctance to sell, with no significant fluctuations in mainstream quotations. However, end-users' purchasing sentiment is weakening, replenishment demand is decreasing across regions, and actual transactions are sporadic. Longzhong expects that the domestic POM market will remain stable in the short term.

5 Related Product Information:

Methanol:Today's methanol spot price index is 2063.13, down by 9.78. The spot price in Taicang is 2080, down by 5, and the price on the North Line of Inner Mongolia is 1995, down by 12.5. According to Longzhong's monitoring of prices in 20 major cities, 10 cities experienced varying degrees of decline, with decreases ranging from 5 to 145 yuan/ton. At the beginning of the week, the domestic methanol market showed average performance, with futures fluctuating narrowly at low levels. The overall spot market at ports was slightly weaker, with demand-based transactions and a generally moderate negotiation atmosphere. In the short term, the market continues to be constrained by high inventory levels, concentrated imports, and the expected shutdown of Ningbo's MTO. Attention should be paid to the pace of market structure adjustments. The inland market showed slight weakness and local minor declines. Although upstream production area inventories are currently not high, due to abundant supply, year-end demand weakening expectations, and freight rate increases, buyers are becoming cautious in following the price rise. It is expected that the market will slightly weaken in the short term, with close attention to weather disturbances.

6 Data Calendar

Table 2 Overview of Domestic POM Data (Unit: 10,000 tons)

|

Data |

Publication Date |

Previous Data |

Current trend forecast |

|

Capacity utilization rate |

Thursday 17:00 |

73.84% |

↗ |

|

Production profit margin |

Thursday 17:00 |

3.90% |

↗ |

|

Data Source: Longzhong Information Note: 1. Consider a significant fluctuation as a substantial change, highlighting data dimensions where the rise or fall exceeds 3%. 2. ↗↘ is regarded as a narrow fluctuation, highlighting data with a rise or fall within the range of 0-3%. |

|||

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

[Today's Plastics Market] General Materials Weakly Fluctuate, Engineering Materials Steadily Rise

-

New Breakthrough in Domestic Adiponitrile! Observing the Rise of China's Nylon Industry Chain from Tianchen Qixiang's Production

-

Daily Review: Polyethylene Prices Under Weak Consolidation, Sellers Face Significant Pressure to Move Inventory

![[POM日评]:货紧形势支撑 下游零星采购(20251208)](https://oss.plastmatch.com/zx/image/6902e26399c1410890120492c8016cf0.png)

![[POM日评]:货紧形势支撑 下游零星采购(20251208)](https://oss.plastmatch.com/zx/image/c36f3553097a423880a583616bb6b785.png)