[pp daily review] slow recovery on demand side, polypropylene market consolidates within a range

1 Today's Summary

①. Sinopec East China PP decreased by 50, Anqing T set at 6850, Zhong'an M17 set at 6900, Youxian ZH179 set at 6950, Shang F800E set at 7700, M800E set at 8100; PetroChina Southwest adjusted down by 50: S1003 Dushanzi Petrochemical at 7220, T30S Lanzhou Petrochemical at 7120, L5E89 Sichuan Petrochemical at 7070, L5D98 Sichuan Petrochemical at 7120, S2040 Dushanzi Petrochemical at 7300, NX40S Ningxia Petrochemical at 7400, H9018 Lanzhou Petrochemical at 7400.

Today, the domestic polypropylene shutdown impact increased by 1.43% compared to yesterday, reaching 14.53%. The daily production proportion of raffia decreased by 0.29% compared to yesterday, standing at 26.30%. The low melt copolymer increased by 0.72% compared to yesterday, reaching 7.63%.

During the period from August 22 to August 28, 2025, the supply-demand balance remains in a pattern of supply exceeding demand. The supply-demand gap maintains a positive value and expands compared to the previous period, forming a bearish influence on market sentiment. In the next period, the surplus in the supply-demand balance will continue, but the gap will narrow. It is expected to still exert a bearish influence on prices.

2 Spot Overview

Table 1 DomesticPolypropylene priceSummary Table (Unit: Yuan/Ton)

Based on the East China region, today's polypropylene raffia is priced at 6,845 RMB/ton, a decrease of 8 RMB/ton compared to yesterday. The national average price of raffia dropped by 13 RMB/ton compared to yesterday, a decrease of 0.19%, in line with the morning forecast.

In the morning, futures fluctuated within a narrow range. Today, the polypropylene market mainly showed weak adjustments. The recovery in downstream demand fell short of expectations, and the overall market sentiment was cautious. Traders primarily focused on selling at discounted prices, while the willingness of end-users to purchase was low, resulting in limited transaction volume. By midday, the mainstream prices for wire drawing in East China were between 6750-7000 yuan/ton.

|

Figure 1 Domestic Polypropylene Price Trend (Unit: Yuan/Ton) |

Figure 2 Domestic Polypropylene Prices in Various Regions (Unit: Yuan/Ton) |

|

|

|

|

Data source: Longzhong Information |

Data Source: Longzhong Information |

3 ============

From the perspective of basis, today the polypropylene basis in East China is -106 yuan/ton, a decrease of 29 yuan/ton compared to yesterday; in North China, the basis is -3 yuan/ton, a decrease of 38 yuan/ton compared to yesterday.

|

Figure 3 Basis Trend in North China (unit: yuan/ton) |

Figure 4 Basis Trends in East China (Unit: Yuan/Ton) |

|

|

|

|

Data source: Longzhong Information |

Data Source: Longzhong Information |

4 Production Dynamics

The polypropylene capacity utilization rate decreased from 77.36% yesterday to 77%, a drop of 0.36% compared to yesterday. Oil-based profit increased by 52.95 yuan/ton to -331.55 yuan/ton compared to yesterday.

|

Figure 5 Domestic Polypropylene Capacity Utilization Trend Chart |

Figure 6 Domestic Polypropylene Profit Price Trend Chart (Unit: Yuan/Ton) |

|

|

|

|

Data source: Longzhong Information |

Data Source: Longzhong Information |

5 Market sentiment

With the release of new production capacity, the pressure from the supply side has become evident. Although the traditional peak season has arrived, the demand recovery is slower than expected, and downstream buyers are generally not very proactive. The pattern of increasing supply and weak demand is unlikely to change, providing insufficient unilateral drive for polypropylene, and the market sentiment remains cautious.

6 Price Prediction

The current demand side is recovering slowly. Downstream factories are maintaining production with existing orders, but the recovery of new orders will take some time. Although there has been an increase in maintenance recently, there remains a gap between the growth rate of demand and the supply increase. The spot market is weak, and combined with the decline in crude oil prices, cost support is weakening, and the market lacks strong drivers. It is expected that the polypropylene market will fluctuate around 6780-7020 yuan/ton next week, with a focus on the recovery of the demand side.

7 Related product information

Table 2 Summary of Prices for Polypropylene-related Products (Unit: Yuan/Ton)

|

Market |

9 April 4th |

9 The 5th of the month |

Change in value |

Change in Price Percentage |

|

Shandong Propylene |

6605 |

6560 |

-45 |

-0.68% |

|

ShandongMethanol |

2380 |

2380 |

0 |

0.00% |

|

Linyi PP powder |

6780 |

6780 |

0 |

0.00% |

8 Data Calendar

Table 3 Overview of Domestic Polypropylene Data (Unit: 10,000 tons)

|

Data Project |

Publication Date |

Previous Data |

The current trend is expected |

Unit |

|

PP Total Inventory |

Wednesday 4:30 PM |

83.34 |

↑ |

10,000 tons |

|

PP Production Enterprise Capacity Utilization Rate |

Thursday 4:30 PM |

79.91% |

↓ |

% |

|

PP Weekly Maintenance Impact |

Thursday 4:30 PM |

13.93 |

↑ |

10,000 tons |

|

Domestic PP enterprise total production |

Thursday 4:30 PM |

81.4 |

↑ |

Ten thousand tons |

|

Profit of Oil-based PP Enterprises |

Thursday 4:30 PM |

-384.5 |

↓ |

CNY/ton |

|

Profit of Coal-to-PP Enterprises |

Thursday 4:30 PM |

482.2 |

↓ |

Yuan/ton |

|

PDH Manufacture of PP Enterprise Profit |

Thursday 4:30 PM |

-792.93 |

↓ |

Yuan/ton |

|

PP Import Profit |

Thursday 4:30 PM |

-578.96 |

↑ |

CNY/ton |

|

PP Export Profit |

Thursday 4:30 PM |

-1.27 |

↑ |

USD/ton |

|

1 Consider significant fluctuations as substantial when highlighting data dimensions with a change exceeding 3%. 2 Considered as narrow fluctuations, highlighting data with a rise and fall range within 0-3%. |

||||

|

Data source: Longzhong Information Note: 1 Consider a significant fluctuation as an increase or decrease of more than 3%, highlighting data dimensions with such changes. 2 Regarded as narrow fluctuations, highlighting data with a rise or fall within the range of 0-3%. |

|||||

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Four Major Chemical New Material Giants Sell Off and Shut Down Again!

-

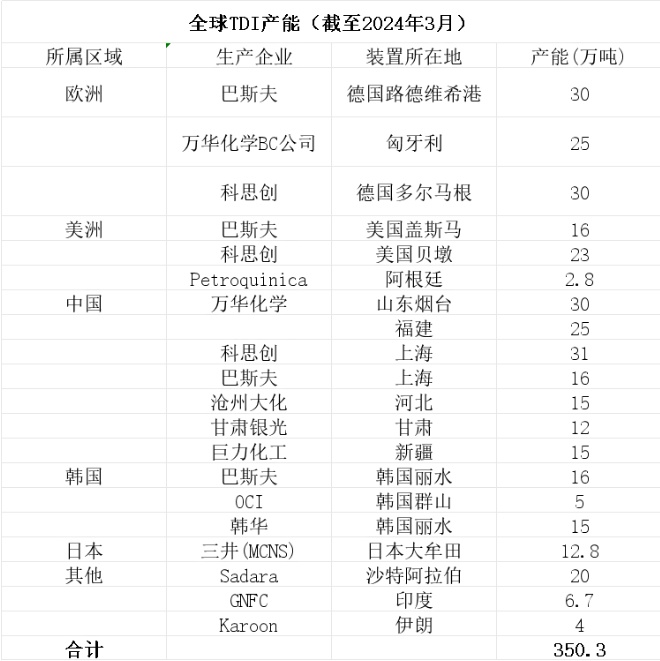

Covestro faces force majeure!

-

DuPont to Spin Off Nomex and Kevlar Brands for $14.4 Billion: Is Aramid Fiber Still Attractive?

-

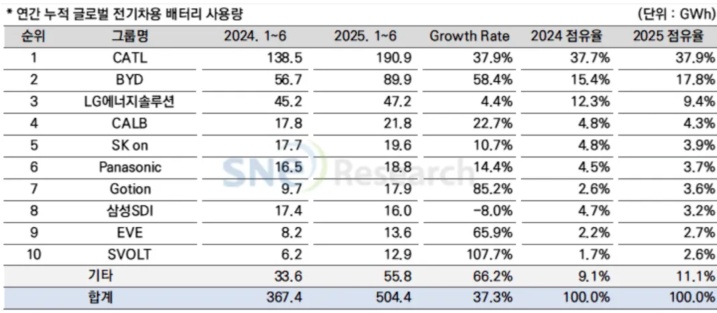

Massive Retreat of Japanese and Korean Battery Manufacturers

-

Napan Unveils Thermoplastic Composite Three-in-One Power System Solution, Battery Cover Weight Reduced by 67%

![[PP日评]:供应量快速攀升 聚丙烯市场承压运行(20250902) [PP日评]:供应量快速攀升 聚丙烯市场承压运行(20250902)](https://oss.plastmatch.com/zx/image/aabf81f6fbd941b5b374405d2da0cd94.png)

![[PP日评]:基本面供强需弱 聚丙烯市场偏弱整理(20250905) [PP日评]:基本面供强需弱 聚丙烯市场偏弱整理(20250905)](https://oss.plastmatch.com/zx/image/f1b23d858d8e45e4af3543c79ab63be7.png)

![[PP日评]:基本面供强需弱 聚丙烯市场偏弱整理(20250905) [PP日评]:基本面供强需弱 聚丙烯市场偏弱整理(20250905)](https://oss.plastmatch.com/zx/image/2c2794558ffe441294b3fe67940e18aa.png)

![[PP日评]:基本面供强需弱 聚丙烯市场偏弱整理(20250905) [PP日评]:基本面供强需弱 聚丙烯市场偏弱整理(20250905)](https://oss.plastmatch.com/zx/image/67a6ce627716404c948f00a8f8052bd9.png)

![[PP日评]:基本面供强需弱 聚丙烯市场偏弱整理(20250905) [PP日评]:基本面供强需弱 聚丙烯市场偏弱整理(20250905)](https://oss.plastmatch.com/zx/image/d6e58a41b36841898dca4ce44e9b6ed1.png)

![[PP日评]:基本面供强需弱 聚丙烯市场偏弱整理(20250905) [PP日评]:基本面供强需弱 聚丙烯市场偏弱整理(20250905)](https://oss.plastmatch.com/zx/image/6dac0ced9a7a48fdbbf243805683a074.png)