Prospects for the Plastic Processing Equipment Market in 2025: Germany Is Pessimistic, While Chinese and Japanese Plastic Machinery Companies Are Optimistic About the Future

The current state of the plastic processing equipment market is complex. Will there be a recovery in 2026? The answer is intricate.

At the 2025 K Show in Germany, the Plastics Industry Association released the "Global Trends Report," with Chief Economist Perc Pineda sharing key data from the industry in 2024.

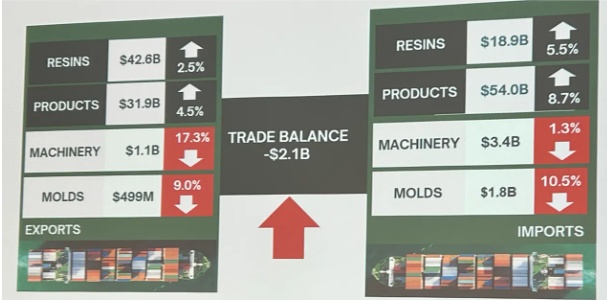

Pineda stated that the export value of the U.S. machinery equipment industry declined by 17.3% to $1.1 billion, while imports decreased by 1.3%, totaling $3.4 billion. The overall trade deficit in the U.S. plastics industry is expected to decrease by $2.1 billion in 2024. If not for a 2.5% increase in resin exports (totaling $42.6 billion), the deficit situation would have significantly worsened. He added that the expected interest rate cuts in 2025 are likely to drive capital expenditure beyond the $24 billion of 2024.

German equipment manufacturers are going through a tough time and are not optimistic about a market recovery in 2026.

KraussMaffeiRalf Benack from KraussMaffei stated at the K 2025 press conference, "The plastic industry has had easier times." Benack and his team noted that current demand is volatile, but the company will continue to push for development and prioritize innovation. At booth C24 in Hall 15, KraussMaffei showcased its high-efficiency all-electric PX series injection molding machines, featuring a compact design, and introduced the company’s Power Print Flex extruder, which it claims to be "the world's best extruder for additive manufacturing."

LeffenhausBernd Reifenhauser, CEO of Reifenhauser, outlined three major challenges faced by German machinery manufacturers: a shortage of skilled workers, uncertainty regarding regulatory pressures related to sustainability, and profitability issues. However, like its peers, the company is maintaining and even seizing market share through technological investments. For example, at booth C22 in Hall 17, Reifenhauser showcased its new Evo Gen3 series blow film production line, which has a capacity of up to 1050 kg/hour, a benchmark that the company claims sets a new industry standard.

At the same time, equipment manufacturers in Japan and China have a more optimistic outlook.

Japanese Injection Molding Machine GiantShibaura Machine(Shibaura Machine) is betting on a market recovery in the first half of 2026 and has initiated a strategic expansion into the European and American markets. Notably, the company announced that it will acquire an 80% stake in the German family-owned enterprise LWB Steinl GmbH in Altdorf. This collaboration will integrate expertise in the fields of injection molding machines and automation. Upon completion of the transaction, Shibaura Machine will establish a European headquarters and production center in Altdorf. In a press conference, Dr. Georg P. Holzinger of Shibaura Machine acknowledged that the current global market is in a slump, but he stated, "We believe that starting from 2026, these uncertainties will gradually be resolved, and we will be prepared for market recovery by then." Shibaura Machine's booth is located in Hall 15, B21.

Terry Machinery(Tederic) maintains a positive attitude. The company showcased an electric hydraulic injection molding machine designed specifically for packaging applications for the first time at K 2025. CEO Zheng Jianguo acknowledged that the current market is in a downturn, but he noted that initial signs of stabilization have been observed in interactions with customers. "We expect the market to see a significant recovery in 2026," he stated. "In 2024, we built two new factories in China, laying the foundation for rapidly and stably meeting the growing demand." Tederic's booth is located at Hall 15, D40.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

India's Q3 Smartphone Shipments Rise 3%; Japanese Mold Factory Closures Surge; Mercedes-Benz Cuts 4,000 Jobs

-

Ascend's Restructuring Plan Approved! Jwell Launches Global Acceleration Plan; Nexperia Chip Crisis Threatens Global Auto Production

-

Dow To Restart Pe Units 5 And 7 This Week, Recovery Date For Unit 6 Remains Undetermined In The United States (US)

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

The Roller-Coaster Behind Sanhua Intelligent Controls' Stock Price: What Are the Advantages of Automotive Thermal Management Companies Crossing Into Humanoid Robots?