Reshuffle Imminent in the Modified Plastics Industry: Technological Breakthroughs and Economies of Scale Are Key

Background Briefing

In recent years, driven by intensive policy support and iterative downstream demand, China's modified plastics industry has shown signs of development."Upgrading amid differentiation, breaking through amid integration"The distinctive characteristics of the above content:

1) Leading enterprises are shifting their focus from scale expansion to quality improvement, resulting in a slowdown in capacity expansion. Although the industry competition landscape remains highly fragmented, it is rapidly undergoing restructuring and integration. 2) Homogenized competition in the low-end product sector continues to intensify and is gradually being phased out. In response to changes in downstream consumption patterns, the upgrade of products towards high-end, eco-friendly, and functional attributes has become the core theme of the industry. 3) Policy benefits and growth in emerging markets are creating a synergistic effect: on one hand, benefiting from policies such as trade-ins, demand in the home appliance and electronics sectors remains robust; on the other hand, emerging fields such as new energy, humanoid robots, and low-altitude economy are booming, driving an increase in the consumption of modified plastics. 4) Industry profitability continues to diverge, with leading enterprises expanding their production and sales scale by leveraging advantages in scale, technology, and channels, thereby concentrating industry profits towards them.

01

The competitive landscape of China's modified plastics industry remains relatively fragmented, while the demand upgrade in emerging areas will accelerate industry reshuffling and expedite the integration process.

The modified plastics industry is a typical technology advancement and consumption upgrade-driven sector. Since the 21st century, with the rapid development of China's manufacturing industry, the widespread adoption of automotive and home appliance products has significantly propelled the growth of the domestic modified plastics industry. The industry scale has rapidly expanded, and the number of enterprises has continuously increased. Currently, China has more than 3,000 modified plastics manufacturing companies, with over 30 listed companies, including representative enterprises.Jinfa Technology, Guoen Co., Ltd., Pulit, Dawn Co., Ltd., Huitong Co., Ltd., Polyrocks Chemical, Tongyi Co., Ltd., CGN Juner, Nanjing Julong, Yinxi Technology, etc.

In 2024, the total production capacity of 10 representative leading modified plastics companies in China is approximately 6.75 million tons per year, accounting for about 17% of the national total production capacity.Since 2022, due to the fluctuations in the prices of upstream bulk chemical raw materials and basic resins, the raw material costs for enterprises have risen significantly. At the same time, intense industry competition has led companies to generally adopt price reduction strategies to secure orders, resulting in a downward fluctuation in the prices of modified plastic products and a continuous narrowing of profit margins.Some lagging enterprises have gradually exited the market due to difficulties in maintaining operations, leading to an increase in industry concentration. However, overall, the competitive landscape of the industry remains relatively fragmented, with a low market concentration.

Compared to international chemical giants, most domestic modified plastic enterprises are still in the imitation stage, lacking comparative advantages in both technological accumulation and industrial scale. This has resulted in fierce homogenous competition in the mid-to-low end product market, while they lack competitiveness in the high-end, specialized modified plastic sector and still rely on foreign brands. Furthermore, most domestic companies have not yet achieved integrated upstream and downstream layouts, remaining relatively passive in controlling raw material costs.

Looking ahead, with the rapid development and demand upgrade in downstream application fields such as new energy vehicles, smart home appliances, electronic information, humanoid robots, and low-altitude economy, the modified plastics industry is set to undergo a deep reshuffle. Enterprises that have homogeneous technologies, lack independent innovation capabilities, and produce low-quality products will gradually be eliminated due to their inability to adapt to market demands; while companies that adhere to innovation, have solid technology, and possess cost competitiveness will stand out. In this process, the industry concentration of the modified plastics sector is expected to further increase.

02

The trade-in policy promotes the growth of modified plastics consumption in the fields of home appliances, automobiles, and electronics; the vigorous development of emerging sectors drives the breakthrough in modified plastics consumption volume.

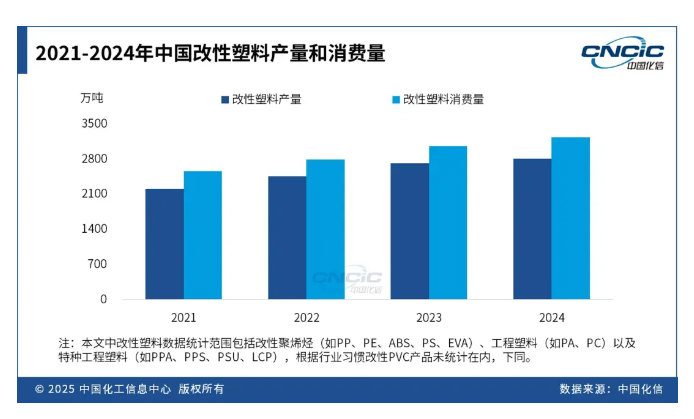

With the continuous transfer of global industries such as automobiles, home appliances, office equipment, and power tools to China, along with the vigorous development of the domestic economy and the deepening trend of "substituting plastic for steel" and "substituting plastic for wood," China has become the largest modified plastics market in the world and serves as the main engine for global demand growth. Against this backdrop, the demand for modified plastics in China has rapidly increased from 25.59 million tons in 2021 to 32.25 million tons in 2024, with a compound annual growth rate (CAGR) of 8.0%. In 2024, China's consumption of modified plastics is expected to grow by 5.6% year-on-year, driven mainly by two key factors:On one hand, the "trade-in" policy has effectively boosted consumer demand in traditional sectors such as home appliances and automobiles. On the other hand, the demand for modified plastics in emerging fields like new energy vehicles, low-altitude aircraft, and intelligent robots is continuously emerging, expanding application scenarios and increasing product market share.

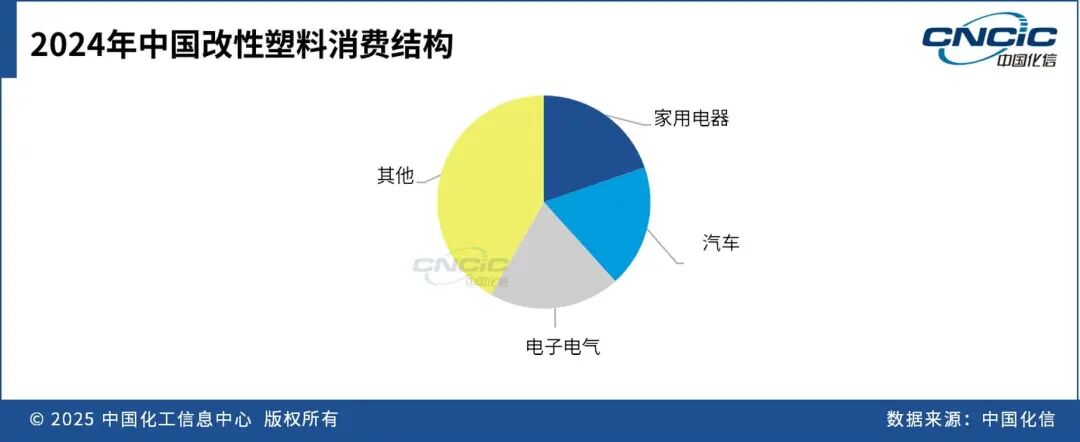

Modified plastics belong to the auxiliary processing segment, and their development is primarily driven by downstream demand. Modified plastics have a wide range of applications, covering fields such as household appliances, automobiles, communications, electronics, electrical, medical, rail transportation, precision instruments, home furnishing, and building materials. Among these, household appliances, as important durable consumer goods, are closely related to the demand for modified plastics. As the world's largest producer and consumer of household appliances, China's steady growth in the appliance market continues to drive the demand for upstream polymer modified materials. Driven by the trend of automotive lightweighting, the demand for modified materials in automobile manufacturing is maintaining a stable growth trajectory.

In recent years, the product structure upgrade of China's modified plastics industry has shown that..."Strong Policy Guidance" and "Hard Demand Pull"The dual-drive feature.

In terms of policy, in January 2025, the National Development and Reform Commission and the Ministry of Finance issued the "Notice on Intensifying and Expanding the Implementation of Large-Scale Equipment Renewal and Trade-In Policies for Consumer Goods in 2025." Specific measures include expanding the scope of support for automobile scrapping and renewal, improving the subsidy standards for automobile replacement and renewal, intensifying support for trade-in of household appliances, and implementing purchase subsidies for digital products such as mobile phones. The continuous advancement of this policy has effectively boosted the sales growth of new energy vehicles, household appliances, and consumer electronics products in China. This not only provides a solid foundation for the demand for modified plastics and composite materials but also raises higher quality requirements for them.In the home appliance sector, consumer trends are rapidly evolving towards safety, health, environmental friendliness, lightweight, and intelligence, with an increasing emphasis on quality, driving the continuous optimization of modified plastic materials. In the automotive sector, the long-term positive outlook for the new energy vehicle market, along with the significant trends in battery systems and lightweighting, has notably driven the demand for high-performance modified plastics. In the electronics sector, the emergence of new products and the trend towards high-end consumption are continuously promoting the upgrading of modified plastic products.

At the same time, the rapid development of emerging industries such as humanoid robots and the low-altitude economy has also posed new demands and challenges for modified plastics in terms of lightweight, strength, and corrosion resistance. This has become an important force driving the consumption breakthrough and iterative upgrading of high-end modified plastics and composite materials.

Overall, it is anticipated that over the next five years, the annual demand for modified plastics in China will maintain steady growth, with a CAGR of approximately 5.5%.

03

The price of modified plastic products is significantly affected by the fluctuation of raw material prices. It is expected that the central trend of crude oil prices will continue to decline in 2026, leading to an adjustment in the prices of modified plastic products accordingly.

In 2020, due to the impact of the COVID-19 pandemic, the prices of modified plastics generally trended downward. As the global economy rapidly recovered after the pandemic, coupled with global inflation factors, commodity prices surged, driving the prices of modified plastics higher, maintaining a high level throughout 2022. However, in 2023, amid the backdrop of the Federal Reserve's interest rate hikes and escalating geopolitical trade frictions, global economic growth slowed, downstream demand weakened, and prices of major chemical products generally fell, leading to a decline in modified plastics prices. In the first half of 2024, with the adjustment of global energy prices and the rebound of some major chemical product prices, the average price of modified plastics experienced a slight recovery, but fell again in the second half of the year.

In the first three quarters of 2025, influenced by the continued decline in the prices of bulk chemical products, the prices of modified plastics generally continued to fall. However, as the decline in product prices was narrower compared to the raw material side, the overall profitability of the industry improved.

In 2026, the pressure on crude oil prices is expected to weaken the cost support for bulk chemicals, resulting in downward pressure on modified plastics prices.However, benefiting from the continuous growth in downstream demand and technological advancements, the decline in product prices is expected to remain smaller than that of raw materials, driving the continuous improvement of corporate profitability. From the perspective of the crude oil market, as OPEC member countries and non-member countries (OPEC+) increase production, the global crude oil balance may experience a large-scale surplus, with prices continuing to be under downward pressure. It is predicted that by 2026, the Brent crude oil price will center around $60 per barrel, and the WTI crude oil price will center around $55 per barrel, a year-on-year decrease of approximately 10-15 percentage points. If OPEC+ consistently refrains from production cuts to maintain oil prices, Brent crude oil prices may fall below $60 per barrel.

04

Leading Chinese modified plastics companies are continuously expanding their production and sales scale, and the industry's profitability has improved.

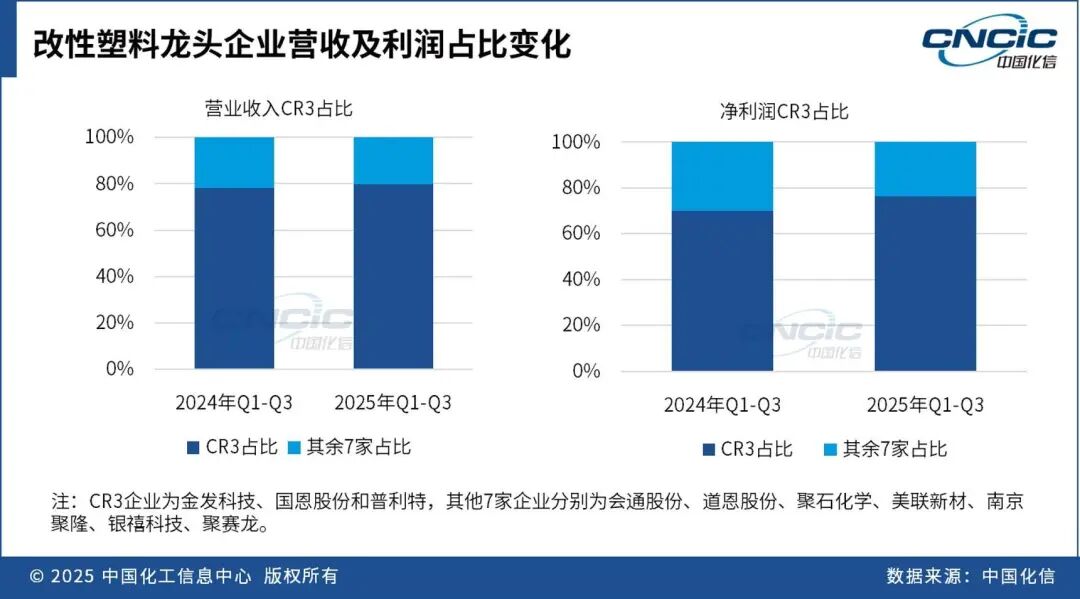

In 2024, the combined revenue of 10 representative leading enterprises in China's modified plastics industry reached 111.37 billion yuan, an increase of 17.8% year-on-year; net profit was 1.65 billion yuan, a decrease of 2.8% year-on-year. The revenue growth of leading enterprises in the industry was mainly driven by demand for new energy vehicles (lightweight materials), consumer electronics (modified plastics for precision structural components), and green packaging (biodegradable materials), with the production and sales volume of modified plastic products continuing to rise. However, the industry's profitability declined year-on-year primarily due to falling product prices, compounded by intensified market competition.

In the first three quarters of 2025, the combined revenue of 10 representative leading companies in the modified plastics industry in China amounted to 90.08 billion yuan, an increase of 16.8% year-on-year; net profit was 2.06 billion yuan, an increase of 45.1% year-on-year. The significant improvement in the industry's profitability is mainly driven by the following factors:1) The rollback of raw material prices has effectively reduced production costs for enterprises, releasing profit margins; 2) The implementation of the "trade-in" policy has boosted the home appliance and consumer electronics markets, driving the demand for modified plastics; 3) The rapid rise in demand from emerging fields such as new energy, humanoid robots, and the low-altitude economy has led to an increased need for lightweight, high-performance engineering plastics; 4) Domestic companies are accelerating their overseas expansion and localization efforts, significantly enhancing their overall competitiveness in overseas markets.

From the revenue and profit share changes of 10 representative leading modified plastics companies in China in recent years, it can be seen that the concentration of the modified plastics industry in China is continuously increasing, and profits are further converging towards the leading companies.

In recent years, China's modified plastics industry has developed rapidly and has great market potential. Domestic companies have significant cost advantages in areas such as raw material procurement, production operations, and logistics distribution, enabling them to respond to the demand of the mid-to-low-end market with more competitive prices. At the same time, these companies enhance their customized service capabilities and establish long-term stable cooperative relationships with downstream customers, effectively increasing customer stickiness and satisfaction. However, compared with foreign enterprises, domestic companies still have a certain gap in technological accumulation, especially in the high-end chemical modification field, where they face challenges such as high technical barriers and insufficient innovation capabilities. In addition, the overall industry concentration is low, with a large number of small and medium-sized enterprises, leading to fierce market competition and squeezed profit margins, which to some extent restricts the industry's sustainable development.

In the long term, China's emphasis on the independent and controllable supply chain in the manufacturing industry brings new development opportunities for the modified plastics industry, making the domestic substitution of high-end products imperative.With the rapid growth of emerging fields such as new energy vehicles, consumer electronics, low-altitude economy, humanoid robots, and green packaging, modified plastics have vast potential for growth in areas like lightweight, high performance, and degradability. In the future, industry competition is expected to gradually shift towards scale and technological advancements, with industrial concentration likely to continue increasing.

In response to the current situation, enterprises should actively increase R&D investment to overcome high-end technology bottlenecks and build core competitive advantages. At the same time, they should deepen collaborative cooperation with upstream and downstream of the industrial chain to promote resource integration and joint development. In addition, companies need to closely monitor changes in customer demand, dynamically optimize product structures, and actively expand into high value-added fields to gain an edge in the increasingly fierce market competition.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories