Russia-Ukraine Tensions Drive Oil Prices Up, Plastic Caught in Cost-Demand Tug-of-War

On December 1, 2025, international oil prices experienced a significant increase of over 1%. The core driving factors included concerns over energy security triggered by a Ukrainian drone attack, transportation uncertainties brought about by the United States closing the airspace of a certain South American country, and supply-side constraints with OPEC+ explicitly maintaining stable production in the first quarter of 2026. The upward movement in oil prices directly strengthened the crude oil market, while plastic, as a key downstream derivative, fell into a dual struggle between rising costs and weak supply and demand.

The crude oil market is experiencing multiple favorable factors, with both domestic and international prices strengthening simultaneously. In terms of driving logic, OPEC+'s decision to maintain production levels directly solidifies supply-side constraints. Additionally, concerns over energy transportation safety triggered by Ukraine's drone attacks, and the potential limitations on crude oil transportation routes due to the U.S. closing the airspace of a certain South American country, collectively elevate market risk premiums. WTI crude oil for January 2026 rose by 1.32% to $59.32 per barrel, Brent crude oil for February increased by 1.27% to $63.17 per barrel, and the domestic SC crude oil main contract 2601 rose by 0.55%, closing at 453.4 yuan per barrel. The increase was higher than some international contracts, closely related to domestic crude oil import costs and the RMB exchange rate factors. In the short term, geopolitical uncertainties and expectations of supply contraction will continue to support crude oil.

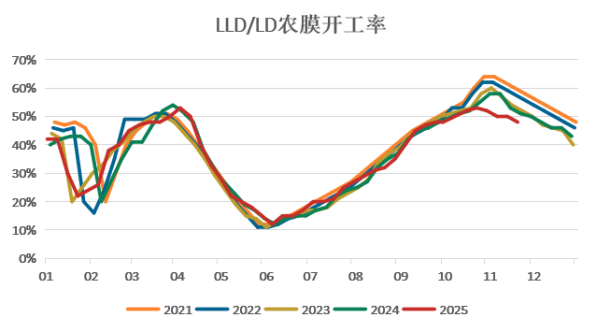

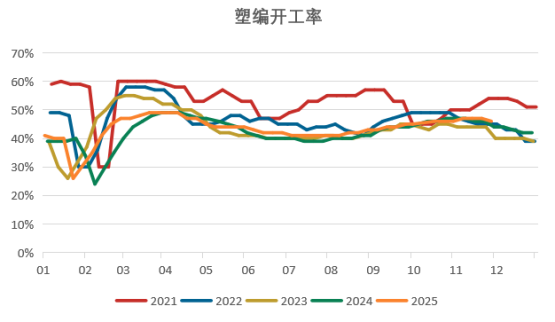

Plastic is characterized by weak elasticity due to the constraints of cost transmission and supply-demand contradictions. Although rising oil prices provide support to plastic costs, the current loose supply-demand pattern in the plastic market weakens the efficiency of cost transmission. From January to October 2025, domestic PE and PP production increased by 14% and 11% year-on-year, respectively, while the export value of plastic products decreased by 1% year-on-year, indicating insufficient demand follow-up. At the same time, although the growth rate of new plastic production capacity will slow down in 2026, high inventory levels in the first half of the year need to be digested, and downstream industries such as agricultural film and plastic weaving have entered a seasonal decline in operations. Therefore, despite favorable factors on the cost side, plastic is unlikely to strengthen in tandem with oil prices in the short term and is likely to maintain bottom-level fluctuations.

Overall, the recent rise in oil prices directly benefits crude oil, while the supply-demand imbalance in plastics hinders cost transmission. Going forward, attention should be paid to the implementation of OPEC+ production policies, the actual impact of geopolitical developments on crude oil transportation, and the strength of the demand rebound during the "Golden March" peak season for plastics.

Author: Wang Shiqi, Senior Market Analysis Expert

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

[Today's Plastics Market] General Materials Weakly Fluctuate, Engineering Materials Steadily Rise

-

New Breakthrough in Domestic Adiponitrile! Observing the Rise of China's Nylon Industry Chain from Tianchen Qixiang's Production

-

Daily Review: Polyethylene Prices Under Weak Consolidation, Sellers Face Significant Pressure to Move Inventory