September Should Mark a Turning Point for the Auto Market

Everyone knows that the next five years will be a reshuffling and endgame period for the Chinese automotive market, but life goes on day by day. As we bid farewell to August and move on to September, it's worth discussing the eventful August, which was marked by the Chengdu Auto Show, second-quarter financial reports, and frequent new car releases.

Regarding the sales in August, the vast majority of the data has been released. Besides some figures that are either impressive or disappointing, there are also some very interesting points and unavoidable facts.

The most important point for new forces is collectively approaching the break-even point.

The new forces are divided into those that are profitable and those that are not, and this is not a jest. Based on the half-year performance data, the new energy car companies are collectively approaching the breakeven point. Following Li Auto, Seres, and Leapmotor, the group of profitable companies is expected to expand further in the fourth quarter.

"The second generation of factories" generally has narrowed losses, but achieving profitability remains challenging.

Behind profitability is the support of sales volume. In this regard, during NIO's Q2 earnings conference call, Li Bin set a target of 50,000 monthly deliveries in the fourth quarter along with achieving profitability. If realized, NIO would be the only new energy vehicle brand in history to achieve 50,000 pure electric vehicle deliveries in a single month while being profitable, which is of great significance.

In August, sales for major independent manufacturers' second-generation vehicles generally increased. Zeekr Technology's overall sales in August reached 44,843 units, a year-on-year increase of 10.6% and a month-on-month increase of 1.5%. Lantu Auto sold 13,505 units, an increase of 119% year-on-year. Avatr sold 10,565 units, a year-on-year increase of 185%. Yipei Technology sold 29,118 units, a significant year-on-year increase of 62.39%, and a month-on-month increase of 4.89%.

In addition to sales growth, unprofitable car companies like Xpeng, Xiaomi, and NIO are also gearing up, setting their profitability targets for the second half of the year. According to a conversation between Luo Yonghao and He Xiaopeng, no new forces have fully secured their ticket, and "none of them can confidently say they will definitely emerge successfully."

Regarding Huawei, it must be mentioned separately.

Sales volume is currently stable or considered normal for Hongmeng Zhixing, but the signals revealed at the Chengdu Auto Show are even clearer.

As expected, the bold move of independently managing exhibition halls will also be showcased by Huawei. Hall 3 has become the domain of HarmonyOS Intelligent Driving, and in the near future, HarmonyOS Intelligent Driving may also take over the entire hall. This is certainly not a performance art, but a solid commercial action.

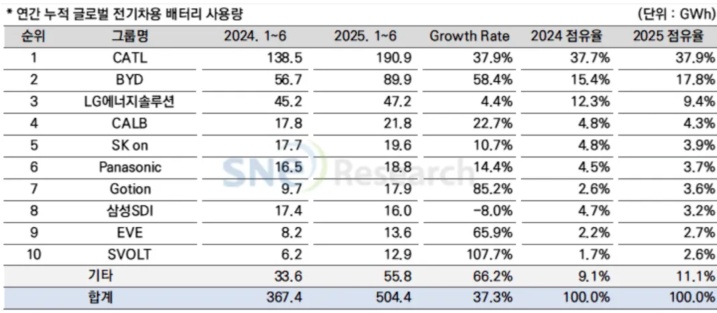

Second, the "Chinese content" in car manufacturers continues to rise, especially as Chinese companies have firmly secured one-third of the market share in intelligent assisted driving.

Having unified the five domains and iterated to HUAWEI ADS 4.0, Huawei will enter a new cycle in September 2025. The keyword for this new cycle can only be one: growth, or even infinite growth.

This means that the current intensified homogeneous competition indicates that the upheaval stirred by solid-state batteries is already brewing, and the final outcome has yet to arrive.

Now, let's talk about the technical approach and trends.

In conclusion, the market for range-extended vehicles is cooling down. The "fuel tank + battery" range-extending route is continuing to decline after reaching its peak, gradually transitioning from a "sharp tool" to an important supplement.

From 2021 to 2124, extended-range vehicles became one of the fastest-growing segments in the new energy vehicle market. Now, after years of struggle, pure electric vehicles are no longer completely overshadowed by extended-range models. At the same time, automakers have collectively entered Li Auto’s stronghold, and the pure electric track is no longer what it used to be. Li Auto must remain vigilant.

According to data released by the China Passenger Car Association, in July 2025, sales of range-extended vehicles reached 102,000 units, representing a year-on-year decline of 11.4%. In contrast, sales of pure electric vehicles in the same period saw a significant year-on-year increase of 24.5%, highlighting a clear divergence in market trends between the two segments.

Barring any surprises, this trend is expected to continue in August.

At this moment, it is easier to understand why the Leada L90 has almost become a car that could change NIO's situation. This pure electric three-row SUV is the result of NIO's persistence. Clearly, timing is crucial.

"A person's destiny certainly depends on personal struggle, but it also needs to consider the progress of the times."

Regarding joint venture new energy vehicles, they have been criticized over the past few years, and their market performance has justified the repeated doubts. However, Dongfeng Nissan N7 has set a standard example for joint ventures. Dongfeng Nissan N7's weekly sales rose from 1,600 to 2,700, and its sales in August exceeded 10,000, making it one of the top three compact pure electric sedans. It can be said to have drawn a perfect curve.

Overall, joint venture new energy vehicles have yet to produce a blockbuster product on par with the N7, while domestic brands are already showing unstoppable momentum.

Among the top four self-owned brands, there is a sense of destiny in finally bearing fruit.

BYD sold 373,600 vehicles in August.

Geely Automobile's sales in August reached 250,100 vehicles, a year-on-year increase of 38%.

Chery Group's sales in August exceeded 242,700 units, a year-on-year increase of 14.6%.

Changan Automobile sold 233,000 units in August, a year-on-year increase of 24.59%.

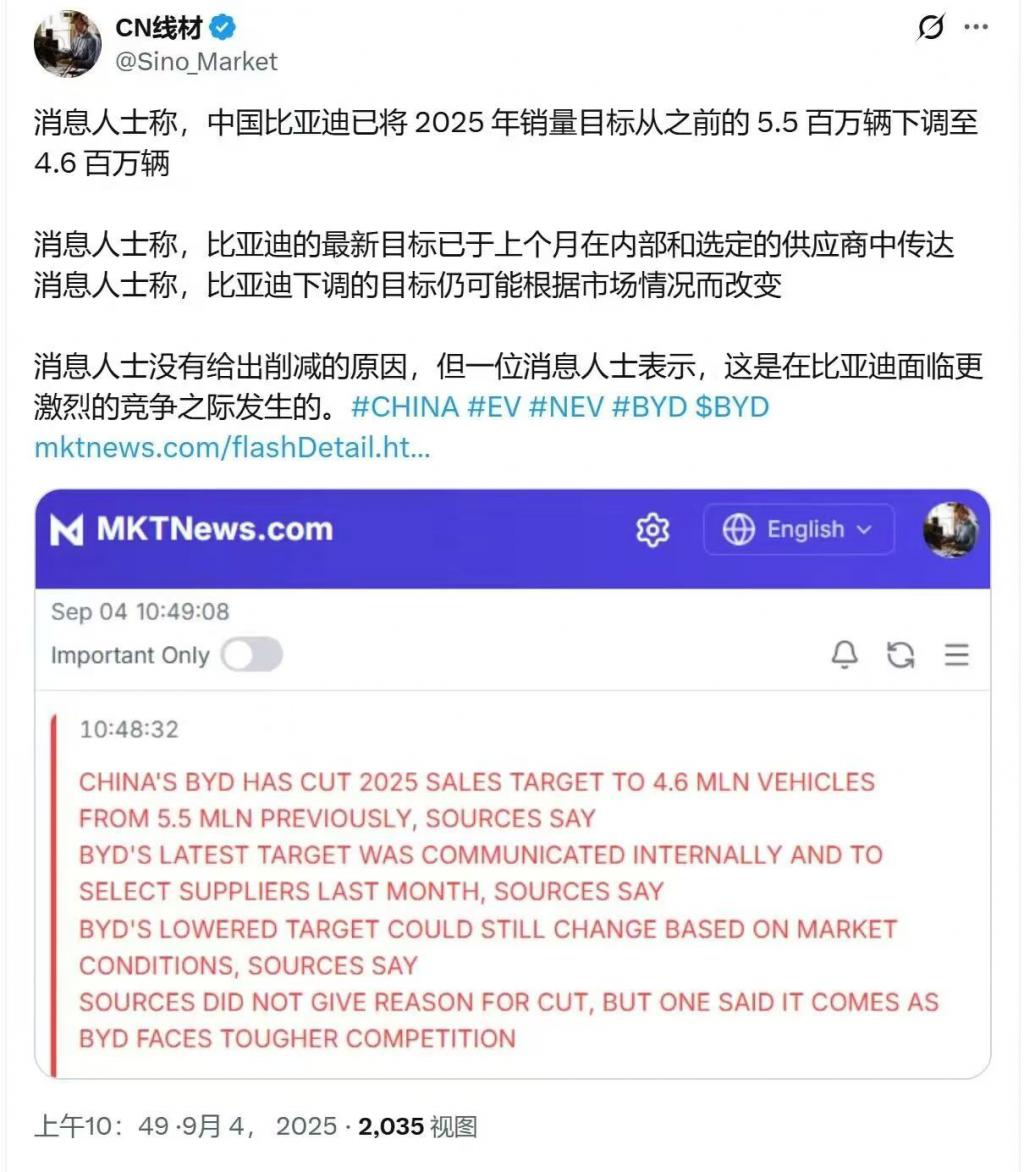

BYD's growth has slowed, and net profit has declined. Recently, foreign media reported that BYD has lowered its 2025 sales target from the previous 5.5 million vehicles to 4.6 million vehicles, a reduction of 16%.

Of course, BYD, Geely, Chery, and Changan each have their own unique strengths. BYD has its flagship family, Geely boasts the Galaxy series, and Lynk & Co 900 achieved deliveries of over 20,000 units within three months of its launch. Chery Automobile accounts for 50% of export volume and has the Jetour brand. The new state-owned enterprise Changan Automobile is relatively balanced, making strong efforts in exports, new energy, and independent brands. Great Wall Motors sold 120,000 vehicles in August, widening the gap with the top four.

It seems that without a trump card, breaking into the top 4 among independent brands is harder than climbing to the sky.

SAIC Motor Corporation Limited also needs to be listed separately.

From August sales, the Chengdu Auto Show, and the second quarter financial report, SAIC Motor is getting better and better. According to August data, SAIC's vehicle sales reached 363,000 units, a year-on-year increase of 41%, with both its own brands and new energy vehicles seeing significant growth.

Do you feel that SAIC gives off a vibe of being ready to go on a killing spree?

This largest car company in China is not just the result of a few popular models, but the outcome of comprehensive reforms in systems, organizational structure, courage in transformation, and adjustments in technological pathways. For instance, the all-new MG4 is priced starting at 65,800 yuan, and semi-solid-state batteries are entering the 100,000 yuan range.

This can be seen from the Chengdu Auto Show, where the efforts on the product front are evident. The new generation Zhiji LS6, Shangjie H5, Roewe M7 DMH, all-new MG4, Audi E5 Sportback, all-new Lingdu L, and the all-new Buick GL8 Land Supreme, among other significant new cars, all made their debut.

According to the financial report, in the first half of this year, SAIC achieved a consolidated operating revenue of 299.59 billion yuan, a year-on-year increase of 5.2%. Net profit attributable to shareholders was 6.02 billion yuan, while net profit attributable to shareholders after deducting non-recurring gains and losses was 5.43 billion yuan, representing a substantial year-on-year increase of 432%.

As for BBA and second-tier luxury brands, the full sales figures for August have not yet been released, but judging from the sales performance in July, not experiencing a decline is already beyond expectations. In other words, not only have the good days for BBA in China come to an end, but they are also in the midst of a deep adjustment period, and it will take time to see the results. This also includes Porsche, which was absent from the Chengdu Auto Show.

At the upcoming Munich Motor Show, BMW Group officially announced that its first new-generation production model, the BMW iX3, will debut at the event. Chairman Zipse emphasized, "China is the decisive battleground in the global automotive technology race—artificial intelligence (AI) has been widely adopted in China." This also signals that the all-new iX3 is tailor-made for the Chinese market, a necessary step for deep adaptation. Mercedes-Benz and Audi are largely following the same approach.

Qishi View: In the September car market, everyone showed their unique skills, with some going full throttle, some leaving, and some turning the page.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Four Major Chemical New Material Giants Sell Off and Shut Down Again!

-

Covestro faces force majeure!

-

DuPont to Spin Off Nomex and Kevlar Brands for $14.4 Billion: Is Aramid Fiber Still Attractive?

-

Massive Retreat of Japanese and Korean Battery Manufacturers

-

Napan Unveils Thermoplastic Composite Three-in-One Power System Solution, Battery Cover Weight Reduced by 67%