Seven Major Chemical New Material Giants: Sell-Offs, Shutdowns, and Layoffs!

Recently, Dow, INEOS, Trinseo, Arlanxeo, Toray, 3M, and Polyplastics have successively announced a series of strategic measures involving products such as polyether polyols, epoxy resins, chlorine, MMA (methyl methacrylate), polystyrene, synthetic rubber, battery separators, and engineering plastics.

Japan Polypropylene Plastics

On October 16, Daicel Corporation announced that it has decided to acquire all of Polyplastics Co., Ltd.'s businesses (excluding the shareholding and management businesses of its subsidiaries and affiliated companies) through an absorption-type merger starting from April 1, 2026.

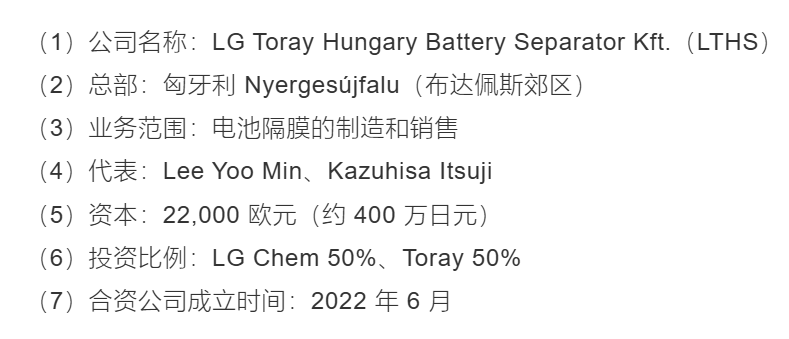

Tianli announced that it will sell all of its 50% stake in LG Toray Hungary Battery Separator Kft. (LTHS) to LG Chem, with a transaction price of approximately 30 billion yen.

3M

Recently, 3M Company has been in discussions with investment banks about the potential sale of certain assets in its industrial division. This strategic move could involve transactions worth billions of dollars, as the company aims to streamline its operations and business portfolio by divesting slower-growing business segments.

3M's Safety and Industrial division, which had revenues of approximately $11 billion last year, includes various business lines such as aftermarket automotive products, personal safety equipment, and industrial adhesives and tapes. Sources indicate that 3M has not yet made a final decision on divesting these assets and may still choose to maintain its current structure.

3M's business is divided into three sectors: Safety and Industrial (accounting for approximately 44% of revenue), Transportation and Electronics (36%), and Consumer (20%). The company recently spun off its healthcare business, now known as Solventum. Nearly half of 3M's revenue comes from regions outside the Americas, and the company's current market capitalization is approximately $84.48 billion.

Dow Chemical

Recently, Dow Chemical announced that it will permanently close its polyether polyols production facility in Tertre, Belgium by the end of the first quarter of 2026. This move will affect 37 employees and 8 contractors, and the plant has an annual capacity of 94,000 tons.

This move was made by Dow following a strategic review of its European assets, with a focus on the polyurethane business. The demand for the European polyether polyols market is weak, especially from key end-use sectors such as automotive, home appliances, construction, and upholstered furniture. Overcapacity and rising imports (with an average annual import volume of 286,000 tons from 2020 to 2024, reaching a record 323,000 tons last year) have further challenged the competitiveness of European producers, with China, South Korea, and Saudi Arabia being the main sources of supply.

Although the Tertre plant has been closed, Dow still has an annual production capacity of 530,000 tons in Terneuzen, Netherlands, and 60,000 tons in Tarragona, Spain, which will ensure a continuous and uninterrupted supply to its customers.

The closure of the Tertre plant is part of Dow's broader rationalization plan in Europe. This plan also includes the closure of an ethylene cracker in Borken, Germany, by the end of 2027, as well as the chlor-alkali and vinyl assets in Schkopau, Germany; and the closure of a basic silicone plant in Barry, UK, by mid-2026.

Ingersoll Rand

Recently, INEOS announced plant closures and layoffs, totaling 235 job cuts.

-

60 employees laid off at the Hull factory in the UK.

-

Closing two factories in Germany and laying off 175 employees.

Styron

On October 6, Trinseo announced a series of strategic plans aimed at further optimizing operations, enhancing cash flow generation capabilities, and strengthening long-term profitability.

-

Close the MMA production facilities in Italy.

-

Possible Closure of Polystyrene Production Facility in Germany

A Lang's New Subject

On October 2nd, synthetic rubber producer ARLANXEO plans to cease operations at its Port Jerome facility in France.

The Jerome Port plant has been in a state of structural loss. Despite many improvement efforts by the company, no viable path for sustained structural improvement is expected.

It is reported that Arlanxeo is a wholly-owned subsidiary of Saudi Aramco, with a production capacity of 100,000 tons per year of polybutadiene rubber (PBR) and 40,000 tons of styrene-butadiene rubber (SBR), and has a production facility in La Wantzenau, France.

It is worth mentioning that upstream, ExxonMobil closed its butadiene (BD) and cracking units located in Jerome Park last year, with a rated capacity of 90,000 tons/year of BD.

In summary, the four companies, Dow, INEOS, Solvay, and Lanxess, stated that the direct reasons for their shutdowns include not only the weak demand in the European end markets and high energy prices but also the increase in imports from Asia.

On October 8, INEOS announced that about half of Europe's ethylene production capacity will be shut down before 2030. Currently, 21 major chemical plants in Europe have closed, with a capacity of over 11 million tons, and more plants are expected to close. The overall chemical production in Europe is declining significantly, with a 30% decrease in the UK, an 18% decrease in Germany, and a 12% decrease in France.

In addition, Sir Jim Ratcliffe, the founder and chairman of INEOS, has called for urgent intervention from European politicians to save the chemical industry. "We are at a critical juncture and there are three issues that need to be addressed. Firstly, remove the green taxes from energy costs. Secondly, abolish the carbon tax. Thirdly, provide us with some tariff protection. What we need is action, not sympathetic words; otherwise, the European chemical industry will be left with very little."

Last month, Julia Schrenz, president of Dow's Europe, Middle East, Africa, and India region, stated that the European chemical and petrochemical industry is facing a "multiple crisis" due to weak domestic demand and a large amount of new capacity being built overseas.

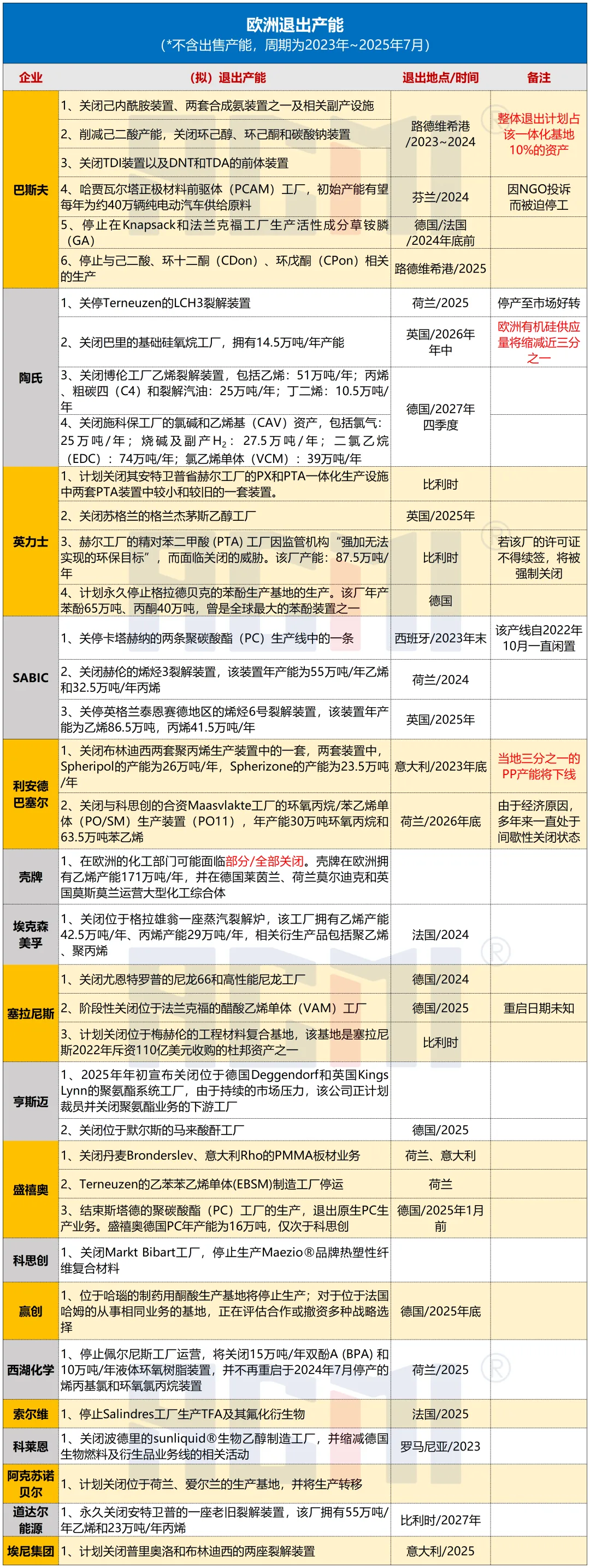

Since 2023, the following companies and facilities have been shut down in Europe:

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

India's Q3 Smartphone Shipments Rise 3%; Japanese Mold Factory Closures Surge; Mercedes-Benz Cuts 4,000 Jobs

-

Ascend's Restructuring Plan Approved! Jwell Launches Global Acceleration Plan; Nexperia Chip Crisis Threatens Global Auto Production

-

Dow To Restart Pe Units 5 And 7 This Week, Recovery Date For Unit 6 Remains Undetermined In The United States (US)

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

The Roller-Coaster Behind Sanhua Intelligent Controls' Stock Price: What Are the Advantages of Automotive Thermal Management Companies Crossing Into Humanoid Robots?