Special Analysis on Economic Resilience in Central and Eastern Europe and Composite Materials Market Development

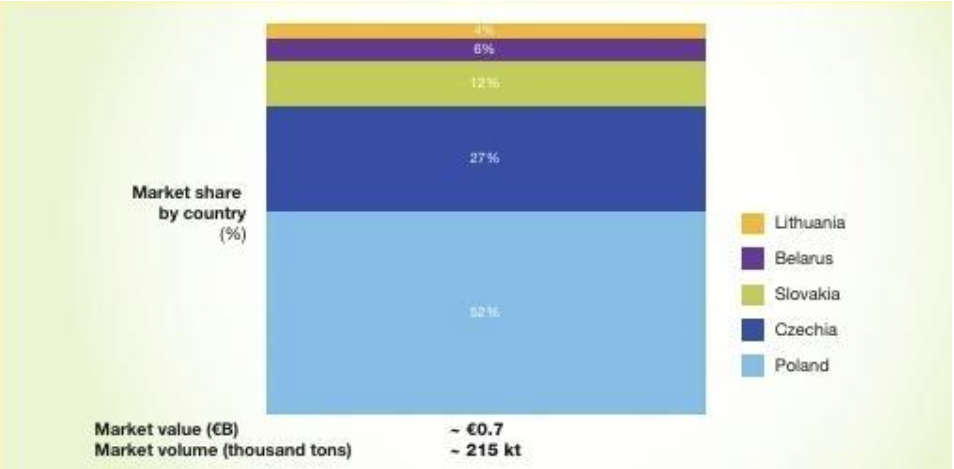

The Central European composite materials market size is 0.7 million tonnes. Poland and the Czech Republic account for about 80% of the market share (composite parts production market size by country/region - Central Europe 2024. Source: Lucintel, Grand View Research, annual reports, Estin & co analysis and estimates).

In Central Europe, the composite materials market has recovered and returned to its long-term growth trend, with an annual growth rate of approximately 5%. (Central Europe - 2018-2024 - Sales) Data source: Analysis and estimates from companies such as Lucintel, Grand View, Estin, etc.

Poland is the ninth largest superyacht producer in the world, accounting for 2% of the total global superyacht orders in 2025 (total global superyacht orders - 2025). Data source: Boat International, Estin & Co analysis and estimates.

In recent years, the economies of Central and Eastern Europe have demonstrated strong economic resilience, exceeding pessimistic expectations in responding to various shocks. Despite current challenges such as the impact of U.S. tariffs and fiscal constraints due to high deficits, the region is still expected to achieve stable development by leveraging its own advantages. Meanwhile, the composite materials market in Central and Eastern Europe continues to grow, driven by various application areas, becoming an important supporting force for regional economic development.

Central and Eastern European Economies: Demonstrating Resilience Amid Challenges

Experts from the economic research department of BNP Paribas point out that Central and Eastern European economies have successfully withstood numerous shocks in recent years, defying pessimistic forecasts. In 2020, the region's GDP contraction was smaller than that of the developed economies of the European Union. At the beginning of the Russia-Ukraine conflict in 2022, Central and Eastern Europe was viewed as the most vulnerable region in Europe due to its high dependence on Russian energy. However, by implementing large-scale fiscal stimulus policies, the region successfully avoided the widespread expectation of recession.

Currently, Central and Eastern European economies are facing tariff shocks imposed by the U.S. government, and they are significantly affected by U.S. tariffs indirectly through Germany. Moreover, most countries in the region are under excessive deficit procedures, limiting their ability to increase spending. Even so, experts still believe that Central and Eastern European economies will once again demonstrate resilience this year, steadily progressing amidst tariff shocks, although downside risks remain. This might even become a critical opportunity for Central and Eastern Europe to strengthen nearshore outsourcing and advance up the value chain. In the medium term, Germany's large-scale infrastructure and defense plans will also bring benefits to countries in the region.

As the economic engine of the Central and Eastern European region, Poland occupies a central position in regional development. In terms of GDP contribution, Poland accounts for 59% of the total for the region; in terms of population, it represents 56% of the region's total population. In the composite materials market, Poland also holds a dominant position, with its production and output value accounting for 50%-55% of the Central and Eastern European region, making it an important pillar of regional economic and industrial development.

Central and Eastern European Composite Materials Market: Combining Size and Structure

An exclusive study conducted by JEC in collaboration with Estin shows that the production of primary composite materials in Central and Eastern Europe (including Poland, the Czech Republic, Slovakia, Lithuania, and Belarus) will reach 200,000 tons in 2024, with a market value of 700 million euros. From 2019 to 2024, the annual growth rate of this market's production is 5%, maintaining a stable growth trend.

From the perspective of the market structure, the Central and Eastern European composite materials market is dominated by large international enterprises, while local companies are relatively limited in scale. In the field of primary materials, international giants such as Safran Group (Syensqo), Hexcel, Dow Chemical, BASF, and Jushi Group dominate both in terms of production and output value. There are relatively few local companies within the region that have international influence (such as Qemetica, Duslo, Spolchemie, etc.), and these companies have revenues below 1.3 billion euros, with a high proportion of exports. Meanwhile, there are also numerous small and medium-sized local enterprises active in the primary materials (such as Polotsk Fiberglass Company, Chemosvit, etc.) and components (such as Matador Automotive, VUKI, etc.) fields.

In terms of trade structure, the Central and Eastern European composite materials industry is generally a net exporter of fibers and a net importer of resins. However, Poland is an exception, with both resins and fibers being net imports. From the consumption side, Central and Eastern Europe is a production-oriented market, with approximately 60%-80% of production being exported, limited import volume, and domestic consumption being less than 100,000 tons.

Application Domain Driven: Diversified Demand Supports Market Growth

Central and Eastern Europe is one of the global automotive industry hubs, with over 50 leading production plants. The development of the automotive industry has become an important driving force for the growth of the composite materials market. In 2024, the transportation sector accounts for 44% of the composite materials production and 39% of the output value in Central and Eastern Europe, with an annual production growth rate of 5% from 2019 to 2024.

The transition of the automotive industry towards electric vehicles (EVs) and the trend towards high-end vehicles are significantly driving the demand for composite materials in Europe and globally. A former executive from a German car manufacturer stated that the move towards high-end vehicles and electric vehicles are the two major trends supporting further growth in the composite materials market: as car prices rise (often accompanied by an increase in horsepower), the cost-benefit gradually shifts towards weight efficiency. The prosperity of the high-end market segment will inevitably lead to an increase in the use of composite materials. At the same time, as the scale of the electric vehicle market expands, the application of composite materials in battery enclosures and thermal management systems is also continuously growing.

In addition to the transportation sector, other application areas also provide significant support for the growth of the composite materials market.

-

In the construction sector: accounting for 20% of production and 20% of output value in 2024, with an annual production growth rate of 6% from 2019 to 2024. Strong growth in Polish residential construction offers significant potential for the penetration of composite materials in the wall panel sector.

-

Energy sector: In 2024, accounting for 12% of production and 11% of output value, with a stable annual growth rate of 6% in production from 2019 to 2024. The wind energy industries in Lithuania (where wind energy accounts for 45% of the energy structure) and Poland (where wind energy accounts for 15% of the energy structure) are the main drivers of demand for composites in this sector, while the potential in other Central and Eastern European countries is relatively limited.

-

Electronics and electrical field: In 2024, it will account for 10% of the output and 11% of the value. The annual growth rate of output from 2019 to 2024 is 4%. Semiconductors and consumer electronics are the main application directions in this field, but their driving effect on the growth of composites in the region is limited.

-

In the consumer goods sector: accounting for 6% of production and 6% of output value in 2024, with an annual growth rate of 6% in production from 2019 to 2024. Although household spending in Central and Eastern Europe is below the European average, the annual growth rate reaches 5%-7% (excluding Belarus), which is much higher than the European average of 3%, providing growth opportunities for composite material demand in the consumer goods sector.

-

In the maritime sector: In 2024, it will account for 4% of production and 5% of output value, with a production growth rate of 7% per annum from 2019 to 2024. Poland's yacht and leisure boat production is steadily increasing (with a motor yacht growth rate of 16% per annum), and it has now become one of the major ship-exporting countries globally. Furthermore, it ranks as the world's ninth-largest superyacht manufacturer, accounting for 2% of global orders in 2025.

-

In the aerospace and defense sector, both production and output proportions in 2024 are less than 1%, with no growth in production from 2019 to 2024. Despite increased defense spending in the context of the Russia-Ukraine conflict, air passenger traffic and aircraft deliveries have not yet returned to their peak levels in 2019. Since the early 21st century, the "Aviation Valley" in southeastern Poland has become a core development hub for leading global aerospace and defense companies in Central and Eastern Europe, while companies in Slovakia, Lithuania, and Belarus are more focused on aircraft repair, maintenance, and overhaul services.

EU Funding Support: A Key Lever for Regional Development

In addition to their own industrial advantages, the continuous injection of EU funds has provided significant support for the economic development and industrial upgrading of Central and Eastern European regions. From 2004 to 2023, Central and Eastern European countries received a cumulative total of 382 billion euros in EU funds, accounting for 22.4% of the region's GDP. These funds have not only been used to promote reforms in various industries but have also supported the development of innovative industries and value chain upgrades, becoming a key factor for the region's economic resilience and sustainable growth.

Overall, despite facing challenges such as external tariff shocks and fiscal constraints, Central and Eastern European economies and the composite materials market are expected to continue to demonstrate resilience in development. This is attributed to a strong industrial base, diversified market demand, and robust support from EU funds, enabling steady progress in an environment where opportunities and challenges coexist. (Data cited in the text are from external agencies, please verify independently.)

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories