Supply Chain Resilience Upgrade: Home Furnishing Overseas Factory, New Opportunities and Challenges for Plastic and Plastics Machinery Enterprises

Since the beginning of this year, the pace of home furnishing companies establishing factories overseas has. In September,Gu Jia Home FurnishingAnnounced an investment of 1.124 billion yuan to establish a production base in Indonesia; in November,Zhongyuan Home FurnishingsPlans to invest USD 16 million to build a factory in Vietnam.

As early as March of this year,Gold Medal Kitchen CabinetsThe first intelligent satellite factory in North America has officially begun production in October.Musi Co., Ltd.Acquired the Singaporean home furnishings brand Maxcoil and its production base in Indonesia.

The domestic home furnishing market has shifted from incremental competition to stock game.Overseas business is becoming a new engine for performance growth.In the period from January to September 2025, the overseas revenue of ZBOM Home Collection increased by 65%, with the scale of the Middle Eastern market nearly tripling. In the first half of the year, Mousse's overseas revenue grew by 73.97%, and Oppein Home's overseas project orders increased by 40%.

Chinese home furnishing companies are accelerating the establishment of production bases overseas, transitioning from simply exporting products to a new phase of deep localization operations.

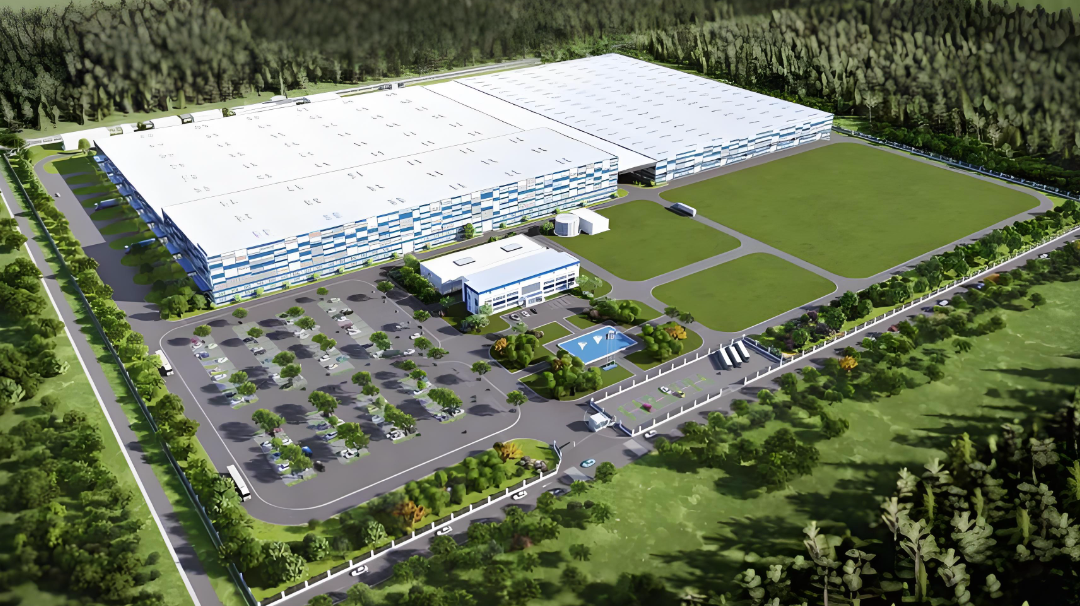

Gu Jia Home Furnishing is constructing a production base in the Kendal Industrial Park in Semarang, Central Java, Indonesia, with a total investment of 1.124 billion yuan. This project includes the construction of new production workshops, research and testing workshops, warehouses, and the purchase of production equipment.Scheduled to launch in the third quarter of 2025.The overall construction period is 4 years. KUKA Home stated that the project is expected to achieve its goals within 3 years after full completion, with an estimated annual operating income of approximately 2.52 billion yuan.

In 2020, Kuka Home announced the establishment of its first overseas production base in Binh Phuoc Province, Vietnam, covering an area of approximately 106,000 square meters, with a total building area of about 210,000 square meters and a total project investment of about 505 million yuan. By 2025, Kuka Home's new factory layout in Vietnam has formed a large-scale production capacity cluster.

Zhongyuan Home Furnishing plans to invest 16 million USD to build a production base in Ho Chi Minh City, Vietnam. This investment will be used for purchasing land, constructing factories and auxiliary facilities, and acquiring machinery and equipment. The company stated that this layout will...Enhance the resilience and security level of the company's supply chain.Support the company's business expansion.

According to data from the China National Furniture Association, since 2023, investment by domestic home furnishing companies in Southeast Asia, Mexico, and other regions has significantly accelerated. In 2023-2024, over 20 domestic furniture companies are establishing or expanding production bases in Vietnam.

With the surge of home furnishing companies building factories overseas, the plastic and plastic machinery industries are welcoming new development opportunities.

Plastics are widely used in home products, ranging from furniture accessories to home decorations, requiring a large number of plastic components. As home furnishing companies expand their overseas production bases, the demand for plastic raw materials and plastic processing equipment is also increasing.

Haitian International has taken the lead in breaking into the European market.The new Serbian manufacturing plant has officially started production.。

The factory is located in Ruma, covering an area of 60,000 square meters, and focuses on the production of the Mars series (servo hydraulic elbow injection molding machines) and the Jupiter series (servo hydraulic two-plate injection molding machines). As of early November, the factory...More than 50 machines have been produced.The first batch of equipment has been delivered to the customer.

Engel, as a global leading manufacturer of injection molding machines, has also established a new factory in Querétaro, Mexico, with a total investment of 1 billion pesos. The initial annual production capacity of the factory is 200 units, and the company's goal is to triple the production by 2027.

The products produced by Engel's factory in Mexico include the e-mac series of fully electric small injection molding machines and the Wintec t-win series of large equipment.

The overseas establishment of factories by home furnishing companies and the international expansion of plastic and plastic machinery enterprises show a significant synergistic effect.

Overseas production bases of home furnishing enterprises have provided new market space for plastic and plastic machinery companies.。

At the same time, the overseas expansion of plastic machinery companies can better serve the localized production needs of home furnishing enterprises.

The Haitian Serbia factory not only produces injection molding machines, but also...As a European spare parts distribution centerThrough warehouses and decentralized storage points in Serbia and Germany, we ensure rapid delivery to minimize customer downtime to the greatest extent possible.

The factory is also recruiting mechanical, hydraulic, and electrical component design engineers to form a European R&D team, focusing on the development of high-performance, market-specific application injection molding machines.

Vanessa Malena, President of Engel North America, explicitly stated: "The factory in Mexico will supply the entire Americas market," and the factory will also supply equipment to Central and South America.

This type of industrial chain collaboration helps home furnishing companies increase the localization rate of overseas production and reduce supply chain risks.

Despite the accelerated pace of overseas expansion by home furnishing and plastic machinery companies, this process is not without its challenges.

Overseas operations face numerous challenges.Including policy regulations, cultural differences, supply chain support, and talent shortages.

Zhongyuan Home Furnishing has previously attempted to establish overseas factories twice but failed. In 2021, Zhongyuan Home Furnishing planned to build a production base in Mexico; in 2023, the company initiated a project for the second phase of its production base in Vietnam, but both projects were ultimately terminated in November and December 2024.

The "Ekornes Norway Factory Capacity Upgrade Project" of Qumei Home has also been delayed due to global macroeconomic fluctuations and geopolitical conflicts.

The company stated that due to industry cycle fluctuations and other factors, the fundraising project has not yet commenced construction. Therefore, the date for the project to reach its intended usable state has been postponed from the originally expected September 2025 to December 31, 2026.

Kuka Home also highlighted the risks of the Indonesia project in the announcement: as of the disclosure date of the announcement, the projectA formal land purchase agreement has not yet been signed.There is a certain level of uncertainty regarding the acquisition of land and the area of the acquired land.

At the same time, there are significant differences between Indonesia's laws, policies, business environment, cultural environment, and those of the domestic context, and the foreign trade situation and import-export policies may also change.

The prospects for cooperation between Chinese plastic machinery companies and overseas home furnishing companies are promising.The commissioning of the Haitan International factory in Serbia perfectly exemplifies this synergistic effect.

As Engel CEO Stefan Engleder said, "We can supply the U.S. from our 10 factories in Austria. Even with tariffs, production in Mexico still makes sense."

In the global layout, localized production close to customer markets is becoming a key strategy for risk mitigation and enhancing competitiveness.

The wave of home furnishing companies establishing factories overseas is reshaping the global division of labor in China's manufacturing industry. As core supporting forces, plastic and plastic machinery companies are transforming from "behind-the-scenes suppliers" to "overseas partners" through technology customization, service upgrades, and ecological collaboration. In the future, as companies like KUKA and Liansu continue to deepen their overseas layouts, the collaborative overseas expansion model of "home furnishing + plastics + plastic machinery" will become more mature. This will not only help Chinese home furnishing brands capture global market share but also propel the industrial chain of China's manufacturing industry towards high-end and global integration.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

New Breakthrough in Domestic Adiponitrile! Observing the Rise of China's Nylon Industry Chain from Tianchen Qixiang's Production

-

Nissan Cuts Production of New Leaf EV in Half Due to Battery Shortage