Supply-Demand Imbalance Continues, Polypropylene (PP) Market Struggles to Rise

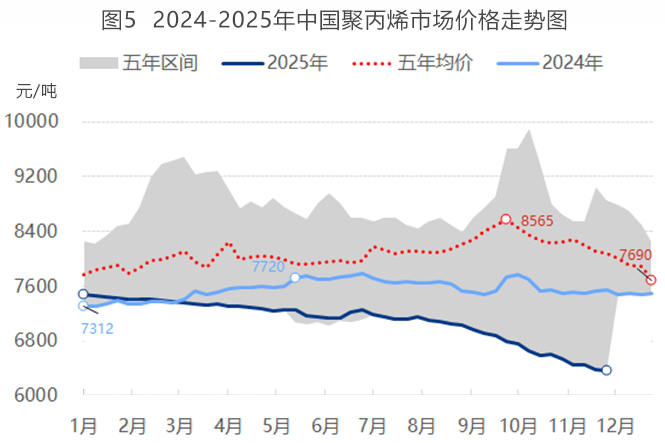

Oil prices have limited support, the PP market is experiencing supply-demand imbalance, and prices may continue to decline this week.

I. Cost Analysis

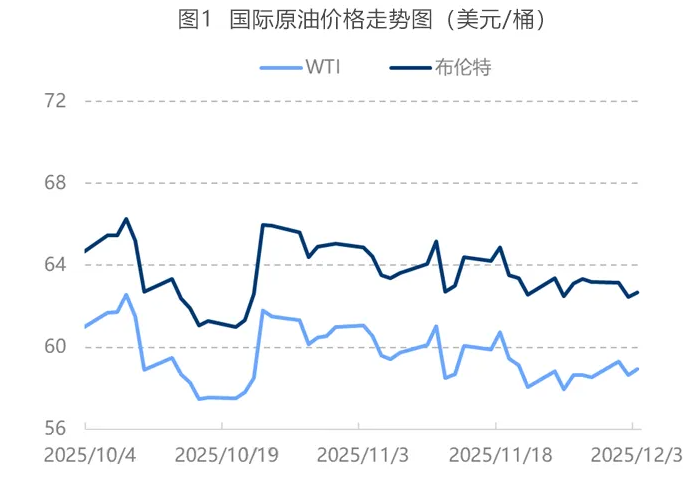

The market continues to weigh the developments in the Russia-Ukraine situation, and concerns about a long-term supply surplus still exist, putting pressure on oil prices. Last week, international oil prices fell. Looking ahead to this week, the prospects for a short-term resolution of the Russia-Ukraine talks appear bleak, and the situation between the U.S. and Venezuela is still evolving. OPEC+ is expected to continue its production increase until the end of this month, while U.S. crude oil production remains stable at high levels. U.S. sanctions on major oil-producing countries are ongoing, posing potential supply risks that provide support for oil prices. It is expected that there is slight room for a rise in international oil prices, which may enhance the cost support for polypropylene.

Section Two: Supply-Side Analysis

Last week, China's polypropylene production was 801,300 tons, a decrease of 0.68% compared to the previous week. Several production units underwent temporary shutdowns for maintenance, leading to a decline in capacity utilization and a reduction in market supply. This week, Ningbo Fude's 400,000 tons/year unit is scheduled for maintenance, while Dongguan Juzhengyuan's dual lines and Guangzhou Petrochemical's dual lines have plans for restart. The expected loss from planned maintenance is anticipated to decrease, and the production trend may shift from a decline to an increase, with an expected rise in market supply.

As of December 3, 2025, China's polypropylene commercial inventory totals 842,900 tons, an increase of 30,900 tons compared to the previous period, a month-on-month increase of 3.80%. With the gradual resumption of previously shut-down facilities, supply pressure has increased, leading to a rise in production enterprise inventories. At the beginning of the month, intermediaries began new billing plans, resulting in an increase in sample enterprise inventories. Overall, last week saw an increase in total commercial inventory, intensifying pressure on market supply. Looking at this week, due to Christmas overseas order demand, port inventory may maintain a destocking trend, coupled with decent factory purchasing willingness. Therefore, it is expected that commercial inventory will decrease this week but remain at a relatively high level, and market shipment pressure may still persist.

III. Demand Side Analysis

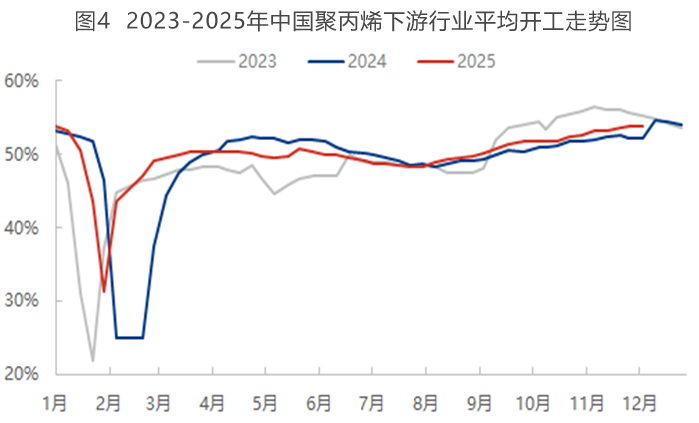

Last week, the average operating rate of the domestic polypropylene downstream industry was 53.93%, a slight increase of 0.1 percentage points compared to the previous period. Recently, the demand side has shown significant structural differentiation: demand in mainstream areas such as packaging is weak, while the operating rates in the BOPP and CPP industries remain stable. The PP non-woven fabric industry has benefited from increased demand for masks and other protective products due to the high incidence of influenza, leading to an improvement in the operating rate of enterprises. As we enter December, policies such as the halving of purchase tax for new energy vehicles continue to exert influence, enhancing consumer willingness to purchase cars and boosting sales of new energy vehicles. Additionally, the demand for production and stocking of small household appliances like air conditioners and heaters has started due to colder weather, contributing to new orders for modified PP and slightly raising the industry's operating rate. Furthermore, as New Year's Day approaches, supermarkets have increased their replenishment demand for daily plastic products like fresh-keeping boxes and storage boxes. The performance of daily injection molding enterprises has been reasonable, and under the joint drive of policy benefits and seasonal demand, the operating rate of the domestic polypropylene product industry has shown a steady and slight upward trend.

IV. This Week's Forecast

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

[Today's Plastics Market] General Materials Weakly Fluctuate, Engineering Materials Steadily Rise

-

New Breakthrough in Domestic Adiponitrile! Observing the Rise of China's Nylon Industry Chain from Tianchen Qixiang's Production

-

Daily Review: Polyethylene Prices Under Weak Consolidation, Sellers Face Significant Pressure to Move Inventory