The Era of New Energy Vehicle Purchase Tax Exemption Is Ending

Recently, the Ministry of Industry and Information Technology, the Ministry of Finance, and the State Administration of Taxation jointly issued the "Notice on the Reduction and Exemption of Vehicle Purchase Tax for 2026-2027."New energy vehicles"The announcement of the product technical requirements" clarifies the specific requirements for the tax exemption policy on the purchase of new energy vehicles for the next two years.

The release of this announcement marks the implementation of the above content that began in September 2014.New energyThe exemption policy for vehicle purchase tax, after several extensions, is officially entering a countdown. Starting from 2026, the purchase tax for new energy vehicles will be adjusted from "exemption" to "half-rate collection," with the tax reduction for each new energy passenger vehicle not exceeding 15,000 yuan.

At the same time, the policy has set higher technical requirements for pure electric and plug-in hybrid vehicles, including pure electric range and energy consumption standards. This change not only affects the cost of car purchases for consumers but also poses new challenges for car manufacturers in terms of product planning and technological upgrades.

Exemption from purchase tax has been in effect for 11 years.

The policy of exempting new energy vehicles from purchase tax began in September 2014 and is one of the important measures taken by China to promote the development of the new energy vehicle industry.

At that time, the global new energy vehicle market was still in its early stages, and Chinese car companies faced numerous challenges in terms of technology, industrial chain, and market scale. The government, by exempting purchase taxes and providing purchase subsidies, could reduce the cost of buying cars for consumers, stimulate market demand, and inject momentum into the initial development of the new energy vehicle industry.

The implementation of this policy has had a profound impact on the new energy vehicle market. Since 2014, China's new energy...Car SalesAchieved a leap in growth. In 2015, the annual sales of new energy vehicles were only 330,000, but by 2024, this number has surpassed 10 million, with a market penetration rate of 40%.

Image Source: CATL

The policy of exempting purchase tax has played an important role in reducing the cost of car purchases for consumers. For example, for a new energy vehicle priced at 200,000 yuan, the exemption from purchase tax can save consumers about 20,000 yuan, significantly enhancing the price competitiveness of new energy vehicles.

The policy has also driven the rapid development of the industrial chain. The technological level of core components such as batteries, motors, and electronic control systems has been continuously improving, while costs keep decreasing, and charging infrastructure is gradually being perfected. Chinese new energy vehicle brands like BYD, NIO, and Li Auto have rapidly emerged and even shown strong competitiveness in the international market.

The exemption policy for purchase tax has not only driven the expansion of the market scale but also laid a solid foundation for the technological accumulation and brand building of China's new energy vehicle industry.

In the past, the policy was extended three times in 2017, 2020, and 2022. In June 2023, the State Council executive meeting decided to extend the policy implementation period for another four years, forming a phased scheme of "two exemptions and two reductions.",This shows a clear signal of gradual policy rollback.

From an economic benefit perspective, the scale of investment in this policy is quite considerable. By the end of 2022, the cumulative tax exemption scale for the new energy vehicle purchase tax exemption policy exceeded 200 billion yuan. According to previous estimates by the Ministry of Finance, the total amount of vehicle purchase tax reduction and exemption will reach 520 billion yuan from 2024 to 2027 after the extension of the policy is implemented.

However, as the new energy vehicle market transitions from the cultivation period to the maturity period, policy support is weakening. The Ministry of Finance and other departments jointly announced that from 2026 to 2027, the purchase tax for new energy vehicles will be halved, marking the end of the more than ten-year "exemption era."

The "bottom-line" battle of car companies begins.

As the adjustment of the purchase tax policy in 2026 approaches, the new energy vehicle market is experiencing a wave of "buying frenzy." According to data from the Passenger Car Association, retail sales of new energy passenger vehicles reached 1.296 million units in September, a year-on-year increase of 15.5%, with a penetration rate rising to 57.8%.

To know, the cost of purchasing a car next year will increase due to the halving of the vehicle purchase tax, with the maximum difference reaching up to 15,000 yuan. This change is particularly sensitive in the fourth quarter, as many car manufacturers are launching "bottom-line" policies to boost annual sales, promising to cover the difference caused by the decline in purchase tax for consumers.

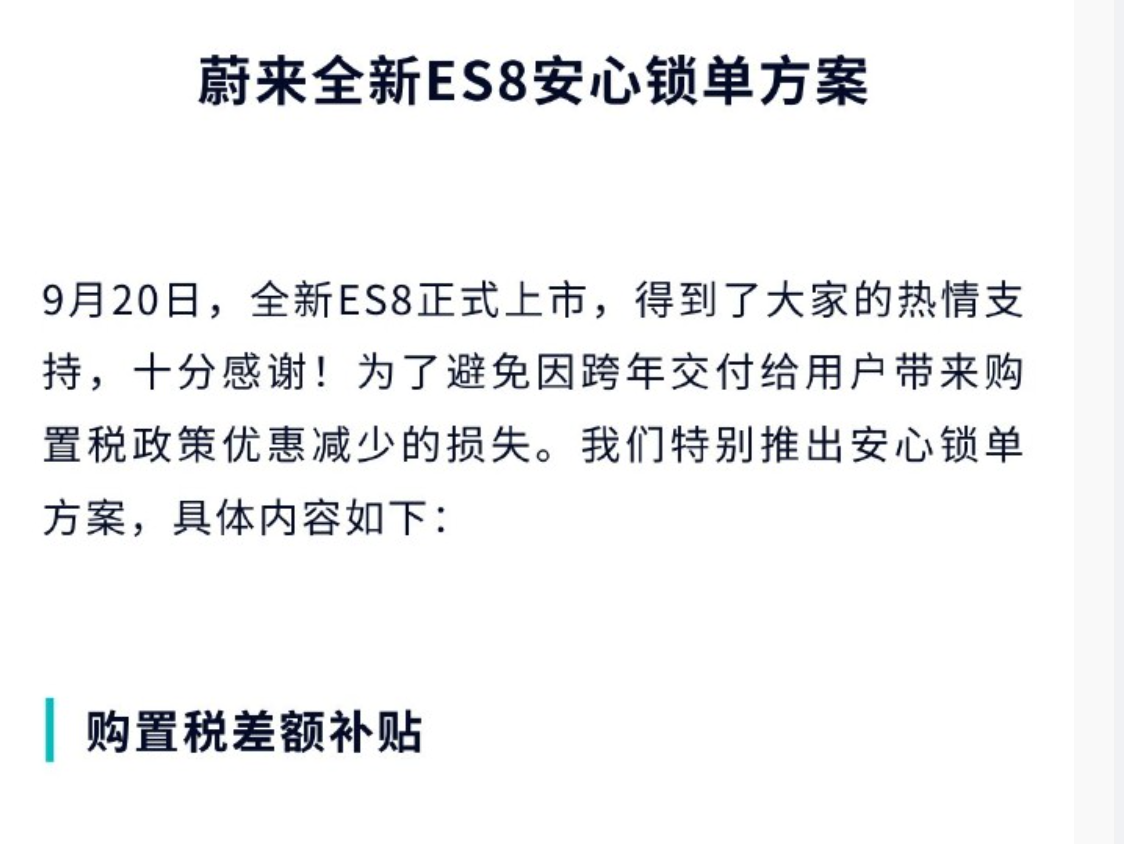

Image source: NIO Automotive

For example, in September, NIO launched the "New ES8 Secure Order Plan," promising that users who complete their orders by the end of 2025 will be eligible for a purchase tax difference subsidy of up to 15,000 yuan if the vehicles are invoiced and delivered in 2026 due to reasons attributable to the car manufacturer.

Brands such as Li Auto, IM Motors, and Zeekr have also quickly followed suit by launching similar bottom-line plans. In addition, some car manufacturers have combined limited-time price guarantees and delivery commitments as marketing strategies to further enhance consumers' sense of urgency in purchasing cars.

According to industry data estimates, the year-on-year growth in new energy vehicle sales in the fourth quarter of 2024 could reach 50% due to the reduction in purchase tax alone. As a result, some car companies are capitalizing on the momentum by introducing limited-time price guarantees and delivery commitments in addition to the baseline policies, further creating a sense of urgency for consumers to place orders.

However, the "bottom-line" behavior of car companies is not a long-term solution. On one hand, after years of rapid growth, the new energy vehicle market has gradually shifted from being policy-driven to market-driven. The withdrawal of policy dividends means that car companies need to rely on product strength, brand strength, and cost control capabilities to compete.

On the other hand, car manufacturers themselves are also facing profitability pressures. Particularly for the new car-making forces, most companies have yet to achieve stable profitability. While having to provide a "safeguard," they also need to balance R&D investments with market competition, making the situation especially severe.

In the long run, the policy green light will eventually close, and new energy vehicles will compete with fuel vehicles on the same starting line. At that time, the advantages of new energy vehicles will no longer rely on purchase tax reductions but will depend on their technological maturity, usage costs, and user experience.

For example, plug-in hybrid models need continuous optimization in terms of pure electric range and energy consumption, while pure electric models need to address issues such as charging convenience and range anxiety. Only through technological innovation and cost control to achieve "price parity between electric and gasoline vehicles" can new energy vehicles compete with gasoline vehicles in a fully market-oriented environment.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

India's Q3 Smartphone Shipments Rise 3%; Japanese Mold Factory Closures Surge; Mercedes-Benz Cuts 4,000 Jobs

-

Dow To Restart Pe Units 5 And 7 This Week, Recovery Date For Unit 6 Remains Undetermined In The United States (US)

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Ascend's Restructuring Plan Approved! Jwell Launches Global Acceleration Plan; Nexperia Chip Crisis Threatens Global Auto Production

-

European TDI Soars Due To Covestro Plant Shutdown