Titanium Dioxide Half-Year Report: Performance Is Quite Good, Is The Macro Environment Recovering? Beware!

Recently, titanium dioxide companies have successively released their 2025 semi-annual reports. Several major titanium dioxide enterprises have shown stable or even slightly increased revenue, and their overall performance is better than expected.

A few days ago, after a prolonged period of low prices, titanium dioxide companies once again collectively announced price increases due to the approach of the "Golden September and Silver October" season.In the first half of 2025, although there was a brief increase in the price of titanium dioxide in the Chinese market, the overall trend was downward.What’s even more distressing is that the semi-annual report shows that almost all companies’ titanium dioxide... It keeps declining.

Relying on sales volume to drive performance cannot be sustained in the long term. Even if this situation results from an improving overall environment, we must remain vigilant—profit growth is the key. If the current increase in performance is a benefit brought by a warming market, then in the future, companies with advantages in product quality and cost will gain more market share, while most companies may not possess strong competitiveness. This is precisely the stage where the gap between companies can widen.During the sprint period, as shown in the half-year reports, many large enterprises are "repairing the plank road" to seize opportunities.。

A summary of the half-year financial reports of titanium dioxide-related companies is provided below.

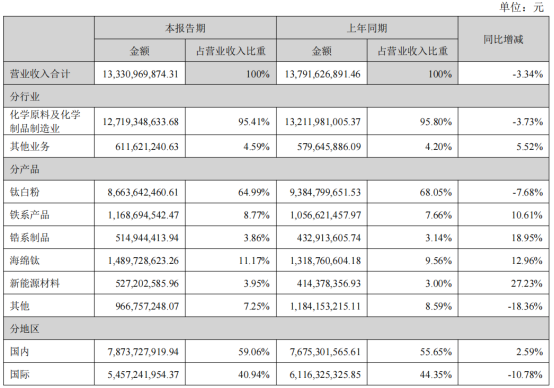

01.Lomon Billions Group

During the reporting period, Longbai Group achieved operating revenue of 13.331 billion yuan, representing a year-on-year decrease of 3.34%; total profit amounted to 1.673 billion yuan, down 20.87% year-on-year; net profit attributable to shareholders of the listed company was 1.385 billion yuan, a year-on-year decline of 19.53%.Net profit declined compared to the same period, mainly due to the decrease in titanium dioxide prices.Titanium dioxide achieved a revenue of 8,663,642,460.61 yuan, representing a year-on-year decrease of 7.68%.

Revenue Composition

During the reporting period,The production of titanium dioxide reached 682,200 tons, a year-on-year increase of 5.02%. Among them, the production of sulfate-process titanium dioxide was 463,500 tons, a year-on-year increase of 2.16%, and the production of chloride-process titanium dioxide was 218,700 tons, a year-on-year increase of 11.64%.。A total of 612,000 tons of titanium dioxide were sold, representing a year-on-year increase of 2.08%. Among them, domestic sales accounted for 43.71%, while international sales accounted for 56.29%.Sales of sulfuric acid process titanium dioxide were 427,400 tons, an increase of 2.10% year-on-year, while sales of chloride process titanium dioxide were 184,600 tons, an increase of 1.99% year-on-year.

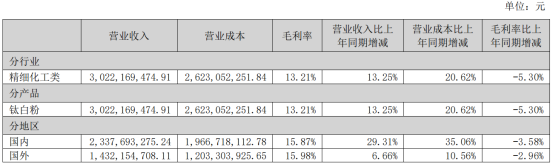

02.CNNC Titanium Dioxide

During the reporting period, CNNC Titanium Dioxide achievedRevenue was 3,769,847,983.35 yuan, a year-on-year increase of 19.66%.Attributed to shareholders of the listed company.Net profit of 259,212,359.67 yuan, a year-on-year decrease of 14.83%.All of the company’s titanium dioxide products are of the rutile type.Its sales revenue accounts for 80.17% of the company's total sales revenue in the first half of 2025.。

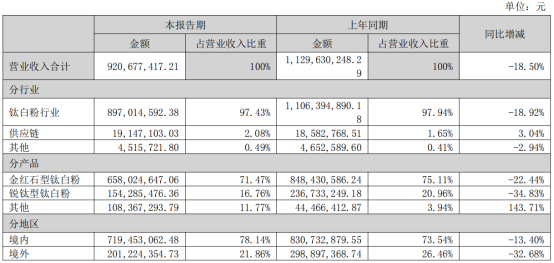

Composition of Operating Revenue

The company currently has a titanium dioxide production capacity of nearly 550,000 tons per year. Among the more than ten traditional grades of titanium dioxide products, the company continuously promotes product upgrades and replacements, key technology research and application for the reduction and harmless treatment of titanium dioxide waste residues, comprehensive utilization of titanium dioxide by-products, and comprehensive utilization of waste acid. Products such as R-213, R-216, and R-217 have been widely applied in global fields including plastics, coatings, and papermaking. In terms of new titanium dioxide product development, the company focuses on the research, development, and industrialization of products to replace imported foreign products, the development of downstream green application fields for titanium dioxide, and the research and development of renewable bio-based organic surface-treated titanium dioxide technologies.

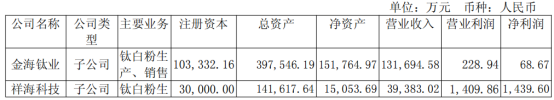

03.Lubei Chemical

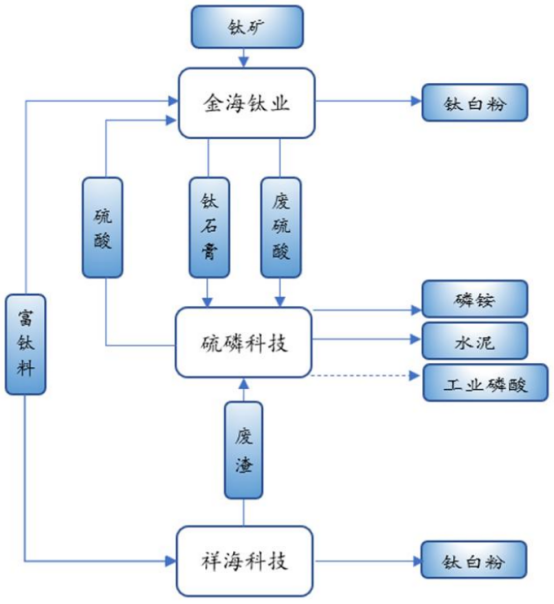

The company's wholly-owned subsidiaries Jinhai Titanium Industry and Xianghai Technology jointly form the company's titanium dioxide business segment. Among them, Jinhai Titanium Industry owns a sulfuric acid process titanium dioxide production line with an annual capacity of over 200,000 tons. During the reporting period, titanium dioxide...The revenue is 1,316.9458 million yuan, and the operating profit is 2.2894 million yuan.Xianghai Technology currently has an annual production capacity of 60,000 tons of chloride process titanium dioxide production lines.Operating income is 393.8302 million yuan, and operating profit is 14.0986 million yuan.

Operating Status of the Subsidiary's Titanium Dioxide Business

Jinhai Titanium has implemented cost reduction and efficiency improvement measures such as secondary filtration of black mud, reuse of kiln tail filtrate, high-temperature tail gas spray transformation, and ferrous centrifuge washing transformation, achieving a total cost reduction of nearly 8 million yuan. Xianghai Technology, through the technical transformation of the packing in the tail gas tower of the chlorination workshop, real-time matching of the optimal settlement plan, and the recovery and reuse of steam condensate, has achieved a total cost reduction of nearly 4 million yuan.

Recycling process

04.Huiyun Titanium Industry

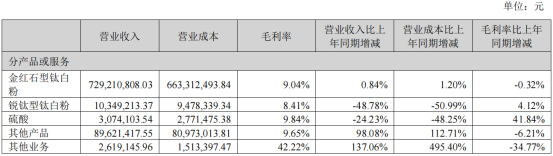

During the reporting period, Huiyun Titanium IndustryRevenue from rutile titanium dioxide was 729,210,808.03 yuan, representing a year-on-year increase of 0.84%.,Gross profit margin was 9.04%, a year-on-year decrease of 0.32%.The revenue of rutile titanium dioxide was 10,349,213.37 yuan, a year-on-year decrease of 48.78%.Gross profit margin was 8.41%, an increase of 4.12% year-on-year.

Composition of Operating Revenue

In response to the decline in titanium dioxide market prices, the company has actively taken countermeasures.The first phase of the “600,000 tons/year Titanium Dioxide Dilute Acid Concentration Technology Upgrade Project,” with an annual capacity of 200,000 tons, has officially commenced production. The project has successfully overcome a series of technical challenges that have hindered the industrialization of waste acid concentration, including low concentration efficiency, high energy consumption, and equipment corrosion. This technology is at the forefront both domestically and internationally. Initial operations have achieved remarkable economic and environmental benefits.With the completion of the subsequent 400,000-ton project, the company's advantages in clean production, circular economy industry chain, and scale effects will be better demonstrated. During the reporting period, the company also deployed the upstream and downstream industry chains.Invest in setting up a marketing company in Singapore.At the same time,Acquired the controlling stake in Chenxiang Mining and initiated the development and operation of mining resources.To achieve partial self-supply of key raw materials, which will have a positive impact on the company's future operating performance.

05.Vanadium Titanium Co., Ltd.

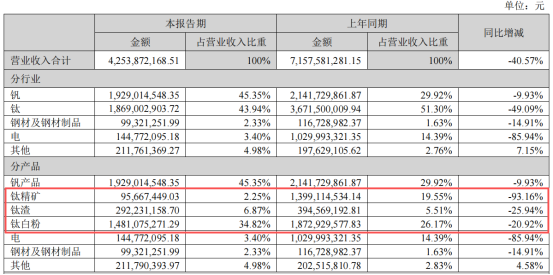

During the reporting period, Vanadium & Titanium Co., Ltd. achieved operating revenue of 4.254 billion yuan, representing a decrease of 40.57% compared to the same period last year; operating costs were 4.044 billion yuan, a decrease of 39.09% compared to the same period last year. This was mainly due to the decline in vanadium and titanium product prices compared to the same period last year and adjustments in the business model of certain operations. Net profit attributable to shareholders of the listed company...-199 million yuan, a decrease of 337 million yuan compared to the previous year, representing a year-on-year decline of 245.15%.

During the reporting period, titanium concentrate revenue was 95,667,449.03 yuan, a year-on-year decrease of 93.16%.Titanium dioxide revenue amounted to 1,481,075,271.29 yuan, down 20.92% year-on-year.

06.Tianyuan Co., Ltd.

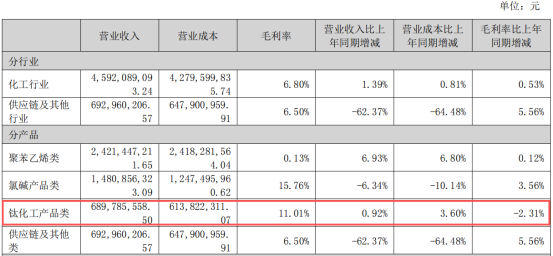

During the reporting period, Tianyuan Co., Ltd.Revenue from titanium chemical products was 689,785,558.50 yuan, an increase of 0.92% year-on-year.The gross profit margin decreased by 2.31%.

Composition of Operating Revenue

Tianyuan Co., Ltd. Titanium Dioxide Business ImplementationThe "Double 1000" plan promotes products through differentiation and high added value, based on an integrated circular economy industrial chain of "chlorine-titanium-phosphorus-iron-lithium."By actively establishing procurement or OEM operations in regions rich in global lithium and titanium mineral resources, advancing the "dual-mineral going global" strategy, promoting the upstream extension of the industrial chain and value chain, and further enhancing the resource security and value creation capabilities of lithium and titanium mineral resources.Yibin Tianyuan Haifeng Heta Co., Ltd., a wholly-owned subsidiary of the company, has completed the construction of a 100,000-ton-per-year iron phosphate project. To further reduce production costs, Haifeng Heta plans to invest 184.8158 million yuan in the implementation of a project for the resource utilization of chlorination process titanium dioxide tailings.

07.Jinpao Titanium Industry

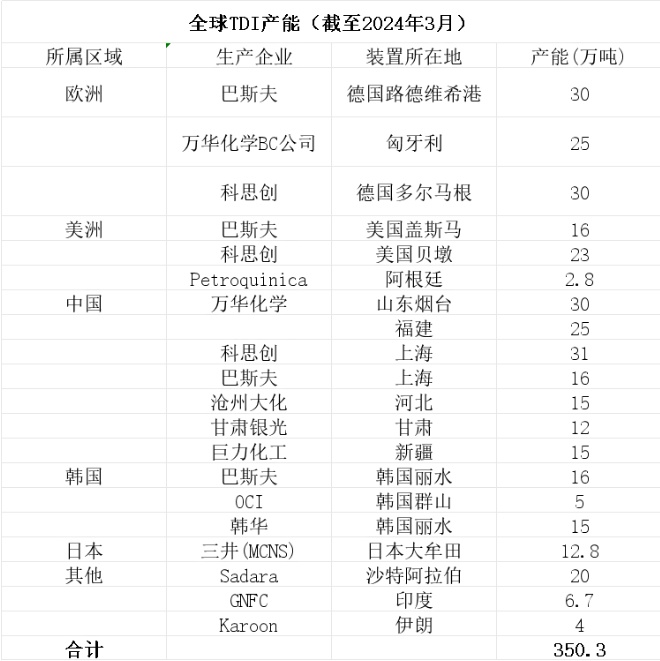

During the reporting period, Jinpu TitaniumRevenue from titanium dioxide was CNY 897,014,592.38, a decrease of 18.92% year-on-year.;The revenue from rutile titanium dioxide was 658,024,647.06 yuan, a year-on-year decrease of 22.44%, while the revenue from anatase titanium dioxide was 154,285,476.36 yuan, a year-on-year decrease of 34.83%.

Revenue Composition

The main reasons for the decline in titanium dioxide profits are threefold:

During the reporting period, the continuous decline in titanium dioxide prices and the increase in sulfur raw material purchase prices led to a rise in production costs, resulting in a decrease in the gross profit margin of titanium dioxide.

During the reporting period, the profit decline of Nanjing Titanium Dioxide Chemical Co., Ltd. was mainly due to an investment loss of 34.21 million yuan from the disposal of its subsidiary, Shanghai Dongyi Hotel.

During the reporting period, the profit decline of Xuzhou Titanium Dioxide Chemical Co., Ltd. was mainly due to the shutdown for maintenance in June.The anatase titanium dioxide production line is scheduled to resume production in September 2025, while there is currently no plan to resume production for the rutile titanium dioxide production line.Accordingly, Xuzhou Titanium Dioxide has made a provision for fixed asset impairment amounting to 56.08 million yuan.

08.Kuncai Technology

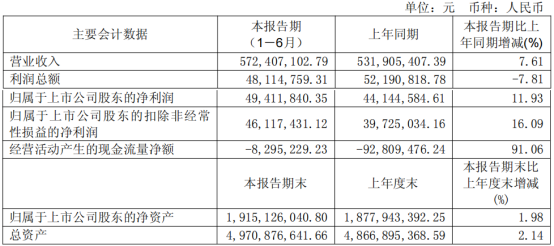

During the reporting period, Kuncai Technology achieved a revenue of 572.4071 million yuan, an increase of 7.61% year-on-year, and realized a net profit attributable to shareholders of the listed company of 49.4118 million yuan, an increase of 11.93% year-on-year.The revenue from titanium dioxide and iron oxide businesses continues to grow.However, due to the overall decline in titanium dioxide market prices, sales for the current period…The total gross profit decreased by 12.704 million yuan compared to the same period last year.

Main Accounting Data

The main raw material for the company's titanium dioxide, titanium concentrate, is in ample supply both domestically and internationally.The intermediate products and by-products (dichlorotitanium oxide and ferric chloride) produced by the extraction process can be used to manufacture pearlescent materials, ensuring quality and raw material supply while reducing costs and achieving good industrial synergy.Kun Cai Technology has independently developed the first hydrochloric acid extraction method for producing titanium dioxide. In the future, they plan to build a production capacity of 800,000 tons per year of high-end titanium dioxide.

09.Anada

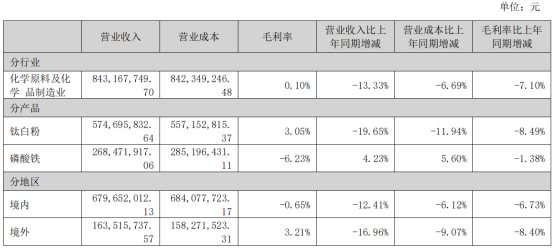

During the reporting period,AnadaTitanium dioxide revenue was 574,695,832.64 yuan, down 19.65% year-on-year.Gross profit margin was 3.05%, a year-on-year decrease of 8.49%.

Revenue Composition

During the reporting period, Annada continued to research and develop rutile titanium dioxide products specifically designed for photovoltaic backsheet applications and newly developed for electrophoretic paint and other specialized fields, aiming to increase the market share of its products in these specialized sectors.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Four Major Chemical New Material Giants Sell Off and Shut Down Again!

-

Covestro faces force majeure!

-

DuPont to Spin Off Nomex and Kevlar Brands for $14.4 Billion: Is Aramid Fiber Still Attractive?

-

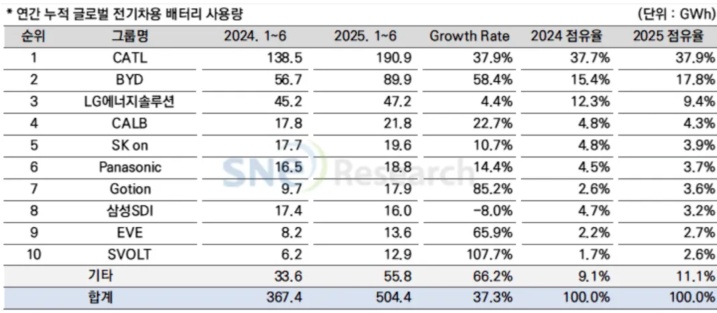

Massive Retreat of Japanese and Korean Battery Manufacturers

-

Napan Unveils Thermoplastic Composite Three-in-One Power System Solution, Battery Cover Weight Reduced by 67%