[Today’s Plastics Market] Weak Fluctuations! PP, PVC, PS, PET Narrow Adjustments; PC, PA Drop Up To 200

Summary: Summary of prices and forecasts for general-purpose and engineering plastics in the market on October 22nd.General MaterialIn terms of the market, trading is generally sluggish, with PP, PVC, and PS fluctuating within a narrow range, with some rising or falling by 2-40. ABS continues to decline, dropping by 20-100. EVA remains in a stalemate.Engineering materialsIn terms of the PC market, there was a narrow fluctuation with some increases and decreases between 50-200. PET prices slightly increased by 40-60. PBT experienced weak fluctuations with individual declines of 50. PA6 operated weakly, with some decreases of 100-200. PMMA and PA66 operated in a dull manner.

General materials

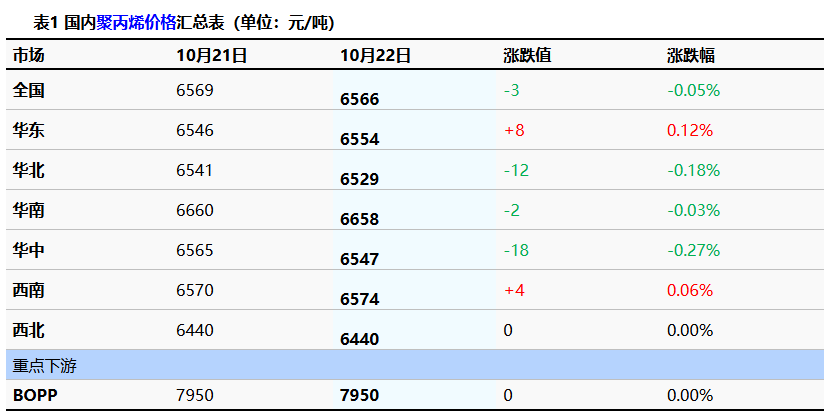

PP: Market trading is generally average, and polypropylene prices are fluctuating and consolidating.

1. Today's Summary

①. Sinopec Central China PP partially adjusted pricing: Changling wire drawing decreased by 200 yuan to 6,600 yuan/ton, injection molding decreased by 100 yuan, M45 to 6,600 yuan/ton, Zhongyuan pipe material decreased by 50 yuan to 7,350 yuan/ton; Luoyang MN70/MN150 decreased by 50 yuan, MN150 to 7,850 yuan/ton.

Today, the domestic polypropylene shutdown impact decreased by 0.51% to 19.40% compared to yesterday. The daily production share of raffia increased by 2.01% to 26.89% compared to yesterday, while the daily production share of low melt copolymer increased by 0.62% to 8.84%.

③、(20251010-1016) The supply-demand balance has shifted from surplus to tight balance in this period, but the support for market sentiment is limited. In the next period, the supply-demand balance will shift to a slight surplus due to increased supply, which is expected to have a bearish impact on prices.

2. Spot Overview

Based on the East China region, today's polypropylene raffia closed at 6,554 CNY/ton, up 8 CNY/ton from yesterday. The national average price for raffia decreased by 3 CNY/ton from yesterday, a drop of 0.05%, in line with the morning forecast.

Today, futures fluctuated within a narrow range and consolidated. In the morning, market quotations were stable with some fluctuations. The support from expectations of the Fourth Plenary Session policies weakened, reducing its driving force. Price support returned to the demand side, with downstream enterprises continuing to make just-in-time purchases. Market traders mainly followed suit in their operations. As of midday, the mainstream price for wire rod in East China is between 6500-6600 RMB/ton, and there is still room for negotiation in the actual transaction.

3 Price Prediction

The policies from the "14th Five-Year Plan" meeting are about to be announced, and market expectations are high, boosting market sentiment. Upstream maintenance is at a high level, slightly reducing supply-side pressure. However, downstream enterprises are not very enthusiastic about production, leading to slow raw material consumption and a lack of strong upward momentum in prices. It is expected that the market will experience narrow fluctuations and adjustments tomorrow, with prices hovering around 6500-6650 yuan/ton.

PVC: Limited Intraday Boost, PVC Spot Transactions Remain Steady

1. Today's Summary

①. Some domestic PVC manufacturers have reduced their ex-factory prices by 10-100 yuan/ton.

②. The maintenance recovery of Yili and Jinyuyuan facilities has been delayed, while Xinfafa is undergoing rotational maintenance and Hangjin is under maintenance.

③. Expanding Domestic Demand, Enhancing Vitality, and Optimizing the Environment: Fruitful Reforms Deepened During the 14th Five-Year Plan.

2 Spot Overview

Based on the Changzhou market in East China, today the cash price for calcium carbide of the five types in the East China region is 4600 yuan/ton, remaining unchanged from the previous trading day. 。

The domestic PVC spot market prices remained stable, with some slight fluctuations during the trading session. The atmosphere for end-user inquiries and transactions was sluggish, and there was no improvement in market supply and demand. The market was driven up by expectations of supply changes in upstream commodities such as black goods. In East China, the cash price for calcium carbide method PVC was between 4570 and 4680 yuan/ton, while for ethylene method it was between 4700 and 4900 yuan/ton, with high-end prices showing a slight decline.

3、Price forecast

In the short term, with the completion of upstream maintenance for PVC, the future market supply is expected to rise again to a high level, with weekly average production expected to approach 500,000 tons. Additionally, new units are gradually starting trial production within the month. Facing the increased upstream supply, domestic market demand remains stable for now, while Northern demand is expected to weaken due to climate impacts. However, exports are expected to remain favorable this month. Overall, future supply pressure is slightly greater than demand, putting pressure on the spot price focus. Macroeconomically, short-term performance is less than optimal, but with the support of expected costs in black commodities, the price range during trading is expected to remain stable. In the East China region, the cash and carry price for acetylene-based Type 5 is between 4,550-4,700 yuan/ton.

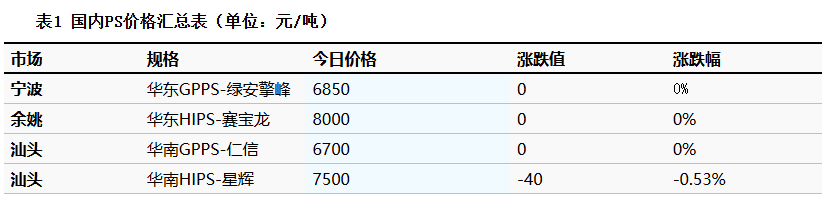

PS: Styrene rebounds at a low level, with the market focused on stable pricing and sales.

1 Today's Summary

Today, the East China GPPS is stable at 6850 yuan/ton.

② 、 The price of styrene in the East China market increased by 45 to 6,510 yuan/ton, in South China it rose by 50 to 6,510 yuan/ton, and in Shandong it went up by 45 to 6,350 yuan/ton.

2 Spot Overview

According to According to Longzhong Information, today the GPPS in East China is stable at 6850 RMB/ton.The price of styrene feedstock slightly rebounded from a low position, leading to slightly better cost support, and there was an increase in stable price operations in the market. The supply of goods is relatively ample, creating some pressure on the spot market. Buyers are purchasing based on just-needed demand, and some transactions have improved.

3 Price Prediction

The raw material styrene has stopped falling and is fluctuating, with some cost support, but the focus remains relatively low. The industry's supply is relatively loose, and downstream demand is driven by just-in-time purchases. In the short term, the PS market may primarily focus on selling at low levels, with some slight price stabilization. It is estimated that the price of transparent modified polystyrene in the East China market may be 6,800-7,900 yuan/ton.

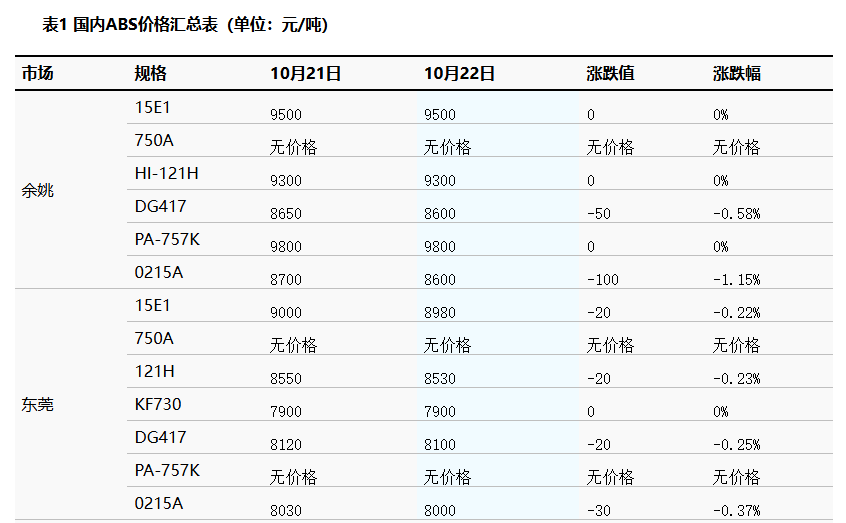

ABS: Today's transactions meet rigid demand, with prices continuing to trend downward.

1 Today's Summary:

Today, the market prices in East China are declining; the market prices in South China are also declining, and market transactions are maintaining just the necessary demand.

②. In October, the monthly production of ABS significantly increased compared to the previous month.

2 Spot Overview:

Based on the regions of Yuyao and Dongguan, prices in the East China market are declining, while prices in the South China market are also falling. Today's market transaction is driven by demand, with multiple negative factors affecting the market. Traders continue to lower prices to sell off inventory, leading to a decline in the market. It is expected that the domestic ABS market prices will maintain a bearish trend tomorrow.

3 Price prediction:

Based on the regions of Yuyao and Dongguan, the market price in East China is declining, while in South China, the market price is experiencing a localized downward trend. Supply remains high, with many bearish factors in the market, traders are offering discounts to sell. It is expected that ABS prices will continue to decline slightly tomorrow.

EVA: Weak Supply and Demand Persist, EVA Market Continues Stalemate

1 Today's Summary

①. This week, the ex-factory price of EVA petrochemicals was reduced, and the auction source prices continued to decline significantly.

This week's EVA petrochemical facilities: Tianli High-tech shut down on the morning of the 21st, Yanshan Petrochemical's facility is on a prolonged shutdown, while the others are operating steadily. The 300,000 tons/year facility of Korea's Hanwha-GS Energy started production on September 25.

2. Spot Overview

Today, the domestic EVA market is weak and consolidating. There is an abundant supply of market commodities, and downstream factories are purchasing at a low frequency, maintaining just-in-time buying. The pressure on sellers to export has increased, and some negotiations involve concessions. Mainstream prices: soft materials are priced at 9,600-10,200 yuan/ton, and hard materials are priced at 10,300-10,500 yuan/ton.

3 Price Prediction

In the short term, the market supply and demand fundamentals lack positive support, sellers are struggling to sell their goods, and downstream buyers are infrequent with low bid prices. The market performance is weak, and it is expected that in the short term. The weak situation in the domestic EVA market is difficult to change, with some petrochemical companies planning to switch to hard material production more frequently, which may lower hard material prices in the future. 。

Engineering materials

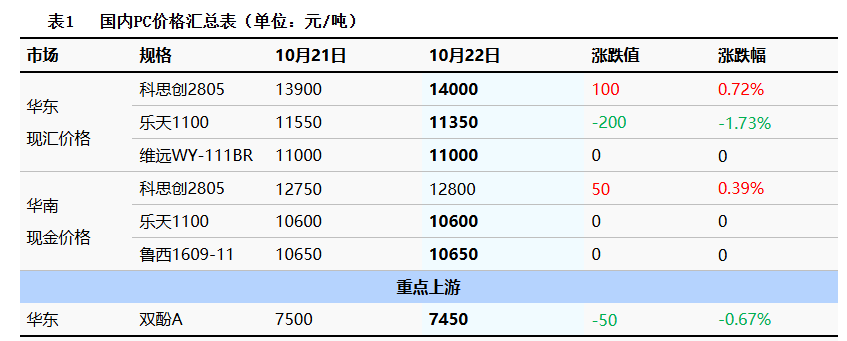

PC: The market continues to experience a narrow range of fluctuations.

1 Today's summary

Tuesday International Crude Oil Rise , ICE Brent crude oil futures for December contract at 61.32, up by 0.31 USD/barrel.

②、 Bisphenol A in the East China market closed at 7450. Yuan/ton, a month-on-month decrease of 50 yuan/ton.

3. There are currently no updates on the latest ex-factory price adjustments from domestic PC factories.

2. Spot Overview

The domestic PC market in China experienced narrow fluctuations and consolidation today. By the afternoon closing, mainstream negotiations for East China's injection molding grade low-end materials were referenced at 10,400-13,300 RMB/ton, while medium to high-end materials were negotiated at 13,400-14,800 RMB/ton. Prices for certain domestic products fell by 50 RMB/ton compared to yesterday. No new ex-factory price adjustments have been made by domestic PC factories. In the spot market, East and South China saw narrow consolidation at low levels, with individual price adjustments. There is minimal fluctuation in fundamental news, and the purchasing pace for just-in-need orders from downstream has weakened. Market participants are cautious and maintain a wait-and-see attitude, negotiating sales flexibly based on current conditions. Insufficient buying interest has led to a muted trading atmosphere.

3 Price Prediction

Currently, under the backdrop of domestic PC factories maintaining price stability, the market is observing and following up, with some domestic materials experiencing sluggish trading at high prices and a weak downward trend. In the short term, although the overall pressure from the supply side is relatively mild, downstream demand has been slow to catch up. Additionally, the continuous decline in related products is dampening market sentiment. It is expected that the domestic PC market will maintain a narrow oscillation pattern in the short term, with attention on the further evolution of market trends.

PET: Polyester bottle chip prices rise

1 Today's Summary

Some factories have raised their prices by 30-50%, while some factories remain stable. Unit: Yuan/Ton

②. Today's domestic polyester bottle chip capacity utilization rate is 73.37%.

2 Spot Overview

Table 1 Domestic Polyester Bottle Chip Price Summary (Unit: Yuan/Ton)

|

Market |

Specifications |

October 21 |

October 22nd |

Price Change |

Change rate |

|

East China |

Aquarius Level |

5630 |

5670 |

40 |

0.71% |

|

South China |

Aquarius Level |

5660 |

5720 |

60 |

1.06% |

|

North China |

Aquarius Level |

5560 |

5610 |

50 |

0.90% |

Based on the East China region, today the spot price for polyester bottle-grade flakes closed at 5670, up 40 from the previous working day, which is basically in line with the morning expectations.

Crude oil drives petrochemical products upward, providing cost support, and the focus of the polyester bottle chip market has significantly increased, with some traders replenishing stock while downstream buyers are cautiously following the price hike. It is heard that October supplies were traded at 5600-5750, mainly at lower prices; November supplies were traded at 5620-5720; December supplies were traded at 5610-5700. The futures contract 2512 is at a discount of 30 to a premium of 90, with the basis weakening. (Unit: RMB/ton)

3. Price Forecast

Crude oil and raw materials are on the rise, and the industry is paying close attention to its sustainability. With poor performance in terminal demand, the polyester bottle chip market continues to lack upward momentum and may fluctuate sideways. It is expected that the spot price of polyester bottle chips for water bottle material in East China will range between 5600-5750 RMB/ton tomorrow. Attention should be paid to the downstream follow-up situation. 。

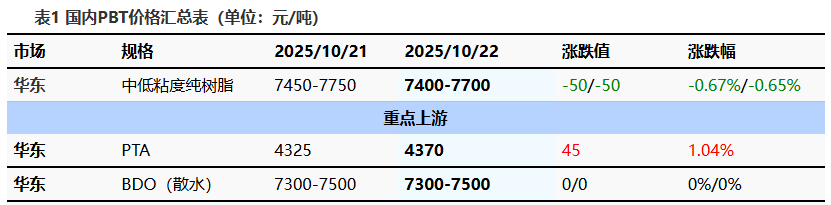

PBT: Lack of demand support, PBT market weak and fluctuating.

1 Today's Summary

This week's PBT manufacturers' quotes remain stable overall.

This week, there are fewer PBT unit maintenance activities.

③ The PBT production for this period is 22,600 tons.The capacity utilization rate is 53.14%, remaining stable compared to the previous period. This week, the average gross profit of domestic PBT is -343 yuan/ton, a decrease of 19 yuan/ton compared to the previous week. 。

2 Spot Overview

The mainstream price of medium and low viscosity PBT resin in the East China region today is 7,400-7,700 yuan/ton, down 50 yuan/ton compared to the previous working day. Today, the PBT market is weak and fluctuating, the PTA market is rebounding from a low level, and the BDO market is experiencing range-bound fluctuations. The cost side provides some support, but the demand side remains consistently weak. The PBT market is weak and fluctuating, and the negotiation focus is declining. , According to Longzhong Information statistics, the price of low to medium viscosity PBT pure resin in the East China market is 7400-7700 yuan/ton.

3 Price Prediction

The PBT market is expected to remain in a wait-and-see mode. On the raw material front, the supply and demand of PTA maintain a tight balance, with the balance sheet continuously drawing down inventory. In the traditional peak season, downstream sectors are engaging in periodic restocking, and after a sustained decline, the market lacks new bearish pressures. Commodity sentiment has somewhat warmed up, and the short-term PTA spot market is expected to weakly rebound. The BD new cycle supply-side policy is supportive, with downstream sectors continuing to follow contracts, and under cost pressure, spot negotiations are moderate. There are no significant bearish or bullish factors in the fundamentals, and market fluctuations are limited. Overall, costs are tending to stabilize, but the bearish sentiment in the PBT market is quite strong. The market may continue with a weak outlook, so Longzhong expects the East China market price for low-to-medium viscosity PBT resin to be around 7400-7700 yuan/ton tomorrow.

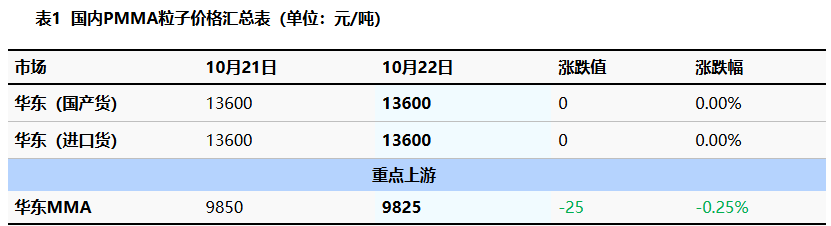

PMMA: PMMA particle light operation

1 Today's Summary

①、 Today's PMMA Particles The market price is stable. 。

②. Today, the domestic utilization rate of PMMA particles remains at 60%.

2 Spot Overview

Based on the East China region, the PMMA particles closed at 13,600 yuan/ton today, stable compared to the previous working day, in line with the morning's expectations. 。 The price of raw material MMA has slightly softened, and industry players are bearish on the market outlook, with little fluctuation in offer prices. Downstream factories have a low purchasing willingness and tend to take a wait-and-see approach. Amidst the game of supply and demand, the market has fallen into a stalemate, and the trading activity of actual transactions is relatively low.

3 Price Prediction

The price of raw material MMA has declined, and sellers are maintaining stable mainstream quotations. Actual transactions are focused on negotiations, while downstream factories continue to procure based on essential needs. The volume of transactions is limited, and it is expected that the market will continue to be in a stalemate and consolidation in the short term.

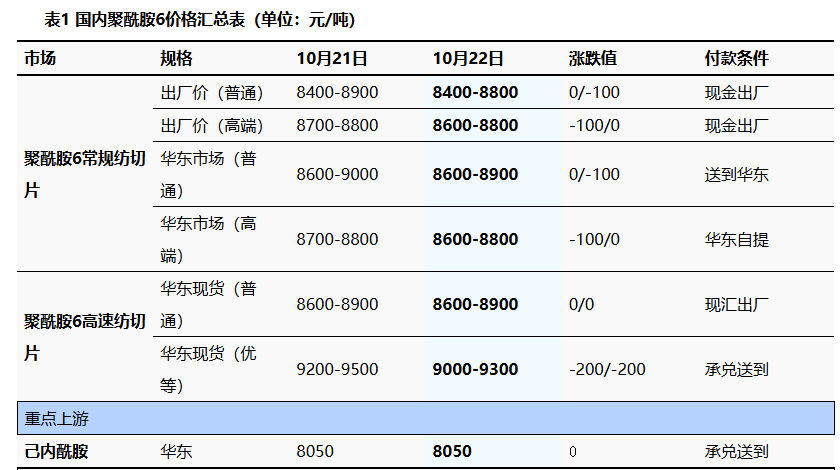

PA6: Limited Demand, PA6 Market Running Weakly

1 Today's summary

①、 Sinopec's caprolactam weekly settlement price last week was 8,710 yuan/ton (six-month acceptance without interest). The previous period's weekly settlement price was 8,580 yuan/ton, including a retrospective monthly settlement for September of 180 yuan.

②、 Sinopec has reduced the price of pure benzene by 200 RMB/ton at various refineries in East and South China, setting the new price at 5,450 RMB/ton, effective from October 21.

2 Spot Overview

Today, the price of polyamide 6 has declined, with the raw material caprolactam remaining at low levels, providing limited cost support. Additionally, downstream procurement attitudes are cautious, maintaining just-in-time restocking. The market transaction atmosphere is generally moderate, with actual transactions being negotiated. In East China, regular spun PA6 is priced at 8,600-8,900 yuan/ton in cash for short delivery, while high-speed spun PA6 spot is priced at 9,000-9,300 yuan/ton for delivery with acceptance. In Chaohu, the cash self-pickup price is 7,950-8,050 yuan/ton.

3 Price Prediction

From the cost perspective, the caprolactam market is operating weakly, with expectations for cost support continuing to decline. From the supply and demand perspective, domestic supply is expected to increase, as Guangxi Hengyi continues to ramp up production. However, downstream demand remains limited, with downstream buyers primarily purchasing based on essential needs and at lower prices. It is expected that the PA6 market will continue to be weak and undergo consolidation in the near term.

PA66: Weak Demand, Market Operating Steadily

1 Today's Summary

① On October 21st, the pressure brought by U.S. tariff and trade policies is expected to ease, coupled with persistent geopolitical instability, leading to a rise in international oil prices. NYMEX crude oil futures for the November contract rose by $0.30/barrel to $57.82, a month-on-month increase of 0.52%; ICE Brent crude futures for the December contract rose by $0.31/barrel to $61.32, a month-on-month increase of 0.51%. China's INE crude oil futures for the 2512 contract fell by 2.9 to 436.2 yuan/barrel, with the night session increasing by 2.8 to 439 yuan/barrel.

Today, the domestic PA66 capacity utilization rate is 67%, with a daily output of approximately 2,650 tons. Some enterprises have increased their capacity utilization. The downstream demand is average, and new production capacity is gradually being released, ensuring ample supply in the domestic PA66 industry.

2 Spot Overview

Based on the Yuyao market in East China, today's market price for EPR27 is referenced at 14,700-14,800 yuan/ton, which is stable compared to yesterday's price. 。 Downstream demand is weak, market spot supply is ample, cost pressures are relatively high, and the market is operating in a consolidating manner.

3 Price Forecast

The downstream continues with just-in-time purchasing, the market has ample spot supply, and the cost pressure is relatively high. It is expected that the domestic PA66 market will consolidate weakly in the short term.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

India's Q3 Smartphone Shipments Rise 3%; Japanese Mold Factory Closures Surge; Mercedes-Benz Cuts 4,000 Jobs

-

Ascend's Restructuring Plan Approved! Jwell Launches Global Acceleration Plan; Nexperia Chip Crisis Threatens Global Auto Production

-

Dow To Restart Pe Units 5 And 7 This Week, Recovery Date For Unit 6 Remains Undetermined In The United States (US)

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

The Roller-Coaster Behind Sanhua Intelligent Controls' Stock Price: What Are the Advantages of Automotive Thermal Management Companies Crossing Into Humanoid Robots?