[Today's Plastic Market] Broad Stability with Minor Fluctuations: PP, PE, ABS, PVC Narrow Oscillations, PA6 Drops by Up to 100!

Summary: Summary of prices and forecasts for general-purpose and engineering plastics in the plastics market on September 5.General materialsThe market mainly fluctuates within a range. PP and PE are mainly traded at low prices, with some prices fluctuating up or down by 4-16. PS benefits from cost-side support, with individual increases of 20. PVC remains steady in the market, with a slight decrease of 10-20.Engineering materialNarrow fluctuations: PET runs slightly stronger, with some prices rising by 20-30; PA6 runs weaker, with some prices dropping by 50-100; POM, PBT, PMMA, and PA66 run steadily with a weak tone.

General material

PE: Market sentiment is weakening, with low-price transactions being the main focus.

1. Today's Summary

①. U.S. commercial crude oil inventories have increased, and the market is concerned that OPEC+ will initiate a new production increase plan, leading to a drop in international oil prices. NYMEX crude oil futures for October contracts fell by $0.49/barrel to $63.48, a decrease of 0.77% from the previous period; ICE Brent crude futures for November contracts fell by $0.61/barrel to $66.99, a decrease of 0.90% from the previous period. China's INE crude oil futures for contract 2510 fell by 8.2 to 483.6 yuan/barrel, with a night session drop of 0.3 to 483.3 yuan/barrel.

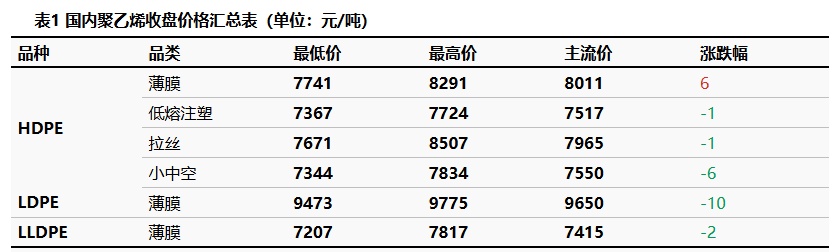

②. The price fluctuation range for the HDPE market is -6 to 6 yuan/ton, the LDPE market price is -10 yuan/ton, and the LLDPE market price is -2 yuan/ton.

2. Spot Overview

The support from raw material costs has weakened, leading some manufacturers to lower their ex-factory prices. Market sentiment has turned bearish, and prices are mainly declining as the market follows the trend. Downstream factories are restocking at lower prices, resulting in some transactions at these reduced prices. The HDPE market price fluctuation range is -6 to 6 yuan/ton, the LDPE market price is -10 yuan/ton, and the LLDPE market price is -2 yuan/ton.

3. Price Prediction

In the short term, On the supply side, there is an increase in enterprise maintenance, while imported resources have increased in the spot market, and inventories may rise. On the demand side, the downstream is gradually entering the traditional peak season, with a slight recovery in orders for product companies, but no significant increase is evident. Therefore, it is expected that the polyethylene market may experience narrow fluctuations next week. 。

PP: Slow Recovery in Demand Side, Polypropylene Market Range-Bound Consolidation

1 Today's Summary

①, Sinopec East China PP down by 50, Anqing T fixed at 6850, Zhong’an M17 fixed at 6900, Youxian ZH179 fixed at 6950, Shang F800E fixed at 7700, M800E fixed at 8100; PetroChina Southwest down by 50: S1003 Dushanzi Petrochemical at 7220, T30S Lanzhou Petrochemical at 7120, L5E89 Sichuan Petrochemical at 7070, L5D98 Sichuan Petrochemical at 7120, S2040 Dushanzi Petrochemical at 7300, NX40S Ningxia Petrochemical at 7400, H9018 Lanzhou Petrochemical at 7400.

Today, the domestic polypropylene shutdown impact increased by 1.43% compared to yesterday, reaching 14.53%. The daily production share of raffia grade decreased by 0.29% compared to yesterday, now at 26.30%. The share of low melt copolymer increased by 0.72% compared to yesterday, reaching 7.63%.

The supply-demand balance for this period (20250822-0828) remains in a state where supply exceeds demand, and the supply-demand gap remains positive and is widening compared to the previous period, negatively impacting market sentiment. The supply-demand balance gap is expected to continue to show a surplus in the next period, but the gap will narrow, which is still expected to negatively impact prices.

2 Spot Overview

Table 1: Summary of Domestic Polypropylene Prices (Unit: Yuan/Ton)

Taking East China as the benchmark, today's polypropylene raffia closed at 6,845 yuan/ton, down 8 yuan/ton from yesterday. The national average price of raffia fell by 13 yuan/ton compared with yesterday, a decrease of 0.19%, which is in line with the morning forecast.

In the morning, futures fluctuated in a narrow range. Today, the polypropylene market mainly showed weak consolidation, as downstream demand recovery was below expectations. Overall market sentiment was cautious, with traders primarily offering discounts to sell goods. End-users had low willingness to purchase, resulting in limited transaction volumes. As of midday, the mainstream price for raffia in East China was between 6750-7000 yuan/ton.

3 Price Prediction

Currently, demand is slowly recovering. Downstream factories maintain operations based on existing orders, but it will take some time for new orders to pick up. Although maintenance activities have increased recently, there remains a gap between the growth rate of demand and the increase in supply. The spot market is weak, and combined with the decline in crude oil prices, cost support has weakened. The market lacks strong drivers. It is expected that next week the polypropylene market will fluctuate around 6,780-7,020 yuan/ton for consolidation. Focus should be placed on the recovery of demand.

Costs are favorable, and the market has partially suspended trading after rising.

1 Today's Summary

Today, East China GPPS increased by 20 to close at 7,600 RMB/ton.

② On Friday, styrene prices in the East China market rose by 90 to close at 7,125 yuan/ton, in the South China market rose by 60 to close at 7,175 yuan/ton, and in Shandong fell by 10 to close at 6,955 yuan/ton.

2 Spot Market Overview

According to Longzhong Information, today East China GPPS rose by 20 to close at 7,600 yuan/ton. The raw material styrene rebounded from a low level, providing some support from the cost side. After a slight market increase, some traders placed limit orders and observed the market, and the market inquiry sentiment improved.

3 Price Prediction

The raw material styrene is fluctuating and rising, providing slight support for costs. Industry production is recovering, and downstream low-level just-in-time procurement is taking place. In the short term, the PS market may see a slight increase. It is expected that the East China market for transparent and modified benzene will be around 7600-8500 yuan/ton.

ABS: Raw material prices rising, today's prices continue to decline.

1 Today's summary:

①. Today, the market price in East China has dropped; the market price in South China has also dropped, and market transactions are average.

② The monthly production of ABS in September will slightly decrease month-on-month.

2 Spot Overview

Table 1 Summary of Domestic ABS Prices (Unit: RMB/ton)

Based on the regions of Yuyao and Dongguan, the market price in East China slightly declined, and the market price in South China slightly declined. Today's market transactions remain driven by rigid demand, with prices continuing to decline slightly. Although raw material prices have risen, ABS market transactions are average, and traders' quotations are trending lower. It is expected that domestic ABS market prices will maintain a narrow range consolidation next week.

3 Price Prediction:

Based on Yuyao and Dongguan regions, prices in the East China market have partially declined, and prices in the South China market have also locally decreased. Today's market transactions are driven by rigid demand, and raw material prices have rebounded. However, ABS market transactions are average. It is expected that ABS prices will maintain a narrow range consolidation next week.

PVC: Emotional fluctuations, but the intraday fundamentals of PVC remain unchanged.

1. Today's Summary

The ex-factory prices of some domestic PVC manufacturers were reduced by 20-30 yuan/ton.

② Zhenyang facility is expected to resume production within the week, while awaiting the maintenance of Jinchuan and Beiyuan next week.

③. Qingdao Haiwan's new unit is ready for feedstock input and startup, while Bohua Development's new unit is expected to start by the end of the month.

2 Spot Market Overview

Table 1 Domestic PVC Spot Price Summary (RMB/ton)

Based on the Changzhou market in East China, today the spot cash price for carbide method Type V in East China is 4,660 yuan/ton, remaining stable compared to the previous trading session. 。

The spot market price of PVC mainly stabilized. In the early trading session, low-end inquiries were concluded, while in the afternoon, market sentiment was boosted by unverified rumors in related industries. However, transaction sentiment weakened due to the unchanged fundamentals of the spot market and altered expectations. In East China, the cash price for carbide-based PVC (type 5) remains at 4,640-4,780 RMB/ton, and ethylene-based PVC at 4,800-5,000 RMB/ton.

3. Price forecast

As the weekend approaches, various unverified rumors are circulating in the market, affecting related black industry sectors and intraday market sentiment changes. Coupled with the expectations of favorable long-term financial policies, there is a strong bullish sentiment in intraday prices. On the spot front, short-term maintenance is expected to cause a slight decrease in production month-on-month before rebounding, and the changes in additional production restrictions are limited. Although the domestic demand peak season is approaching, the impact of export policy restrictions is limited. Overall, the supply-demand imbalance is expected to slightly decrease, and the industry's inventory accumulation rate is expected to slow down. Short-term cost support is relatively strong, and the volatility in the PVC spot market is expected to be limited. The spot price is slightly pressured but there is a strong policy-driven bullish sentiment. It is expected that the spot price for carbide-based type 5 in the East China region will be in the range of 4650-4800 yuan/ton.

Engineering materials

PET: Costs first decrease then increase, with bottle-grade polyester chips fluctuating with a slightly warmer trend.

1 Today's Summary

The factory quotations are mostly stable, with individual decreases of 20-50. Unit: Yuan/ton)

②. The capacity utilization rate of domestic polyester bottle chips reached 72.98% today.

2 Spot Overview

Table 1: Summary of Domestic Polyester Bottle Chip Prices (Unit: Yuan/Ton)

|

market |

Specification |

September 4 |

September 5th |

Change in value |

Price change percentage |

|

East China |

Aquarius-class |

5790 |

5820 |

+30 |

+0.52% |

|

South China |

Aquarius class |

5860 |

5880 |

+20 |

+0.34% |

|

North China |

Aquarius-class |

5780 |

5810 |

+30 |

+0.52% |

In the East China region, the spot price of polyester bottle-grade PET settled at 5880 today, an increase of 30 compared to the previous working day, which did not meet the morning expectations.

Morning crude oilDue to the decline in raw material prices, polyester bottle chip factory quotations remained mostly stable, with some dropping by 30. The market focus shifted slightly downward. In the afternoon, as the commodity atmosphere warmed up, the market rose, inquiries increased, and the transaction focus moved upward. Today's closing prices for September: 5800-5860, October: 5820-5870. Unit: yuan/ton.

3. Price Prediction

The downstream rigid replenishment behavior may provide a temporary bottom support for prices, and there are expectations of weakened supply. However, the demand side is generally running weak. The processing fee for bottle-grade polyester chips has slightly recovered recently. It is expected that next week, polyester bottle chips may fluctuate with the raw material price trend. The spot price of bottle-grade polyester chips in the East China region is expected to fluctuate warmly within the range of 5,820-5,950 yuan/ton next week. Going forward, it is crucial to focus on the guiding role of cost changes on the market.

POM: Supported by maintenance benefits, market sentiment remains relatively firm.

1. Today's Summary

1. The Xinjiang Xinlianxin POM unit is scheduled to shut down for maintenance on September 4th, with an estimated duration of about 21 days.

The Tangshan Zhonghao POM unit is scheduled to restart operations soon.

2 Spot Overview

Table 1 Summary of Domestic POM Prices (Unit: RMB/ton)

Based on the Yuyao area, the price of Yuntianhua M90 is 10,800 yuan/ton today, remaining stable compared to the previous period. Today, the POM market remained generally stable with minor fluctuations. Supported by the positive impact of plant maintenance, manufacturers maintained a firm attitude, and mainstream market offers showed no significant changes. However, downstream users were mainly cautious and on the sidelines, resulting in relatively light trading. As of market close, the tax-included price of domestic POM in the Yuyao market was 8,100-11,100 RMB/ton, while the cash price in the Dongguan market was 7,300-10,400 RMB/ton.

3. Price Prediction

The overall supply volume tightened throughout the week, and POM ex-factory prices remained relatively stable. However, sales performance in various regions did not improve, with dealers showing a strong wait-and-see attitude. Affected by low-priced imported materials, some offers continued with negotiations for transactions. Given that end-user factories have sufficient inventory, user purchasing sentiment remains relatively weak, resulting in sporadic actual transactions.Longzhong expects that the domestic POM market will experience a narrow range consolidation in the short term.

PBT: Market News is Quiet, PBT Market Narrowly Consolidates

1 Today's Summary

This week, PBT manufacturers' quotations remained generally stable.

There were fewer PBT plant maintenance shutdowns this week.

③ The PBT output for this period is 23,800 tons.An increase of 0.12 million tons compared to the previous period, a rise of 5.31%.Capacity utilization rate: 56.11%Compared to the previous period, it increased by 2.97%. This week, the average gross profit of domestic PBT is -379 yuan/ton, an increase of 88 yuan/ton compared to last week. 。

2 Spot Market Overview

Table 1 Summary of Domestic PBT Prices (Unit: RMB/ton)

Based on the East China region, the mainstream price of low to medium viscosity PBT resin today is between 7,650 and 7,900 yuan per ton, remaining stable compared to the previous working day. Today, the PBT market consolidated within a narrow range, the PTA market continued to weaken due to inertia, and the BDO market remained stable. Although the raw material PTA continued to decline, its impact on the PBT market was not significant. The market showed no obvious fluctuations, and traders mostly quoted prices following the market trend. According to Longzhong Information, the price of low to medium viscosity pure PBT resin in the East China market is 7,650-7,900 yuan/ton.

3 Price Forecast

The PBT market is expected to be cautiously strong. The incremental supply increase of PTA at the far end of the raw material side is clear, while the anticipated recovery in downstream incremental demand is limited, leading to overall market sentiment being subdued. However, the near-end supply and demand remain relatively tight, the balance sheet continues to destock, and combined with low valuations, there is a short-term expectation of a weak rebound in the PTA spot market. BDO’s September cycle supplier order receipts are satisfactory, supporting suppliers to actively stabilize the market. Downstream contract orders are following up, and holders negotiate with spot traders, resulting in little fluctuation in the market. Overall raw material support remains stable, and downstream and end-user demand may gradually improve. The PBT market sentiment has the potential to turn positive, with the market focus likely to fluctuate on the stronger side. Therefore, Longzhong expects the East China market price for medium and low viscosity PBT resin to be in the range of 7,700 to 8,000 yuan/ton next week.

PMMA: PMMA particle arrangement operation

1 Today's Summary

①、 Today's PMMA particle market is operating in an organized manner.

②. Today, the utilization rate of domestic PMMA particles remains at 62%.

2 Spot Market Overview

Table 1 Domestic PMMA Particle Price Summary (Unit: RMB/ton)

Based on the East China region, today's PMMA particles closed at 12,800 yuan/ton, stable compared to the previous working day, in line with the morning forecast. 。 The domestic PMMA particle market is organized and operating. As the weekend approaches, the trading atmosphere in the market is calm, and the performance of raw material MMA is weakening. Coupled with slightly insufficient demand, market participants are observing the market trend, resulting in few actual transactions.

3 Price prediction

The stalemate in the raw material side leads to a lukewarm cost support, with downstream sentiment being predominantly bearish. Holders mainly test the market with stable pricing, quoting based on their respective inventory situations. To promote shipments or offer discounts, focus on low prices within the market. In the short term, the range of PMMA particles tends to consolidate towards the lower end.

PA6: Downstream demand is limited, and the PA6 market is running weakly.

1 Today’s Summary

①、 Sinopec's high-end caprolactam settlement price for August 2025 is 9,330 yuan/ton (liquid premium grade, six-month acceptance, self pick-up), an increase of 270 yuan/ton compared to the July settlement price.

②、 Sinopec has reduced the price of pure benzene at refineries in East China and South China by 100 yuan/ton to 5900 yuan/ton, effective from September 4th.

2 Spot Overview

Table 1 Summary of Domestic Polyamide 6 Prices (Unit: RMB/ton)

The PA6 market is operating weakly today. The raw material market is consolidating at a low level, and sliced products continue to face pressure from loss-making costs. However, downstream purchasing sentiment remains cautious, primarily replenishing based on just-needed demand at lower prices. Market transactions are average, with actual deals subject to negotiation. Regular spinning PA6 in East China: ordinary spinning 9150-9450 RMB/ton cash short delivery; high-speed spinning spot 9600-9900 RMB/ton acceptance bill delivery. Chaohu 8550-8650 RMB/ton cash self-pickup price.

3 Price Prediction

From a cost perspective, the caprolactam market is consolidating at a low level, with slice profits still under pressure from losses and costs; from a supply and demand perspective, new capacity is being released while maintenance occurs simultaneously, domestic supply is expected to remain stable, but downstream demand is likely limited as purchases are made selectively based on low prices. It is expected that the PA6 market will undergo slight consolidation in the near term.

PA66: Cost pressure remains high, market consolidates and operates steadily.

1 Today's Summary

①. On September 4th, U.S. commercial crude oil inventories increased, and the market is concerned that OPEC+ might initiate a new production increase plan, leading to a drop in international oil prices. NYMEX crude oil futures for the October contract fell by $0.49 to $63.48 per barrel, a decrease of 0.77% from the previous period. ICE Brent crude futures for the November contract fell by $0.61 to $66.99 per barrel, a decrease of 0.90% from the previous period. China's INE crude oil futures for the 2510 contract fell by 8.2 to 483.6 yuan per barrel, and decreased by 0.3 to 483.3 yuan per barrel during the night session.

Today, the domestic PA66 capacity utilization rate is 60%, with a daily output of approximately 2,350 tons. Under cost and demand pressure, the capacity utilization rate of domestic PA66 enterprises remains stable. However, the demand from downstream is average, and the supply of goods in the domestic PA66 industry is sufficient.

2 Spot Market Overview

Table 1 Summary of Domestic PA66 Prices (Unit: RMB/ton)

Taking the Yuyao market in East China as the benchmark, today's EPR27 market price is referenced at 15,000-15,200 yuan/ton, remaining stable compared to yesterday's price. 。 Raw material prices fluctuate, and cost support remains stable, but demand is weak, resulting in a narrowly ranged market.

3 Price Forecast

The raw material market is fluctuating, with relatively stable cost support. Downstream maintains rigid demand for procurement, and the spot supply in the market remains stable. The industry sentiment is cautious. It is expected that the domestic PA66 market will remain weak and stalemated in the short term.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Four Major Chemical New Material Giants Sell Off and Shut Down Again!

-

Covestro faces force majeure!

-

DuPont to Spin Off Nomex and Kevlar Brands for $14.4 Billion: Is Aramid Fiber Still Attractive?

-

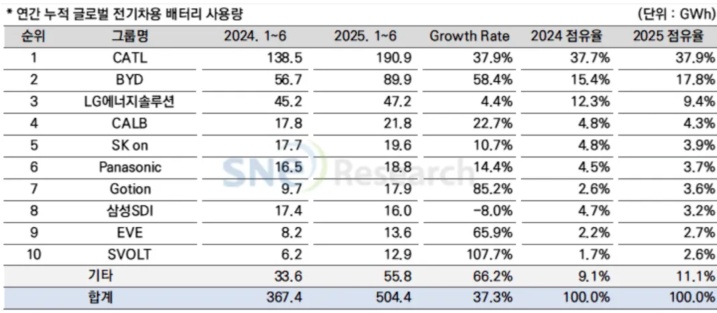

Massive Retreat of Japanese and Korean Battery Manufacturers

-

Napan Unveils Thermoplastic Composite Three-in-One Power System Solution, Battery Cover Weight Reduced by 67%