[Today's Plastics Market] Weak Volatility: General Materials Generally Fall, EVA Drops Up to 100, PC Rises Against the Trend by 300

Summary: Summary of plastic market general and engineering material prices and forecasts for December 8. In terms of general materials, the market is weak, with PE and PP continuing to decline, dropping by 2-64; PVC is fluctuating at low levels, with some falling by 10-40; EVA continues its weak trend, with some dropping by 50-100; the ABS market is down by 20-30. In terms of engineering materials, the cost support has collapsed, with PET falling by 10-30; PC continues to rise, with some increasing by 50-300; PMMA, POM, PBT, and PA are operating weakly and steadily.

General material

PE: Supply is abundant, prices are falling.

1. Today's Summary

The Federal Reserve is expected to cut interest rates next week, boosting economic and demand expectations. Coupled with geopolitical instability, international oil prices have risen. NYMEX crude oil futures for the January contract are up $0.41 at $60.08 per barrel, a week-on-week increase of +0.69%; ICE Brent crude futures for the February contract are up $0.49 at $63.75 per barrel, a week-on-week increase of +0.77%.

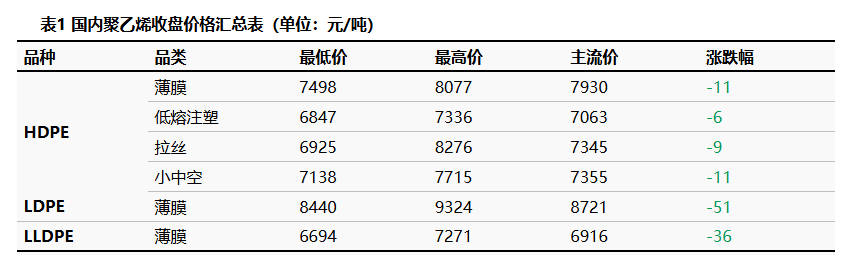

②, The price change range for the HDPE market is -11 to -6 yuan/ton, the LDPE market price is -51 yuan/ton, and the LLDPE market price is -36 yuan/ton.

2. Spot Overview

The current polyethylene market has abundant supply, while downstream factories purchase based on demand. Traders, aiming to relieve inventory pressure, tend to offer discounts to facilitate sales, leading to a decline in actual transaction prices. Against the backdrop of ongoing capacity expansion, overall supply pressure remains significant, and the pace of destocking in social inventory is slower than expected. The market price fluctuation range for HDPE is -11 to 6 yuan/ton, for LDPE is -51 yuan/ton, and for LLDPE is -36 yuan/ton.

3. Price Prediction

In the short term, the current polyethylene market is facing significant supply pressure. New production capacity is set to be released, coupled with ample import resources. On the demand side, downstream factories are generally cautious in their purchasing behavior, mainly restocking as needed, which provides limited support to the market. It is expected that polyethylene market prices will primarily fluctuate downward tomorrow.

PVC: Expected performance is poor, PVC fluctuates at low levels.

1. Today's Summary

Some domestic PVC manufacturers slightly lowered their ex-factory prices by 20-50 yuan/ton.

2. Zhenyang will undergo maintenance, Yibin will have a rotation off, and Hanwha will undergo maintenance next week.

③、 The Federal Reserve's December interest rate decision is approaching, marking a crucial window for global risk assets.

2 Spot Overview

Based on the East China Changzhou market, the cash transaction price for acetylene-based PVC Type 5 in the East China region is 4,400 yuan/ton today, a decrease of 10 yuan/ton compared to the previous trading day. 。

The domestic PVC spot market is experiencing fluctuations and a downward trend, with weak supply and demand. Supply remains high, while there are no highlights in domestic trade demand, and price competition continues in the export market. Macroeconomic expectations are performing poorly in the short term, leading to fluctuations in transaction prices seeking lower levels. In East China, the cash price for calcium carbide method PVC is between 4360-4500 yuan/ton, while the ethylene method is between 4400-4600 yuan/ton.

3. Price Forecast

Recently, the domestic PVC market has continued its downward trend, mainly due to pressure on the supply-demand structure, industry inventory accumulation, and poor expectations for the future. In the short term, there are limited changes in the market supply structure, with no obvious trend of production reduction. Moreover, both domestic and foreign trade remain stable and weak. The bottom cost support for PVC has increased, which to some extent supports PVC prices to weakly fluctuate within a small range at low levels. It is expected that the cash price of calcium carbide method PVC in East China will fluctuate between 4360-4460 Yuan/ton.

EVA: The market continues to operate weakly.

1 Today's Summary

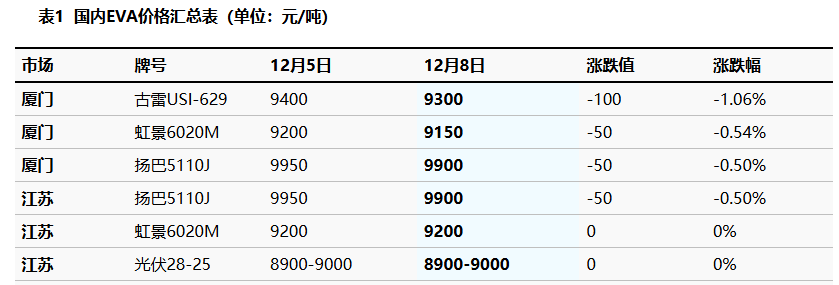

This week, the ex-factory price of EVA petrochemical continues to decrease.

This week, EVA petrochemical units: Yangzi Petrochemical is undergoing shutdown maintenance, Sinochem Quanzhou is under major overhaul; Zhejiang Petrochemical and Lianhong's new units are being put into operation.

2. Spot Overview

Today, the domestic EVA market continues to operate weakly, with insufficient confidence among industry players, and petrochemical ex-factory prices continue to decline. Downstream demand is slow to follow up, and holders are cautiously operating, leading to a decline in actual transaction focus. Mainstream prices are: soft material reference 9100-9700 yuan/ton, hard material reference 9000-9900 yuan/ton.

3 Price prediction

In the short term, the domestic EVA market is weak and difficult to recover, with insufficient market confidence. The news of new production capacity about to come online has impacted overall market sentiment, and downstream terminal demand is not following up adequately. The market is primarily focused on futures delivery in the previous period, making it challenging for spot transaction prices to stabilize. It is expected that the EVA market will operate weakly in the near term. 。

ABS: Today, the manufacturer's prices continue to decline, and the market follows suit.

1 Today's summary:

1. Today, the market prices in East China are declining; the market prices in South China are also declining, with transactions driven by just demand.

In December, the monthly production of ABS increased month-on-month.

2 Spot Overview:

Based on the regions of Yuyao and Dongguan, prices in the East China market are declining slightly, and prices in the South China market are also declining slightly. Today, the market transactions are driven by demand, with raw material prices rising, but this has not boosted the spot market prices of ABS. Today, the prices from petrochemical manufacturers continue to decline, and there are many negative factors in the market. It is expected that the domestic ABS market prices will maintain a downward trend tomorrow.

3 Price prediction:

The market prices in South China are declining, based on the Yuyao and Dongguan regions. Today, the market transactions are driven by demand, and the supply remains high. Although raw material prices have risen today, it has not boosted the ABS spot market prices. It is expected that ABS prices will continue to decline tomorrow.

Engineering materials

PC: The market rally continues.

1 Today's Summary

Last week International crude oil Increase ICE Brent crude futures February contract at 63.75, up 0.49. USD/barrel.

②、 The raw material BPA closed at 7475 in the East China market. Yuan/ton, a month-on-month increase of 100 yuan/ton.

3. This week, some domestic PC factories have recently raised their ex-factory prices by 100-200 yuan/ton.

2. Spot Overview

Today, the domestic PC market maintained a steady upward trend. As of the afternoon close, the mainstream negotiation reference for low-end injection molding materials in East China was 10,850-13,050 yuan/ton, while mid-to-high-end materials were negotiated at 14,350-14,800 yuan/ton. The domestic market focus increased by about 100 yuan/ton compared to last Friday. At the beginning of the week, some domestic PC factories continued to raise their latest ex-factory prices by 100-200 yuan/ton. The supply of spot goods from the production side remains tight. In the spot market, both East and South China continued to rise with volatility, supported by positive fundamentals. Market participants maintained a cautious and moderate attitude, with selling prices continuing to rise. Downstream inquiries and procurement were generally moderate, with transactions mainly driven by just-in-time needs.

3 Price Prediction

This week, domestic PC manufacturers have mostly continued to raise prices, with the spot market following suit, though the overall sentiment remains cautious. In the short term, the overall order situation in the PC downstream industry is average, with limited just-in-time purchasing within the market. The pace of high-price transactions continues to slow, but considering that PC manufacturers face no pressure in overall spot sales, and coupled with the fact that social inventory levels remain extremely low, the domestic PC market is expected to maintain a firm trend.

PET: Cost support collapses, polyester bottle chip prices decline.

1 Today's Summary

① Many factories have lowered prices by 50-90, while other factories are reporting stable prices (unit: yuan/ton).

②. Today's domestic polyester bottle chip capacity utilization rate is 73.05%.

2. Spot Overview

In the East China region, the spot price of polyester bottle-grade PET closed at 5700 today, down 20 from the previous working day, in line with the morning forecast.

Terminal demand remains weak, and raw materials are under downward pressure. Cost support has collapsed, leading to polyester bottle chip factory prices being adjusted down by 50-90, causing a narrow decline in market focus. Some traders and downstream buyers are restocking, with transactions reportedly concentrated around 5680-5700. In the afternoon, the decline narrowed, and trading became subdued. (Unit: Yuan/ton)

3. Price Prediction

The support from raw materials is generally weak, coupled with lackluster downstream demand, leading to increased pressure on factories and holders to take orders. However, the circulation of local supplies is tightening, and the polyester bottle chip market may temporarily remain stable.It is expected that the spot price of polyester bottle flakes for water bottles in the East China region will be between 5650-5750 yuan/ton.

PMMA Daily Review: PMMA particles operate weakly and steadily.

1 Today's Summary

①、 Today's PMMA Particles The market price is stable. 。

The utilization rate of domestic PMMA particles today is 65%.

2 Spot Overview

Based on the East China region, today's PMMA particle price closed at 12,800 yuan/ton, remaining stable compared to the previous working day, in line with morning expectations. 。 The price of raw material MMA remains low and stagnant, with a persistent pessimistic outlook in the market. Trading volumes are insufficient, and downstream buyers have a certain price-suppressing mentality. Some holders are selling at a discount, leading to slightly lower purchasing prices from end-users. The focus of actual transactions remains skewed towards the low end.

3 Price Prediction

Original The focus remains low and stagnant. The support from the cost side is weak, sporadic low-priced offers appear from holders in the market, and demand is sluggish. The focus of the market discussion may be on a lower level of consolidation.

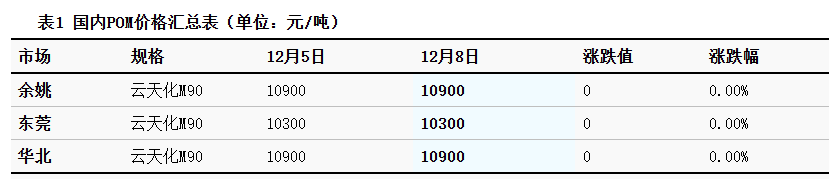

POM: Tight supply situation supports sporadic procurement from downstream.

1. Today's Summary

The Yanzhou Coal Mining Company Lu Hua Phase I POM unit was shut down for maintenance from November 25 to December 7 and is currently in the process of restarting.

The Hebi Longyu POM facility will be shut down for maintenance on October 20, and the restart time is yet to be determined.

2 Spot Overview

Based on the Yuyao region, today's Yuntianhua M90 is priced at 10,900 yuan/ton, with the price remaining stable compared to the previous period. Today, the POM market is consolidating at a high level. Petrochemical plants continue to experience tight supply, with a strong short-term intention to maintain prices. The fundamentals remain relatively stable, and the market trend is holding at a high level. Traders focus on maintaining prices for sales, with no significant fluctuations in mainstream offers. End users mainly adopt a wait-and-see attitude, and transactions are negotiated based on demand. As of the close, the domestic POM inclusive tax price in the Yuyao market is 8200-11100 RMB/ton, and the cash price in the Dongguan market is 7700-10400 RMB/ton.

3. Price Forecast

At the beginning of the week, the fundamentals of POM still have support, and the petrochemical plants do not face inventory pressure. There is a strong intention to maintain prices in the short term, and the ex-factory prices still have support. The mainstream market quotations are firm, and traders continue to hold back on sales. There are no significant fluctuations in the main quotations, but the purchasing mentality of end users has softened, and the replenishment demand in various regions has decreased, leading to sporadic transactions in the spot market. Longzhong expects that the domestic POM market will operate steadily in the short term.

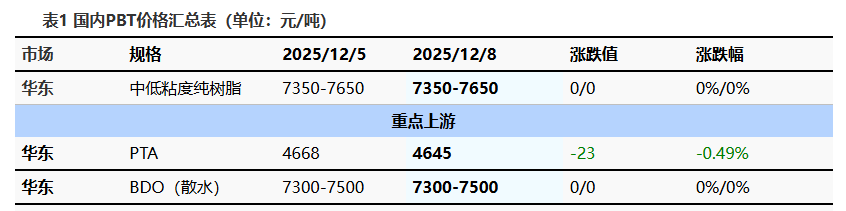

PBT: Limited changes in fundamentals, narrow fluctuations in the PBT market.

1 Today's Summary

This week's PBT manufacturers' quotes remained basically stable.

There are fewer PBT plant maintenance activities this week.

③ The production volume of PBT in this period is 23,600 tons, with a capacity utilization rate of 55.45%, remaining stable compared to the previous period. The average domestic PBT gross profit this week is -624 yuan/ton, a decrease of 32 yuan/ton compared to the previous week. 。

2 Spot Overview

Based on the East China region, the mainstream price of medium and low viscosity PBT resin today is between 7350-7650 yuan/ton, which is unchanged from the previous working day. Today, the PBT market is making slight adjustments, the PTA market is experiencing a downward shift, and the BDO market is operating with a wait-and-see attitude. At the beginning of the week, there are not many changes in the market fundamentals. PBT market Continue the narrow adjustment. , According to Longzhong Information, the price of low to medium viscosity PBT pure resin in the East China market is 7,350-7,650 yuan/ton.

3 Price prediction

The PBT market is expected to fluctuate weakly. In terms of raw materials, the terminal performance of PTA is not good, and the demand side lacks support. However, the supply and demand maintain a tight pattern, the balance sheet continues to destock, and the raw material supply is tight, providing strong cost support. In the short term, the PTA spot market is expected to remain volatile. Recently, BDO supply has decreased due to maintenance of some units, and the demand from downstream industries has also reduced. The supply and demand negotiations continue, with contract orders being traded, but spot negotiations are sluggish, making market fluctuations difficult. The market sentiment is mainly one of observation, and the focus of the PBT market may continue to fluctuate within a range. Therefore, Longzhong expects the East China market's low to medium viscosity PBT resin to be priced at 7,350-7,650 yuan/ton tomorrow.

PA6: Limited demand, PA6 market runs steadily.

1 Today’s Summary

①、 Sinopec's caprolactam weekly settlement price last week was 9,885 yuan/ton (six-month acceptance without interest), which was an increase of 150 yuan/ton compared to the settlement last month.

②、 Sinopec's pure benzene prices at refineries in East and South China have been lowered by 200 yuan/ton, effective at 5,450 yuan/ton, starting from October 21.

2 Spot Overview

Today, the market for polyamide 6 is operating steadily. The caprolactam market remains strong, resulting in significant cost pressure on the chips. However, downstream replenishment sentiment is cautious, and demand is limited. Some manufacturers are negotiating shipments, leading to overall average market transactions. In East China, the conventional spinning price for PA6 is 9,650-9,950 yuan/ton cash on short delivery, while the price for high-speed spinning spot is 9,900-10,200 yuan/ton with acceptance delivery.

3 Price prediction

From a cost perspective, the supply of caprolactam is tight, and market prices are running steadily. From a supply-demand perspective, some polymer enterprises have plans to reduce production in the future, but downstream demand is limited and procurement is cautious. Attention should be paid to the operational changes of polymer enterprises and the situation of downstream demand. It is expected that the PA6 market will consolidate in the near term.

PA66: Cost Pressure Persists, Market Remains Firm

1 Today's Summary

①. December 5: The Federal Reserve is expected to cut interest rates next week, boosting economic and demand expectations. Coupled with geopolitical instability, international oil prices have risen. NYMEX crude oil futures for the January contract rose by $0.41 per barrel to $60.08, a month-on-month increase of +0.69%; ICE Brent crude futures for the February contract rose by $0.49 per barrel to $63.75, a month-on-month increase of +0.77%. China's INE crude oil futures for the January 2026 contract rose by 2.1 to 453.4 yuan per barrel, and increased by 3.7 to 457.1 yuan per barrel in the night session.

②. Today, the domestic PA66 capacity utilization rate is 66%, with a daily production of approximately 2,650 tons. The capacity utilization rate is relatively stable, downstream demand is average, and the supply of goods in the domestic PA66 industry is sufficient.

2 Spot Overview

Based on the Yuyao market in East China, the current market price for EPR27 is referenced at 14,600-14,800 yuan/ton, remaining stable compared to the previous trading day. 。 The market spot supply is stable. Cost pressures are relatively high, downstream demand maintains a just-in-time purchasing rhythm, and the supply side is reluctant to sell at low prices, resulting in a stable market operation.

3 Price Prediction

The spot supply in the market remains stable, with the cost pressure continuously affecting it. The sentiment for price increases among suppliers is still present, and in the short term, the domestic PA66 market is expected to remain firm.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

[Today's Plastics Market] General Materials Weakly Fluctuate, Engineering Materials Steadily Rise

-

New Breakthrough in Domestic Adiponitrile! Observing the Rise of China's Nylon Industry Chain from Tianchen Qixiang's Production

-

Daily Review: Polyethylene Prices Under Weak Consolidation, Sellers Face Significant Pressure to Move Inventory