TPU Demand Remains Strong, Why Are Profits Disappearing?

In reviewing China's TPU market in 2025, the most prominent feature of the industry is not a decline in demand, but a reality that is becoming increasingly clear and yet unsettling.

The demand for terminals continues to grow, but the overall profitability of the industry is deteriorating.

From a macro perspective, TPU still maintains a relatively stable consumption base in the fields of shoe materials, films, cables, injection molding, and certain industrial sectors, and the market has not experienced a cliff-like decline. However, in stark contrast to the demand, enterprises generally feel a "disappearance of profits."

More and more companies are realizing that it’s not that TPU can’t be sold, but rather that the more they sell, the harder it is to make a profit.

"Increment without profit," and even "exchanging quantity for loss," is becoming a common reflection of the industry.

The voices from the market are highly consistent: the coexistence of high costs and weak price transmission means that any fluctuations on the demand side will quickly amplify the pressure on corporate profits. This is no longer just a simple cyclical downturn, but a concentrated manifestation of long-term structural contradictions.

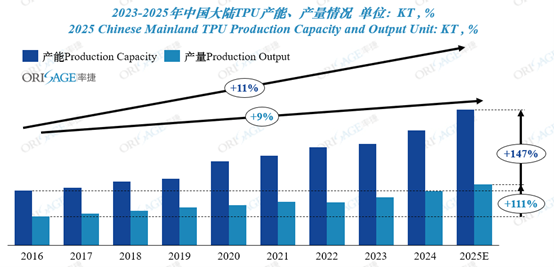

The pressure on the supply side is one of the most intuitive and easily perceived contradictions in the current TPU industry. However, simply summarizing it as "overcapacity" underestimates the complexity of the issue.

The real pressure does not come from the scale of production capacity itself, but from the high convergence of technological pathways and product choices.

Macroscopic surplus and microscopic concentration.

Source: Ruijie Consulting

From an industry-wide perspective, the new production capacity has not effectively opened up new application spaces but is instead highly concentrated in several common grades. A large number of newly established production lines are targeting common grades with relatively low technical barriers, and their target markets highly overlap with conventional application fields such as footwear materials, ordinary films, pipes, and general injection molding. This has injected more homogeneous supply into an already competitive mature market, directly intensifying price competition.

2. Homogenization of New Entry Paths

The structural surplus behind this is the astonishing similarity in the industry's entry paths. Many new players adopt nearly identical strategies to enter the market: procuring standardized production equipment, introducing or imitating mature (or even outdated) technological formulas, and targeting price-sensitive customers with standardized performance requirements in the mid-to-low-end market. This "same equipment, same technology, same customers" model has led to the industry struggling to establish a differentiated competitive landscape. When the products offered by all participants are highly substitutable, competition inevitably degenerates into a struggle over prices and payment terms.

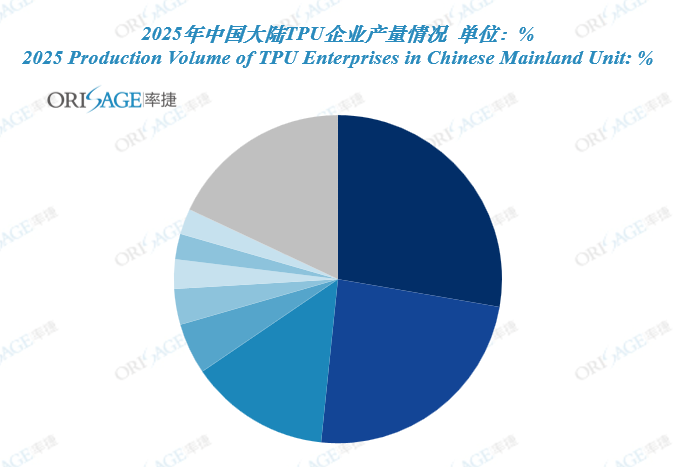

3. The squeezing effect of leading enterprises.

Leading enterprises, with their scale, integration capabilities, and technological reserves, maintain an advantage in both cost and high-end markets. Meanwhile, the numerous small and medium-sized enterprises are squeezed into the narrow mid-to-low-end tracks. When leading enterprises adopt flexible pricing strategies during market stagnation periods to maintain operation rates and market share, it creates a significant squeezing effect on the profit margins of small and medium-sized enterprises.

Source: RateJet Consulting

In contrast to the "concentrated shock" on the supply side, the new normal on the demand side is characterized by "dispersed and fragmented" patterns. The overall demand in the TPU market is still growing, but the way it is shared has fundamentally changed, no longer "concentrating rewards on any single factory." The rhythm of shipments has been disrupted by the uncertainty of trade tariff policies, with alternating fluctuations of "early overdrafts" and "delayed vacuums" in orders. The "emotional" purchasing driven by geopolitical factors has further exacerbated the fragmentation and unpredictability of market demand over time.

1. Consumer Goods: Large Volume but Transformation in Order Model

Cost transmission differentiation: Terminal brands face market competition and a slowdown in consumption growth, passing cost pressures upstream without attenuation. However, upstream manufacturers find it difficult to pass on the cost pressures of raw material fluctuations to the terminals, leading to a sharp compression of their profit margins.

2. Fragmentation of Orders: To respond to rapidly changing consumer trends, brands are promoting an order model with more SKUs, smaller batches, and shorter delivery times. This requires TPU manufacturers to frequently switch production lines, weakening the cost advantages of large-scale production. The complexity and costs of operations increase, trapping companies in a vicious cycle where "the more orders they have, the more chaotic the scheduling becomes, and the lower the per-ton efficiency."

3. Apply "small" and "many": The growth highlight of the consumer goods market lies in its continuous "fragmented innovation," where product iterations are extremely fast and diverse demands are placed on material properties, dividing the market into countless "small ponds." Each pond has opportunities, but the water volume is insufficient for a single factory to thrive on one product alone, requiring suppliers to have agile R&D and flexible supply capabilities.

Industrial products: high barriers to entry and reliance on long-termism.

High performance and certification barriers: Customers' demands for product performance consistency, stability, and long-term reliability far exceed their sensitivity to price. Additionally, each niche market has its unique technical specifications and certification requirements, which keeps many companies that can only produce general grades out of the market.

Verification cycles are lengthy: from material testing and component validation to final application, the cycle often spans "years." This characteristic of "slow pace and long verification cycles" determines that it cannot quickly ramp up like the general materials market, digesting excess capacity, and growth relies on long-termism. It rewards companies with technological patience and strategic determination rather than short-term speculators seeking quick turnover.

Profit and risk coexist: Customers' emphasis on product safety and compliance also means that once validated, customer loyalty is extremely strong, and profit margins are more secure. However, the initial investment is substantial and the risks are high.

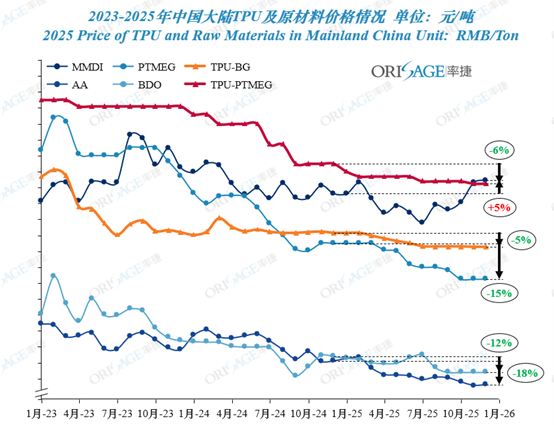

Under the dual pressure of homogeneous supply and fragmented demand, the traditional price formation mechanism in the TPU industry is failing. Market prices have lost their "anchor" based on long-term costs and value, drifting towards "sentiment pricing" dominated by short-term supply and demand emotions.

Cost transmission failure in both directions.

When raw material prices rise, TPU manufacturers generally "dare not raise prices" due to fears of losing orders and market share, forcing them to internally absorb the cost pressures, which erodes their profits. Conversely, when raw material prices drop, downstream customers "immediately press for lower prices," leveraging the buyer's market advantage to capture all the benefits of reduced costs, leaving TPU manufacturers unable to retain any profits. This situation of "unable to rise, quick to fall" locks manufacturers' profits into an extremely thin or even negative range.

Source: Shuai Jie Consulting

2. Long-term agreement failure and spot market sentiment dominance

In a stable market environment, long-term agreements serve as stabilizers to smooth price fluctuations and protect the interests of both supply and demand sides. However, in the current highly uncertain market environment, the binding force of long-term agreements has significantly weakened. Some downstream customers are more inclined to shorten procurement cycles and increase the proportion of "as-needed" purchases from the spot market to seek lower costs and more flexible supply chains. This causes sporadic transactions in the spot market and individual manufacturers' "low-price dumping" behavior to quickly amplify and become a fuse affecting the entire market sentiment. Prices are no longer based on long-term cost and value analysis but are influenced by short-term panic, gamesmanship, and speculative psychology.

3. Continuous Disturbance of New Players

The influx of homogeneous new production capacity on the supply side not only represents static excess pressure but also serves as a dynamic source of price disturbances. New entrants, in order to expand their market and secure orders, wield the most direct weapon: price. Their behavior of "low-price grabbing" continuously breaks through the psychological bottom line of the market, forcing existing manufacturers to passively follow suit, thus triggering a series of "stampede-like" price reductions. This makes it difficult for the entire industry's price level to escape the low-level cycle.

The predicament of the TPU market in China in 2025 is a systemic issue. The market has not completely failed; the vast foundational base of ordinary shoes, pipes, lines, and films, as well as the growth potential in automotive, medical, and industrial markets, indicate that the growth potential of TPU as a high-performance material remains solid. This directly leads to a more acute and essential question: why are so many TPU factories operating at a loss despite the demand not collapsing?

The core of the issue lies in the fact that, under the current industrial structure, traditional business models that rely on scale expansion and cost leadership are systematically failing.When supply becomes homogenized, demand becomes fragmented, and the price mechanism shifts towards emotional factors, simply focusing on "selling more and increasing volume" can instead amplify losses. This is the reality that the TPU industry must recognize: the issue is not whether companies are working hard enough, but whether the original logic still holds true.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories