Trump's Tariff Stick Swings at 8 European Nations! Crude Oil Rises Beyond Monthly Volatility, Plastics Futures Mostly Fall

Overnight Crude Oil Market Dynamics

International oil prices rose as geopolitical instability persists, coupled with bargain hunting by some traders. NYMEXCrude oil futures WTI crude oil futures for February delivery rose by $0.25 per barrel to $59.44, a sequential increase of +0.42%. ICE Brent crude oil futures for March delivery rose by $0.37 per barrel to $64.13, a sequential increase of +0.58%. China's INE crude oil futures for March delivery fell by 12.7 to 439.7 yuan per barrel during the day session, and rose by 6.5 to 446.2 yuan per barrel in the night session.

Market outlook

Although the situation in Iran has temporarily eased, the market remains concerned that instability has not been completely eliminated.

The number of US oil rigs has not shown significant growth, meaning output is unlikely to increase substantially. (Bullish)

Several institutions believe that the supply-side support caused by short-term geopolitical risks in mainland China should not be ignored. (Positive)

II. Macro Dynamics

1、Trump imposes tariffs on Greenland to 8 European countries, EU to hold emergency meetingTrump: Tariffs may be imposed on countries with differing views regarding Greenland; Joint statement by eight European nations: Trump's threat to impose tariffs undermines transatlantic relations and could lead to a dangerous vicious cycle; In response to Trump's tariff threats, Macron states he will request the activation of the EU's anti-coercion instrument if necessary.Several EU countries are considering imposing tariffs on €93 billion worth of US goods imported into the EU. The EU is considering holding an in-person summit on Thursday, January 22.

Federal Reserve - ① Trump: Wants Hassett to stay in his position. ②Hassett downplays criminal investigation targeting Fed Chair Powell; says he would pledge to preserve the Fed's independence if he were Fed chair. ③Fed Governor Bowman focuses on potential layoff risks, urging against signaling a pause in interest rate cuts.

3. Iran Situation: ① US Special Envoy: The United States prefers to resolve Iran tensions through diplomatic means. ② According to AXIOS: Mossad chief visits the US to discuss the Iranian issue. It is reported that the US military is deploying more defensive and offensive capabilities to the region in order to act swiftly. ③ Putin spoke with the Iranian President and Netanyahu separately about the Iran situation.

U.S. Commerce Secretary: Korean companies will face 100% chip tariffs if they don't increase investment in the U.S.

U.S.-led coalition aircraft flew over a conflict zone in northern Syria, deploying warning flares. The Syrian government and the Syrian Democratic Forces (SDF) have reached an agreement: a comprehensive ceasefire and the SDF will transfer all oil field rights to the Syrian government. All SDF forces will be integrated into the Syrian Ministry of Defense; Syrian state institutions will enter the eastern and northeastern provinces.

According to the Financial Times, Nvidia suppliers have halted production of a key component for the H200 chip.

7、Successful verification of manned spacecraft landing buffer technology marks China's first for commercial spaceflight.

Outcomes of China-Canada Economic and Trade Consultations: Specific arrangements were made for properly resolving economic and trade issues in areas such as electric vehicles, steel and aluminum products, canola, and agricultural and aquatic products.

9、The China Securities Regulatory Commission (CSRC) held its 2026 system work conference, emphasizing stability as the top priority and consolidating the market's positive momentum.

The draft of the "National Reserve Security Law of the People's Republic of China (Draft for Solicitation of Comments)" is released to the public for soliciting opinions.

The Ministry of Industry and Information Technology released management measures, for the first time including technology-based SMEs in the scope of gradient cultivation.

The General Administration of Customs: During the "15th Five-Year Plan" period, we should not only expand exports but also appropriately expand imports.

The National Robotics Standardization Technical Committee Commercial Community Service Robot Working Group was established.

A blast occurred at the steel plate factory of Baogang Steel Union, resulting in 2 deaths and 78 injured people being sent to the hospital.

15. Tongwei Co., Ltd.: It is projected that the net profit for 2025 will be a loss of 9 billion to 10 billion yuan.

III. Plastics Market Morning Update

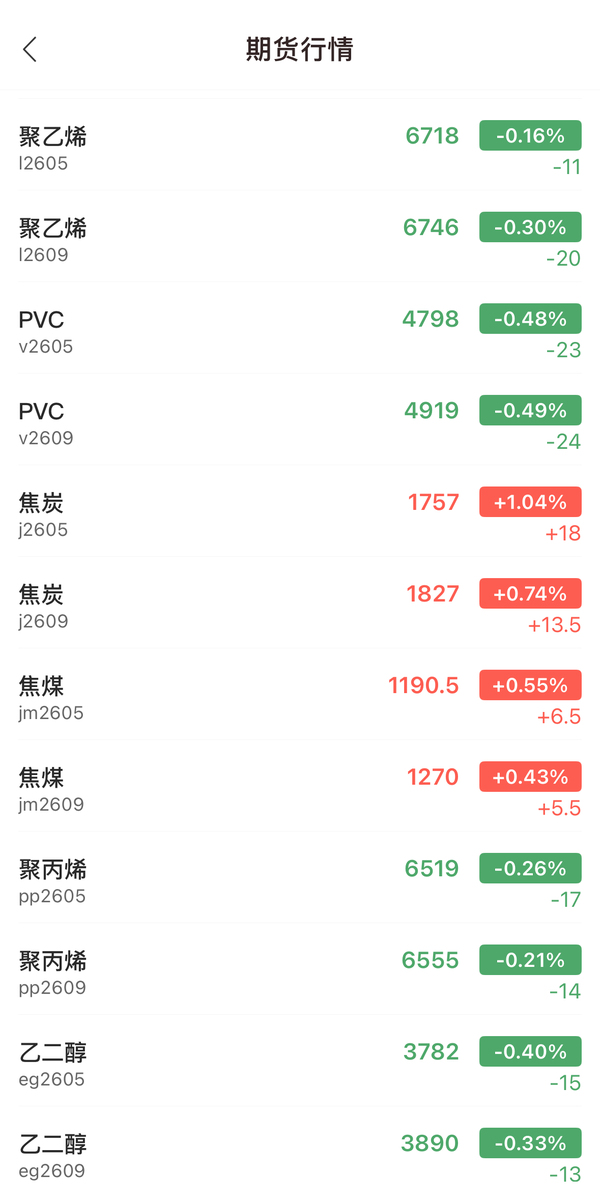

Geopolitical instability coupled with some traders buying on dips drives international oil prices higher! Overnight, domestic plastic futures main contracts saw mixed performance with more declines than gains.

The price of plastic 2609 contract is 6746 yuan/ton, a decrease of 0.30% compared to the previous trading day.

PP2605 contract is trading at 6519 yuan/ton, down 0.26% from the previous trading day.

PVC2605 contract was quoted at 4798 yuan/ton, down 0.49% from the previous trading day.

Styrene 2602 contract is trading at 7263 yuan/ton, up 1.40% from the previous trading day.

IV. Market Forecast

PE: As the Spring Festival holiday approaches, the seasonal characteristics of China's polyethylene market become increasingly prominent. Multiple factors interact, jointly dominating the market's operating rhythm. Although current market inventory pressure has eased compared to the previous period, this positive change has not effectively boosted market sentiment. The core reason is the failure to improve the weak demand situation. Downstream major application areas have entered the traditional off-season for consumption. The operating rates of industries such as packaging and agricultural films have declined significantly. Coupled with weak follow-up of terminal orders, companies' production enthusiasm has diminished. Out of consideration for operating risk avoidance, they generally adopt operating strategies such as lowering operating loads and reducing capacity release, which further exacerbates the contraction of market demand. In this context, downstream companies' wait-and-see sentiment remains strong, and pre-holiday stocking performance is far below expectations. Not only has the stocking scale been significantly reduced, but the stocking cycle has also been shortened significantly. Most companies only maintain small-scale rigid demand replenishment, and the willingness to actively increase inventory is low. At the same time, downstream companies have a strong aversion to high-priced goods, and actual transactions are mostly concentrated in the low-price range, which significantly suppresses market prices. Comprehensive judgment suggests that the polyethylene market lacks effective demand-side support in the short term and is expected to show a range-bound fluctuation pattern.

The global economic recovery slowdown has led to weak overall end-market demand. The Federal Reserve's slower-than-expected pace of interest rate cuts has further suppressed liquidity and risk appetite in the commodity market, weakening the transmission efficiency of cost-side benefits. Downstream markets are sluggish, with mainstream sectors such as woven plastics and BOPP entering their traditional off-season. Annual orders are nearing completion, and new orders are weak. Enterprises are mainly replenishing inventory for immediate needs, with low willingness to stockpile. Furthermore, with the Chinese New Year approaching, some factories have planned shutdowns for holidays, and production activities will further contract. Only niche areas such as high-end modified materials for automotive and home appliance components are maintaining relative stability, but incremental growth is limited and insufficient to drive overall demand recovery. Although the supply side has marginally contracted due to maintenance of some units, and the market has continued to destock this week, the pressure is currently under control. However, the overall pattern of ample supply has not fundamentally changed. As a result, the previous speculative atmosphere in the market has gradually cooled down, and the market has entered a stage of digesting previous gains. Although there have been consecutive rallies, the lack of demand-side volume support casts doubt on the sustainability of the gains. Overall, the core contradiction in the short-term polypropylene market remains the game between cost support and weak demand, and it is expected to exhibit range-bound fluctuations.

PVC: From the supply side, recent ex-factory prices are quoted on the basis of post-increase levels. Most PVC plants are operating at normal and high capacity. However, demand-side constraints are relatively obvious, showing a weakening trend. Furthermore, the currently high market prices and ex-factory prices are also limiting the hoarding confidence of intermediaries. The supply and demand rhythm is not favorable before the holiday. Under the guidance of external policies and news, short-term PVC spot prices may return to their own fundamentals, exhibiting a weak and slight downward trend before the holiday.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories