Two Departments Issue Action Plan to Stabilize Growth in Electronic Information Manufacturing Industry! Oil Prices Continue to Fall, Futures Main Contracts Slightly Rise

1. Overnight Crude Oil Market Dynamics

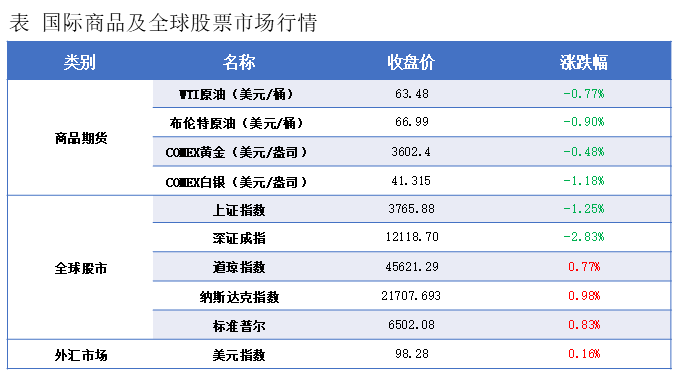

American BusinessCrude oil inventoryGrowth, coupled with market concerns that OPEC+ may initiate a new production increase plan, led to a decline in international oil prices. NYMEXCrude Oil FuturesThe October contract closed at $63.48 per barrel, down $0.49, a decrease of 0.77% compared with the previous period; ICE Brent crude oil futures November contract closed at $66.99 per barrel, down $0.61, a decrease of 0.90% compared with the previous period.

Market Outlook

Crude oil prices continued to decline on Thursday. On Wednesday, oil prices plunged, erasing gains from the previous two days, due to concerns that OPEC+ might continue to increase production. On Thursday, prices continued to fall out of inertia, with the night session mainly showing a tug-of-war pattern. However, as evidenced by the intraday back-and-forth that ultimately resulted in a candlestick with a lower shadow, the crude oil market remains in a stalemate without clear signs of a breakout. Investors are waiting for OPEC's monthly meeting on Sunday.

Survey data shows that OPEC's oil production in August increased by 360,000 barrels per day compared to July, reaching 27.84 million barrels per day, marking the largest production increase in five months.Following the news of increased production on Wednesday, the market is paying closer attention to the final capacity discussions at the OPEC+ monthly meeting scheduled for this Sunday. On Thursday afternoon, Russian Deputy Prime Minister Novak stated that it is currently not on the agenda for eight OPEC+ countries to further increase oil production. The current market conditions and forecasts will be considered, and a decision will be made during the meeting. From previous plans and the news from meetings in recent months, it seems that OPEC+ is likely to be cautious about continuing to increase production. From the trend of oil prices, the market is also cautious about this. Currently, the market has completely different interpretations of the impact of OPEC+ production increases from different perspectives. One side, represented by the EIA and the International Energy Agency, believes that the crude oil market will face severe supply surplus pressure in the near future, thus leading to a significant decline in oil prices. This judgment is the mainstream view in the market, and so far, oil prices have shown relatively strong resistance to decline. However, there is still enough time within the year to verify this judgment. On the other hand, optimists believe that after four months of accelerated production increases by OPEC+, the crude oil market has not shown exaggerated surplus pressure, and the subsequent surplus pressure might be overstated. A typical signal is that countries like Saudi Arabia, although continuously increasing production, have also significantly raised official prices for two consecutive months, indicating strong market demand and that Middle Eastern oil is not lacking buyers. This supports OPEC's forecast that there is no severe supply surplus pressure in the crude oil market. These two perspectives lead to completely different outlooks for the market and have resulted in intense competition. Although overall, the bears have a slight advantage, they have not formed an overwhelming dominance. This has resulted in oil prices maintaining a very complex oscillation pattern with a slow downward shift in focus since July.

According to EIA data, the accumulation of crude oil inventories in the U.S. for the week ending August 29 exceeded the earlier API inventory figures, with a significant increase of over 2 million barrels in Cushing inventories. In terms of refined products, diesel inventories increased while gasoline inventories decreased, overall data corroborated the API figures.

Trump stated his commitment to promoting a peace agreement between Russia and Ukraine but said that both sides are not yet ready. Putin responded to the Russia-Ukraine issue while in China, saying that if Zelensky wants to talk, let him come to Moscow to see me; the Ukrainian side has declared this unacceptable. Currently, the crude oil market still faces a complex situation intertwined with geopolitical, macroeconomic, and supply-demand factors. A strong guiding factor is needed to dominate the market trend. The OPEC meeting on Sunday is a potential factor. Before that, it is necessary to remain patient. For opportunity selection, it is mainly recommended to short on rallies, pay attention to timing, and participate cautiously.

2. Macroeconomic Developments

Chinese President Xi Jinping held talks with Kim Jong Un, General Secretary of the Workers' Party of Korea and Chairman of the State Affairs Commission. Xi Jinping emphasized that China will, as always, support North Korea in pursuing a development path suited to its national conditions and in continuously opening up new prospects for its socialist cause. On the Korean Peninsula issue, China has always maintained an objective and impartial stance and is willing to continue strengthening coordination with North Korea to do its utmost to safeguard peace and stability on the Korean Peninsula.

The General Office of the State Council has issued the "Opinions on Unlocking the Potential of Sports Consumption and Further Promoting the High-Quality Development of the Sports Industry," which proposes 20 key measures in 6 areas. The goal is that by 2030, a group of sports enterprises and events with global influence will be cultivated, the development level of the sports industry will be significantly enhanced, and the total scale will exceed 7 trillion yuan.

The two departments issued an action plan for stabilizing the growth of the electronic information manufacturing industry, with the main expected targets for 2025-2026 being: an average growth rate of around 7% in the added value of the computer, communication, and other electronic equipment manufacturing industries above designated size. Including related fields such as lithium batteries, photovoltaics, and component manufacturing, the average annual revenue growth rate of the electronic information manufacturing industry is expected to reach over 5%.

Shanghai has launched the "Keyan" Return Plan (Pilot), which offers eligible female science and technology talents a grant of 50,000 yuan after childbirth. The plan is currently in the pilot phase, with future plans to expand its scope to support female science and technology talents who have temporarily left their positions due to childbirth in returning to the research field.

The White House announced that U.S. President Trump has signed an executive order to officially implement the U.S.-Japan Trade Agreement. The executive order will specify tariff adjustment measures to ensure that Japanese imports previously subject to higher tariffs will not be double-taxed, while products with a previous tariff rate below 15% will be adjusted to the new rate. In addition, the White House stated that Japan is working to accelerate the implementation of its plan to increase its purchase of U.S. rice by 75%.

The U.S. trade deficit in July surged 32.5% month-on-month to $78.3 billion, exceeding market expectations of $75.7 billion and hitting a four-month high. Total imports in July soared by 5.9% to $358.8 billion, while total exports edged up by 0.3% to $280.5 billion.

The U.S. government has criticized Norway's sovereign wealth fund, which manages assets worth $2 trillion, for its recent divestment from Caterpillar Inc., calling it "deeply troubling." A spokesperson for the U.S. State Department stated that they are engaging in direct communication with the Norwegian government on this issue.

The U.S. Department of Justice has launched a criminal investigation into Federal Reserve Board Governor Cook and has issued a subpoena. As President Trump attempts to influence the Federal Reserve and push for interest rate cuts, investor concerns about the Fed's independence are intensifying. The JPMorgan team stated that investors are preparing for potential inflation increases. Goldman Sachs analysts believe that the "growing concerns" over the Fed's credibility are triggering a "significant tail risk."

In August, the U.S. ADP employment increased by nearly 54,000, significantly below the market expectation of 65,000. After revision, July's figure was 104,000. Following the release of the data, the market has almost fully priced in a rate cut by the Federal Reserve in September. The number of initial jobless claims in the U.S. increased by 8,000 last week to 237,000, marking the highest level since June, with expectations at 230,000.

According to the latest data from Challenger, U.S. companies announced plans to add 1,494 new jobs in August, the lowest number for the same period since statistics began in 2009. Meanwhile, the number of announced layoffs soared to nearly 86,000. Excluding the impact of the pandemic, this is the highest figure for the same period since 2008.

In August, the U.S. ISM Services PMI was 52, marking the fastest expansion in six months, mainly driven by the strongest growth in orders in nearly a year. The new orders index jumped 5.7 points to 56, the largest increase since last September.

3. Early Morning Dynamics of the Plastic Market

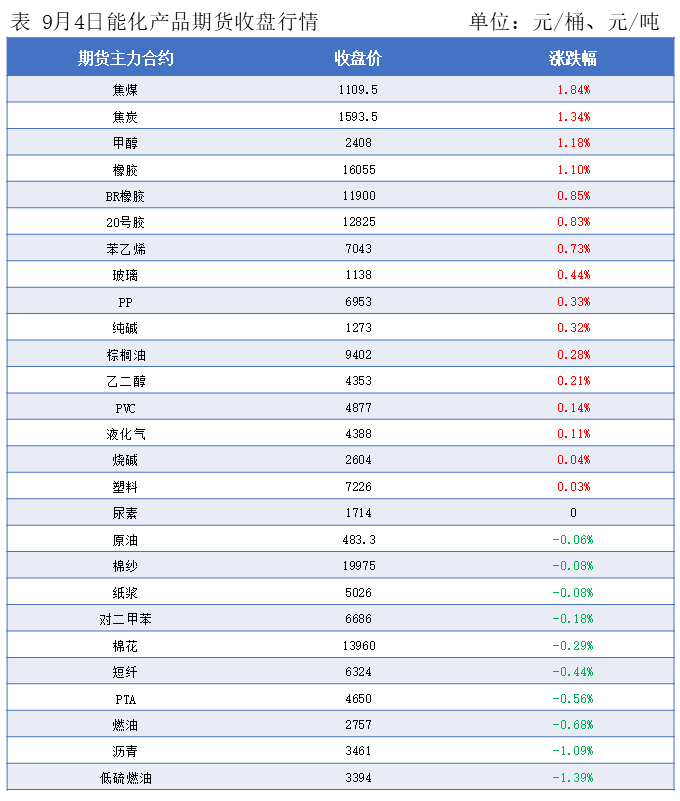

Oil prices have fallen for consecutive sessions! Overnight, the main contract of domestic plastic futures saw a slight increase.

The plastic 2601 contract was quoted at 7,226 yuan/ton, up 0.03% from the previous trading day.

The PP2601 contract was quoted at 6,953 yuan/ton, up 0.33% from the previous trading day.

The PVC2601 contract closed at 4,877 yuan/ton, up 0.14% compared to the previous trading day.

The styrene 2510 contract was quoted at 7,043 yuan/ton, up 0.73% from the previous trading day.

4. Market Forecast

The focus of the spot market price for PE continues to shift downward, with overall stable sentiment among market participants. Traders face pressure from costs and market expectations, resulting in relatively limited concessions. Downstream companies mainly purchase on a need-basis for restocking, with low enthusiasm. This aligns with the traditional off-season characteristics in downstream sectors such as PE films and pipes, where the release of terminal orders is insufficient, maintaining low operating rates and providing weak support for raw material procurement. It's important to note that the market is gradually moving towards the traditional peak demand season of "Golden September," and some market participants expect a recovery in downstream demand. However, based on the current situation, this expectation has not yet translated into actual purchasing behavior, and its boosting effect on the market has yet to manifest. Considering the overall supply-demand pattern and market expectations, it is anticipated that the polyethylene market may continue to maintain a weak consolidation pattern in the short term.

PP: The current domestic polypropylene market is influenced by a mix of bullish and bearish factors. On the bullish side, support comes from the continuation of U.S. sanctions policies against oil-producing countries and uncertainties in geopolitical situations that bolster the cost side. On the bearish side, pressure arises from OPEC+'s insistence on increasing production, coupled with poor global economic performance that suppresses overall demand expectations. On the supply side, Ningxia Baofeng's PP plant is scheduled to halt for maintenance today, with an expected maintenance period of 20 days, which may cause some disturbances in local supply in the short term. On the demand side, the pace of recovery remains slow, and it has yet to provide effective support to the market. It is worth noting that the market is gradually approaching the traditional "Golden September" demand peak season, and some participants have expectations for improved future demand. However, judging from the current progress of downstream recovery, the peak season expectations have not yet translated into substantial purchasing momentum, and the market's boost effect is not yet evident. Considering the mix of bullish and bearish factors and the current market situation, it is expected that the polypropylene market may maintain a narrow range consolidation in the short term, with traders mainly focusing on stable pricing to promote transactions. The room for actual price negotiations may remain, and continued attention is needed on the pace of downstream demand recovery and the realization of "Golden September" expectations.

PVC: The spot market in various regions has started to adopt a wait-and-see attitude at low levels, with the spot market undergoing small and steady adjustments. One-price quotations from traders in different regions have changed little, but higher-priced offers are difficult to close deals, resulting in weak spot market transactions. On the international front, crude oil prices have fallen, erasing the gains from the previous trading day, as OPEC+ is considering increasing oil production again at its meeting this weekend. Overall, the spot market prices are expected to continue to fluctuate within a narrow range.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Four Major Chemical New Material Giants Sell Off and Shut Down Again!

-

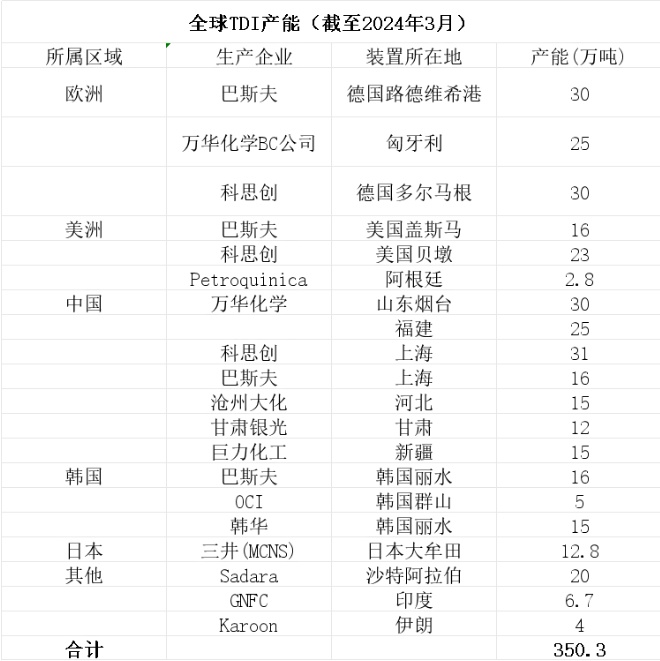

Covestro faces force majeure!

-

DuPont to Spin Off Nomex and Kevlar Brands for $14.4 Billion: Is Aramid Fiber Still Attractive?

-

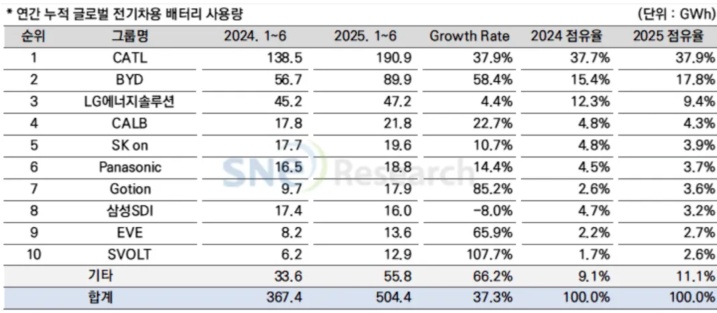

Massive Retreat of Japanese and Korean Battery Manufacturers

-

Napan Unveils Thermoplastic Composite Three-in-One Power System Solution, Battery Cover Weight Reduced by 67%