U.s.-russia talks on russia-ukraine peace plan last nearly 5 hours; oil prices decline amid wait; plastic futures weighed down

1. Overnight Crude Oil Market Dynamics

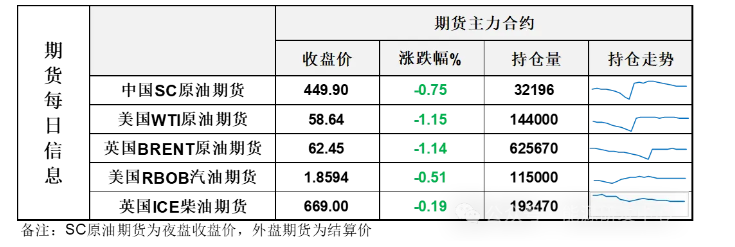

On December 2nd, concerns about long-term oversupply in the market persist, and the developments of the Russia-Ukraine situation continue to be weighed, leading to a decline in international oil prices. NYMEX crude oil futures for the January contract fell by $0.68 per barrel to $58.64, a decrease of 1.15% compared to the previous period. ICE Brent crude futures for the February contract fell by $0.72 per barrel to $62.45, a decrease of 1.14% compared to the previous period. China's INE crude oil futures for the 2601 contract fell by 0.1 to 453.3 yuan per barrel, with the night session dropping 3.4 to 449.9 yuan per barrel.

Market Outlook

On Tuesday, oil prices significantly retreated. Trump announced that he would make an important announcement at midnight, keeping the market in anticipation, but the content of the announcement ultimately left the market somewhat indifferent. Meanwhile, the market remained in a wait-and-see stance before the results of the Russia-Ukraine peace talks between the US and Russia emerged. In the afternoon, the Middle East physical window showed that premiums for benchmark spot prices generally fell, reflecting that the crude oil market still faces oversupply pressure amid recent geopolitical developments. In the early hours of Wednesday, API data showed that inventories of crude oil and gasoline increased. Although during the night session, oil prices briefly rebounded after a sharp drop due to Putin's announcement that he would take retaliatory measures against Ukrainian facilities following attacks on Black Sea oil tankers and ports, ultimately, oil prices closed lower after the tug-of-war.

Currently, the oversupply in the crude oil market remains the fundamental backdrop, and the oil market does not have the conditions for a reversal. However, peace talks are still the short-term focus of the market, which also involves geopolitical risks related to Russia and Ukraine attacking each other's energy facilities. Although all parties are trying to express positive rhetoric regarding the progress of the talks, it is clear that there are still significant differences in their demands. The likelihood of reaching a peace agreement in the short term remains low, but whether the negotiation process will trigger fluctuations in oil prices is a possibility. It is expected that oil prices will continue to exhibit a volatile tug-of-war under pressure, so it is important to strengthen risk control and manage the rhythm carefully.

Section 2: Macroeconomic Market Trends

Trump will announce the candidate for Federal Reserve Chair early next year.Positive implications suggest Hassett as the next Chairman of the Federal Reserve.

Putin threatens to cut off Ukraine's maritime routes.Pledge to strengthen attacks on Ukrainian facilities and vessels.Putin said.Unable to accept Europe's modifications to the Russia-Ukraine "peace plan."If Europe wants to go to war, Russia is ready now.Putin held a meeting with the US envoy that lasted nearly five hours.The Russian side stated that the meeting was fruitful, and both parties agreed not to disclose the substantive content of the talks.

The OECD maintains its forecast for global economic growth for this year and next, and expects the interest rate cutting cycle in major economies to end next year.

4、Amazon launches custom AI chip Trainium3, Nvidia faces a new round of offensive.

5、The People's Bank of China net injected 50 billion yuan through open market operations in November.

On December 2, 2025, local time, Wang Yi, a member of the Political Bureau of the Central Committee of the Communist Party of China and Director of the Central Foreign Affairs Office, co-hosted the 20th round of China-Russia strategic security consultations in Moscow with Nikolai Patrushev, Secretary of the Russian Security Council. They conducted comprehensive and in-depth discussions on major issues concerning the strategic security interests of both countries, reaching new consensus and enhancing strategic mutual trust. Both sides agreed to fully implement the important consensus reached by the two heads of state in the field of strategic security and to promote the strategic cooperation between the two countries to a higher quality. Patrushev emphasized that Russia firmly adheres to the One China principle and resolutely supports China’s positions on Taiwan, Tibet, Xinjiang, and Hong Kong issues. He expressed a willingness to work with China to implement the consensus of the two heads of state, strengthen bilateral cooperation, and jointly promote the establishment of a more just and reasonable multipolar world. The two sides conducted strategic consultations on issues related to Japan, reaching a high level of consensus, and agreed to firmly safeguard the outcomes of World War II achieved through sacrifice and blood, resolutely resist any erroneous statements and actions that seek to rewrite the history of colonial aggression, and firmly counter the resurgence of fascism and Japanese militarism.

3. Plastic Market Dynamics

Traders assess the risks posed by Ukraine's drone attacks on Russian energy facilities, the situation in Venezuela, and mixed prospects for U.S. fuel inventories, leading to a pullback in international oil prices near a two-week high, while plastic futures face downward pressure.

Plastic 2601 contract is quoted at 6817 yuan/ton, down 0.06% compared to the previous trading day.

The PP2601 contract is quoted at 6398 yuan/ton, down 0.14% from the previous trading day.

The PVC2601 contract is quoted at 4546 yuan/ton, down 0.33% from the previous trading day.

Styrene contract 2601 is quoted at 6585 yuan/ton, up 1.23% compared to the previous trading day.

Section 4: Today's Market Forecast

PE: In the short term, although the recent strengthening of the futures market has led to a warming trend in the prices of some products, suppliers are still focused on inventory reduction as their core business strategy. They actively reduce factory prices and increase promotional efforts to clear inventory. Meanwhile, the consumption side remains weak, and overall demand in downstream industries is declining. Considering the supply and demand dynamics, the short-term price of China's polyethylene market is likely to fluctuate weakly. Overall, it is expected that today's polyethylene price will fluctuate within the range of 20-70 yuan/ton.

PP: Recently, the increase in influenza cases has led to a rise in mask usage, driving up the demand for non-woven fabrics, providing a certain degree of support. Additionally, the increase in crude oil prices has added support on the cost side. Intermediaries are tentatively raising their prices, but the downstream still purchases based on demand, with low acceptance of high-priced products. It is expected that the market will fluctuate and consolidate within the narrow range of 6300-6500 yuan/ton in the short term.

PVC: The scale of maintenance by PVC production enterprises has weakened, and production and operating rates are expected to continue increasing on a month-on-month basis. The industry faces increased inventory pressure, domestic demand enthusiasm is expected to weaken in the long term, and recent performance in foreign trade exports has been underwhelming. The spot market fundamentals continue to operate under pressure. From the cost perspective, expectations are rising, with carbide ethylene prices remaining firm and caustic soda margins declining, both contributing to an enhanced trend of bottom cost support. Short-term sentiment is positive due to external policy expectations, providing some support to the market. The market price is expected to be generally stable within a weak range in the near term, with the PVC spot market price in East China for carbide-based type V expected to fluctuate in the range of 4450-4550 yuan/ton.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

[Today's Plastics Market] General Materials Weakly Fluctuate, Engineering Materials Steadily Rise

-

New Breakthrough in Domestic Adiponitrile! Observing the Rise of China's Nylon Industry Chain from Tianchen Qixiang's Production

-

Daily Review: Polyethylene Prices Under Weak Consolidation, Sellers Face Significant Pressure to Move Inventory