Wanhua Battery Holdings Anada Behind: Titanium Dioxide Loses Ground, Iron Phosphate Under Pressure, How to Break the Game?

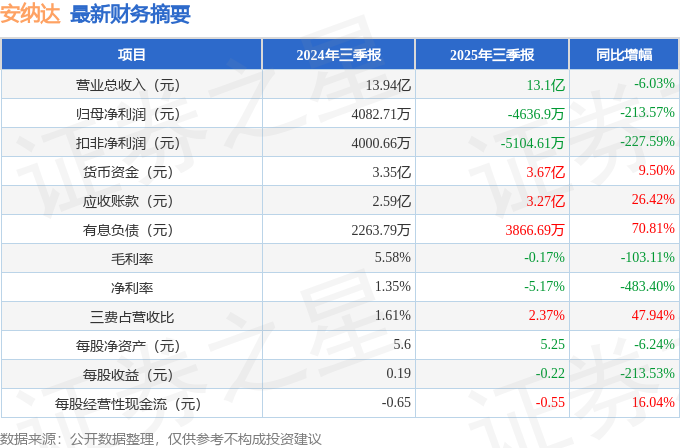

Recently, Anhui Annada Titanium Co., Ltd. (stock code: 002136.SZ) released its third-quarter financial report. The data shows that from January to September 2025, the company achieved a cumulative operating income of 1.31 billion yuan, a decrease of 6.03% compared to the same period last year. The net profit attributable to shareholders of the listed company was -46.369 million yuan, a significant decline from the profit of 40.8271 million yuan in the same period last year, turning from profit to loss.

Image source: Securities Star

In the third quarter alone, the company's operating revenue was 434 million yuan, an increase of 4.52% year-on-year; however, the net profit for the quarter still recorded a loss of 20.1012 million yuan, marking the second consecutive quarter of losses for Anada.

01 Profitability has declined across the board, with the main business facing significant pressure.

From the perspective of profit indicators, Anada's profitability situation in the first three quarters of 2025 is not optimistic. The net profit after deducting non-recurring gains and losses was -51.0461 million yuan, a year-on-year decline of 227.59%. This figure is even lower than the total net profit, indicating that the company's main business profitability has weakened, and the losses mainly stem from daily operations rather than occasional factors.

The gross margin is -0.17%, a decrease of 103.11% compared to the same period last year; the net profit margin is -5.17%, a year-on-year decline of 483.4%. In addition, the earnings per share is -0.2156 yuan, and the weighted average return on equity is -4.03%, a decrease of 7.45 percentage points compared to the same period last year. Although the company received 6.03 million yuan in government subsidies recorded as other income, which mitigated the losses to some extent, it did not reverse the overall downward trend in profits.

In terms of cash flow, the net cash flow from operating activities was -118 million yuan. Although it has improved compared to the same period last year, it is still negative, reflecting that the company faces certain pressure in fund recovery and maintaining daily operations. It is noteworthy that the company's accounts receivable is relatively large, accounting for as much as 2906.21% of the latest annual report's net profit attributable to shareholders, which may pose a certain risk of bad debts.

Both major business segments are facing challenges, with falling product prices dragging down gross profit.

Anada's business mainly consists of two segments: titanium dioxide and iron phosphate.

Image source: Anada

In the first half of 2025, titanium dioxide products achieved operating revenue of 575 million yuan, accounting for 65.61% of the company's total revenue, but the gross profit margin was only 3.05%, a decrease of 8.49 percentage points compared to the same period last year.

The company stated that the decrease in the selling price of titanium dioxide was the main reason for the reduction in gross profit. In the first half of 2025, the titanium dioxide market experienced a trend of rising first and then falling. There were three rounds of price increases from the beginning of the year to March, but since late March, demand weakened, and prices continued to decline, hitting a low point for the first half of the year by June.

The iron phosphate business is operated by the subsidiary Tongling Nayuans. In the first half of the year, this business generated operating revenue of 258 million yuan, a year-on-year decrease of 35.09%, with a net profit of -29.9 million yuan and a gross margin dropping to -6.23%. The company explained that the iron phosphate business made provisions for inventory impairment, with asset impairment losses reaching -9.6097 million yuan. Industry data shows that the price of iron phosphate has dropped from 15,000–18,000 yuan/ton at the beginning of 2023 to 10,000–11,500 yuan/ton in 2025, falling below the cash cost line for some enterprises, reflecting the current situation of overcapacity and intense market competition in the industry.

Source of the image: Doubao AI

The industry environment is challenging, and companies are actively seeking strategies to respond.

Anada is facing cyclical downward pressure in both the titanium dioxide and iron phosphate industries. Titanium dioxide, as a traditional chemical product, is widely used in coatings, plastics, and other fields, with its demand closely linked to the prosperity of the real estate and infrastructure sectors. In recent years, the slowdown in domestic macroeconomic growth and adjustments in the real estate market have suppressed the demand for titanium dioxide. Meanwhile, the issue of industry overcapacity is prominent, leading to intense price competition among enterprises.

Iron phosphate, as a precursor material for lithium battery cathodes, experienced an investment boom during the rapid development period of the new energy industry. However, with many companies expanding production, market supply has significantly increased, leading to a continuous decline in prices. Although the demand for iron phosphate in the end markets for new energy vehicles and energy storage continues to grow, the rapid expansion on the supply side has compressed the overall profit margins in the industry.

Faced with operational pressure, Anada stated in its financial report that it will "closely monitor changes in national policies and industry development trends, enhance its ability to assess market and industry changes, and actively optimize product structure." The company's general manager, Zhang Rushan, has publicly emphasized focusing on enhancing the industrial chain, developing a circular economy, and advancing equipment intelligence.

The significant increase in construction in progress and prepaid accounts in the financial data also indicates that the company is intensifying its investment efforts, attempting to cope with the industry downturn through technological upgrades and capacity adjustments.

Wanhua Battery Takes Over, May Welcome New Opportunities

It is worth noting that there may be a change in the controlling shareholder of Anada. In 2024, the company announced that its controlling shareholder, Tonghua Group, signed a share transfer agreement with Wanhua Battery. Upon completion of the transaction, Wanhua Battery will become the new controlling shareholder of Anada, and the actual controller will change to the State-owned Assets Supervision and Administration Commission of Yantai City, Shandong Province.

As of the end of the third quarter of 2025, Wanhua Chemical Group Battery Technology Co., Ltd. has held a 15.20% stake in Anada. As a leading enterprise in the domestic chemical industry, Wanhua Chemical possesses significant advantages in funding, technology, management, and industrial chain integration. The entry of its subsidiary, Wanhua Battery, is expected to provide resource support to Anada, helping the company enhance its competitiveness in the titanium dioxide and iron phosphate businesses, especially in expanding a broader market space in the field of new energy materials.

Anada's performance in the first three quarters of 2025 reflects the severe challenges the company faces against the backdrop of a cyclical downturn in the industry. The decline in titanium dioxide prices, oversupply of iron phosphate capacity, and intensified competition in the overall chemical and new energy sectors have collectively led to a decline in the profitability of the company's main business. Although the company is attempting to transform by controlling costs and increasing investment, it is still difficult to offset the negative impact of the market environment in the short term.

With the imminent takeover by Wanhua Battery, Anada is expected to leverage the new controlling shareholder's industrial resources and management experience to optimize its product structure and enhance operational efficiency. In the medium to long term, the industry's downturn also presents an opportunity for companies to adjust their strategies and strengthen their foundations. Whether Anada can seize the opportunity during the industry's recovery will depend on the effectiveness of its structural adjustments and its ability to establish a sustainable competitive advantage in the fields of titanium dioxide and new energy materials.

Edit: Lily

Source of materials: Titanium News, Qian Tu Online, Securities Star, Sina, etc.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

India's Q3 Smartphone Shipments Rise 3%; Japanese Mold Factory Closures Surge; Mercedes-Benz Cuts 4,000 Jobs

-

Dow To Restart Pe Units 5 And 7 This Week, Recovery Date For Unit 6 Remains Undetermined In The United States (US)

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Ascend's Restructuring Plan Approved! Jwell Launches Global Acceleration Plan; Nexperia Chip Crisis Threatens Global Auto Production

-

European TDI Soars Due To Covestro Plant Shutdown