Wanhua's Technological Upgrade Lands at Year-End, Ethane Feedstock Welcomes Another Giant Entry!

Additionally, SKGC plans to cooperate with SK Gas to build an integrated supply chain, with the latter responsible for procurement, transportation, and price negotiations across the entire North American region, to ensure price competitiveness and supply stability.

Ulsan production base under SK Group

The autonomous supply chain is a top priority.

Currently, some Asian petrochemical giants, such as domestic companies Satellite Chemical and Wanhua Chemical, have taken the lead in laying out ethane raw materials, driving a regional transformation in raw material structure. Among them, Wanhua Chemical's Yantai industrial park's ethylene phase I unit is expected to complete the conversion from propane feedstock to ethane feedstock by the end of 2025. According to Wanhua, its raw material costs are expected to decline significantly.

In order to establish a more cost-effective structure, companies need to overcome multiple challenges such as streamlining import processes and coordinating transportation, based on the supply chain setup experiences of these two industry giants.

Furthermore, it is particularly noteworthy that currently, on a global scale, ethane production areas are mainly concentrated in the United States and the Middle East. According to relevant data from 2024, the combined capacity of these two regions accounts for approximately 85% of the global total ethane production, with the United States being the dominant player. Among them, the export capacity involved in international trade almost entirely comes from the United States. This pattern results in a "unipolar" situation in the global ethane supply landscape: with a single trade route, any geopolitical or policy disturbance can directly amplify supply chain risks.

Recently, the import and export turmoil that troubled the Sino-U.S. energy trade market serves as an example.

In fact, the "resource game" behind the previous ethane export controls also involves another scarce resource—rare earths. However, as the approval process for related export licenses gradually resumes, the confrontation between China and the United States is also gradually easing.

From the perspective of the supply chain, whether it is ethane or rare earths, the core issue lies in the vulnerability of a single source. Currently, when domestic companies in our country are building ethane supply chains, they are intentionally pursuing diversification. This can be seen in the case of Kuwait's Petrochemical Industries Company investing in Wanhua Chemical (Yantai) Petrochemical Co., Ltd. as an example. In the realm of rare earths, Europe and the United States are following the same logic. Recently, Solvay announced that it expects to start supplying heavy rare earths, which have been included in China's control list, by 2026.

The root cause of the crisis at Korean Petrochemical.

The South Korean petrochemical industry is highly dependent on imported naphtha. As international oil prices rise, its cost disadvantage becomes increasingly apparent. The decision by SKGC to change some of its raw materials is closely related to the country's traditional business model of "naphtha cracking - ethylene export."

At the same time, facing the dual pressure of continuous expansion from China, the Middle East, and India, the profit margins of Korean petrochemical companies have been further squeezed. As a result, in the second half of this year, 10 large Korean petrochemical companies, including SKGC, GS Caltex, LG Chem, and Lotte Chemical, unanimously signed a business restructuring agreement, aiming to jointly reduce their naphtha cracking capacity by 25%.

What added insult to injury was that American oil giant Chevron suddenly announced in early September a significant increase in its investments in South Korea, focusing on the refining and petrochemical sectors. This decision was quickly met with public skepticism, questioning whether it was a "low-entry" strategy aimed at further gaining control over South Korea's pillar industries during a period of industrial downturn.

Chevron has made significant investments in South Korea and holds a 50% stake in GS Caltex, the country's second-largest energy company. GS Caltex operates one of the world's largest refineries in Yeosu, which is also the largest refinery in Chevron's system, with a crude oil processing capacity of 800,000 barrels per day.

In addition, Chevron is involved in local petrochemical and natural gas businesses through GS Caltex and Chevron Korea, providing commercial and operational support for its upstream and midstream projects.

In other words, South Korea's strategic pillar industry seems to be experiencing an awkward situation of "when it rains, it pours."

Overall, South Korea's petrochemical industry, which began developing in the 1960s and experienced rapid growth in the 1990s, has become the third largest in Asia and the fifth largest globally by 2024. However, in recent years, this traditional advantage has been continuously surpassed by neighboring countries. In September 2025, according to the "2025 Second Quarter Business Analysis" report released by the Bank of Korea, the sales revenue of South Korea's petrochemical industry has decreased by 7.8% year-on-year, marking four consecutive quarters of negative growth since the third quarter of 2024.

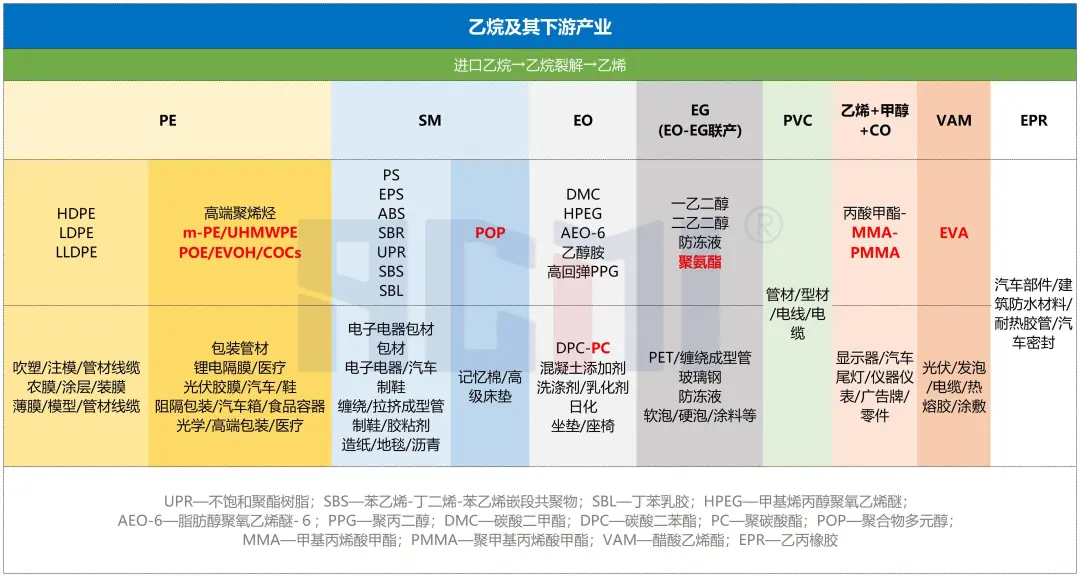

Additionally, it is worth mentioning that returning to the aforementioned cost strategy of changing from petroleum naphtha to ethane, although this raw material has the advantages of being low-cost, green, and low-carbon, the structural risk of its single cracking product cannot be easily ignored.

In addition to ethylene, the products from ethane cracking produce very little propylene and heavier compounds, while generating a large amount of hydrogen. In the long run, the development space for the downstream industry chain is relatively narrow, and the ability to withstand market fluctuations is weak. However, if the by-product hydrogen can be optimized and utilized effectively, it may further enhance the overall profitability of the ethane route.

Ethane-Ethylene-New Materials Industry Chain

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

[Today's Plastics Market] General Materials Weakly Fluctuate, Engineering Materials Steadily Rise

-

New Breakthrough in Domestic Adiponitrile! Observing the Rise of China's Nylon Industry Chain from Tianchen Qixiang's Production

-

Daily Review: Polyethylene Prices Under Weak Consolidation, Sellers Face Significant Pressure to Move Inventory