Wanwei Hi-Tech H1 PVA Optical Film Sales Surge 120.58% YoY, Domestic PVA Optical Film Gains Traction?

PVA optical thin filmPVA optical film is the core material of polarizers, accounting for about 12% of its raw material costs. As the global LCD production capacity continues to shift towards China, the domestic polarizer market is becoming increasingly competitive, and there is a growing demand for the localization of upstream raw materials. According to relevant data, by 2025, the actual demand for polarizers in China, based on production capacity, will be approximately 300 million square meters, which translates to nearly 200 million square meters of PVA optical film.

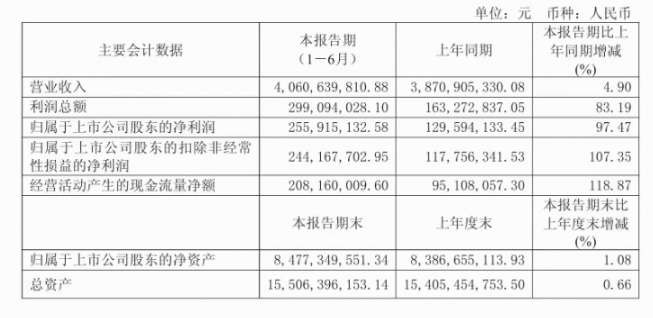

Recently, Wanwei High-Tech, the absolute leading company in the domestic PVA optical film sector, released its 2025 semi-annual report. According to the report, in the first half of 2025, Wanwei High-Tech achieved a total operating revenue of 4.061 billion yuan, representing a year-on-year increase of 4.9%. The net profit attributable to shareholders of the listed company was 256 million yuan, up 97.47% year-on-year; the net profit attributable to shareholders of the listed company after deducting non-recurring gains and losses was 244 million yuan, a year-on-year increase of 107.35%.

During the reporting period, the production of PVA optical films reached 4.2049 million square meters, representing a year-on-year increase of 56.72%; sales amounted to 4.3023 million square meters, a year-on-year increase of 120.58%; sales revenue reached 48.6464 million yuan, a year-on-year increase of 100.98%.

In terms of polarizer production and sales, according to the semi-annual report, Anhui Wanyi Gaoxin (Hefei Deruige) achieved an actual production of 1.4746 million square meters in the polarizer product field in the first half of 2025, an increase of 209.30% compared to the same period last year. Sales reached 1.4884 million square meters, an increase of 101.79% compared to the same period last year, with sales revenue of 56.5757 million yuan, an increase of 117.83% compared to the same period last year.

In fact, due to the high technical content of PVA optical film technology, the global market is mainly monopolized by Kuraray and Sekisui Chemical, with Kuraray accounting for about 80% of the global capacity and monopolizing the PVA raw material market for films. Currently, domestic companies that can independently produce PVA optical films are limited to Wanwei High-Tech, Chuanwei Chemical, Chongqing Spectrum, and Taiwan Changchun, with a relatively low market share.

According to Zhang Qianlei, Deputy Director of the PVA Branch Factory of Anhui Weigao New Materials, speaking at the 7th Pola Film Industry Conference by Shiyin, the current domestic PVA optical films face issues such as low stretching ratios in downstream applications, as well as defects like striations, curling, and scattered spots. The root cause of the insufficient product performance lies in the multi-scale structure and compositional non-uniformity. To solve the "bottleneck" problem of PVA optical films, it is necessary to comprehensively overcome the technical barriers across the entire chain of resin, process, and equipment.

In response, Wanwei High-Tech has actively promoted the integration of industry, academia, and research, establishing multiple relevant research platforms. At the PVA optical film raw material level, the company has built a production line with an annual capacity of 5,000 tons of optical-grade PVA resin, achieving mass production of TFT-grade PVA optical resin with various indicators comparable to foreign products. Meanwhile, Wanwei High-Tech has actively carried out R&D related to PVA optical film technology, such as in-situ research methods for structural regulation during processing, obtaining the regulation rules of PVA optical film process-structure-performance, and research on controlling the uniformity of the condensed-state structure of PVA optical films. At present, the company has successfully developed TFT-LCD PVA optical films with thicknesses ranging from 30 to 75 microns and a width of 3.4 meters.

In addition, Wanwei High-Tech is actively developing high-performance PVA optical film products in areas such as thin-type and high-transparency films. The company is conducting trial runs for domestically produced PVA optical film production lines and planning the construction of ultra-wide PVA optical film production lines to support domestic polarizer production lines with widths over 2 meters. The production capacity is expected to reach more than 60 million square meters by 2027.

According to the semi-annual report, during the reporting period, Wanwei High-tech made continuous breakthroughs in PVA optical film casting technology, breaking the long-standing foreign monopoly on PVA optical films, a core material in China's liquid crystal display industry. The company has achieved stable production of 7 million square meters per year of wide-width PVA optical films, supplying the market in batches. Additionally, its newly established project for an annual output of 20 million square meters of wide-width PVA optical films for TFT polarizers is scheduled to be put into production in the second half of the year.

In addition, to achieve investment savings and autonomy in core equipment, Wanwei High-Tech is actively promoting the localization of major equipment. Following the localization of large-size ultra-mirror casting rolls for PVA optical film, the company is also working on the localization of major equipment for PVA optical film production lines, such as extruders and fully automatic winding machines.

For future industrial development, Anhui Weigao New Materials Co., Ltd. has stated that it will make efforts from multiple dimensions to continuously improve production efficiency: by implementing technological transformations and building digital factories, effectively enhancing the level of production automation and intelligence, reducing manual intervention, and ensuring efficient and stable operation of production lines. The company will also optimize from raw material procurement, production process control to product quality inspection, aiming to reduce production costs and improve production efficiency while ensuring product quality, thereby achieving maximum production capacity.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories