West lake chemical shuts down four plants! high costs and overcapacity weighing down, is "de-europeanization" of global chemical chain an established trend?

On December 15, 2025, Westlake Chemical announced the closure of four factories in the United States, affecting approximately 295 employees. This is the company's second major capacity adjustment this year—six months ago, they just...Pernis factory in the Netherlands has been permanently closed.Lay off 230 people.

Source: Westlake Chemical official website

The continuous retreat of the world's second-largest PVC producer is not an isolated incident. From Europe to America, from BASF, INEOS to Dow, chemical giants are globally reallocating assets, and a major restructuring of the global chemical industry chain has already begun.

01 Strategic Retreat: Contraction on Both North American and European Fronts

The year 2025 marks a strategic adjustment for Xihu Chemicals. In the first half of the year, Xihu Chemicals focused on withdrawing from the European market, while in the second half, the adjustment shifted towards North America.

In June 2025, Westlake Chemical announced the cessation of all operations at its Pernis facility in the Netherlands, shutting down the plant's 150,000 tons/year bisphenol A (BPA) and 100,000 tons/year liquid epoxy resin units, and decided not to restart the allyl chloride and epichlorohydrin units that had been shut down since July 2024.

The company bluntly pointed out that the "deterioration" of its European business is the main reason for this decision. The shutdown action is expected to cost Westlake Chemical approximately 190 million euros before taxes, including 30 million euros for employee severance and 160 million euros for environmental remediation.

In December, the plant closure plans in North America are equally intense. Westlake Chemical announced the closure of its suspension PVC plant in Aberdeen, Mississippi (with an annual capacity of 450,000 tons), its VCM plant in Lake Charles, Louisiana (with an annual capacity of 413,000 tons), as well as the diaphragm caustic soda facility and styrene plant in the same area.

All these closed factories share a common characteristic: they are primarily oriented towards export markets.Westlake Chemical's President and CEO Jean-Marc Gilson admitted in a special conference call: "Due to the global overcapacity of certain materials (mainly the vinyl chloride and styrene chains), the revenue and profit margin of the PEM division have dropped to an unacceptable level."

02 Global Landscape: Chemical Giants' Collective Withdrawal

The contraction of two lines at Xihu Chemicals is merely a microcosm of the major adjustments in the global chemical industry.

2025Since the beginning of the year, an unprecedented "Shutdown waveSweeping across the European chemical sector.

INEOS (UK): In January 2025, the last synthetic ethanol plant in the UK will be closed.

Huntsman (Germany): In February 2025, after evaluation, plans to close some polyurethane plants in the European region.

LANXESS (Germany): The caprolactam plant at the Krefeld-Uerdingen site will be shut down ahead of schedule in the second quarter of 2025.

SGL Carbon (Portugal): In June 2025, the Lavradio plant will cease production (mainly products are acrylic fibers and carbon fiber precursors), and plans to achieve full closure of the plant by the end of 2026.

Trinseo (Germany): In June 2025, confirmed the permanent closure of the 160,000-ton/year polycarbonate plant in Stade, Germany.

Westlake Chemical (Netherlands): In June 2025, the bisphenol A and liquid epoxy resin facilities at the Pernis plant in the Netherlands will be closed, marking the complete shutdown of the plant.

Shell (Germany/Netherlands/UK): In July 2025, Shell officially announced three shutdown plans - the aromatic/olefin units at the Rheinland facility in Germany, the olefin derivatives unit at the Moerdijk facility in the Netherlands, and the cracker unit at the Mossmorran facility in the UK (scheduled to be phased out between 2026-2027).

Ineos (Germany/France/UK): In July 2025, it will shut down the 650,000 tons/year phenol/acetone plant in Gladbeck, Germany; the 350,000 tons/year ethylene unit in Grangemouth, UK (planned to be completed by the end of 2026); and the 500,000 tons/year olefin unit in Lavéra, France.

Celanese (Germany): Permanently close the Frankfurt Vinyl Acetate Monomer (VAM) plant in July 2025.

Arkema (France): In July 2025, the chlorine, soda, and chloromethane production lines at the Jarrie plant in France will be closed.

BASF (Germany): In June-July 2025, the Ludwigshafen site will shut down multiple core facilities, including those for adipic acid, caprolactam, and TDI (toluene diisocyanate).

In addition, several other devices are planned to be shut down.

In October 2025, Dow Chemical announced that it will permanently close its polyether polyols plant (55,000 tons/year) located in Belgium by the end of the first quarter of 2026. Dow Chemical also plans to close an ethylene cracker (ethylene 510,000 tons/year, propylene 250,000 tons/year) located in Böhlen, Germany, as well as the chlor-alkali and vinyl assets (chlorine 250,000 tons/year, caustic soda 275,000 tons/year) located in Schkopau, Germany, by the end of 2027. Additionally, it intends to shut down a basic silicones plant located in Barry, UK, by mid-2026.

TotalEnergies (Belgium) plans to shut down the 550,000 tons/year ethylene cracker unit at the Antwerp complex in Belgium by 2027, among other things.

According to industry assessments, over 15 million tons per year of chemical production capacity in Europe has been listed for shutdown, and its industrial foundation is being shaken. The shutdown list includes various chemical products such as ethylene, polyurethane, carbon fiber, aramid, vinyl acetate monomer (VAM), propylene oxide, phenol, acetone, liquid epoxy resin, and coatings. By the end of 2027, it is expected that approximately 4.6 million tons per year of ethylene capacity, 2.28 million tons per year of propylene capacity, and 430 thousand tons per year of butadiene capacity will be permanently withdrawn from the market in Europe.

03 Driving Factors: The Dual Pressure of Energy Costs and Overcapacity

The systemic difficulties faced by the European chemical industry are the fundamental reason for the wave of shutdowns in the past two years.

High energy costs have become the primary factor.According to INEOS, the natural gas costs at its Cologne plant are 100 million euros higher than in the United States, electricity costs are 40 million euros higher, and the carbon tax bill is rising towards a staggering 100 million euros. Relevant data indicates that in the first quarter of 2025, European gas prices will be as much as 3.3 times those in the United States.

EU'sPunitive Carbon Tax PolicyFurther increased the burden on chemical companies.Chemical companies are required to pay high fees for carbon emissions, causing products produced in Europe to lose competitiveness in the international market. In November 2025, INEOS warned that the influx of large quantities of low-cost, high-carbon-emission imports due to Europe's weak trade protection measures is threatening thousands of manufacturing jobs, investments, and sovereignty in Europe. This situation is akin to "industrial self-mutilation." According to data from the European Chemical Industry Council (CEFIC), in the first half of 2025, chemical imports from China surged by 8.3%, with a large influx of carbon-intensive products into Europe—these products bear only very low energy costs and almost no carbon emission costs.

Source: INEOS

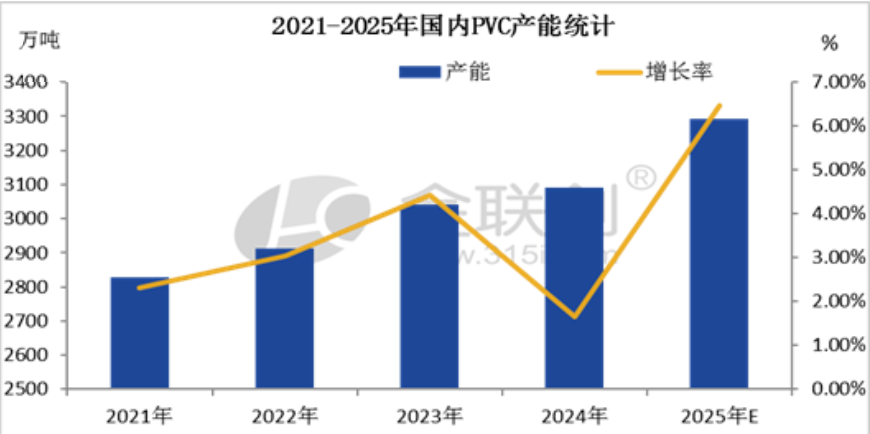

Structural overcapacity in global production and weak demand further exacerbate the situation.According to data from the European Chemical Industry Council, the capacity utilization rate of the EU chemical industry in the first quarter of 2025 is only 74%, significantly lower than the long-term average of 81.4%. Specifically for polyvinyl chloride, China's polyvinyl chloride industry continues to expand its capacity due to its cost advantage, capturing about 47% of the global market share, which puts significant pressure on established chemical companies in Europe and the United States.

Source: Jinlianchuang

With the tightening of energy consumption dual control and environmental protection policies, the expansion and operation of calcium carbide, a core raw material for carbide-based PVC, are restricted. Meanwhile, China's newly added PVC production capacity in recent years mainly relies on the ethylene method, gradually replacing carbide-based PVC.

04 Industry Impact: Global Chemical Chain Restructuring and Market New Balance

The retreat of chemical industry giants is reshaping the global supply chain landscape. The concentrated withdrawal of production capacity in Europe has disrupted the original supply-demand balance, driving the global price restructuring of key raw materials.

Capacity adjustments have also accelerated the cross-regional restructuring of global chemical production capacity, prompting industry resources to concentrate in regions with lower energy costs, more favorable policy environments, and stronger market demand. The role of China and other Asian countries in this transformation is complex. On one hand, Chinese chemical companies are expected to undertake some of the global capacity transfer and acquire advanced technology and market share from Europe; on the other hand, they face challenges such as avoiding "low-level capacity redundancy" and dealing with trade barriers like the EU's "carbon tariffs."

From the perspective of product segmentation,The pattern of vinyl chloride and its downstream products is undergoing profound changes.As the most important downstream product of vinyl chloride, the global production capacity of PVC has significantly shifted towards Asia.

The polyvinyl chloride (PVC) industry itself is also facing transformation pressures. With the advancement of policies related to "carbon peaking and carbon neutrality," the entry barriers for the PVC industry are further tightening, and the approval cycle for new production capacities will be correspondingly extended. In the medium to long term, the expansion of production capacity in the PVC industry will develop in an orderly and rational direction, and the industry's profit levels are expected to continue improving.

05 Strategic Shift: Differentiated Survival and Specialized Breakthrough

Faced with changes in the industry, chemical companies are showing differentiated trends in strategic adjustments. Xihu Chemical has chosen "Strategic contraction+ The path involves closing low-profit basic chemical bases and concentrating resources on the high-value-added specialty chemicals sector. The closed factories are characterized by being "oriented towards export markets" and having "relatively high logistics costs," while the remaining seven North American production bases are more cost-competitive.

This adjustment aims to enhance overall profitability by reducing exposure to low-priced export markets. According to Westlake Chemical, starting from 2026, these measures are expected to bring the company approximately $100 million in annual EBITDA benefits. In 2026, it is estimated to save an additional $75 million in cash by avoiding capital expenditures and equipment maintenance costs.

On the other hand, companies are actively increasing their investment in research and development to develop new products and technologies, enhancing product value and market competitiveness. The global chemical industry is shifting from "scale-driven" to "quality-driven," and from "regional integration" to "global optimization." As the global chemical industry chain is restructured, companies need to focus more on improving efficiency and driving innovation, rather than simply expanding scale.

Edited by: Lily

Source material: Production capacity utilization and import data from Westlake, INEOS, BASF, Dow, TotalEnergies, Shell, Trinseo, Celanese, Huntsman, Lanxess, Arkema, and the European Chemical Industry Council (CEFIC), as well as Jinlianchuang, etc.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories