Where Is Trinseo's 'Second Growth Curve' as Profits Are Squeezed to the Limit?

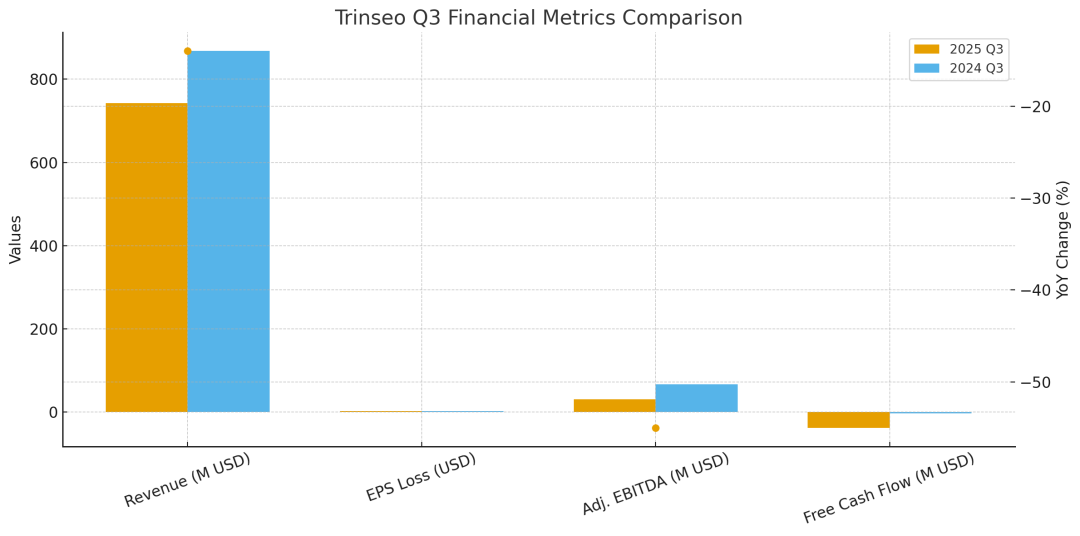

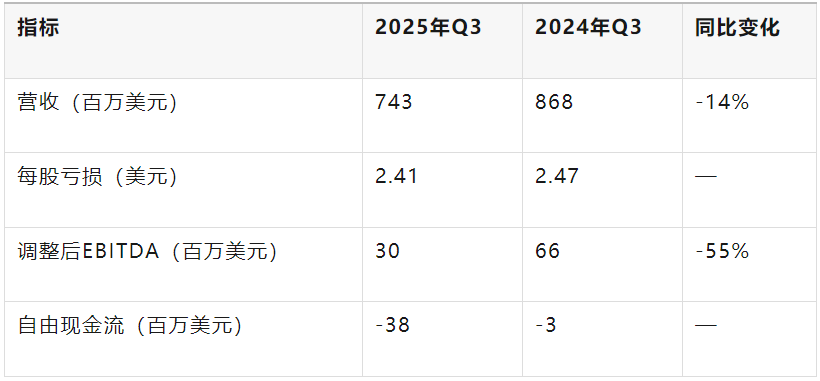

Trinseo, a U.S. materials supplier, faced pressure in its third-quarter 2025 performance. The company reported revenues of $743 million, a 14% year-over-year decline, and a net loss of $110 million, with a loss of $2.41 per share. Adjusted EBITDA was only $30 million, significantly lower than last year's $66 million. Meanwhile, free cash flow was negative $38 million, much weaker than last year's negative $3 million. In the context of the global chemical cycle downturn, Trinseo's performance was affected by multiple adverse factors. Globally, an oversupply of basic raw materials such as ethylene led to price declines, as evidenced by Arkema's disclosure of a 4.7% decline in its Q3 revenue, including a 3.7% negative price effect due to the "acrylic market cycle," squeezing profit margins for chemical companies overall. Additionally, weak demand further pressured company profits. The oversupply from Asian production capacity is particularly evident, with the U.S. and European markets impacted by imports of ABS, PMMA, and other resins from regions such as South Korea and Taiwan.

Engineering Materials Sector: Demand Structure and Price Pressure

Trinseo's engineering materials business saw sales in the third quarter remain roughly flat year-on-year. The company's financial report indicated that while there was an increase in the sales of certain high-value-added products, demand for acrylic resins in construction and automotive applications rose, but demand in the medical sector declined, resulting in limited overall fluctuations. Specifically, sales of high-formula PMMA resins in construction and automotive applications saw a slight increase, while medical application demand was lackluster. However, global resin prices continued to decline, putting pressure on profits. Both the European and Asian markets experienced significant downward price pressures, with Trinseo reporting "significant pricing pressure" in the European and Asia-Pacific markets where some of its businesses operate. Peer Arkema's performance also confirmed this trend—Arkema reported a decline in its high-performance resin business revenue, primarily due to a 3.7% negative price effect resulting from falling acrylic product prices.

Recycled Plastics Business: Highlights of High-Growth Potential

Despite pressure on traditional businesses, Trinseo has shown impressive performance in the fields of recycled plastics and specialty formulated resins. The company's senior management stated that demand for "high-formulation PMMA resins" is rapidly increasing: starting from the end of the third quarter of 2025, sales in this business segment have grown by more than 10% year-on-year, and this momentum has continued into the fourth quarter. The demand for the company's recycled plastic products is also strong: pilot facilities for recycled content in ABS, acrylic, and polycarbonate have sold out, indicating robust market demand. As of now, sales of products containing recycled materials have increased by approximately 12% year-on-year, making it an important growth driver in the engineering materials segment. The financial report mentions that Trinseo is continuously increasing investment in circular recycling technologies, believing that future regulations will drive demand. CEO Frank Bozich pointed out that although current production is still small, entering this emerging market will have a significant impact on the company's long-term performance as economies of scale become apparent.

At the same time, the high-profit margin applications in traditional businesses have also seen an increase. During the reporting period, the sales of high value-added products such as battery binders continued to rise; in the third quarter, sales of battery binders increased by 27% year-on-year, and the company is collaborating with several large battery manufacturers. The performance of these emerging businesses has effectively offset some of the weakness in the main business.

EU Regulations and Industry Trends

The recent EU regulations on End-of-Life Vehicles (ELV) will significantly boost the demand for plastic recycling. In September this year, the European Parliament passed a provision requiring that by 2031, new vehicles must contain at least 20% recycled plastic in their plastic components, of which 15% must come from end-of-life vehicles. The EU also proposed to increase this percentage to 25% within the next decade. This stringent target will drive automakers to accelerate the adoption of high-performance recycled materials such as recycled ABS and recycled PMMA. Trinseo believes this regulation "officially reflects the EU's commitment to enhancing the circularity of the industrial chain." Company executives emphasized that they are prepared with technological reserves to "embrace this demand-driven growth opportunity" and expect the regulation to boost demand for recycled products in the short term. Foreign counterparts are also accelerating the transition to a circular economy: Germany's Röhm (a PMMA supplier) has established a PMMA recycling alliance across Europe with industry partners, utilizing chemical and mechanical technologies to recycle waste PMMA back into raw materials; France's Arkema has also launched the "Virtucycle" project, offering SCS-certified recycled high-performance polymers (such as PA11 and PA12). These initiatives highlight that the high-performance plastics industry is rapidly evolving towards a circular economy and increased recycling utilization.

Strategic adjustment and capacity restructuring

Faced with prolonged market downturns and cost pressures, Trinseo has announced a series of strategic capacity adjustments. The company plans to exit the production process of virgin methyl methacrylate (MMA) and precursor acetone cyanohydrin at its Rho plant in Italy and will source MMA raw materials from third parties in the future to reduce production costs and allocate resources to high-value PMMA businesses and recycling projects. This initiative is expected to contribute approximately $20 million in annual profit improvement and $10 million in capital expenditure savings. Additionally, the company is moving forward with the closure of the polystyrene production line in Schkopau, Germany, consolidating the remaining capacity into the Belgium plant, which is expected to bring about $10 million in annual profit improvement. Overall, these structural adjustments are anticipated to cumulatively achieve approximately $30 million in EBITDA enhancement by 2026. Trinseo has also announced the suspension of quarterly dividends to further conserve cash. The company emphasized that the savings in costs and capital will be invested in more profitable high-value resin and recycled materials businesses, aiming to maintain competitiveness during market lows and prepare for future growth.

Asian Import Shocks and Competitive Environment

Trinseo has not escaped the challenges posed by global trade dynamics. The company management pointed out that plastic products such as ABS and acrylic from Taiwan and South Korea have significantly impacted the European and American markets. For example, South Korea's exports of ABS to Europe increased by 18% in 2025 (with a quarter-on-quarter growth of 26% in the second quarter), making it the largest source of ABS imports in Europe. A large amount of Asian production capacity is entering the United States via Mexico to bypass tariff barriers, causing "price inversion" and further squeezing domestic profit margins. Trinseo expects that if these trade flows continue, market competition will become more intense. In this environment, the company anticipates that adjusted EBITDA in the fourth quarter will range between $30 million and $40 million. Despite this, the management believes that under limited demand, more attention should be paid to stabilizing demand and value, even if it requires accepting slight price differences. By shutting down high-cost facilities and exiting low-value-added businesses, Trinseo is seeking to maintain profit margins amidst global competition while capturing market opportunities in recycled plastics and specialty formulated resins.

Peer Comparison: Arkema vs Röhm

From an industry benchmarking perspective, Trinseo's strategic transformation is not an isolated case. Other high-performance resin companies in the industry are also accelerating the layout of circular economy and sustainable products. Arkema mentioned in its third-quarter 2025 performance that sales in high-performance materials and innovation fields (such as batteries and new energy) maintained growth, while traditional markets were suppressed, with overall revenue down 4.7% year-on-year, mainly affected by the unfavorable acrylic resin cycle. Arkema is actively developing circular materials, such as its acquisition of recycled plastic regeneration company Agiplast and the launch of the Virtucycle® program, providing customers with high-performance polyamides and PVDF materials containing recyclable content. Röhm (a PMMA manufacturer) has partnered with Pekutherm, MyRemono, and others to establish a PMMA recycling system across Europe, which can chemically degrade or mechanically recycle waste PMMA to near virgin grade. These initiatives align with Trinseo's recycled plastics strategic direction. It can be seen that industry-leading companies are combining environmental protection with business growth, turning recycled plastics from an "environmental symbol" into a competitive advantage. By benchmarking against such peers, Trinseo leverages technology and market strategies to continue advancing in the field of specialty formulated resins and circular materials, seizing new opportunities as the plastics industry transitions to high performance and a circular economy.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

[Today's Plastics Market] General Materials Weakly Fluctuate, Engineering Materials Steadily Rise

-

New Breakthrough in Domestic Adiponitrile! Observing the Rise of China's Nylon Industry Chain from Tianchen Qixiang's Production

-

Daily Review: Polyethylene Prices Under Weak Consolidation, Sellers Face Significant Pressure to Move Inventory