Will Japan Really Cut Off Photoresist Supply? Domestic Alternatives Usher in a "Golden Verification Window"

From December 1 to 2, 2025, the A-share photoresist concept sector experienced significant fluctuations and surges. Several stocks, including Huarong Chemical and Rongda Photoelectric, hit the daily limit or saw substantial increases.

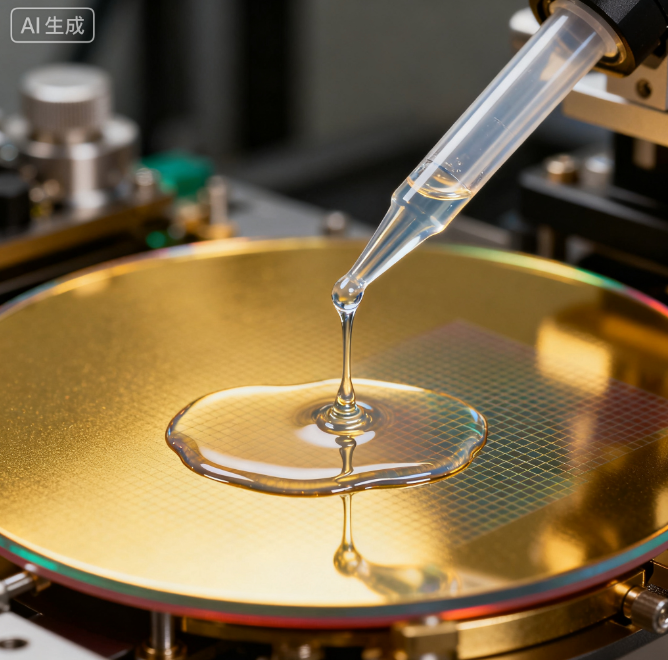

Image source: Material Collection

This market performance is precisely attributed to a gloom that hangs over the entire industry.——Recently, "Canon, Nikon, Mitsubishi Corporation, and other Japanese giants may collectively halt the supply of core photoresist and suspend maintenance of lithography machines.Rumors are spreading, and although there has been no confirmation so far, many people working in wafer factories and industry chain insiders are questioning: Will Japan really cut off supply this time?

Image source: Doubao AI

Japan's Hegemony: Absolute Dominance in the Photoresist Market

Japan's dominant position in the photoresist sector is indeed remarkable. In the global semiconductor photoresist market, Japanese companies such as JSR, Shin-Etsu Chemical, Tokyo Ohka Kogyo, and Sumitomo Chemical, along with American company DuPont and South Korean company Dongjin Semichem, collectively account for 95% of the global supply, with Japan being in an absolutely leading position.

In the segmented market, it is even more so: in the KrF photoresist field, five major Japanese companies hold 95% of the global market share; in the ArF photoresist market, Japanese companies hold 94% of the share; and the EUV photoresist market is completely monopolized by JSR, Shin-Etsu Chemical, and Tokyo Ohka Kogyo.

Japan's hegemony is not only reflected in the finished photoresist but also extends to the entire supply chain. The auxiliary materials for photoresist, such as anti-reflective coatings, as well as core raw materials like resins, monomers, and photoinitiators, are primarily supplied by companies from Japan, the United States, and Europe.

This comprehensive control over the entire industry chain makes photoresist the preferred leverage tool for Japan in conflicts with other countries. During the 2019 trade dispute between Japan and South Korea, the first export that Japan restricted was photoresist.

Not only photoresist, but among the 19 key materials in semiconductor manufacturing, Japan holds a global market share of over 50% in 14 materials. For instance, the world's largest semiconductor silicon wafer supplier is Shin-Etsu Chemical (with a market share of 27%), and the world's largest photomask producer is Toppan Printing of Japan (with a market share of over 30%). In the equipment sector, Japanese companies occupy 30% of the global semiconductor manufacturing equipment market. Tokyo Electron (etching and thin film equipment), Advantest (testing equipment), and Screen (cleaning equipment) are indispensable entities in the industry chain.

Game Logic: Why a Complete Supply Cutoff Is Unlikely

Faced with such a strong monopolistic position and 'previous offenses,' market concerns about Japan's supply cut to China seem quite reasonable. However, the complex reality of global trade provides an answer that appears contradictory.

Japan will not completely cut off the supply of core photoresist. The answer is negative—the binding of interests in the global market makes a complete cutoff a lose-lose choice that does not benefit any party.

China is the largest customer of Japan's semiconductor industry, and this mutual benefit forms a natural defense line. The data is most convincing: in 2021, Japan's semiconductor equipment exports to China reached $11.843 billion, accounting for 38.8% of its global export total. Shin-Etsu Chemical's electronic and functional materials division generates approximately 27% of its global revenue from the Asian region (primarily China); moreover, 31% of JSR's ArF photoresist orders come from wafer fabs in mainland China.

The prosperity of Japan's semiconductor materials largely depends on the demand from the Chinese market. In 2021, the trade volume of semiconductors between China and Japan exceeded 47 billion US dollars, and there are more than 30,000 Japanese semiconductor-related enterprises operating in China. Moreover, Japan relies on China for key raw materials. Ninety percent of the rare earth elements such as dysprosium and terbium, which are needed for the production of Japanese semiconductor materials, are imported from China. This mutual dependency makes a complete supply cut a double-edged sword. As stated in an internal report by the Japan Business Federation (Keidanren), "A complete supply cut would only give Chinese alternative companies a window of opportunity, ultimately harming Japanese companies."

Implicit restrictions: disguised supply cuts have become the norm

However, the constraint of commercial interests does not mean that Japan will abandon its strategic alignment with allies to exert pressure. A more covert yet also more challenging form of "disguised supply cut" has quietly emerged, becoming the new normal in the semiconductor game between China and Japan.

In July 2023, Japan officially implemented the "Six Categories of 23 Semiconductor Equipment Export Controls," creating an implicit barrier for Chinese companies. Except for 42 friendly countries, other countries (including mainland China) must obtain a separate export license from Japan's Ministry of Economy, Trade and Industry to import related equipment. This policy has led to the approval rate of photoresist exports to China dropping from 89% to 76%, with the average approval time increasing from 25 days to 38 days. The approval for advanced process ArFi photoresists is even more stringent, with several wafer fabs reporting that their applications were required to supplement multiple rounds of materials.

Another form of indirect supply cut is prioritizing customers in other regions. In 2021, due to capacity constraints, Shin-Etsu Chemical stopped supplying KrF photoresist to small-scale wafer fabs in mainland China, while prioritizing the needs of international giants. As the global wafer fab expansion trend continues, Japanese companies use capacity allocation as an excuse to prioritize limited resources for international clients such as Samsung and TSMC. At the same time, they implement quota supplies to mainland Chinese enterprises and significantly increase prices.

China's Breakthrough: Gradual Replacement with Domestic Photoresist

The supply environment characterized by "unattainable demands" or "returns that do not justify the costs" has greatly stimulated and accelerated the localization process of China's domestic photoresist industry. Facing external pressures, China's photoresist industry is rapidly making breakthroughs.

Currently, the localization rate of G-line photoresist exceeds 60%, and the localization for I-line photoresist used in 6-inch and smaller wafer fabs has been completed. Some mature KrF photoresist products have achieved localization substitution, with an overall localization rate of less than 5%. Multiple companies are in the development and verification stages for ArF/ArFi photoresists, with a localization rate of less than 2%.

Specific aspects of the enterprise:

Nanjing Yangguang OptoelectronicsSeveral ArF photoresists developed are currently being validated by major domestic integrated circuit chip manufacturing companies, and three products that have passed validation have already achieved small-scale sales.

Tongcheng New Materials subsidiary Beijing KehuaIt is the only company in China listed by SEMI among the global top eight photoresist companies, with profound technology in the fields of g-line, i-line, and KrF photoresists.

Jingrui Electronic MaterialsAs a leader in I-line/G-line photoresists, the company has been dedicated to the research and production of photoresists for nearly 30 years, with a wide range of product types. It is set to be listed on the Sci-Tech Innovation Board on November 18, 2025.Hengkun New MaterialsThe ArF immersion photoresist has been validated by customers and shipped in small batches.

Dinglong Co., Ltd.The high-end wafer photoresist business is progressing rapidly, with several key models sprinting for orders in the fourth quarter of 2025.

Another driving force behind the breakthrough of domestic photoresists comes from the proactive support of downstream wafer manufacturers.

Due to supply constraints from Japanese companies, domestic first-tier wafer fabs are accelerating the verification process for domestic photoresists.

A representative from a 12-inch wafer fab revealed that since 2023, the validation progress of domestic KrF photoresist has been six months ahead of schedule. This "downstream pushing upstream" model is precisely the core logic that South Korea used to break Japan's monopoly on photoresist back in the day, and it is now reappearing in the Chinese market. As long as the performance of domestic photoresist meets the standards, wafer fabs are willing to provide more opportunities.

It is evident that the optimism in the capital market in early December is not based on speculation about short-term rumors, but rather a rational prediction of the long-term breakthrough trend in China's photoresist industry. The core of this game has never been about waiting for Japan to ease restrictions, but accelerating the development of its own capabilities. From photoresist to photolithography machines, every domestic breakthrough in each segment adds resilience to the supply chain, which is the fundamental confidence for China’s semiconductor industry to forge ahead amid challenges.

Editor: Lily

Source of materials: Tongbi Finance, WELINK Plastics, Material Exchange, Chip Master, World Semiconductor Trade Statistics (WSTS), Changjiang Securities, Japan External Trade Organization (JETRO), International Semiconductor Industry Association (SEMI), official interactive platforms and announcements of various companies (such as Rongda Photosensitive, Nanda Optoelectronics, etc.)

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

[Today's Plastics Market] General Materials Weakly Fluctuate, Engineering Materials Steadily Rise

-

New Breakthrough in Domestic Adiponitrile! Observing the Rise of China's Nylon Industry Chain from Tianchen Qixiang's Production

-

Daily Review: Polyethylene Prices Under Weak Consolidation, Sellers Face Significant Pressure to Move Inventory