Yangtze River Energy Science Technology Debuts on Beijing Stock Exchange with 290% Surge: Revenue and Net Profit Expected to Increase in First Three Quarters, "Three Barrels of Oil" Are Key Clients

Leju Finance Wang MinOn October 16, Changjiang Nengke (BJ: 920158) was listed on the Beijing Stock Exchange, with Guotai Haitong as the sponsor. It opened with a 290% increase, resulting in a total market value of 2.87 billion yuan.

The prospectus shows that Changjiang Energy Technology is a national-level specialized and innovative "little giant" enterprise focused on the design, research and development, manufacturing, and services of specialized equipment for the energy and chemical industries. The company's main products include electric, separation equipment, heat exchange equipment, storage equipment, carbon capture equipment, hydrogen energy equipment, as well as additives and technical services.

Changjiang Energy Technology's core product, the electrostatic desalting equipment, is a key device in the initial stages of offshore and onshore oil field crude oil transportation as well as in the refining and chemical industries. It determines whether the crude oil can meet the export standards and affects the operational efficiency and energy consumption of the refining equipment. According to statistics from the Jiangsu Province Petrochemical Equipment Industry Association, the company has maintained the number one market share in the domestic electrostatic desalting equipment market from 2021 to 2023.

Currently, Changjiang Energy Technology is a qualified supplier for Sinopec, PetroChina, and CNOOC, and has established long-term stable partnerships with well-known companies such as Yulong Petrochemical, Dongfang Shenghong, Rongsheng Petrochemical, and Jingbo Holding Group.

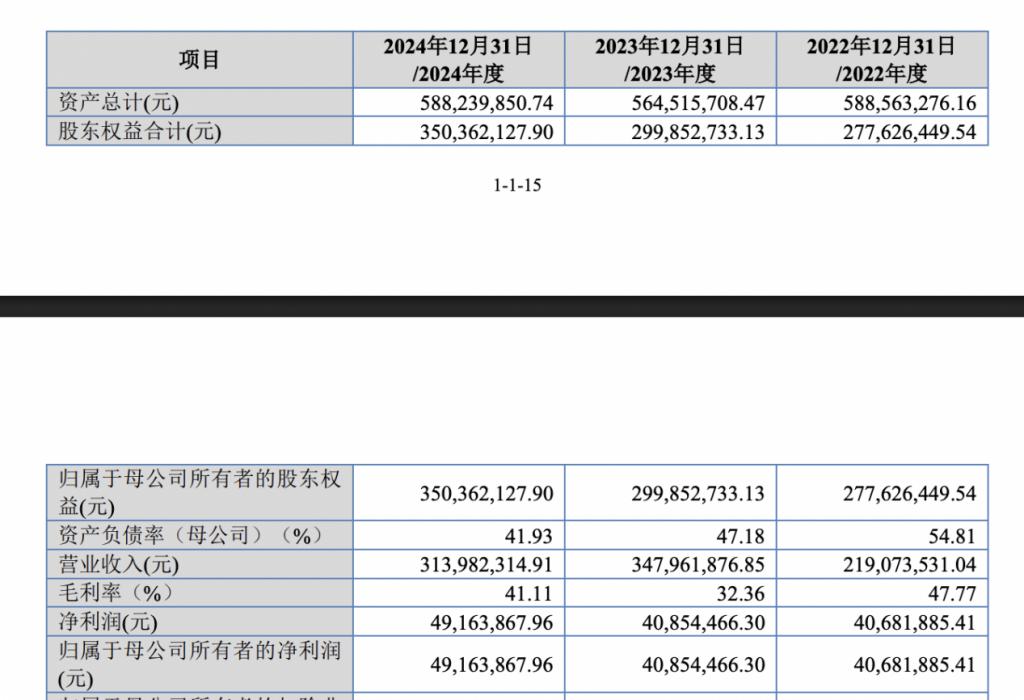

From 2022 to 2024, Changjiang Nengke's operating revenues were 219 million yuan, 348 million yuan, and 314 million yuan, respectively. The net profits were 40.6819 million yuan, 40.8545 million yuan, and 49.1639 million yuan, respectively. The gross profit margins were 54.81%, 47.18%, and 41.93%, respectively.

Changjiang Nengke expects its revenue and net profit for January to September 2025 to show a steady growth trend year-on-year. Revenue is expected to increase by 0.78% to 15.90% year-on-year, while net profit is expected to grow by 3.62% to 13.04% year-on-year.

During the reporting period, the proportion of sales revenue from the company's top five customers under the same control accounted for 86.93%, 63.42%, and 85.62% of the operating income for the respective periods. The high customer concentration is mainly due to: on one hand, the downstream industries are primarily resource-intensive and capital-intensive energy and chemical industries, mainly operated by large state-owned enterprises and large private enterprises, such as China National Petroleum Corporation (CNPC), China Petroleum & Chemical Corporation (Sinopec), and China National Offshore Oil Corporation (CNOOC). These downstream industries themselves have a high concentration. On the other hand, the company's products are mainly applied in fields such as oil and gas engineering, refining and chemical engineering, and marine engineering. The investment amount for individual construction projects in these fields is relatively high, and the corresponding procurement of electrostatic desalting equipment and other energy and chemical equipment is substantial. As the issuer's business is in a growth stage with a relatively small operating scale, it is easily affected by the high investment scale of individual customer projects, resulting in high customer concentration for the issuer.

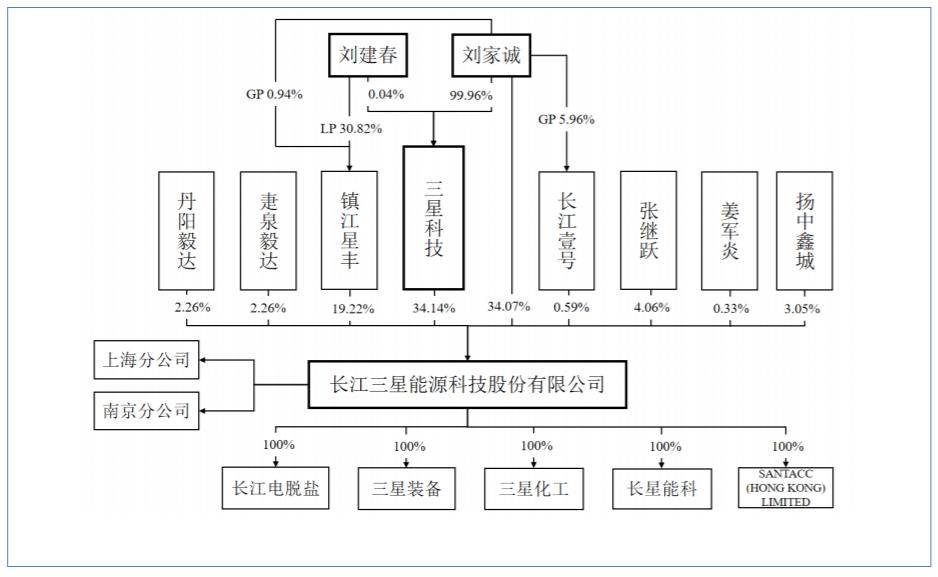

Before going public, the controlling shareholder of Yangtze Energy Technology was Samsung Technology, and the actual controllers were Liu Jianchun and his son Liu Jiacheng. The actual controllers Liu Jianchun and Liu Jiacheng collectively controlled 88.03% of the company's shares.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

India's Q3 Smartphone Shipments Rise 3%; Japanese Mold Factory Closures Surge; Mercedes-Benz Cuts 4,000 Jobs

-

Ascend's Restructuring Plan Approved! Jwell Launches Global Acceleration Plan; Nexperia Chip Crisis Threatens Global Auto Production

-

Dow To Restart Pe Units 5 And 7 This Week, Recovery Date For Unit 6 Remains Undetermined In The United States (US)

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

The Roller-Coaster Behind Sanhua Intelligent Controls' Stock Price: What Are the Advantages of Automotive Thermal Management Companies Crossing Into Humanoid Robots?