Yinhui Technology Surges 185.13%!

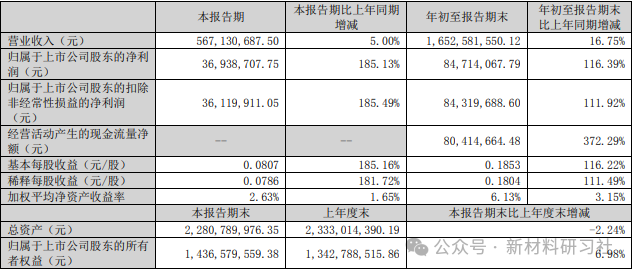

On the evening of October 20th, Yinxi Technology released its third-quarter report for 2025. For the first three quarters, the company achieved a total operating revenue of 1.653 billion yuan, an increase of 16.75% year-on-year; net profit attributable to the parent company was 84.7141 million yuan, an increase of 116.39% year-on-year. In the third quarter alone, the net profit attributable to the parent company was 36.9387 million yuan, with a year-on-year increase of 185.13%.

Yinjixi Technology was founded in 1997 and is a national high-tech enterprise integrating the research and development, production, and sales of high-performance polymer new materials. The company has established production and research bases in Dongguan Humen, Daojiao, Songshan Lake, Zhuhai, Suzhou Wuzhong, Anhui Chuzhou, Zhongshan, and Guangdong Zhaoqing. To complete its international layout, the company has also set up a production base in Vietnam. The company and its subsidiaries are currently focusing on industrial layout in emerging technology fields such as polymer modified plastics, smart lighting, 3D printing materials, and fine chemicals. The modification and processing of materials in three major categories—general-purpose resins, engineering resins, and ultra-high-performance resins—remain the core business of the company.

Performance Growth Drivers

Core business gross profit increase: In the first three quarters, the company's gross profit increased by 89.6161 million yuan year-on-year.

Equity incentive expense adjustment: 2025 is the last assessment period for the "2021 Restricted Stock Incentive Plan." Due to not meeting performance targets, the company reversed the previously amortized incentive expenses. From January to September 2025, the equity incentive expense was -5.6659 million yuan, an increase of 9.8698 million yuan compared to the same period last year.

Shareholder Changes

Shareholder Count and Shareholding Concentration: As of the end of the third quarter, the company had 34,600 shareholders; the top ten shareholders held a total of 58,527,800 shares, accounting for 12.35% of the total share capital. The shareholding situation of the top ten shareholders is as follows:

During the reporting period, core shareholder Peng Zhaohui increased their holdings by 6.11%, raising the number of shares held to 16.1331 million, which accounts for 3.53% of the circulating shares, with an additional 929,400 shares acquired. Chen Qingliang and Xu Zhiqian increased their holdings by 25.9% and 44.54%, respectively.

Peng Zhao Hui became the largest shareholder of Silver Jubilee Technology in the first quarter of 2025. In May of the same year, he submitted three proposals involving the introduction of a controlling shareholder and the reorganization of the board of directors and supervisors, all of which were rejected by the board on the grounds of non-compliance with regulations. Is Silver Jubilee Technology being "forced to comply"? The largest shareholder was rejected.

In July 2021, the company's former actual controller, Tan Songbin, had 18.9179 million shares remaining under his control, accounting for 4.2% of the total shares at that time. Due to factors such as stock pledge liquidation, the equity of the company held by Tan Songbin through Ruichen Investment was continuously subject to passive reduction. At that time, the company announced that "there is no situation where any shareholder can have a significant impact on the resolutions of the company's general meeting of shareholders solely based on the voting rights of the shares they actually control."

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

India's Q3 Smartphone Shipments Rise 3%; Japanese Mold Factory Closures Surge; Mercedes-Benz Cuts 4,000 Jobs

-

Ascend's Restructuring Plan Approved! Jwell Launches Global Acceleration Plan; Nexperia Chip Crisis Threatens Global Auto Production

-

Dow To Restart Pe Units 5 And 7 This Week, Recovery Date For Unit 6 Remains Undetermined In The United States (US)

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

The Roller-Coaster Behind Sanhua Intelligent Controls' Stock Price: What Are the Advantages of Automotive Thermal Management Companies Crossing Into Humanoid Robots?