Starting from August 26, Swiss Post will suspend the acceptance of postal items destined for the United States, except for express mail (including official documents and certificates) and express courier items. Swiss Post stated that, as the United States will suspend the duty-free treatment for imported parcels valued at $800 or less starting from August 29, all goods shipped to the United States must be transported with duties already paid. Swiss Post made this decision after close consultation with the relevant national authorities.

Profit Margins of US Ethylene Companies May Further Contract

Recently, a global energy and chemical industry market information service provider reported that U.S. chemical companies are facing shrinking profits due to price fluctuations in oil and natural gas, along with the impact of tariffs and economic uncertainties. It is estimated that the average price of Brent crude oil will drop by 6.7% in 2025 and by another 7.4% in 2026; the average price of WTI will fall by 6.7% in 2025 and by an additional 7.9% in 2026. The cost of chemical raw materials in the U.S., particularly ethane, fluctuates with changes in natural gas prices. It is estimated that the average price of U.S. natural gas will rise by 66.8% in 2025 and by another 3.9% in 2026. These trends will inevitably squeeze the profit margins of U.S. ethylene producers. However, demand for ethylene is declining. Tariffs have increased the import costs of raw materials used in the production of catalysts and plastic additives, and the EU and Canada may impose retaliatory tariffs on polyethylene exported from the U.S. John Hanson, CEO of U.S. chemical producer Huntsman Corporation, expects that due to uncertainties in tariffs and mortgage interest rates, the recovery of the U.S. real estate market may be delayed, and continued weakness in the construction sector's demand for ethylene will further exacerbate the instability in the ethylene market.

Related Breaking News

-

2025-08-26 10:26:12

Swiss Post Suspends Parcel Delivery to the US

-

2025-08-26 09:57:38

Trump Announces Removal of Fed Governor Cook

On August 25 local time, U.S. President Donald Trump publicly released a letter to Federal Reserve Governor Lisa Cook on his social media platform "Truth Social," announcing her immediate dismissal.

The letter cites Article II of the U.S. Constitution and relevant provisions of the Federal Reserve Act enacted in 1913, with Trump stating that there is sufficient reason to remove Cook from his position. The letter mentions a criminal referral submitted by the Federal Housing Finance Agency on August 15, alleging that Cook is suspected of making false statements in mortgage documents.

-

2025-08-26 09:54:30

United States ITC Officially Initiates Section 337 Investigation Into Child Safety Seats for Vehicles

According to the China Trade Remedy Information Network, on August 25, 2025, the United States International Trade Commission (ITC) voted to initiate a Section 337 investigation (Investigation No. 337-TA-1459) concerning certain child car seats.

-

2025-08-22 11:02:55

Global Foldable OLED Screen Shipments Expected to Reach 124.6 Million Units by 2032

According to Omdia's forecast, by 2032, the global shipment volume of foldable OLED screens will reach 124.6 million units, accounting for 8.6% of the overall OLED market, significantly higher than the 23.1 million units in 2024 and the projected 23.5 million units in 2025. Omdia believes that over the next eight years (from 2024 to 2032), the estimated shipment volume of foldable phones will surge fivefold.

-

2025-08-21 16:53:42

Nanjing Julong's 2025 Interim Report Shows Net Profit of 57.36 Million Yuan, Up 40.73% Year-on-Year

Nanjing Julong (300644.SZ): Net profit for the mid-year report of 2025 is 57.3644 million yuan, an increase of 40.73% compared to the same period last year.

Most Popular

-

Four Major Chemical New Material Giants Sell Off and Shut Down Again!

-

Covestro faces force majeure!

-

DuPont to Spin Off Nomex and Kevlar Brands for $14.4 Billion: Is Aramid Fiber Still Attractive?

-

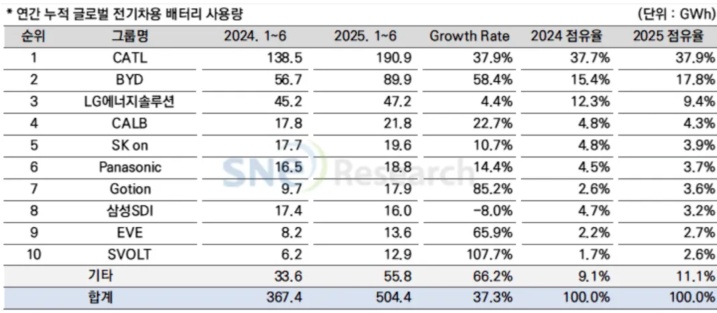

Massive Retreat of Japanese and Korean Battery Manufacturers

-

Napan Unveils Thermoplastic Composite Three-in-One Power System Solution, Battery Cover Weight Reduced by 67%